Tracking The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and Why is it Important for the Amundi Dow Jones Industrial Average UCITS ETF?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. For an ETF like the Amundi Dow Jones Industrial Average UCITS ETF, the NAV is calculated by taking the total market value of all the stocks in the Dow Jones Industrial Average held by the ETF, subtracting any liabilities (like management fees), and dividing by the total number of outstanding ETF shares.

The NAV is fundamentally linked to the ETF's share price. While the share price can fluctuate throughout the trading day, the NAV provides a more accurate reflection of the ETF's intrinsic value. A significant divergence between the share price and NAV can present arbitrage opportunities for sophisticated traders.

Monitoring the NAV of the Amundi Dow Jones Industrial Average UCITS ETF is crucial for several reasons:

- Accurate Performance Measurement: NAV provides a precise measure of the ETF's performance, independent of short-term market fluctuations.

- Identifying Potential Arbitrage Opportunities: Large discrepancies between NAV and share price can signal potential arbitrage opportunities.

- Understanding the ETF's Underlying Asset Performance: Tracking NAV allows you to assess the performance of the underlying Dow Jones Industrial Average components.

- Comparing Against Benchmark Indices: Comparing the NAV against the Dow Jones Industrial Average itself helps evaluate the ETF's tracking efficiency.

How to Find the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Accessing real-time and historical NAV data for the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Reliable sources include:

- Official ETF Provider Website (Amundi): Amundi's official website is the primary source for accurate and up-to-date NAV information.

- Financial News Websites: Reputable financial news sources like Bloomberg, Yahoo Finance, and Google Finance typically provide NAV data for major ETFs.

- Brokerage Platforms: Most brokerage platforms display the NAV alongside the current share price of the ETFs you hold or are considering.

NAV data is usually presented in tables or charts, often alongside historical data to visualize performance trends. It's important to be aware of potential time lags in NAV reporting; the NAV might not be updated instantly, especially after market close. Therefore, verifying data from multiple sources is essential to ensure accuracy.

Factors Affecting the Amundi Dow Jones Industrial Average UCITS ETF's NAV

Several factors can influence the NAV of the Amundi Dow Jones Industrial Average UCITS ETF:

- Underlying Assets (Dow Jones Industrial Average Components): The performance of the 30 constituent stocks of the Dow Jones Industrial Average directly impacts the ETF's NAV. A rise in the overall index leads to a higher NAV, and vice versa.

- Currency Fluctuations: If the ETF is denominated in a currency different from your base currency, exchange rate fluctuations will affect the NAV when converted to your local currency.

- ETF Expenses and Management Fees: Management fees and other expenses deducted from the ETF's assets will naturally reduce the NAV.

- Market Conditions and Overall Economic Trends: Broader market conditions, economic news, and investor sentiment all play a significant role in influencing the NAV.

Specific factors influencing NAV changes include:

- Changes in the prices of individual Dow Jones stocks.

- Dividend payments from underlying companies (which increase NAV).

- Currency exchange rate variations.

- Market sentiment and investor behavior (leading to overall market fluctuations).

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Understanding NAV changes is crucial for effective investment strategies. By comparing the NAV against the ETF's share price and the Dow Jones Industrial Average, you can assess the ETF's performance relative to its benchmark. You should also consider other factors such as trading volume and volatility.

Using NAV data for decision-making can involve:

- Dollar-cost averaging: Regularly investing a fixed amount regardless of NAV fluctuations.

- Identifying undervalued or overvalued ETFs: Comparing NAV to share price can help identify potential buying or selling opportunities.

- Tracking NAV to assess long-term performance: Monitoring NAV over time provides a clear picture of the ETF's long-term growth.

Conclusion: Mastering NAV Tracking for the Amundi Dow Jones Industrial Average UCITS ETF

Regularly tracking the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is vital for informed investment decisions. We've explored reliable sources for accessing NAV data, the key factors influencing it, and practical applications for investment strategies. By understanding and utilizing NAV information effectively, you can make data-driven choices, optimizing your investment in this important ETF. Remember to continue researching the ETF and its performance using NAV as a key indicator for long-term success. Start tracking the Net Asset Value today to improve your investment strategies!

Featured Posts

-

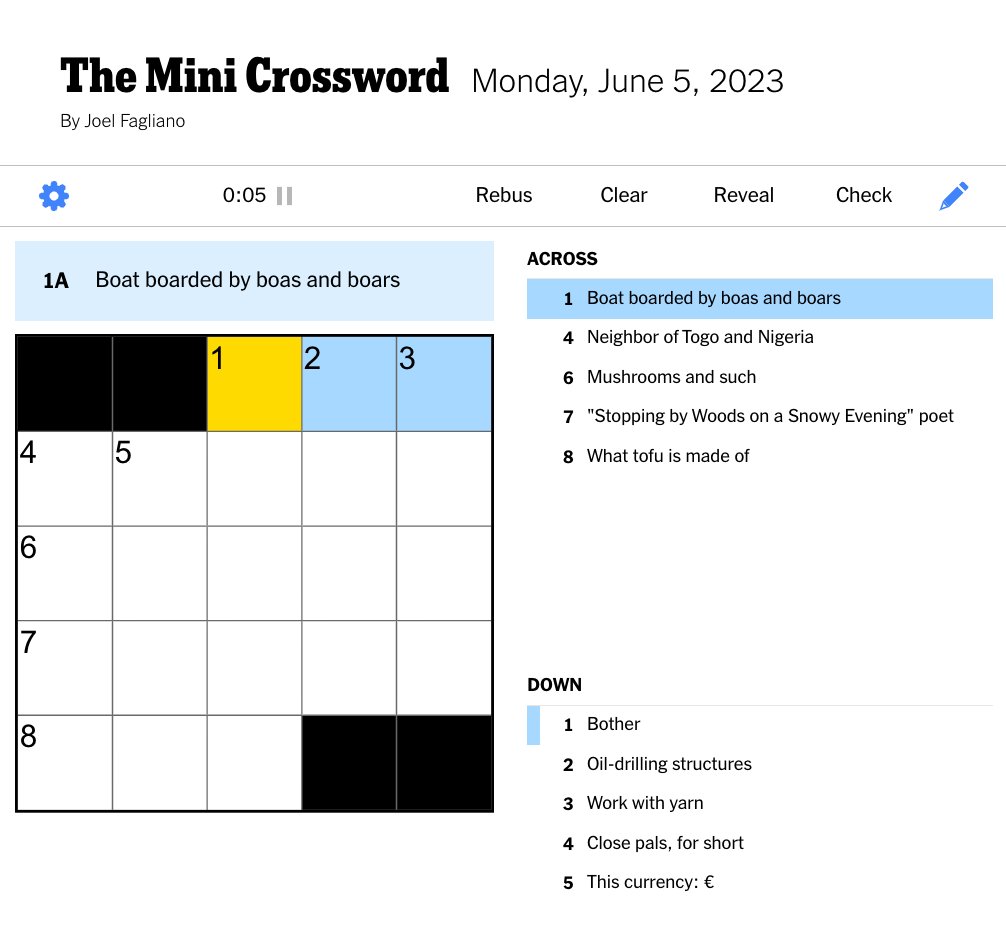

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 24, 2025

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 24, 2025 -

Nrw Eis Ranking Essen Enthuellt Den Ueberraschenden Sieger

May 24, 2025

Nrw Eis Ranking Essen Enthuellt Den Ueberraschenden Sieger

May 24, 2025 -

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025

Avoid Memorial Day Travel Chaos Best And Worst Flight Days In 2025

May 24, 2025 -

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025

Live Updates Pedestrian Struck By Vehicle On Princess Road Emergency Response Underway

May 24, 2025 -

Proverte Svoi Znaniya Oleg Basilashvili Test Dlya Kinomanov

May 24, 2025

Proverte Svoi Znaniya Oleg Basilashvili Test Dlya Kinomanov

May 24, 2025

Latest Posts

-

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Increase After Trumps Tariff Pause

May 24, 2025 -

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025

Ai Stuwt Relx Groei Ondanks Zwakke Economie Vooruitzichten Tot 2025

May 24, 2025 -

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025

Philips 2025 Agm Key Announcements And Shareholder Information

May 24, 2025 -

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Jump On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025

Economische Recessie Relx Blijft Groeien Dankzij Ai

May 24, 2025