The Next Fed Chair Faces An Unprecedented Challenge: Trump's Economic Policies

Table of Contents

Donald Trump's economic strategy was characterized by significant tax cuts, widespread deregulation, and aggressive trade wars. While these policies aimed to boost economic growth, they also created a complex and potentially volatile environment. His administration’s significant tax cuts, for instance, fueled substantial increases in the national debt, while deregulation efforts created new risks within the financial system. Simultaneously, the trade wars initiated significant disruptions in global supply chains, impacting both US businesses and consumers. The net effect is a complex economic picture that requires careful navigation.

Navigating the Aftermath of Trump's Tax Cuts

The substantial tax cuts implemented during the Trump administration significantly impacted the US economy, leaving a lasting legacy for the next Fed Chair.

Fiscal Imbalance and National Debt

Trump's tax cuts led to a substantial increase in the national debt. The long-term implications for fiscal policy are significant, requiring careful coordination with monetary policy. The challenge for the next Fed Chair will be navigating this delicate balance:

- Increased budget deficits: The tax cuts reduced government revenue, leading to larger budget deficits and a faster accumulation of national debt.

- Potential for inflation: Increased government borrowing could potentially drive up inflation, requiring the Fed to implement countermeasures.

- Challenges in managing debt levels: The rising national debt presents significant long-term challenges for fiscal sustainability, impacting future economic growth and policy flexibility. Managing this debt will require careful consideration of interest rate policies and economic growth forecasts.

Stimulus Impact and Economic Growth

While the tax cuts provided a short-term economic boost, their sustainability remains a concern. The next Fed Chair will need to assess the long-term effects of this stimulus:

- GDP growth rates under Trump: While initial GDP growth was observed, the sustainability of this growth is questionable given the increased national debt and potential inflationary pressures.

- Potential for inflationary pressures: The increased money supply due to the stimulus, coupled with the potential for supply chain disruptions, could lead to significant inflationary pressures.

- Impact on investment: The tax cuts aimed to stimulate private investment, however, their actual impact remains a subject of ongoing debate amongst economists, with some studies indicating limited effect on long-term capital expenditures.

The Legacy of Deregulation

The Trump administration's significant deregulation efforts across various sectors have created substantial challenges for the next Fed Chair.

Financial Market Stability Risks

Reduced financial regulations increase the potential for instability in the financial markets. The next Fed Chair will be responsible for mitigating these risks:

- Increased leverage: Relaxed regulations may have encouraged increased leverage in the financial system, making it more vulnerable to shocks.

- Potential for financial crises: A less regulated financial system is more susceptible to systemic risks, increasing the likelihood of future financial crises.

- Challenges in regulating shadow banking: The growth of shadow banking activities, operating outside traditional regulatory frameworks, poses additional challenges for maintaining financial stability.

Environmental Regulations and Economic Impact

The rollback of environmental regulations under the Trump administration has significant long-term economic consequences. The next Fed Chair must consider these impacts:

- Impact on industries: Relaxed environmental regulations may have provided short-term benefits to certain industries, but long-term costs related to environmental damage could outweigh these gains.

- Long-term costs of environmental damage: The costs associated with climate change, pollution, and resource depletion pose a significant threat to long-term economic growth and social well-being.

- Potential for increased inequality: The disproportionate impact of environmental damage on vulnerable communities exacerbates existing inequalities, creating social and economic instability.

Managing the Fallout from Trump's Trade Wars

Trump's trade policies significantly disrupted global supply chains and created substantial economic challenges.

Global Trade Uncertainty and Supply Chains

The trade wars initiated under Trump created significant uncertainty in global supply chains:

- Increased tariffs: Tariffs imposed on imported goods increased prices for consumers and disrupted established trade relationships.

- Trade deficits: While the aim was to reduce trade deficits, the trade wars may have inadvertently led to further distortions in global trade flows.

- Shifts in global supply chains: Businesses were forced to re-evaluate their supply chains, leading to increased costs, delays, and potential disruptions to production.

Inflationary Pressures and Monetary Policy Response

Trade wars can contribute to inflationary pressures, creating significant challenges for monetary policy:

- Impact on import prices: Tariffs directly increase import prices, contributing to higher inflation rates.

- Potential for stagflation: The combination of slow economic growth and high inflation (stagflation) presents a particularly difficult challenge for monetary policymakers.

- Need for skillful monetary policy adjustments: The Fed will need to carefully calibrate its monetary policy response to address inflationary pressures while supporting economic growth.

Conclusion: The Next Fed Chair's Critical Role in Addressing Trump's Economic Legacy

The next Federal Reserve Chair faces an unprecedented challenge: navigating the complex economic legacy of Trump's policies. The combination of fiscal imbalances, increased financial risks from deregulation, and lingering effects from trade wars requires skillful leadership and deft policy adjustments. Successfully managing these challenges is crucial for maintaining economic stability and ensuring sustainable growth. Understanding the challenges of the next Fed Chair, analyzing the impact of Trump's economic policies, and preparing for the future of the US economy requires careful consideration of these interconnected factors. We encourage you to learn more about the candidates and the selection process to better understand the critical role the next Fed Chair will play in shaping the future of the American economy.

Featured Posts

-

Contentious Town Halls Public Anger Targets Lawmakers

Apr 26, 2025

Contentious Town Halls Public Anger Targets Lawmakers

Apr 26, 2025 -

1050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 26, 2025

1050 V Mware Price Hike At And Ts Concerns Over Broadcoms Acquisition

Apr 26, 2025 -

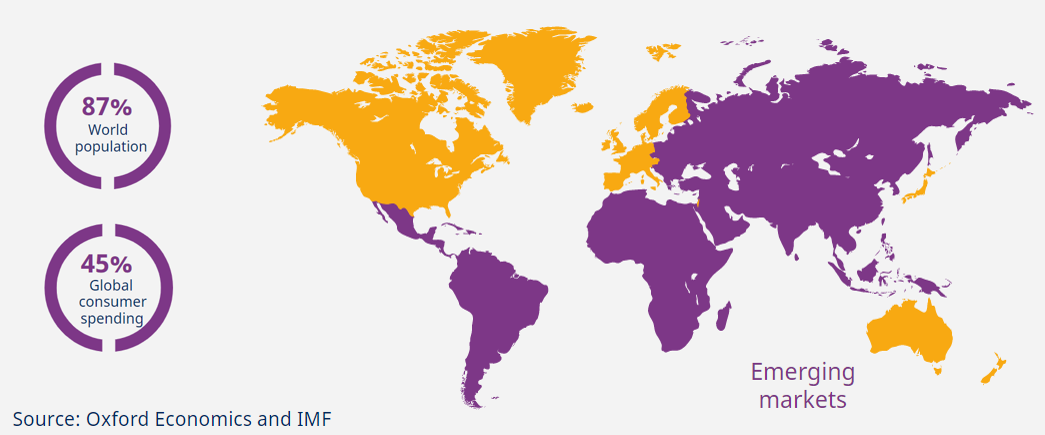

Closure Of Point72s Emerging Markets Fund Trader Exodus

Apr 26, 2025

Closure Of Point72s Emerging Markets Fund Trader Exodus

Apr 26, 2025 -

Nyt Spelling Bee Solution For February 26th Puzzle 360 Complete Guide

Apr 26, 2025

Nyt Spelling Bee Solution For February 26th Puzzle 360 Complete Guide

Apr 26, 2025 -

Quem E Benson Boone E Seu Caminho Para O Sucesso Antes Do Lollapalooza

Apr 26, 2025

Quem E Benson Boone E Seu Caminho Para O Sucesso Antes Do Lollapalooza

Apr 26, 2025

Latest Posts

-

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025

German Securities Trading Act 40 Abs 1 Wp Hg Pne Ag Nutzt Eqs Pvr

Apr 27, 2025 -

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Offenlegungspflicht Pne Ag Nutzt Eqs Pvr Fuer Europaweite Verbreitung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025

Eqs Pvr Pne Ag Veroeffentlichung Gemaess 40 Abs 1 Wp Hg

Apr 27, 2025 -

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025

Grand National Horse Mortality Statistics 2025 Perspective

Apr 27, 2025 -

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025

The Number Of Horse Deaths At The Grand National Ahead Of The 2025 Race

Apr 27, 2025