Third Straight Day Of Losses: Amsterdam Stock Exchange Down 11%

Table of Contents

Causes of the Amsterdam Stock Exchange Decline

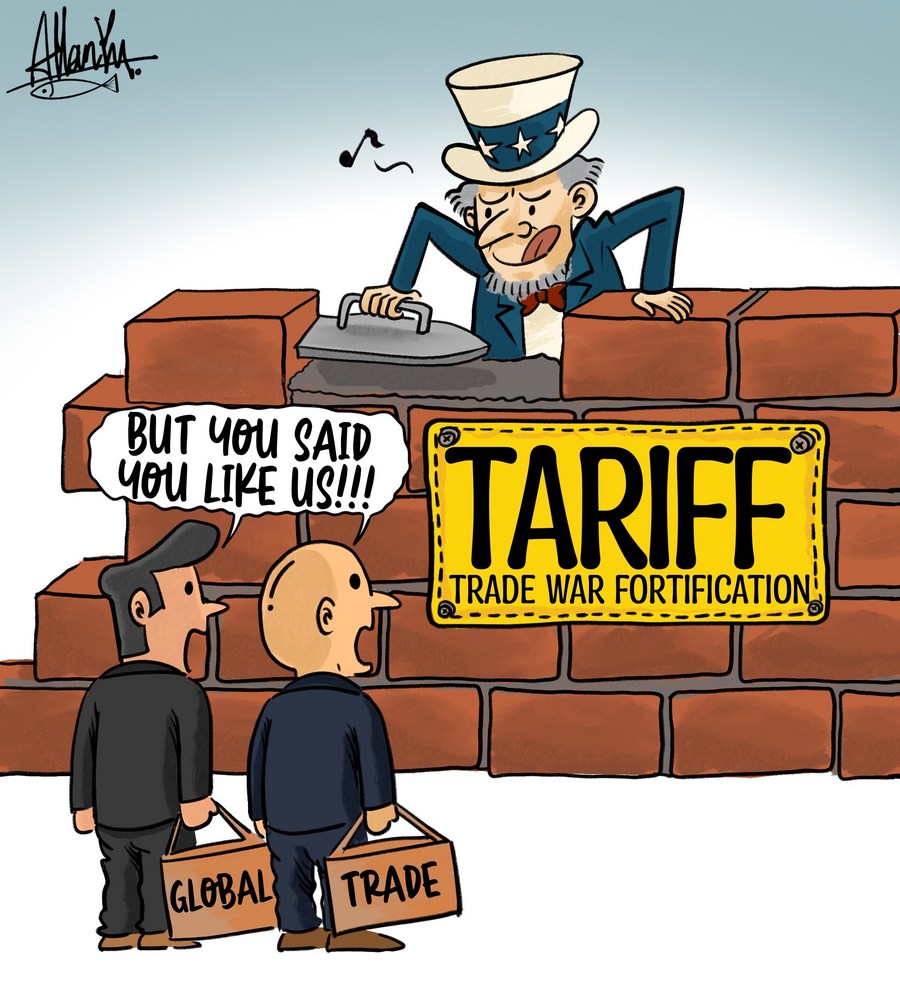

The sharp decline in the Amsterdam Stock Exchange can be attributed to a complex interplay of factors. The severity of the 11% drop over three days points to a confluence of issues impacting investor confidence.

-

Global Economic Slowdown and Recessionary Fears: The global economy is grappling with slowing growth, fueled by persistent inflation and aggressive interest rate hikes by central banks worldwide. Recessionary fears are prevalent, leading to risk aversion among investors and a sell-off in equities, including those listed on the Amsterdam Stock Exchange.

-

Impact of Rising Interest Rates and Inflation: Central banks' efforts to curb inflation by raising interest rates are impacting borrowing costs for businesses and consumers. Higher interest rates increase the cost of capital, hindering business investment and potentially leading to reduced corporate earnings – a major factor driving down stock prices on the Amsterdam Stock Exchange. According to the European Central Bank (ECB), inflation remains stubbornly high, exacerbating these concerns.

-

Sector-Specific Issues Affecting Dutch Companies: Specific sectors within the Dutch economy are experiencing particular difficulties. The energy sector, for instance, is facing volatility due to global energy price fluctuations. Similarly, the technology sector, sensitive to interest rate changes and investor sentiment, has also experienced significant pressure. The AEX index's composition reflects these sector-specific vulnerabilities.

-

Geopolitical Uncertainties and Their Influence on Investor Confidence: The ongoing war in Ukraine and escalating geopolitical tensions are contributing to global uncertainty. These events create risk aversion among investors, pushing them to seek safer havens and leading to a sell-off in riskier assets, like stocks listed on the Amsterdam Stock Exchange.

-

Analysis of Key Market Indicators Reflecting the Downturn: Key market indicators like trading volume and volatility indices have shown significant increases, reflecting the heightened anxiety and uncertainty in the Amsterdam Stock Exchange. These indicators suggest a substantial shift in investor sentiment.

Impact on Dutch Investors and the Economy

The 11% drop in the Amsterdam Stock Exchange has significant repercussions for Dutch investors and the broader economy.

-

Portfolio Value Reduction for Dutch Investors: The sharp decline directly translates to substantial losses for Dutch investors holding equities listed on the AEX. Pension funds and retirement savings are particularly vulnerable to these market fluctuations.

-

Potential Impact on Retirement Savings and Pension Funds: Many Dutch pension funds hold significant investments in the Amsterdam Stock Exchange. The recent losses could impact their long-term solvency and ability to meet future pension obligations.

-

Effect on Consumer Confidence and Spending: The stock market downturn can negatively influence consumer confidence, leading to reduced spending and potentially slowing economic growth. This effect is particularly pronounced if the decline triggers widespread job losses.

-

Ripple Effects on the Broader Dutch Economy, Including Business Investment: A weakened stock market can discourage business investment, as companies may find it harder to raise capital or may postpone expansion plans due to decreased investor confidence in the Amsterdam Stock Exchange.

Expert Analysis and Market Outlook for the Amsterdam Stock Exchange

Financial analysts offer mixed perspectives on the Amsterdam Stock Exchange's short-term and long-term outlook.

-

Short-term predictions for the AEX index: Some analysts predict further short-term volatility, suggesting a cautious approach for investors. Others believe the current downturn presents buying opportunities for long-term investors.

-

Long-term outlook and potential recovery scenarios: The long-term outlook hinges on the resolution of global economic uncertainties and the effectiveness of central bank policies in curbing inflation. A recovery scenario depends on a combination of factors, including improved global growth and reduced geopolitical tensions.

-

Recommendations for investors navigating the downturn (risk management strategies): Experts advise investors to adopt prudent risk management strategies, diversifying their portfolios and avoiding panic selling. Rebalancing portfolios and considering defensive investments are commonly recommended approaches.

-

Analysis of potential catalysts for a market rebound: Potential catalysts for a market rebound include signs of easing inflation, improved corporate earnings, and reduced geopolitical risks. These factors could restore investor confidence and trigger a recovery in the Amsterdam Stock Exchange.

Comparing the Amsterdam Stock Exchange Performance to Other Global Markets

The Amsterdam Stock Exchange's performance should be viewed in the context of broader global market trends.

-

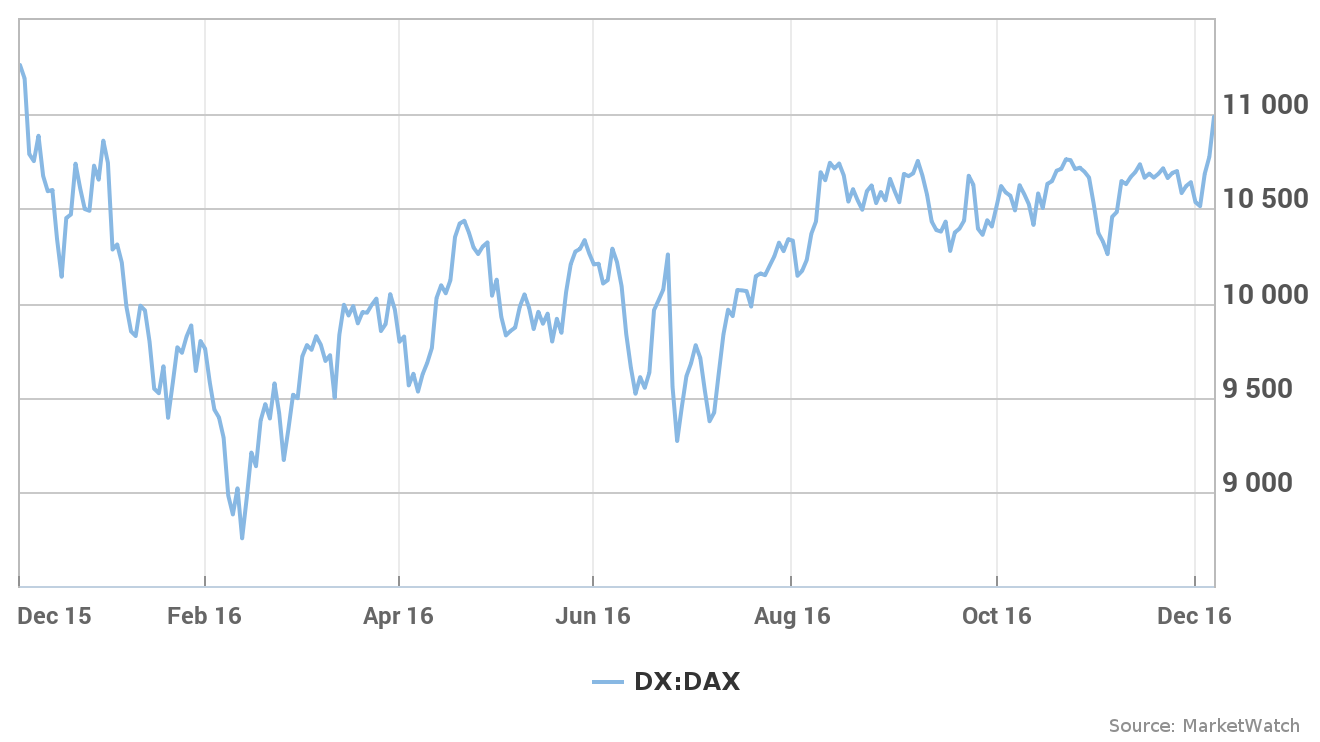

Performance of similar European markets (e.g., London, Frankfurt, Paris): While other European markets have also experienced declines, the severity of the AEX's drop suggests unique factors affecting the Dutch market.

-

Contrast with US stock market performance during the same period: The US market's performance during this period provides a useful comparison, highlighting whether the AEX's underperformance is specific to the Netherlands or reflects broader global trends.

-

Highlight any unique factors affecting the Amsterdam Stock Exchange’s underperformance: Factors specific to the Dutch economy, such as the relative performance of key Dutch sectors or unique regulatory environments, may contribute to the AEX's underperformance compared to other markets. Visual representations, such as charts comparing the AEX with other indices, would further illustrate this comparison.

Conclusion: Navigating the Amsterdam Stock Exchange Downturn – What's Next?

The three-day, 11% plunge in the Amsterdam Stock Exchange highlights the significant challenges facing the Dutch economy and global markets. The causes are multifaceted, stemming from global economic slowdown, rising inflation, interest rate hikes, sector-specific issues, and geopolitical uncertainties. The impact extends beyond investors to the broader Dutch economy, affecting consumer confidence and business investment. While the short-term outlook remains uncertain, long-term investors should adopt prudent risk management strategies. To navigate this period effectively, it's crucial to follow the Amsterdam Stock Exchange closely, monitoring its performance and staying informed through reputable financial news sources. Understanding the Amsterdam Stock Exchange's fluctuations is key to making informed investment decisions. Despite the volatility, the resilience of the market and the importance of long-term investment strategies should not be overlooked. The Amsterdam Stock Exchange, like all markets, will eventually recover; navigating this downturn requires patience, informed decision-making, and a focus on long-term goals.

Featured Posts

-

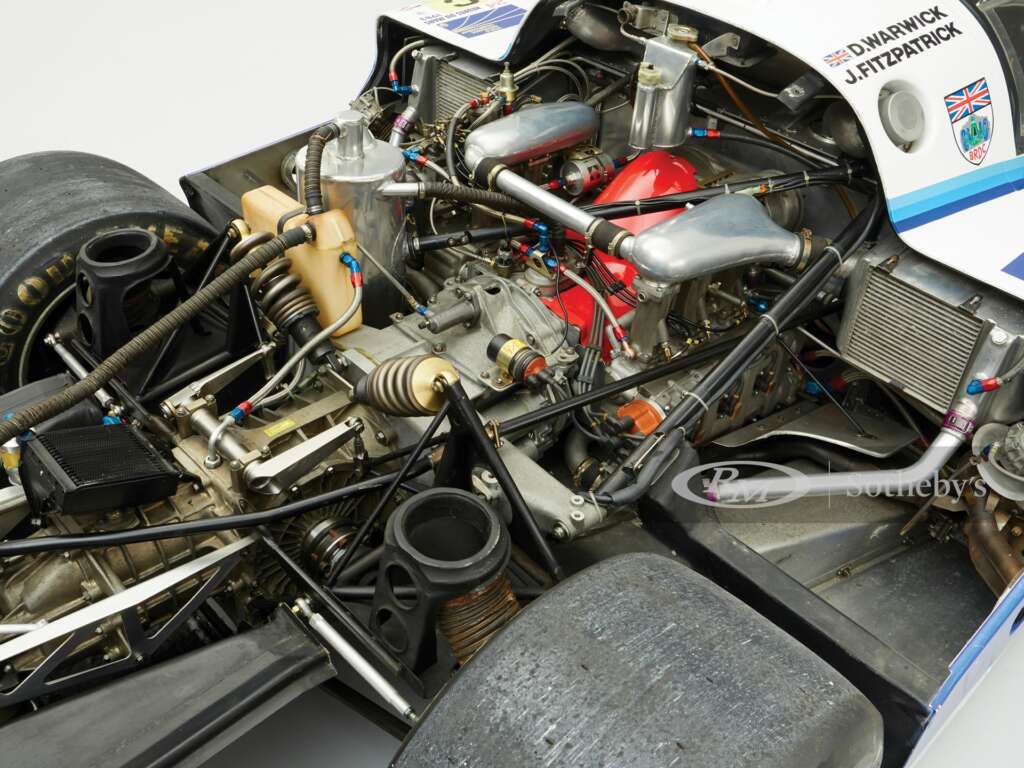

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025

Porsche 956 Nin Tavanindan Asili Sergilenmesinin Teknik Sebepleri

May 25, 2025 -

Planning Your Memorial Day Trip Smartest Days To Fly In 2025

May 25, 2025

Planning Your Memorial Day Trip Smartest Days To Fly In 2025

May 25, 2025 -

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Actions

May 25, 2025

Mia Farrow On Trump Imprisonment Necessary After Venezuelan Deportation Actions

May 25, 2025 -

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx Europe 600 Ve Dax 40 In Durumu

May 25, 2025

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx Europe 600 Ve Dax 40 In Durumu

May 25, 2025 -

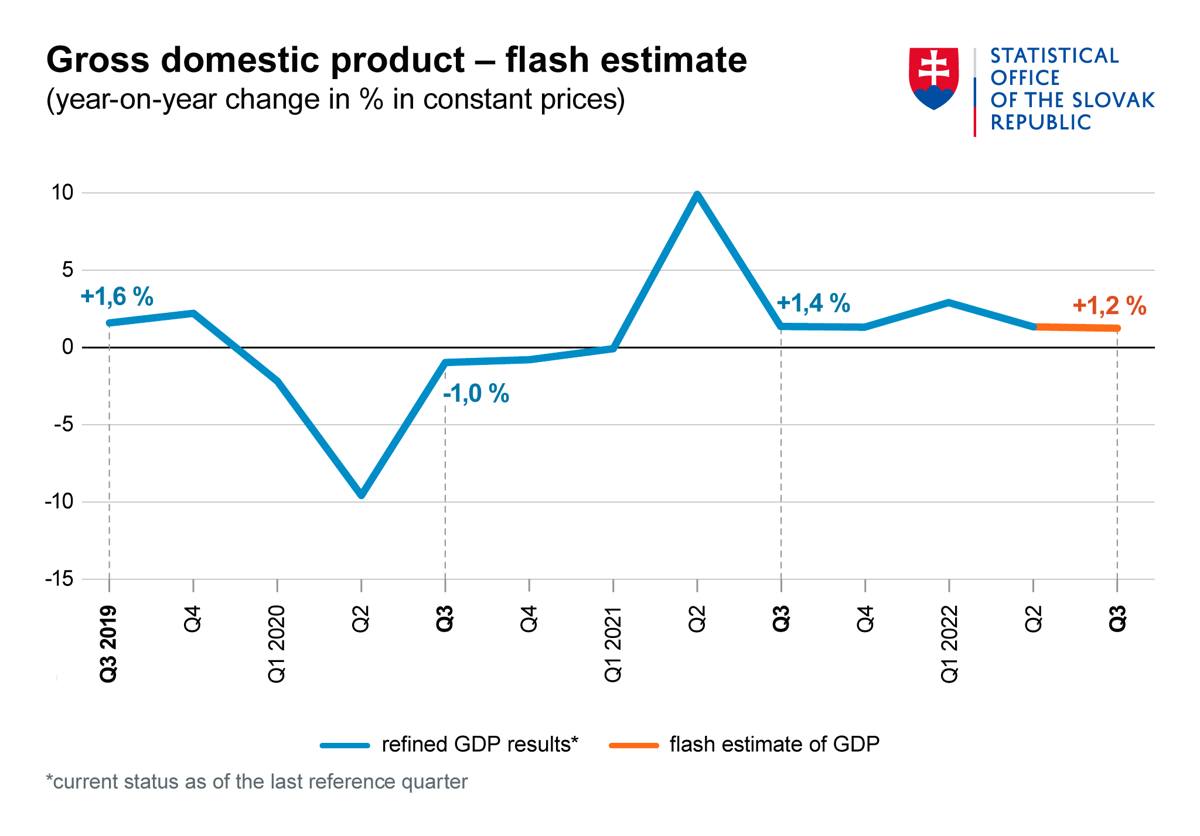

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025

Nemecke Firmy Rusia Pracovne Miesta Prehlad Najvaecsich Prepustani

May 25, 2025

Latest Posts

-

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025 -

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025

Increased China Us Trade The Impact Of The Approaching Trade Truce

May 25, 2025 -

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025

Uk Inflation Report Spurs Pound Rally Boe Rate Cut Bets Diminish

May 25, 2025 -

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025

How Middle Management Drives Productivity And Employee Engagement

May 25, 2025