Thursday's CoreWeave (CRWV) Stock Dip: A Comprehensive Explanation

Table of Contents

Potential Factors Contributing to the CoreWeave (CRWV) Stock Decline

Several interconnected factors likely contributed to the CoreWeave (CRWV) stock decline on Thursday. Understanding these factors requires analyzing both broader market trends and company-specific news.

Overall Market Conditions and Sector-Specific Sentiment

Thursday's market presented a complex picture. The broader market's performance plays a crucial role in influencing individual stock prices, especially for high-growth tech companies like CoreWeave.

- Broader Market Downturn: Were there any significant economic reports released, such as unexpectedly high inflation figures or revised GDP forecasts, that negatively impacted investor sentiment across the board? This general negativity could have disproportionately affected a volatile stock like CRWV.

- Cloud Computing Sector Performance: A comparison of Thursday's performance of other cloud computing stocks (e.g., AWS, GCP, Azure) is vital. If the entire sector experienced a downturn, it suggests sector-specific headwinds rather than solely CoreWeave-specific issues. A correlation analysis would help determine the extent of this influence.

- Negative Investor Sentiment: Reports highlighting concerns about the overall valuation of cloud computing companies or anxieties related to the long-term viability of the AI boom could have triggered widespread selling. News articles and analyst reports from that day should be reviewed for insights into prevailing sentiment.

- Example: News of a potential slowdown in AI investment from venture capitalists could create a ripple effect, affecting investor confidence in CoreWeave.

Company-Specific News and Developments

Internal factors related to CoreWeave itself could have also influenced the stock price drop.

- Press Releases and Announcements: A thorough review of any press releases or announcements made by CoreWeave on Thursday is essential. Did the company release disappointing earnings forecasts, announce a significant delay in a key project, or experience any negative regulatory developments?

- Missed Earnings Expectations: A considerable discrepancy between reported earnings and analyst expectations often leads to immediate sell-offs. Analyzing the specific areas where CoreWeave fell short of projections is crucial. Investors scrutinize key metrics like revenue growth, operating margins, and customer acquisition costs.

- Example: If CoreWeave missed its projected revenue target for the quarter due to slower-than-expected customer adoption of its services, this could justify a significant stock price drop.

- Analyst Downgrades: A change in ratings from key financial analysts can also severely impact a stock's price. Identifying any downgrades and the reasoning behind them provides valuable insights into the market's perception of CoreWeave's prospects.

- Example: If a prominent analyst downgraded CoreWeave's rating due to concerns about its competitive landscape or its ability to sustain growth, this could trigger a sell-off.

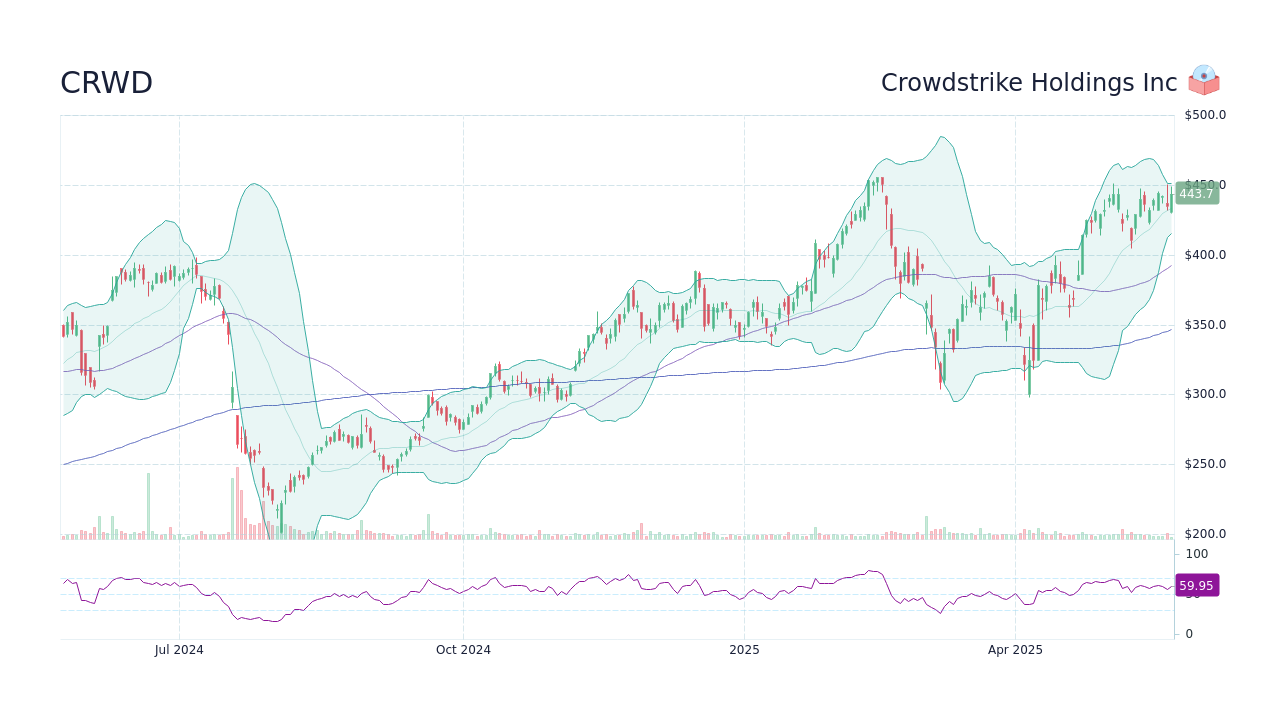

Technical Analysis and Trading Patterns

Technical analysis provides a different perspective by examining the stock's chart patterns and trading volume.

- Chart Patterns: A look at the CRWV stock chart for Thursday reveals if any significant resistance levels were broken, indicating a potential loss of support. Identifying chart patterns like head-and-shoulders formations or bearish engulfing candlesticks can signal a potential shift in momentum.

- Volume Spikes: High trading volume accompanying the price drop could indicate a significant number of investors selling their shares, reinforcing the downward pressure. Conversely, low volume might suggest a more controlled decline driven by other factors.

- Short Selling Activity: Tracking short-selling activity—where investors borrow shares to sell, hoping to buy them back at a lower price—can indicate a negative outlook among some investors. High levels of short selling could amplify a downward trend.

- Institutional Investor Activity: Institutional investors (mutual funds, hedge funds, etc.) often hold substantial portions of a company's stock. A significant sell-off by these investors could greatly influence the price. News reports should be checked for insights into institutional trading.

Analyzing the Long-Term Implications for CoreWeave (CRWV)

While Thursday's dip is certainly concerning, assessing the long-term implications requires a nuanced approach that considers both the immediate factors and CoreWeave's underlying fundamentals.

Assessing CoreWeave's Fundamentals

CoreWeave operates in the rapidly growing cloud computing and AI sectors. Understanding its long-term potential depends on assessing its inherent strengths:

- Business Model: Does CoreWeave's business model offer a sustainable competitive advantage? Is it differentiated enough to withstand competition from established players?

- Strengths and Competitive Advantages: Does CoreWeave possess unique technologies, cost advantages, or superior customer service that set it apart? Identifying these strengths is crucial for evaluating its long-term prospects.

- Financial Health: A detailed review of CoreWeave’s financial statements, including its debt levels, cash flow, and profitability, provides valuable insights into its financial stability. A strong balance sheet can help weather market fluctuations.

- Growth Projections: The company's growth projections—both in terms of revenue and market share—provide a picture of its future potential. Conservative growth projections are more credible than overly optimistic ones.

Investor Reaction and Future Outlook

The market's long-term reaction to Thursday's dip will be crucial.

- Buy the Dip? Some investors might view the dip as a buying opportunity, anticipating a future price recovery. However, this strategy requires careful evaluation of the underlying causes of the dip.

- Expert Opinions: Consulting financial experts and industry analysts' opinions on CoreWeave’s future prospects will aid in making informed decisions.

- Market Forecasts: Market forecasts for the cloud computing and AI sectors can provide a broader context for CoreWeave’s potential.

- Price Recovery Potential: The potential for price recovery depends heavily on the resolution of the issues that triggered the initial decline.

Conclusion

The CoreWeave (CRWV) stock dip on Thursday was likely a result of a complex interplay between broader market conditions, sector-specific sentiment, and company-specific news. Understanding these factors—market volatility, potential negative investor sentiment, the performance of other cloud computing stocks, and any specific issues related to CoreWeave—is critical. While the dip is noteworthy, a thorough analysis of CoreWeave's fundamentals and future growth prospects is essential. Before making any investment decisions regarding CoreWeave (CRWV) stock, conduct your own thorough research, monitor its performance closely, and stay informed on future news related to the company and the broader cloud computing and AI sectors. Stay informed on future developments in the CoreWeave (CRWV) stock situation.

Featured Posts

-

Abn Amros Bonus Scheme Potential Regulatory Action

May 22, 2025

Abn Amros Bonus Scheme Potential Regulatory Action

May 22, 2025 -

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025 -

Why Did Core Weave Inc Crwv Stock Price Increase On Wednesday

May 22, 2025

Why Did Core Weave Inc Crwv Stock Price Increase On Wednesday

May 22, 2025 -

Rutte Sanchez Goeruesmesi Avrupa Nin Enerji Krizi Ve Nato Nun Rolue

May 22, 2025

Rutte Sanchez Goeruesmesi Avrupa Nin Enerji Krizi Ve Nato Nun Rolue

May 22, 2025 -

Understanding The Thursday Decline In Core Weave Inc Crwv Stock

May 22, 2025

Understanding The Thursday Decline In Core Weave Inc Crwv Stock

May 22, 2025