US Economic Growth To Slow Considerably: Deloitte Forecast

Table of Contents

Key Factors Contributing to the Slowdown in US Economic Growth

Several interconnected factors are converging to create a perfect storm for slowed US economic growth, according to Deloitte's analysis. These include persistent inflation, global economic uncertainty, and weakening consumer confidence.

Inflation and Rising Interest Rates

Persistent inflation continues to erode purchasing power, impacting both consumer spending and business investment. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are further exacerbating the situation by increasing borrowing costs for businesses and individuals.

- Inflationary Pressures: Soaring energy prices, supply chain disruptions, and robust consumer demand have all contributed to persistent inflation exceeding the Federal Reserve's target rate.

- Interest Rate Increases: The Federal Reserve has implemented several significant interest rate increases in an attempt to cool down the economy and control inflation. These increases make borrowing more expensive, impacting everything from mortgages and auto loans to business expansion plans.

The combination of high inflation and rising interest rates creates a double whammy, squeezing household budgets and dampening investment. This monetary policy, while intended to curb inflation, risks triggering a more significant economic slowdown.

Global Economic Uncertainty

The global economic landscape is far from stable, adding significant pressure to the US economy. Geopolitical instability, particularly the war in Ukraine, has disrupted global supply chains and driven up energy prices.

- Geopolitical Risks: The ongoing conflict in Ukraine continues to impact global energy markets and supply chains, creating uncertainty and volatility.

- Supply Chain Disruptions: Ongoing supply chain bottlenecks, exacerbated by geopolitical events and pandemic-related issues, continue to constrain production and increase costs.

- Energy Price Volatility: Fluctuations in energy prices, driven by geopolitical events and supply constraints, create instability and uncertainty for businesses and consumers.

The potential for a global recession adds another layer of complexity, potentially further dampening demand for US goods and services.

Weakening Consumer Confidence

Declining consumer confidence is a significant indicator of economic slowdown. High inflation, uncertainty about job security, and rising interest rates are all contributing to a more pessimistic outlook among consumers. This translates into reduced spending, a critical driver of US economic growth.

- Impact on Spending: As consumer confidence falls, spending decreases, impacting various sectors of the economy.

- Job Market Uncertainty: Concerns about job security, even in a relatively strong labor market, can contribute to decreased consumer spending.

- Weakening Sentiment: Data from consumer confidence surveys consistently show a downward trend, reflecting a growing sense of economic pessimism.

Deloitte's Forecast in Detail: Specific Projections and Implications

Deloitte's forecast projects a substantial deceleration in US GDP growth over the coming quarters. While the exact figures vary depending on the specific timeframe and underlying assumptions, the overall trend points towards a significantly slower pace of economic expansion compared to previous years.

Projected GDP Growth Rates

[Insert Chart/Graph here showing Deloitte's projected GDP growth rates] Deloitte's projections suggest a notable drop in GDP growth compared to previous years, signaling a significant economic slowdown. (Specific numbers should be included here if available from the Deloitte report).

Sector-Specific Impacts

The slowdown will not affect all sectors equally. Deloitte's analysis indicates that sectors heavily reliant on consumer spending, such as housing and retail, will likely experience the most significant impact. Manufacturing and technology sectors, while potentially resilient, may also face challenges due to global economic uncertainty and reduced investment.

Employment Market Outlook

While the labor market remains relatively strong, Deloitte's forecast suggests a potential moderation in job growth and a slight increase in the unemployment rate. Wage growth may also stagnate or even decline in certain sectors, further dampening consumer spending.

Strategies for Businesses to Navigate the Slowdown

Businesses need to adapt proactively to navigate the anticipated slowdown. This requires a multi-pronged approach focusing on cost optimization, innovation, and supply chain resilience.

Adapting to Changing Economic Conditions

- Cost-Cutting Measures: Identifying and implementing cost-cutting measures without sacrificing quality or innovation is crucial.

- Diversification Strategies: Businesses should diversify their product offerings and target markets to mitigate risks associated with sector-specific downturns.

- Exploring New Markets: Expanding into new markets can help mitigate risks and tap into new sources of revenue.

Investing in Innovation and Technology

Investing in technological advancements and process improvements can significantly enhance efficiency and productivity, improving competitiveness during a slowdown.

Strengthening Supply Chains

Building more resilient and diversified supply chains is critical to mitigate future disruptions and ensure business continuity.

Conclusion: Understanding the Deloitte Forecast and Preparing for Slowed US Economic Growth

Deloitte's forecast paints a clear picture: a significant slowdown in US economic growth is on the horizon, driven by a confluence of factors including inflation, global uncertainty, and weakening consumer confidence. This has significant implications for businesses and consumers alike. Understanding this forecast and preparing for the challenges ahead is paramount. By proactively implementing strategies for cost optimization, innovation, and supply chain resilience, businesses can position themselves for success even during periods of slowed US economic growth. Learn more about Deloitte's full report on the US economic outlook and develop your own strategies to navigate this predicted slowdown by visiting [link to Deloitte report].

Featured Posts

-

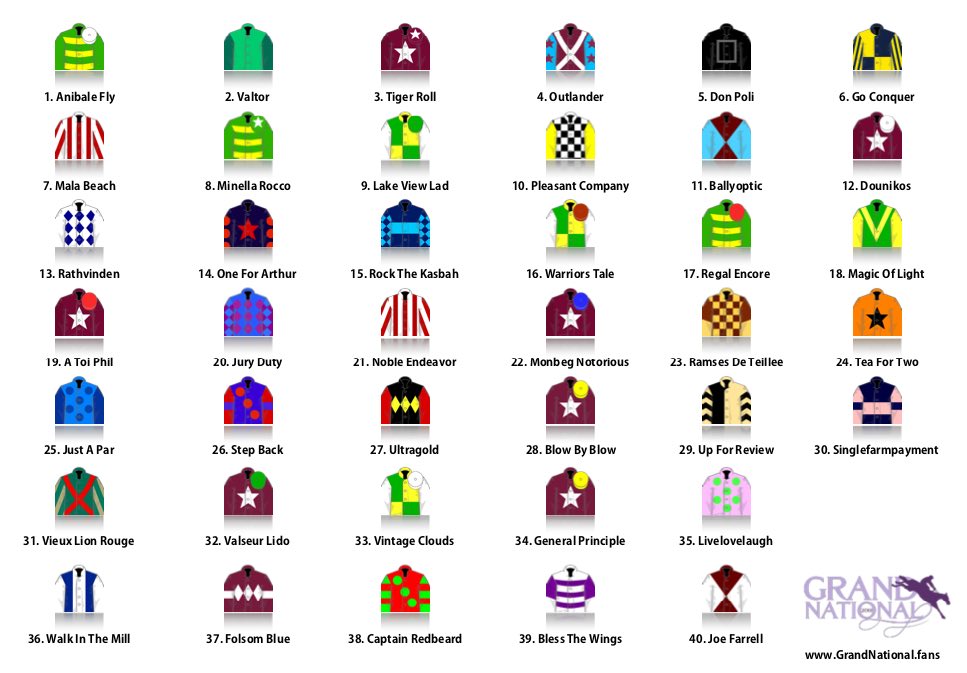

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025

Grand National 2025 Key Runners And Predictions For Aintree

Apr 27, 2025 -

Helmeyers Path To Blaugrana Glory

Apr 27, 2025

Helmeyers Path To Blaugrana Glory

Apr 27, 2025 -

Patrick Schwarzeneggers Forgotten Role In Ariana Grandes White Lotus Music Video

Apr 27, 2025

Patrick Schwarzeneggers Forgotten Role In Ariana Grandes White Lotus Music Video

Apr 27, 2025 -

Cdc Vaccine Study Hire Concerns Over Discredited Misinformation Agent

Apr 27, 2025

Cdc Vaccine Study Hire Concerns Over Discredited Misinformation Agent

Apr 27, 2025 -

Two More Ecb Rate Cuts Possible Simkus Highlights Trades Economic Strain

Apr 27, 2025

Two More Ecb Rate Cuts Possible Simkus Highlights Trades Economic Strain

Apr 27, 2025

Latest Posts

-

Activision Blizzard Acquisition Ftc Files Appeal

Apr 28, 2025

Activision Blizzard Acquisition Ftc Files Appeal

Apr 28, 2025 -

Ftcs Appeal Could Block Microsofts Activision Purchase

Apr 28, 2025

Ftcs Appeal Could Block Microsofts Activision Purchase

Apr 28, 2025 -

Ftc Appeals Microsoft Activision Merger Ruling

Apr 28, 2025

Ftc Appeals Microsoft Activision Merger Ruling

Apr 28, 2025 -

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025

January 6th Ray Epps Defamation Case Against Fox News Explained

Apr 28, 2025 -

Fox News Faces Defamation Suit From Ray Epps Regarding January 6th Allegations

Apr 28, 2025

Fox News Faces Defamation Suit From Ray Epps Regarding January 6th Allegations

Apr 28, 2025