The Risks And Rewards Of Investing In XRP (Ripple)

Table of Contents

Understanding XRP and Ripple's Ecosystem

What is XRP and how does it work?

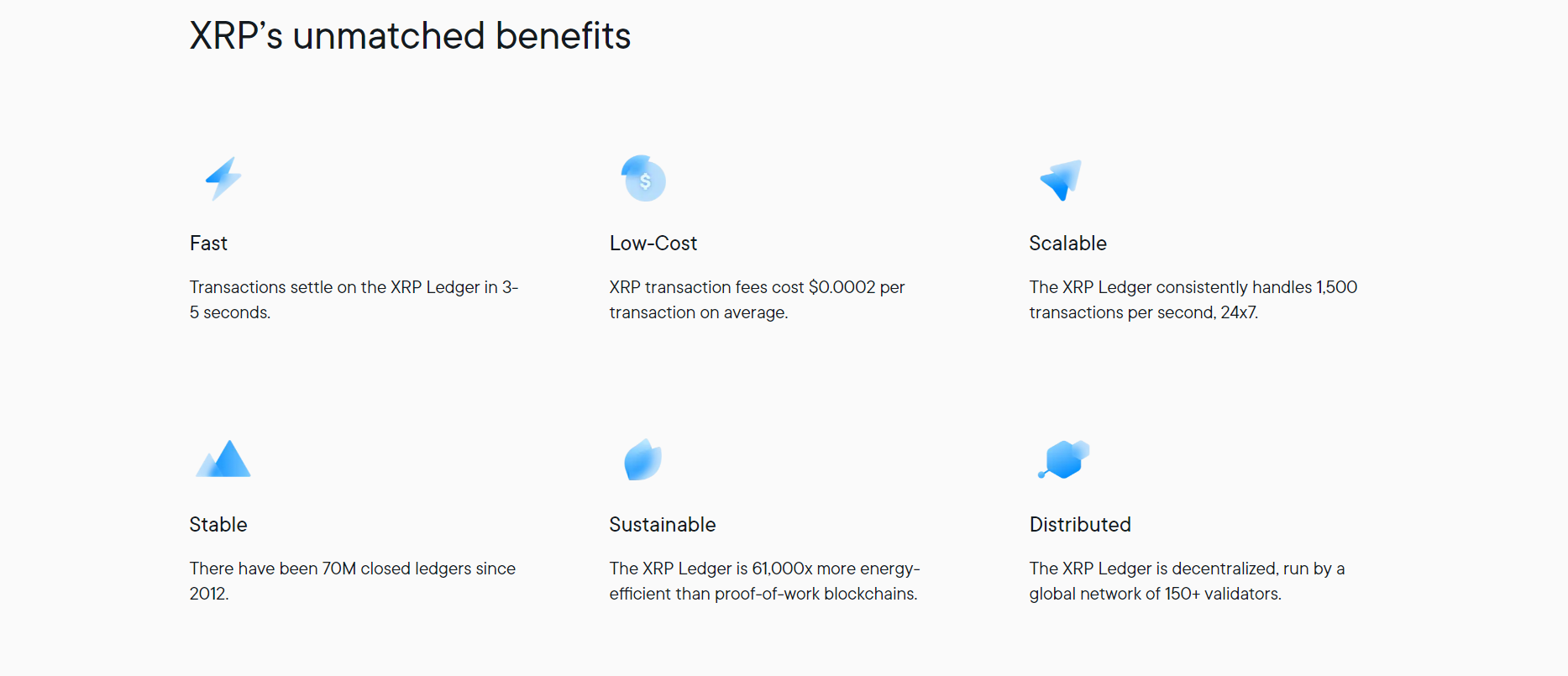

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments through Ripple's network. Unlike cryptocurrencies that rely on proof-of-work or proof-of-stake, XRP utilizes a unique consensus mechanism, allowing for real-time gross settlement (RTGS) of transactions. Its key characteristics include:

- Low transaction fees: XRP transactions typically cost significantly less than those on other major networks.

- Fast transaction speeds: Transactions are processed within seconds, offering a significant advantage over traditional banking systems.

- Large total supply: While there is a fixed supply of XRP, the total number is substantial compared to some other cryptocurrencies.

- Use in cross-border payments: XRP's primary function is to enable efficient and cost-effective international money transfers.

Ripple's partnerships and market adoption

Ripple has forged numerous partnerships with major financial institutions globally, driving the adoption of XRP in international payment systems. This institutional adoption is a key factor influencing XRP's value and market position. Examples of key partnerships include:

- Major Banks: Ripple works with several large banks to facilitate cross-border payments, leveraging XRP's speed and efficiency.

- Money Transfer Operators: Numerous money transfer operators use RippleNet to streamline their operations and reduce costs.

- Payment Processors: Several payment processors integrate XRP into their systems to offer faster and cheaper international transactions.

These strategic partnerships showcase Ripple's commitment to real-world applications and contribute to the growing acceptance of XRP within the financial sector.

The Potential Rewards of Investing in XRP

High potential for growth

The increasing adoption of XRP by financial institutions and its potential for wider use in global payments creates a high potential for growth. While past performance is not indicative of future results, historical price charts (available on reputable cryptocurrency exchanges) can illustrate XRP's volatility and periods of significant price appreciation. This volatility, however, also presents considerable risk. Factors influencing potential growth include:

- Increased market demand: Higher demand for faster and cheaper cross-border transactions could drive up XRP's price.

- Expansion of RippleNet: The ongoing expansion of RippleNet to new financial institutions could boost XRP's usage and value.

- Growing institutional adoption: Increased participation by banks and other financial institutions could lead to higher demand and price appreciation.

Low transaction fees and fast transaction speeds

XRP offers a compelling advantage over traditional payment systems and other cryptocurrencies due to its significantly low transaction fees and high transaction speeds.

- Transaction Fees: Compared to Bitcoin or Ethereum, XRP transaction fees are often orders of magnitude lower.

- Transaction Speeds: XRP transactions are typically processed within seconds, providing a substantial speed advantage.

This cost-effectiveness and speed are attractive to both businesses and consumers seeking efficient cross-border payment solutions.

Diversification benefits

Adding XRP to a diversified investment portfolio can potentially reduce overall risk. Cryptocurrencies, while volatile, are often considered a separate asset class from traditional stocks and bonds. Including a small percentage of XRP as part of a well-diversified portfolio may help mitigate risk. However, remember that diversification does not eliminate risk.

The Risks of Investing in XRP

Regulatory uncertainty

The ongoing legal battles faced by Ripple, particularly the SEC lawsuit alleging XRP is an unregistered security, create significant regulatory uncertainty. The outcome of these legal challenges could dramatically impact XRP's price and future prospects. Key aspects of the regulatory risk include:

- SEC Lawsuit: The ongoing SEC lawsuit casts uncertainty over XRP's regulatory status in the US and globally.

- Potential Delisting: If deemed a security, XRP could be delisted from major exchanges, significantly impacting its liquidity and accessibility.

- Regulatory Compliance: Future regulations could impose restrictions on XRP's use and trading.

Market volatility

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price can experience significant swings in short periods, driven by factors such as:

- Market Sentiment: News, social media trends, and general market sentiment can dramatically impact XRP's price.

- Regulatory Announcements: Regulatory developments and legal decisions directly affect XRP's price.

- Technological Developments: Advancements in blockchain technology can influence XRP's position in the market.

Security risks

Like all cryptocurrencies, XRP is susceptible to security risks, including:

- Exchange Hacks: Exchanges holding XRP can be targets for hacking attempts.

- Wallet Security: Users need to implement robust security measures to protect their XRP holdings.

- Phishing and Scams: Investors should be wary of phishing attempts and fraudulent schemes.

Centralization concerns

Concerns exist regarding Ripple's centralized nature and its potential impact on XRP's decentralization. While XRP's transaction ledger is public, Ripple Labs controls a significant portion of XRP's total supply.

Conclusion

Investing in XRP presents both exciting opportunities and substantial risks. The potential for high growth and low-cost, fast transactions is counterbalanced by the considerable regulatory uncertainty, market volatility, security concerns, and centralization issues. While XRP's adoption by financial institutions is promising, the ongoing legal battles and inherent volatility of the cryptocurrency market cannot be ignored. Conduct your own thorough research and only invest what you can afford to lose. Make informed decisions regarding your XRP investment strategy.

Featured Posts

-

The Impact Of Celebrities On Who Wants To Be A Millionaire Ratings

May 07, 2025

The Impact Of Celebrities On Who Wants To Be A Millionaire Ratings

May 07, 2025 -

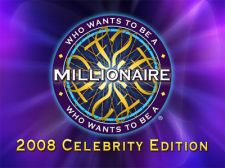

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025

Ib Ri S Dla Onetu Kto Zyskal A Kto Stracil Zaufanie Polakow

May 07, 2025 -

New Savage X Fenty Lingerie Rihannas Perfect Wedding Night Look

May 07, 2025

New Savage X Fenty Lingerie Rihannas Perfect Wedding Night Look

May 07, 2025 -

Analysis Whale Buys 20 Million Xrp Fueling Market Interest

May 07, 2025

Analysis Whale Buys 20 Million Xrp Fueling Market Interest

May 07, 2025 -

Is John Wick 5 Necessary A Case Against Another Sequel

May 07, 2025

Is John Wick 5 Necessary A Case Against Another Sequel

May 07, 2025

Latest Posts

-

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025 -

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025

Understanding Ethereums Price A Deep Dive Into Market Dynamics

May 08, 2025 -

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025 -

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025 -

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025