Understanding Stock Market Valuations: BofA's View For Investors

Table of Contents

Key Valuation Metrics BofA Considers

Bank of America, a leading financial institution, likely employs a range of valuation metrics to assess the overall market and individual stocks. Understanding these metrics is crucial for interpreting their analysis.

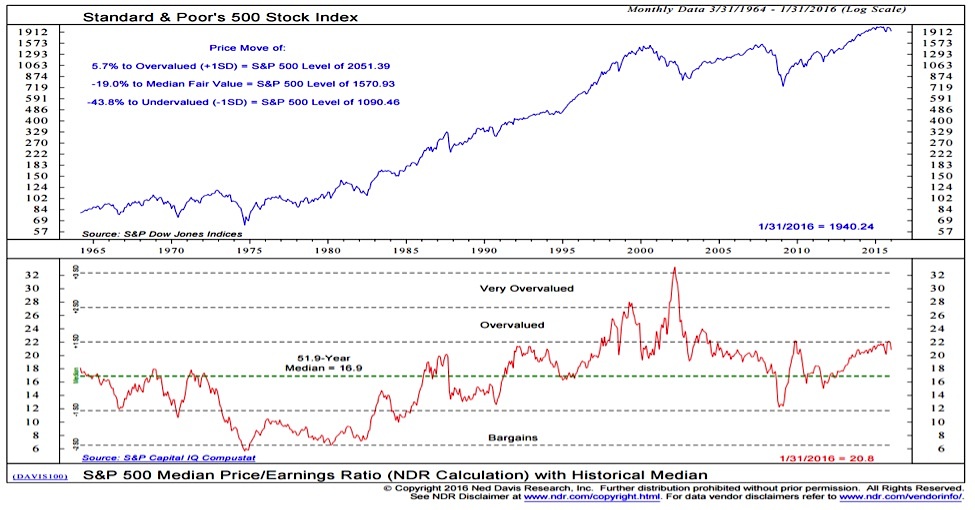

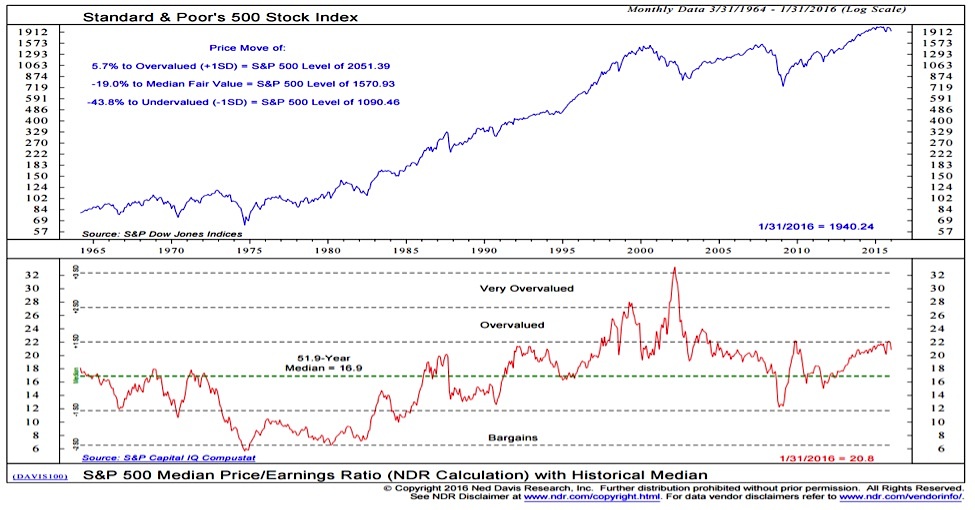

Price-to-Earnings Ratio (P/E)

The Price-to-Earnings Ratio (P/E) is a fundamental valuation metric calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio might suggest that the market expects high future growth, potentially indicating overvaluation. Conversely, a low P/E ratio could signal undervaluation. BofA's analysts likely utilize this ratio extensively.

- Limitations of P/E Ratio: It's crucial to compare P/E ratios within the same industry sector, as different sectors have varying growth rates and profit margins. A high P/E in a high-growth tech sector might be justified, while the same ratio in a mature utility sector might suggest overvaluation.

- Forward vs. Trailing P/E: BofA likely considers both trailing P/E (based on past earnings) and forward P/E (based on projected future earnings). The forward P/E offers a more forward-looking perspective on a company's valuation.

- BofA's Focus: BofA's analysts probably use P/E ratios to identify potential investment opportunities, comparing them against historical averages and industry benchmarks.

Price-to-Book Ratio (P/B)

The Price-to-Book Ratio (P/B) compares a company's market capitalization to its book value (assets minus liabilities). This ratio is particularly relevant for asset-heavy industries like banking or manufacturing. A low P/B ratio might suggest that a company's assets are undervalued by the market.

- Identifying Undervalued Assets: BofA might utilize the P/B ratio to pinpoint potentially undervalued companies with substantial assets, especially in sectors experiencing temporary downturns.

- Limitations of P/B Ratio: The P/B ratio is less useful for service-oriented companies with fewer tangible assets. Intangible assets, like brand reputation or intellectual property, are not always fully reflected in book value.

- Tangible vs. Intangible Assets: BofA's analysis likely differentiates between tangible and intangible assets when interpreting the P/B ratio, acknowledging the limitations of relying solely on book value.

Other Relevant Metrics

BofA's comprehensive equity valuation likely incorporates additional metrics to provide a holistic view.

- PEG Ratio: This metric adjusts the P/E ratio for growth, offering a more nuanced view of valuation.

- Dividend Yield: This indicates the annual dividend per share relative to the stock price, attractive to income-focused investors.

- Free Cash Flow Yield: This shows the free cash flow per share relative to the stock price, reflecting a company's ability to generate cash.

- Combined Analysis: BofA likely uses a combination of these metrics to gain a comprehensive understanding of a company's valuation and identify potential investment opportunities and risks.

BofA's Current Market Outlook and Valuation Predictions

BofA regularly publishes market outlooks and valuation predictions, providing valuable insights for investors. Understanding their perspective is crucial for informed decision-making.

Sector-Specific Analysis

BofA’s analysts likely conduct in-depth sector-specific analyses, evaluating valuations across various sectors. For example, they might identify the technology sector as potentially overvalued due to high P/E ratios and heightened competition, while viewing the healthcare sector as relatively undervalued due to its defensive nature.

- Overvalued vs. Undervalued Sectors: BofA might highlight specific sectors they believe to be overvalued or undervalued, providing investors with insights into potential investment opportunities and risks.

- Reasoning Behind Predictions: BofA's predictions are based on a variety of factors including industry trends, macroeconomic conditions, and individual company performance.

Overall Market Sentiment

BofA's overall assessment of market valuation – whether it's overvalued, undervalued, or fairly valued – is a critical piece of information for investors.

- Influencing Factors: This assessment is shaped by a variety of factors, including interest rate movements, inflation, economic growth prospects, and geopolitical events.

- Impact of Macroeconomic Factors: Macroeconomic factors significantly impact equity valuations. For example, rising interest rates can lead to lower valuations as investors demand higher returns.

Potential Risks and Opportunities

BofA's analysis should also highlight potential risks and opportunities arising from current market valuations.

- Downside Risks: Potential downside risks include market corrections, economic downturns, or geopolitical instability.

- Investment Opportunities: BofA might point to specific sectors or companies they believe offer attractive investment opportunities based on their valuation analysis.

Applying BofA's Insights to Your Investment Strategy

BofA's analysis should inform, but not dictate, your investment decisions. Remember to create a strategy incorporating diversification and long-term goals.

Portfolio Diversification

Diversifying your portfolio across different sectors and asset classes is crucial to mitigate risk. Don't put all your eggs in one basket.

Risk Management

Effective risk management is essential, especially considering BofA's market outlook. Understand your risk tolerance and adjust your portfolio accordingly.

Long-Term Investing

Focus on long-term investment strategies rather than attempting to time the market based on short-term fluctuations.

Conclusion

Understanding stock market valuations is crucial for successful investing. BofA's analysis provides valuable insights into current market conditions, helping investors identify potential opportunities and manage risks effectively. By utilizing key valuation metrics and considering BofA's sector-specific predictions, investors can develop a more informed investment strategy. Remember to prioritize diversification and long-term goals when making investment decisions. Stay informed about stock market valuations and continue to monitor BofA's insights for a clearer picture of the market. Learn more about effectively using stock market valuations to improve your investment strategy.

Featured Posts

-

Analyzing The Visual Improvements Of Assassins Creed Shadows Of Mordor On Ps 5 Pro With Ray Tracing

May 08, 2025

Analyzing The Visual Improvements Of Assassins Creed Shadows Of Mordor On Ps 5 Pro With Ray Tracing

May 08, 2025 -

Transferimi I Neymar Deshmi E Re Ceku Ne Arabisht 222 Milione Euro

May 08, 2025

Transferimi I Neymar Deshmi E Re Ceku Ne Arabisht 222 Milione Euro

May 08, 2025 -

Sommers Thumb Injury A Blow To Inter Milans Champions League And Serie A Hopes

May 08, 2025

Sommers Thumb Injury A Blow To Inter Milans Champions League And Serie A Hopes

May 08, 2025 -

Poor Performance Angels Minor League System Receives Low Ranking

May 08, 2025

Poor Performance Angels Minor League System Receives Low Ranking

May 08, 2025 -

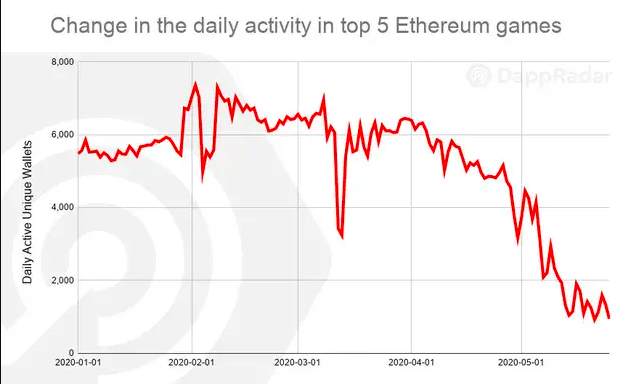

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Latest Posts

-

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025 -

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025