The Economic Impact Of Trump's Tariffs: A CEO Perspective

Table of Contents

Increased Costs and Reduced Competitiveness

Trump's tariffs significantly impacted businesses by increasing costs and reducing competitiveness. Understanding these effects is crucial for strategic planning.

Rising Input Prices

Tariffs directly increased the cost of imported goods, impacting production costs across various sectors. This ripple effect had far-reaching consequences.

- Increased raw material prices: The tariffs on steel and aluminum, for example, led to higher prices for manufacturers relying on these materials.

- Higher manufacturing costs: Increased input costs translated directly into higher manufacturing costs, squeezing profit margins.

- Squeezed profit margins: Businesses faced the difficult choice of absorbing increased costs, reducing profit margins, or raising prices for consumers.

- Reduced investment in innovation: Facing tighter margins, many companies cut back on research and development, hindering long-term growth.

The impact was acutely felt in industries like automotive manufacturing, construction, and consumer goods. For instance, the 25% tariff on steel imports significantly increased the cost of producing cars, leading to higher prices for consumers and reduced competitiveness against foreign automakers.

Loss of Market Share

The resulting price increases made American goods less competitive, both domestically and internationally.

- Foreign competitors gaining market share: As American goods became more expensive, foreign competitors, unaffected by the tariffs, gained significant market share.

- Reduced exports: American exports declined as foreign buyers opted for cheaper alternatives from other countries.

- Job losses in affected industries: The reduced competitiveness led to job losses in various sectors as companies struggled to maintain profitability.

- Pressure to relocate production: Some companies, facing higher production costs in the US, relocated manufacturing to countries with lower input costs.

Companies like Harley-Davidson, facing retaliatory tariffs from the EU, were forced to relocate some production overseas, highlighting the significant consequences of trade disputes. This illustrates the complexities of navigating trade wars and their effects on domestic employment.

Retaliatory Tariffs and Trade Wars

Trump's tariffs sparked retaliatory measures from other countries, escalating trade tensions and disrupting global supply chains.

Global Trade Tensions

The imposition of tariffs triggered a series of retaliatory actions, creating a climate of uncertainty and instability.

- Reduced global trade volume: The resulting trade disputes significantly reduced the overall volume of global trade.

- Uncertainty in international markets: Businesses faced increased uncertainty in forecasting demand and planning for future production.

- Disrupted supply chains: The retaliatory tariffs disrupted established supply chains, increasing lead times and logistical costs.

- Increased logistical costs: Companies had to adapt to new trade routes and navigate complex regulations, leading to higher shipping and handling costs.

China, for example, retaliated with tariffs on various American agricultural products, impacting farmers and related industries. This demonstrates the interconnectedness of the global economy and the potential for widespread consequences from trade disputes.

Negotiating Power and Trade Deals

Despite the disruption, the tariffs served as a negotiating tool in some instances, leading to renegotiated trade deals.

- Potential for renegotiated trade deals: The threat of tariffs provided leverage in negotiating new or revised trade agreements.

- Securing better terms for American businesses in some sectors: In some cases, tariffs led to improved terms for American businesses in specific sectors.

- Increased focus on bilateral trade agreements: The experience highlighted the potential benefits and risks of focusing on bilateral, rather than multilateral, trade agreements.

The renegotiation of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA) is a prime example of how tariffs could influence trade negotiations, albeit with significant short-term economic challenges. However, the effectiveness of tariffs as a negotiating tactic remains a subject of ongoing debate.

Long-Term Economic Consequences of Trump's Tariffs

The long-term effects of Trump's tariffs are still unfolding, with significant implications for the economy.

Inflationary Pressures

Tariffs contributed to inflationary pressures, impacting consumer spending and economic growth.

- Increased consumer prices: The increased costs of imported goods were passed on to consumers in the form of higher prices.

- Reduced consumer spending: Higher prices reduced consumer purchasing power, impacting overall economic growth.

- Slower economic growth: The combination of reduced consumer spending and business investment contributed to slower overall economic growth.

- Impact on inflation indices (CPI, PPI): The tariffs demonstrably impacted inflation indices like the Consumer Price Index (CPI) and Producer Price Index (PPI).

This inflationary pressure created a challenging environment for businesses and consumers alike.

Shifting Global Supply Chains

Businesses were forced to adapt, leading to significant shifts in global supply chains.

- Reshoring of production: Some companies chose to bring manufacturing back to the US to avoid tariffs and reduce dependence on foreign suppliers.

- Diversification of supply chains: Companies sought to diversify their supply chains, reducing their reliance on any single country or region.

- Increased investment in domestic manufacturing: The reshoring trend led to increased investment in domestic manufacturing facilities and infrastructure.

- Impact on global trade patterns: The changes in supply chains altered global trade patterns, impacting various countries and industries.

This restructuring of global supply chains is likely to have long-lasting implications for businesses and the global economy.

Conclusion

The economic impact of Trump's tariffs was multifaceted and complex. While some businesses benefited from increased protection, many others faced increased costs, reduced competitiveness, and disruptions to their global supply chains. The long-term consequences are still unfolding, with ongoing debates about the overall effectiveness of tariffs as a trade policy tool. Understanding the implications of these policies remains crucial for CEOs navigating the complexities of global trade. To successfully navigate this landscape, thorough analysis and strategic planning are critical in adapting to evolving trade policies. A deep understanding of the economic impact of future tariffs is essential for long-term success.

Featured Posts

-

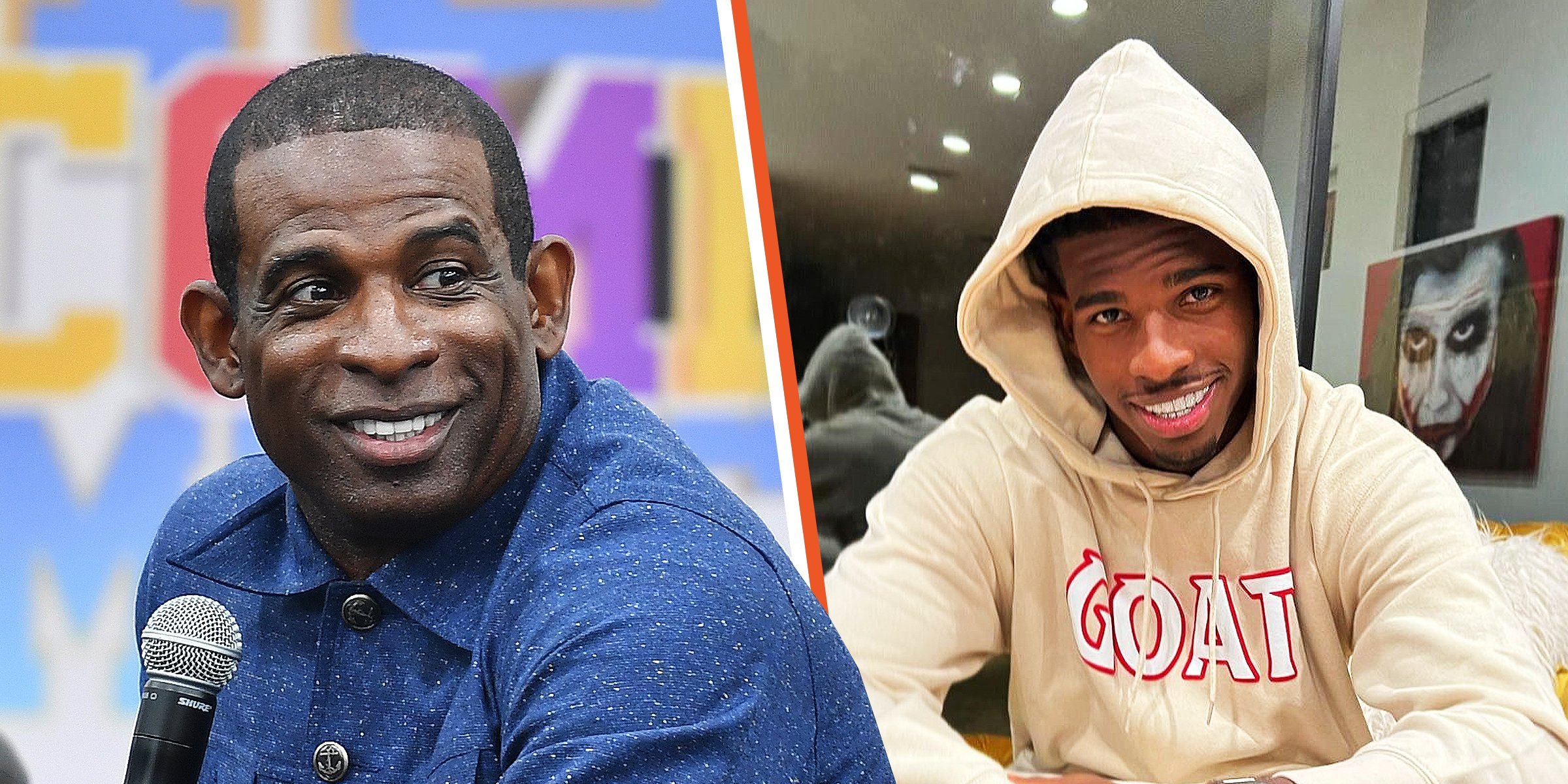

Deion And Shedeur Sanders A Browns Insiders Perspective

Apr 26, 2025

Deion And Shedeur Sanders A Browns Insiders Perspective

Apr 26, 2025 -

The Newsom Democratic Party Rift A Deep Dive Into The Conflict

Apr 26, 2025

The Newsom Democratic Party Rift A Deep Dive Into The Conflict

Apr 26, 2025 -

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025

Will Thaksins Influence Lead To A New Era Of Us Thai Trade Agreements

Apr 26, 2025 -

Game Stop Line Success My Nintendo Switch 2 Preorder

Apr 26, 2025

Game Stop Line Success My Nintendo Switch 2 Preorder

Apr 26, 2025 -

Mission Impossible Dead Reckoning Teaser Ethan Hunts Daredevil Feats

Apr 26, 2025

Mission Impossible Dead Reckoning Teaser Ethan Hunts Daredevil Feats

Apr 26, 2025

Latest Posts

-

Amphibien Und Reptilien In Thueringen Ein Umfassender Atlas

Apr 27, 2025

Amphibien Und Reptilien In Thueringen Ein Umfassender Atlas

Apr 27, 2025 -

Entdeckung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025

Entdeckung Der Herpetofauna Thueringens Der Neue Amphibien Und Reptilienatlas

Apr 27, 2025 -

Thueringens Amphibien Und Reptilien Der Neue Atlas

Apr 27, 2025

Thueringens Amphibien Und Reptilien Der Neue Atlas

Apr 27, 2025 -

Thueringen Amphibien Und Reptilienatlas Erscheinen Des Umfassenden Werks

Apr 27, 2025

Thueringen Amphibien Und Reptilienatlas Erscheinen Des Umfassenden Werks

Apr 27, 2025 -

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025