XRP On The Brink: ETF Applications, SEC Legal Battles, And The Future Of Ripple

Table of Contents

The SEC Lawsuit: A Defining Moment for XRP

The SEC lawsuit against Ripple Labs is arguably the most significant event shaping XRP's trajectory. Understanding this legal battle is crucial for anyone considering investing in or trading XRP.

Understanding the SEC's Allegations

The SEC alleges that Ripple conducted an unregistered securities offering by selling XRP. Their key argument centers on the classification of XRP as a security, arguing that investors purchased XRP with a reasonable expectation of profit based on Ripple's efforts.

- SEC's Argument: XRP was sold as an investment contract, meeting the Howey Test criteria. Investors anticipated profit derived from Ripple's efforts.

- Ripple's Argument: XRP is a decentralized digital asset, not a security. They argue that XRP functions similarly to other cryptocurrencies like Bitcoin and Ethereum and that its value is not solely dependent on Ripple's activities.

The case hinges on interpreting existing securities laws in the context of a novel technology. Key dates include the December 2020 filing of the lawsuit and ongoing procedural developments, which can be tracked through official SEC filings and reputable financial news sources. [Link to SEC filing (if available)]. [Link to relevant news article]. Keywords: SEC lawsuit, XRP security, Ripple lawsuit, unregistered securities offering.

Potential Outcomes and Their Impact on XRP's Price

The outcome of the SEC lawsuit will significantly impact XRP's price and market position.

- Favorable Ruling for Ripple: A victory for Ripple could lead to a substantial increase in XRP's price, reflecting renewed investor confidence and potentially unlocking institutional investment. Short-term price spikes are likely, followed by longer-term growth as the legal uncertainty dissipates.

- Settlement: A settlement could involve Ripple paying a fine and agreeing to certain conditions. The impact on XRP's price would depend on the terms of the settlement. A relatively lenient settlement could lead to moderate price gains, whereas a harsh settlement could trigger further price drops.

- Unfavorable Ruling: An unfavorable ruling could severely damage XRP's price, potentially leading to delisting from major exchanges and causing significant investor losses. The long-term effects on XRP's viability would be substantial.

Investor confidence plays a crucial role here. A positive outcome would boost confidence, while a negative one could decimate it, leading to widespread selling. Predicting precise price movements is impossible, but these scenarios offer a reasonable framework for understanding potential price volatility. Keywords: XRP price prediction, Ripple SEC settlement, XRP price volatility.

The Rise of XRP ETF Applications: A Catalyst for Growth?

The emergence of XRP ETF applications presents a potential turning point for the cryptocurrency. Securing ETF approval could be a catalyst for significant growth.

The Significance of ETF Listings

ETF (Exchange-Traded Fund) approval is a game-changer for any asset. For XRP, it would mean:

- Increased Liquidity: Trading volume would surge as ETFs provide a convenient and regulated way for investors to access XRP.

- Institutional Investment: Institutional investors, including pension funds and hedge funds, typically favor ETFs due to their regulated nature. This influx of capital could dramatically boost XRP's market capitalization.

- Mainstream Acceptance: ETF listings contribute to increased legitimacy and mainstream acceptance of the asset.

Several companies have either applied for or are expected to apply for XRP ETFs [List companies if available]. However, regulatory hurdles remain significant, with the SEC's stance on crypto ETFs still evolving. Keywords: XRP ETF, crypto ETF, Ripple ETF application, institutional investment in XRP.

Analyzing the Potential Impact of ETF Approval

The consequences of ETF approval would be multifaceted:

- Positive Impacts: Price surges, increased trading volume, heightened market capitalization, and increased mainstream adoption.

- Negative Impacts: Potential for price manipulation, increased regulatory scrutiny, and possible short-lived speculative bubbles.

The impact of ETF approval on XRP's price would likely mirror that of other cryptocurrencies that have seen ETF approvals. Analyzing those precedents provides valuable insight into potential scenarios. Keywords: XRP market capitalization, ETF impact on XRP, XRP trading volume.

The Future of Ripple and XRP: Predictions and Analysis

The future of XRP is intertwined with Ripple's technological advancements and broader adoption within its ecosystem.

Technological Advancements and Ripple's Ecosystem

Ripple continues to invest in developing its XRP Ledger and RippleNet, aiming to enhance transaction speed, efficiency, and security. These advancements, coupled with partnerships and collaborations, will impact XRP's long-term utility and value. [Mention specific partnerships or advancements]. Keywords: XRP Ledger, RippleNet, Ripple technology, XRP utility.

Long-Term Outlook for XRP

Predicting the long-term outlook for XRP requires considering several factors:

- The outcome of the SEC lawsuit: This will significantly influence investor confidence and regulatory acceptance.

- The success of ETF applications: ETF approval would catalyze growth but also increase regulatory scrutiny.

- The continued development and adoption of Ripple's technology: The utility and adoption of XRP within Ripple's ecosystem will determine its long-term value.

Expert opinions and market analyses vary widely. A balanced perspective is crucial, considering both the potential for significant growth and the substantial risks involved. Keywords: XRP future, long-term XRP investment, XRP price forecast.

Conclusion: Navigating the Uncertain Future of XRP

The future of XRP is inherently uncertain, shaped by the interplay of the SEC lawsuit, ETF applications, and Ripple's technological progress. While the potential for significant gains exists, so too does the risk of substantial losses. The SEC lawsuit's outcome, the success of ETF listings, and the continued development of Ripple’s technology are all crucial factors to consider when assessing XRP's potential. Conducting thorough research before making any investment decisions regarding XRP is paramount. The future of XRP remains uncertain, but understanding these complexities is crucial for informed decision-making. Stay informed and continue your research on XRP to make your own assessment.

Featured Posts

-

The Glossy Mirage Unveiling The Illusion

May 07, 2025

The Glossy Mirage Unveiling The Illusion

May 07, 2025 -

The Cobra Kai Series Hurwitzs Original Mock Trailer Pitch Unveiled

May 07, 2025

The Cobra Kai Series Hurwitzs Original Mock Trailer Pitch Unveiled

May 07, 2025 -

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025 -

Lets Stop Here Why A John Wick 5 Is Unnecessary

May 07, 2025

Lets Stop Here Why A John Wick 5 Is Unnecessary

May 07, 2025 -

Seattle Mariners Dominate Marlins 14 0 Victory Fueled By First Inning

May 07, 2025

Seattle Mariners Dominate Marlins 14 0 Victory Fueled By First Inning

May 07, 2025

Latest Posts

-

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025

Understanding The Risks And Rewards Of Investing In Xrp Ripple

May 08, 2025 -

Can Investing In Xrp Ripple Help You Achieve Your Financial Goals

May 08, 2025

Can Investing In Xrp Ripple Help You Achieve Your Financial Goals

May 08, 2025 -

Xrp Ripple Investment A Realistic Assessment Of Potential Returns

May 08, 2025

Xrp Ripple Investment A Realistic Assessment Of Potential Returns

May 08, 2025 -

Could Buying Xrp Ripple Today Change Your Financial Future

May 08, 2025

Could Buying Xrp Ripple Today Change Your Financial Future

May 08, 2025 -

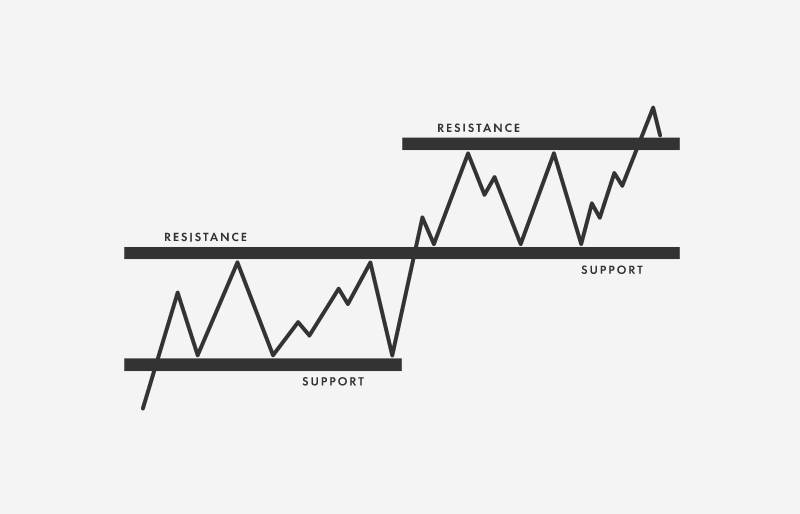

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025