XRP ETF Approval: A Realistic Look At Potential $800 Million Inflows

Table of Contents

The Current State of XRP and the SEC Lawsuit

The ongoing legal battle between Ripple Labs and the SEC casts a long shadow over XRP's future and the prospects of an XRP ETF approval. The SEC's lawsuit, alleging that XRP is an unregistered security, has created significant regulatory uncertainty. A favorable outcome for Ripple could dramatically shift investor sentiment and significantly increase the likelihood of ETF approval.

-

Summary of the key arguments in the SEC lawsuit: The SEC claims XRP sales constitute unregistered securities offerings, while Ripple counters that XRP is a decentralized, utility token. The core of the dispute hinges on how the court defines a "security."

-

Analysis of recent court decisions and their implications for XRP: Recent court decisions have offered some positive signals for Ripple, but the case remains far from settled. Any ruling heavily influences investor confidence and, consequently, the appetite for an XRP ETF.

-

How a favorable ruling could pave the way for ETF approval: A victory for Ripple would likely alleviate much of the regulatory uncertainty surrounding XRP, making it significantly more attractive to ETF providers and increasing the chances of SEC approval for an XRP ETF.

-

Current regulatory uncertainty surrounding XRP and its effect on institutional investment: The ongoing lawsuit has deterred many institutional investors from engaging with XRP due to the inherent legal risks. Resolution of the lawsuit is crucial for attracting substantial institutional investment.

Potential Inflows and Market Impact of an XRP ETF

The projected $800 million inflow figure stems from estimations based on the potential assets under management (AUM) for an XRP ETF, considering the existing market capitalization and potential investor interest following SEC approval. While this number is an estimate, it highlights the potentially significant market impact of an approved XRP ETF.

-

Breakdown of the $800 million figure – where it comes from and its potential variability: This figure is derived from market analysis considering comparable ETF launches and projected investor demand for an XRP-based investment vehicle. The actual inflow could be higher or lower depending on several factors, including the overall market conditions and investor sentiment.

-

Potential price increase scenarios based on various inflow levels: An $800 million inflow would likely cause significant upward pressure on XRP's price. However, the extent of the price increase will depend on factors like trading volume, market liquidity, and general market sentiment. Smaller inflows will result in less dramatic price action.

-

Analysis of the impact on XRP's market capitalization and ranking: A substantial inflow would greatly increase XRP's market capitalization, potentially boosting its ranking among cryptocurrencies. This could attract further investment, creating a positive feedback loop.

-

Discussion on increased liquidity and trading volume after ETF approval: The listing of an XRP ETF would significantly increase liquidity and trading volume, making it easier for investors to buy and sell XRP. This greater accessibility would attract more participation from both retail and institutional investors.

-

Potential for increased institutional investment in XRP: ETF approval would likely encourage institutional investment, as it provides a regulated and accessible vehicle for large-scale participation in the XRP market.

Factors Influencing the Probability of XRP ETF Approval

Several factors could either accelerate or impede XRP ETF approval. The SEC's stance on cryptocurrencies, the broader regulatory environment, and the level of institutional investor demand are all key considerations.

-

Analysis of the SEC's recent actions and statements regarding crypto ETFs: The SEC's recent approval of Bitcoin futures ETFs suggests a gradual shift in its stance on cryptocurrencies. However, their cautious approach to spot crypto ETFs means that XRP ETF approval isn't guaranteed.

-

Discussion of the ongoing debate surrounding crypto regulation in the US: The evolving regulatory landscape for cryptocurrencies in the US significantly impacts the likelihood of XRP ETF approval. Clearer regulatory frameworks would increase the probability of approval.

-

Evaluation of institutional investor interest in XRP and its potential effect on ETF applications: Strong demand from institutional investors would strengthen the case for an XRP ETF. This would demonstrate the market's desire for a regulated XRP investment vehicle.

-

Examination of the process and timelines for ETF approval: The SEC's review process for ETF applications is often lengthy and complex. The timeline for approval remains uncertain, and delays are possible.

Competing Factors: Potential Challenges to ETF Approval

Despite the potential benefits, several obstacles could hinder XRP ETF approval.

-

Potential for SEC rejection despite a positive court ruling on the Ripple lawsuit: Even a favorable ruling in the Ripple lawsuit doesn't guarantee SEC approval for an XRP ETF. The SEC may still have concerns about XRP's overall regulatory status.

-

The impact of market fluctuations on ETF approval decisions: Periods of high market volatility could make the SEC more hesitant to approve new crypto ETFs, as they might perceive increased risk.

-

Competition from other cryptocurrencies vying for ETF listing: The competitive landscape for crypto ETFs is intense. Other cryptocurrencies are also seeking ETF approval, which could divert attention and resources away from XRP.

Conclusion

The potential for an XRP ETF and the projected $800 million inflow represent a significant turning point for the XRP ecosystem. The outcome of the SEC lawsuit against Ripple is paramount to the likelihood of approval. While a positive outcome significantly increases the chances, regulatory hurdles and market conditions remain critical factors. The potential for increased liquidity, institutional investment, and price appreciation makes an XRP ETF a compelling prospect, but investors should always conduct thorough research and understand the associated risks before committing any capital. Stay informed about the latest developments in the XRP ETF space and the SEC lawsuit to make informed investment decisions. Further research into XRP and its potential is crucial before making any investment choices. Consider the risks involved in investing in cryptocurrencies before committing your capital.

Featured Posts

-

Middle Managers The Unsung Heroes Of Company Performance And Employee Growth

May 07, 2025

Middle Managers The Unsung Heroes Of Company Performance And Employee Growth

May 07, 2025 -

The Last Of Us Season 2 Understanding Dinas Character And Isabela Merceds Performance

May 07, 2025

The Last Of Us Season 2 Understanding Dinas Character And Isabela Merceds Performance

May 07, 2025 -

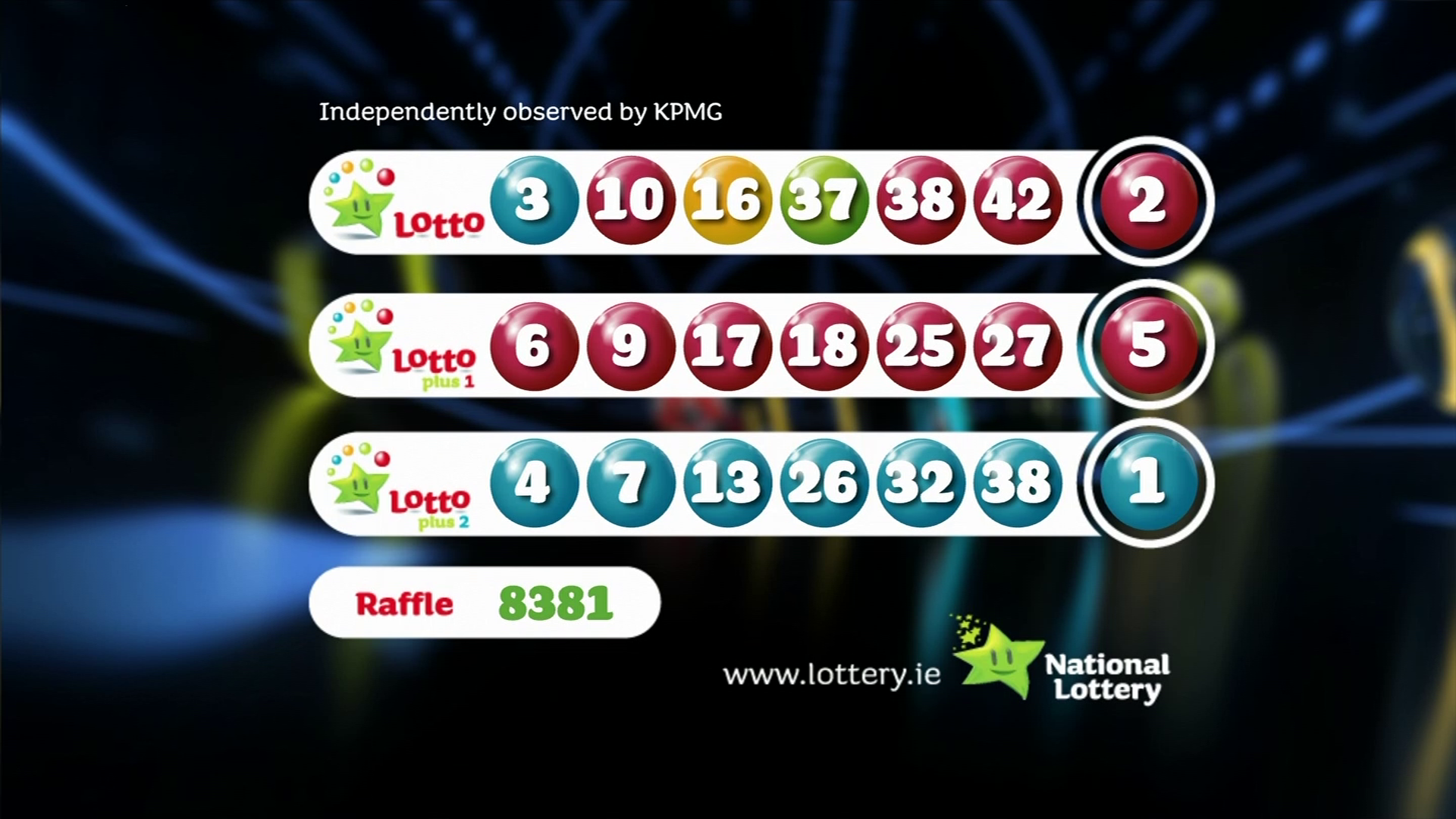

Die Lottozahlen Des 6aus49 Vom 19 April 2025

May 07, 2025

Die Lottozahlen Des 6aus49 Vom 19 April 2025

May 07, 2025 -

Sondaz Zaufanie Polakow Do Dzialan Trumpa Ws Ukrainy Zaskakujace Wyniki

May 07, 2025

Sondaz Zaufanie Polakow Do Dzialan Trumpa Ws Ukrainy Zaskakujace Wyniki

May 07, 2025 -

Wednesday April 9th Lotto Draw Winning Numbers Announced

May 07, 2025

Wednesday April 9th Lotto Draw Winning Numbers Announced

May 07, 2025

Latest Posts

-

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025

Ethereum Price Forecast Factors Influencing Future Value

May 08, 2025 -

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025

Kripto Lider In Basarisinin Sirri Yeni Bir Kripto Para Yatirim Stratejisi Mi

May 08, 2025 -

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025

Predicting Ethereums Future A Comprehensive Market Analysis

May 08, 2025 -

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025

Kripto Lider Detayli Analiz Ve Gelecek Potansiyeli

May 08, 2025 -

Kripto Lider Nedir Ve Neden Herkes Konusuyor

May 08, 2025

Kripto Lider Nedir Ve Neden Herkes Konusuyor

May 08, 2025