The Impact Of Tariff Uncertainty: U.S. Companies Implement Cost-Saving Strategies

Table of Contents

Increased Input Costs and Supply Chain Disruptions

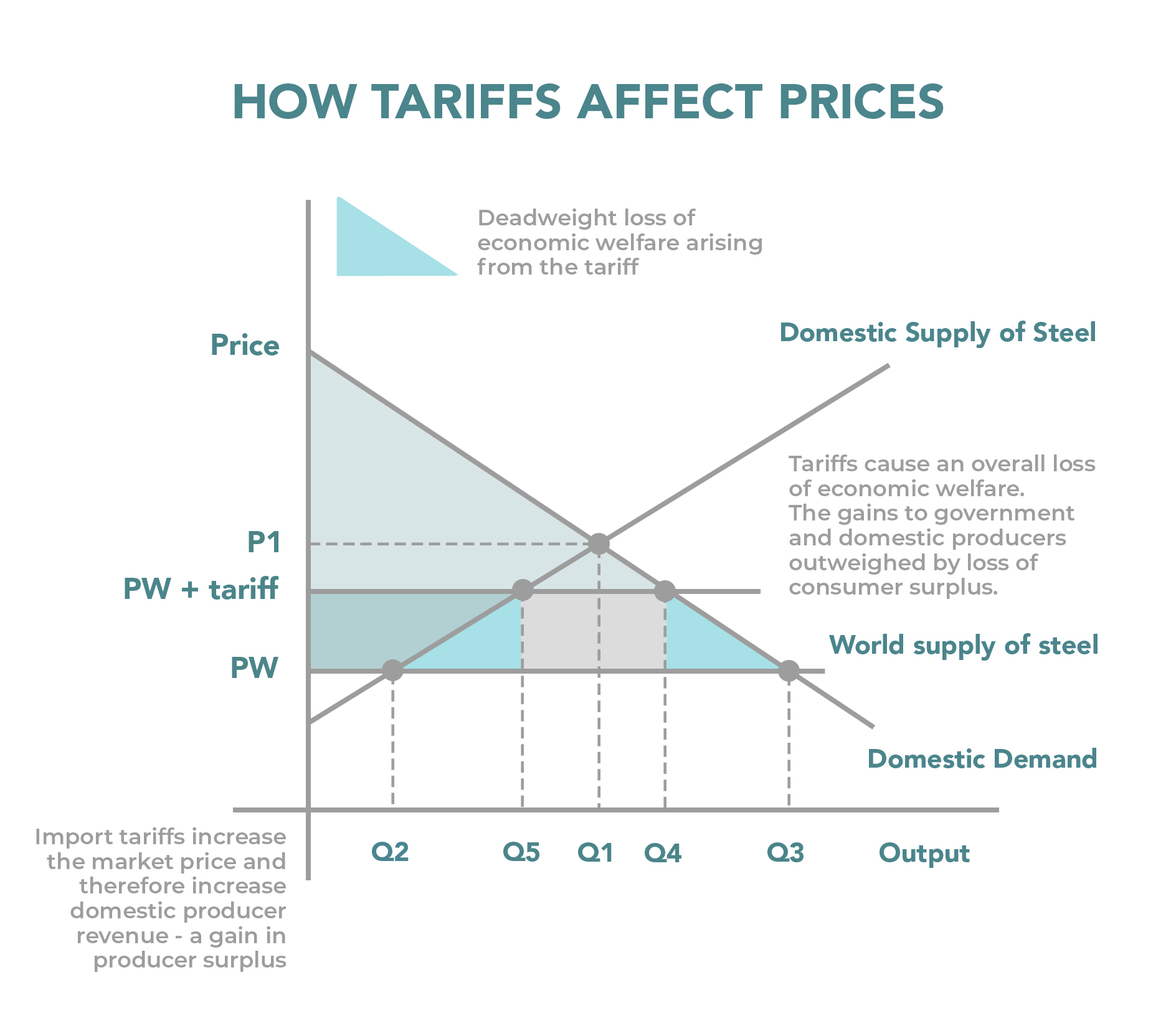

Tariffs directly increase the cost of imported goods and raw materials, significantly impacting businesses reliant on global supply chains. This increase in input costs directly translates to reduced profit margins, making it harder for companies to remain profitable and competitive. The uncertainty surrounding future tariff changes adds another layer of complexity, making accurate cost forecasting nearly impossible.

- Higher prices for imported components: Increased tariffs on raw materials or intermediate goods lead to higher production costs, squeezing profit margins and potentially leading to price increases for consumers.

- Increased logistical challenges: Trade restrictions and delays caused by tariff changes create significant logistical headaches, leading to increased shipping costs and extended lead times. This can disrupt production schedules and negatively impact customer satisfaction.

- Difficulty in accurately forecasting costs: The unpredictable nature of tariff changes makes it incredibly difficult for businesses to accurately predict future costs, hindering effective long-term planning and investment decisions. This volatility makes budgeting and financial forecasting extremely challenging.

- Industries heavily affected: Manufacturing, agriculture, and technology are just a few of the sectors significantly impacted by tariff uncertainty. These industries rely heavily on imported components and raw materials, making them particularly vulnerable to tariff fluctuations.

Reshoring and Nearshoring Initiatives

In response to tariff uncertainty, many U.S. companies are undertaking reshoring and nearshoring initiatives – shifting manufacturing and production back to the U.S. or to nearby countries. This strategy aims to reduce reliance on foreign suppliers and mitigate the risks associated with international trade disputes.

- Reduced transportation costs and lead times: Bringing production closer to home reduces shipping costs and lead times, improving efficiency and responsiveness to market demands.

- Improved control over the supply chain and quality assurance: Domestic production allows for greater control over the supply chain, ensuring higher quality and better oversight of the entire production process.

- Creation of domestic jobs and economic stimulus: Reshoring initiatives can lead to the creation of new jobs within the U.S., boosting domestic employment and stimulating economic growth.

- Challenges associated with reshoring: Higher labor costs in the U.S. compared to some overseas locations and potential infrastructure limitations present significant hurdles to reshoring.

- Successful examples: Companies in the automotive and textile industries have successfully implemented reshoring strategies, demonstrating the potential benefits of this approach.

Automation and Technological Advancements

To reduce reliance on imported goods and improve efficiency, companies are increasingly adopting automation and technological advancements. This involves investing in innovative technologies to streamline operations and reduce costs.

- Increased adoption of automation: Automation in manufacturing and logistics helps reduce labor costs and improves productivity, partially offsetting the increased costs associated with tariffs.

- Investment in robotics and AI: Robotics and artificial intelligence are being utilized to automate repetitive tasks, increasing efficiency and reducing the need for manual labor.

- Use of 3D printing: 3D printing enables on-demand production, reducing dependence on external suppliers and allowing for greater flexibility in responding to market changes.

- Potential downsides of automation: While automation offers numerous benefits, it also raises concerns about potential job displacement and the high upfront investment costs associated with implementing new technologies.

Diversification of Suppliers and Sourcing Strategies

Reducing reliance on single suppliers and exploring alternative sourcing options is crucial for mitigating the risks associated with geopolitical instability and trade wars. A diversified supplier base provides greater resilience to supply chain disruptions.

- Mitigation of risks: Diversifying suppliers reduces the impact of potential disruptions from any single supplier, such as natural disasters, political instability, or unexpected tariff increases.

- Negotiating better pricing and terms: Having multiple suppliers allows companies to negotiate better pricing and terms, leveraging competition to obtain more favorable contracts.

- Increased resilience to supply chain disruptions: A diversified supply chain is better equipped to withstand unforeseen events and maintain business continuity during periods of uncertainty.

- Challenges of managing multiple suppliers: Managing relationships with multiple suppliers across different regions can be complex and require robust logistical and communication systems.

Strategic Pricing and Cost Reduction Measures

Companies are adapting their pricing strategies and implementing internal cost-cutting measures to offset the impact of tariff uncertainty. This involves a careful examination of all aspects of the business to identify areas for improvement.

- Implementing lean manufacturing techniques: Lean manufacturing principles aim to optimize production processes, minimizing waste and maximizing efficiency to reduce overall costs.

- Negotiating better terms with suppliers and distributors: Strong negotiation skills are vital in securing favorable terms with suppliers and distributors to minimize expenses.

- Adjusting product offerings and reducing unnecessary costs: Streamlining product lines and eliminating unnecessary costs can help maintain profitability during periods of tariff uncertainty.

- Impact of price increases on consumer demand: While price increases may be necessary to offset increased input costs, businesses must carefully consider the impact on consumer demand and price elasticity.

Conclusion

The impact of tariff uncertainty is forcing U.S. companies to adopt proactive cost-saving strategies, including reshoring, automation, supplier diversification, and strategic pricing adjustments. These measures are essential for maintaining competitiveness and profitability in an unpredictable global market. Understanding the effects of tariff uncertainty is crucial for businesses of all sizes. By implementing effective cost-saving strategies and staying informed about evolving trade policies, companies can navigate the challenges and build resilience against future tariff uncertainty and related risks. Learn more about mitigating the impact of tariff uncertainty on your business today!

Featured Posts

-

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025

Shooting At North Carolina University One Dead Six Injured

Apr 29, 2025 -

Lessons Learned From The April 8th Treasury Market

Apr 29, 2025

Lessons Learned From The April 8th Treasury Market

Apr 29, 2025 -

How Ai Thinks A Surprisingly Simple Explanation

Apr 29, 2025

How Ai Thinks A Surprisingly Simple Explanation

Apr 29, 2025 -

How U S Companies Are Responding To Tariff Uncertainty A Cost Cutting Focus

Apr 29, 2025

How U S Companies Are Responding To Tariff Uncertainty A Cost Cutting Focus

Apr 29, 2025 -

Hungarys Stand Against Us Pressure Preserving Economic Links With China

Apr 29, 2025

Hungarys Stand Against Us Pressure Preserving Economic Links With China

Apr 29, 2025

Latest Posts

-

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025

Netflixs Sirens Trailer Supergirl Milly Alcock And Julianne Moores Cult

Apr 29, 2025 -

Pete Rose And A Presidential Pardon Examining The Implications Of Overturning The Mlb Ban

Apr 29, 2025

Pete Rose And A Presidential Pardon Examining The Implications Of Overturning The Mlb Ban

Apr 29, 2025 -

Milly Alcock As Supergirl In Netflixs Sirens A Look At The Cult Trailer

Apr 29, 2025

Milly Alcock As Supergirl In Netflixs Sirens A Look At The Cult Trailer

Apr 29, 2025 -

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025

Supergirl Milly Alcock Joins Julianne Moores Cult In Netflixs Sirens Trailer

Apr 29, 2025 -

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025