US Regulatory Developments Boost Bitcoin To New Record High

Table of Contents

Increased Institutional Investment Fueled by Regulatory Clarity

Clearer regulatory frameworks in the US are significantly encouraging institutional investors to allocate more capital to Bitcoin. The reduced uncertainty surrounding Bitcoin's legal status is a major catalyst for this influx of institutional money.

- Examples of recent regulatory actions: The Grayscale Bitcoin Trust's approval, along with evolving SEC rulings on digital asset investment vehicles, has legitimized Bitcoin in the eyes of many institutional players. Furthermore, the increasing number of Bitcoin ETFs under review signals a growing acceptance within the traditional finance sector.

- Increased participation from major financial institutions: We've seen significant increases in Bitcoin holdings by major financial institutions, pension funds, and hedge funds. This shift represents a significant validation of Bitcoin as an asset class worthy of institutional consideration.

- Impact of regulatory clarity on reducing investment risk perception: Regulatory clarity directly reduces the perceived risk associated with Bitcoin investment. This makes it more palatable for risk-averse institutional investors who previously hesitated due to regulatory uncertainty. The market capitalization growth directly reflects this increased confidence. For instance, [insert data on market cap growth linked to a credible source].

Growing Adoption of Bitcoin as a Hedge Against Inflation

Bitcoin's recent surge is also fueled by its growing adoption as a hedge against inflation, particularly relevant given the current US economic climate. Many investors see Bitcoin as a potential safe haven asset during periods of economic uncertainty and inflationary pressures.

- Explanation of Bitcoin's deflationary nature: Unlike fiat currencies, Bitcoin has a limited supply of 21 million coins. This inherent scarcity contributes to its potential as an inflation hedge, as its value may increase as the value of fiat currencies decreases due to inflation.

- Comparison with traditional assets during inflationary periods: Historical data shows that traditional assets like gold often perform well during inflationary periods. Bitcoin, with its limited supply and decentralized nature, is increasingly being compared to gold as an alternative store of value during inflationary pressures.

- Growing investor interest in Bitcoin as a safe haven asset: More and more investors are looking towards Bitcoin as a safe haven asset, driven by concerns about inflation and the potential erosion of purchasing power of traditional currencies. [Insert relevant economic data or expert quotes on inflation and Bitcoin as a hedge].

Technological Advancements and Infrastructure Development

Significant technological advancements and infrastructure development have also contributed to Bitcoin's price surge. These improvements have made Bitcoin more accessible, efficient, and user-friendly.

- Improved transaction speeds and reduced fees: The Lightning Network, a layer-2 scaling solution, significantly improves transaction speeds and reduces fees, making Bitcoin more practical for everyday use and large-scale transactions.

- Increased accessibility and ease of use for institutional and retail investors: The development of robust custodial services and user-friendly exchanges has simplified Bitcoin investment and management for both institutional and retail investors.

- Positive impact on Bitcoin's scalability and adoption: These technological advancements are enhancing Bitcoin's scalability, allowing it to handle a larger number of transactions, which is crucial for widespread adoption.

Potential Regulatory Risks and Future Outlook

While the current regulatory environment is generally positive, potential regulatory risks and uncertainties remain. Future regulations could significantly impact the Bitcoin market.

- Discussion of potential future regulations and their impact on the Bitcoin market: The ongoing debate surrounding Bitcoin regulation in the US and globally will continue to shape the market. Changes to tax policies, KYC/AML regulations, and potential outright bans in certain jurisdictions could affect Bitcoin's price and adoption.

- Analysis of the ongoing debate surrounding Bitcoin regulation: Various regulatory bodies are grappling with how to classify and regulate Bitcoin. The outcome of this debate will be crucial in determining Bitcoin's future trajectory.

- Assessment of the long-term outlook for Bitcoin, considering regulatory factors: The long-term outlook for Bitcoin remains positive, but it's essential to acknowledge that regulatory uncertainty could introduce volatility. However, increasing global adoption and technological innovation could potentially offset these risks.

The Future of Bitcoin in the Face of US Regulatory Developments

US regulatory developments have played a significant role in driving Bitcoin to new record highs. Increased institutional investment fueled by regulatory clarity, its growing adoption as an inflation hedge, and technological advancements have all contributed to this remarkable growth. However, potential future regulatory changes and their impact remain key considerations.

To summarize, the interplay of favorable US regulatory developments, increased institutional investment, its function as an inflation hedge, and technological progress have all been pivotal in propelling Bitcoin to new heights. Stay updated on the latest US regulatory changes affecting Bitcoin and explore the opportunities this evolving market presents. Understanding US Bitcoin policy and its impact on Bitcoin investment is crucial for anyone interested in this dynamic asset class.

Featured Posts

-

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025

Daks Alalmany Ytjawz Dhrwt Mars Mwshr Awrwby Rayd

May 24, 2025 -

Amundi Djia Ucits Etf A Detailed Look At Its Net Asset Value

May 24, 2025

Amundi Djia Ucits Etf A Detailed Look At Its Net Asset Value

May 24, 2025 -

Shop Owner Stabbing Previously Bailed Teen Faces New Arrest

May 24, 2025

Shop Owner Stabbing Previously Bailed Teen Faces New Arrest

May 24, 2025 -

Investigating The Use Of Orbital Space Crystals For Improved Drug Efficacy

May 24, 2025

Investigating The Use Of Orbital Space Crystals For Improved Drug Efficacy

May 24, 2025 -

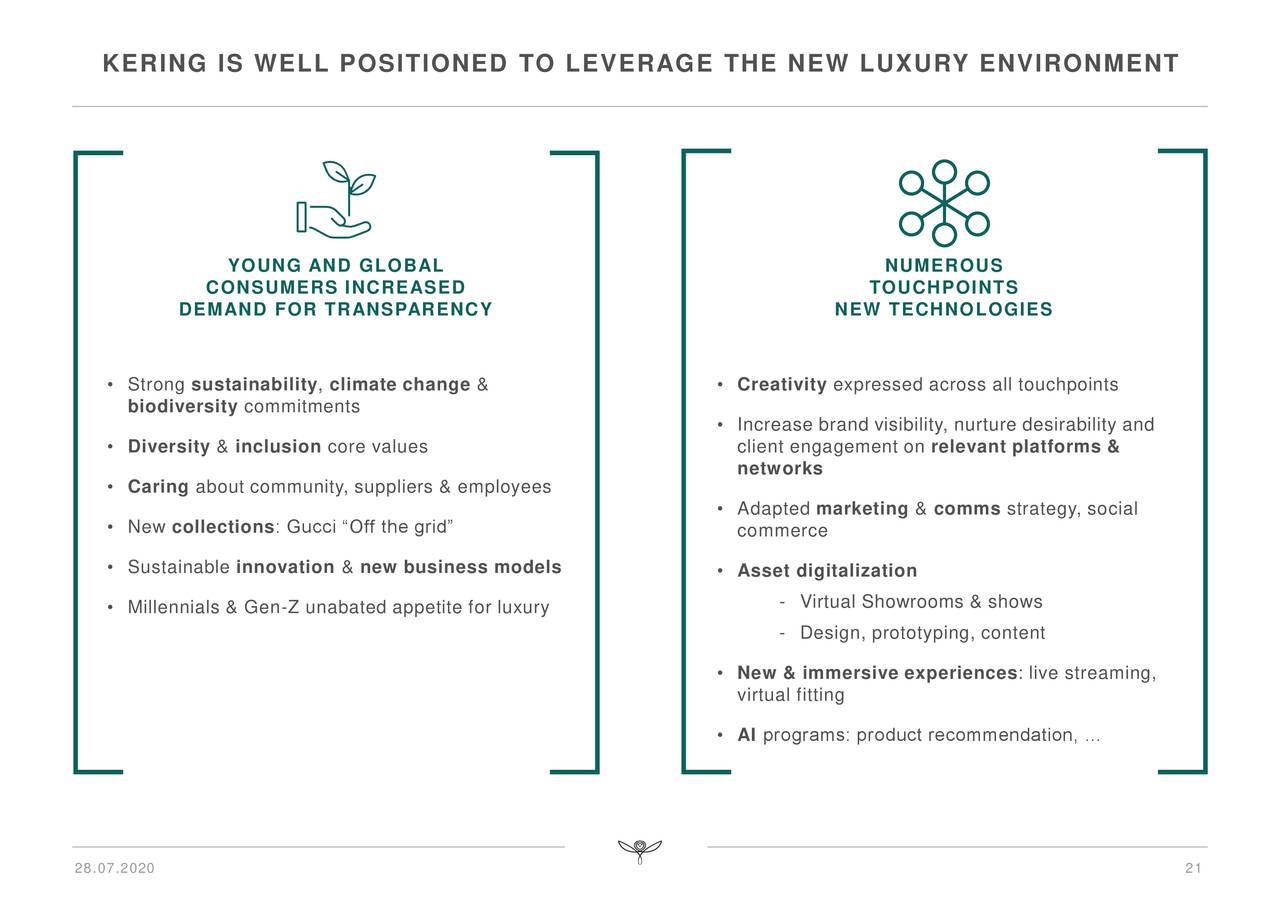

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Kering Shares Plunge 6 Following Disappointing Q1 Earnings

May 24, 2025

Latest Posts

-

Evrovidenie 2014 2023 Chto Delayut Pobediteli Seychas

May 25, 2025

Evrovidenie 2014 2023 Chto Delayut Pobediteli Seychas

May 25, 2025 -

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Triumfatorami

May 25, 2025

10 Rokiv Peremog Yevrobachennya Scho Stalosya Z Triumfatorami

May 25, 2025 -

Experience Ferrari Excellence Bengalurus New Service Centre

May 25, 2025

Experience Ferrari Excellence Bengalurus New Service Centre

May 25, 2025 -

Kuda Propali Pobediteli Evrovideniya Zhizn Posle Pobedy Za Poslednie 10 Let

May 25, 2025

Kuda Propali Pobediteli Evrovideniya Zhizn Posle Pobedy Za Poslednie 10 Let

May 25, 2025 -

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025

Yevrobachennya Doli Peremozhtsiv Za Ostanni 10 Rokiv

May 25, 2025