Trump's Tariff Relief Hint Boosts European Stock Markets; LVMH Dips

Table of Contents

European Stock Market Surge Following Tariff Relief Hint

The news of potential Trump tariff relief ignited a significant rally in European stock markets. The reduced uncertainty surrounding the ongoing trade war between the US and the EU dramatically improved investor sentiment. This positive shift was reflected in substantial gains across major European indices.

- The DAX (Germany) saw a jump of 2.5%, the CAC 40 (France) increased by 3%, and the FTSE 100 (UK) rose by 1.8%. These percentage increases demonstrate the significant impact of the perceived easing of trade tensions.

- Investor sentiment shifted dramatically. The optimism stemmed from the belief that reduced trade barriers would boost economic growth and international trade. The lingering threat of escalating tariffs had weighed heavily on investor confidence; this hint of relief lifted that burden.

- The potential impact on European economic growth is substantial. Reduced trade barriers could stimulate exports, increase foreign investment, and ultimately lead to higher GDP growth. Sectors heavily reliant on international trade, such as automotive and manufacturing, benefited disproportionately.

- Beyond the immediate gains, the market reaction suggests a broader appetite for risk-taking, indicating increased confidence in the future economic outlook.

LVMH's Unexpected Dip Despite Positive Market Sentiment

While the broader European market celebrated the potential tariff relief, LVMH, the luxury goods conglomerate, experienced a notable 1.5% dip in its stock price. This unexpected downturn contrasts sharply with the overall positive market sentiment. Several factors may explain this discrepancy:

- Concerns about the luxury goods market are prominent. Luxury goods are often considered discretionary purchases, making them particularly vulnerable to economic downturns or shifts in consumer confidence. Even with reduced trade barriers, anxieties about global economic stability may persist, affecting consumer spending habits.

- Geopolitical factors beyond tariffs might be affecting LVMH's performance. Global political instability, regional conflicts, or shifts in currency exchange rates could all impact the luxury goods market, independent of US trade policy.

- LVMH's recent financial performance and internal company news may also be contributing factors. Any internal challenges, such as supply chain disruptions or decreased sales figures, could further depress the stock price despite positive external market forces.

- In contrast to other luxury brands, LVMH’s high exposure to the Chinese market might be causing some hesitation. Trade tensions between China and the US, separate from EU relations, could continue to impact LVMH's profitability.

Analyzing the Long-Term Implications of Trump's Tariff Statement

The long-term implications of Trump's tariff statement remain uncertain. While the market reacted positively to the hint of relief, the reliability of the statement itself is debatable.

- The statement's reliability is questionable. Was it a genuine indication of a policy shift, or merely a strategic maneuver to influence market sentiment? The lack of concrete details accompanying the statement leaves room for skepticism.

- The potential long-term implications for US-EU trade relations are complex. Even with reduced tariffs, underlying trade tensions may persist, potentially leading to future disagreements. A sustained, collaborative approach will be essential for strengthening bilateral ties.

- The overall impact on global economic uncertainty is still evolving. While the immediate market reaction suggests a reduction in uncertainty, continued trade disputes in other regions could still weigh on global growth.

- For long-term investors, navigating this complex landscape requires caution and diversification. Continuous monitoring of global trade developments and adjusting investment strategies accordingly is crucial for mitigating risks and capitalizing on emerging opportunities.

Conclusion

Trump's tariff relief hint triggered a significant surge in European stock markets, demonstrating the strong influence of trade policy on investor sentiment. However, LVMH's contrasting dip highlights the complex interplay of various factors affecting individual companies within a broader macroeconomic context. While the short-term impact appears positive for many sectors, long-term implications remain uncertain and require close monitoring. Understanding the impact of Trump's tariff decisions and their evolution is crucial for navigating the complexities of the global market. Stay informed about further developments in trade negotiations and their implications for your investment strategies; the effects of Trump's tariffs on global markets are far from settled.

Featured Posts

-

80 Millioert Felvertezett Porsche 911 Az Extrak Szemleje

May 24, 2025

80 Millioert Felvertezett Porsche 911 Az Extrak Szemleje

May 24, 2025 -

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Nav Deep Dive

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Nav Deep Dive

May 24, 2025 -

Porsche Elektromobiliu Ikrovimo Tinklas Auga Europoje

May 24, 2025

Porsche Elektromobiliu Ikrovimo Tinklas Auga Europoje

May 24, 2025 -

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Latest Posts

-

Pound Strengthens As Traders Reduce Expectations Of Boe Interest Rate Cuts

May 24, 2025

Pound Strengthens As Traders Reduce Expectations Of Boe Interest Rate Cuts

May 24, 2025 -

Ray Epps Sues Fox News For Defamation A Deep Dive Into The January 6th Allegations

May 24, 2025

Ray Epps Sues Fox News For Defamation A Deep Dive Into The January 6th Allegations

May 24, 2025 -

Uk Inflation Slows Impact On Boe Rate Cuts And The Pound Sterling

May 24, 2025

Uk Inflation Slows Impact On Boe Rate Cuts And The Pound Sterling

May 24, 2025 -

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6 Case

May 24, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6 Case

May 24, 2025 -

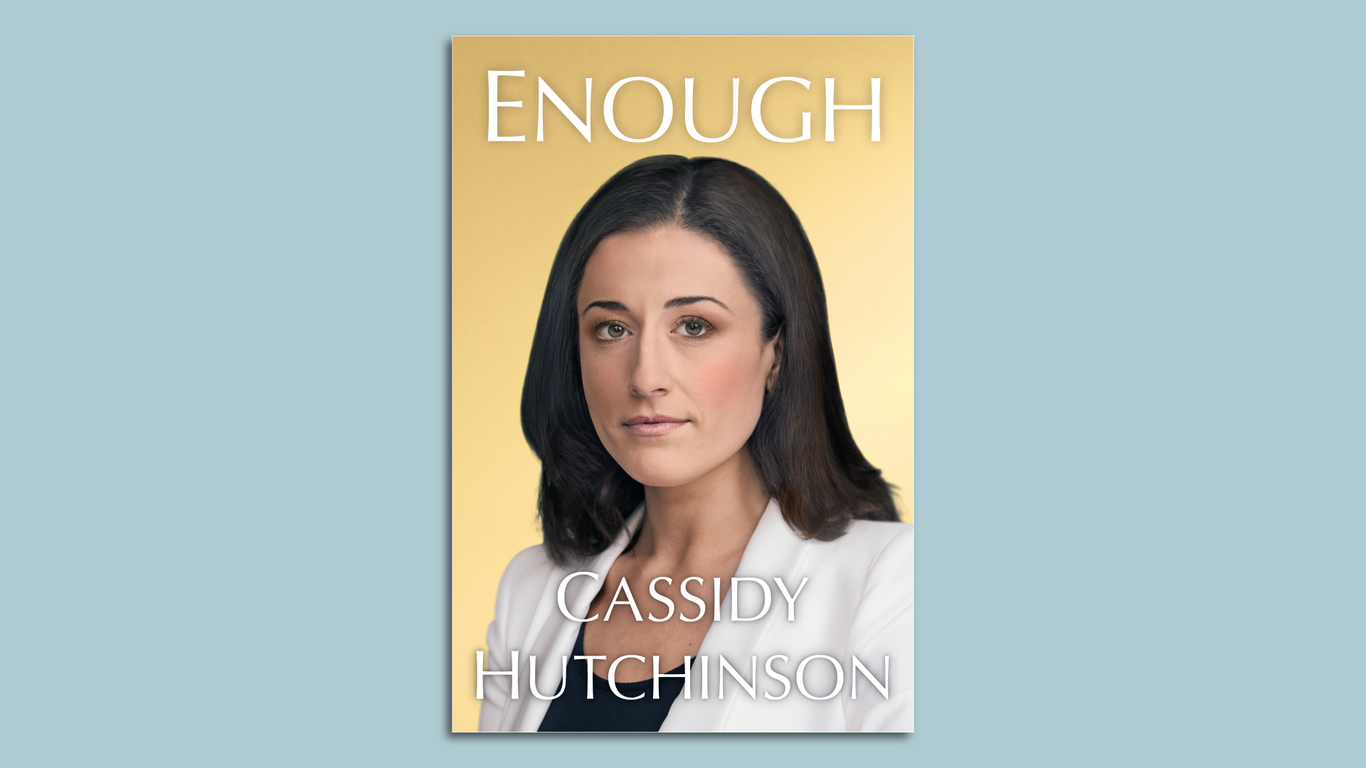

Cassidy Hutchinsons Fall Memoir Uncovering The January 6th Capitol Attack

May 24, 2025

Cassidy Hutchinsons Fall Memoir Uncovering The January 6th Capitol Attack

May 24, 2025