XRP Price Action: Analyzing The Impact Of The Derivatives Market

Table of Contents

Understanding the XRP Derivatives Market

What are XRP Derivatives?

XRP derivatives are financial contracts whose value is derived from the price of XRP. Several types exist, each offering unique risk and reward profiles for traders.

-

XRP Futures: These contracts obligate the buyer to purchase XRP at a predetermined price on a specific future date. Traders use futures to hedge against price drops or speculate on future price increases. For example, a trader expecting XRP to rise might buy a futures contract, locking in a purchase price and profiting from the difference if the price indeed increases.

-

XRP Options: These give the buyer the right, but not the obligation, to buy (call option) or sell (put option) XRP at a specific price (strike price) before or on a certain date (expiration date). Options allow traders to define their risk exposure and profit from price movements in a specific direction. A trader anticipating a price fall might buy a put option, benefiting if their prediction is correct.

-

XRP Swaps: These are private agreements between two parties to exchange cash flows based on the price of XRP. Swaps are often used for hedging purposes by institutional investors.

Growth and Liquidity of the XRP Derivatives Market

The XRP derivatives market has experienced significant growth, although it remains smaller than those for Bitcoin or Ethereum. However, its increasing liquidity is a crucial factor impacting price discovery.

-

Trading Volume: While precise figures fluctuate, XRP derivatives trading volume has shown consistent growth, indicating increased market participation and interest. This growth is partly fueled by institutional investors seeking sophisticated risk management tools.

-

Open Interest: A rising open interest (the total number of outstanding contracts) can signal increasing confidence and potential for future price movements. Conversely, a declining open interest might suggest waning interest and potential price consolidation.

-

Number of Participants: The increasing number of exchanges offering XRP derivatives and the growing participation of institutional investors contribute to greater market depth and liquidity. This improved liquidity facilitates smoother price adjustments and reduces the impact of large individual trades.

Key Players in the XRP Derivatives Market

Several major exchanges and market makers dominate the XRP derivatives landscape, influencing price action through their trading activities.

-

Major Exchanges: While the specific players vary depending on region and regulatory considerations, several prominent cryptocurrency exchanges offer a range of XRP derivatives products, attracting substantial trading volume.

-

Market Makers: These entities provide liquidity to the market by consistently quoting bid and ask prices, facilitating smoother trading. Their actions play a significant role in price stability and the efficient execution of trades.

The Impact of Derivatives on XRP Price Volatility

Hedging and its Effect on Price

Hedging, using derivatives to mitigate risk, can impact XRP price stability.

-

Institutional Hedging: Large institutional investors holding significant XRP might use derivatives like futures or swaps to hedge against potential price drops. This hedging activity can partially absorb downward pressure, potentially lessening volatility.

-

Reduced Price Swings: Effective hedging by large players can dampen extreme price swings, creating a more stable environment for smaller investors.

Speculation and its Role in Price Swings

Speculative trading in XRP derivatives amplifies price movements.

-

Leverage and Volatility: The use of leverage in derivatives trading magnifies both profits and losses, increasing the potential for sharp price swings. High leverage can exacerbate volatility, leading to rapid price increases or decreases.

-

Short Selling and Long Positions: Short selling (betting on a price decline) and long positions (betting on a price increase) create opposing forces in the market. The interplay between these positions significantly influences XRP price action.

-

Past Examples: Several instances demonstrate how speculative trading in XRP derivatives has driven significant price rallies and corrections.

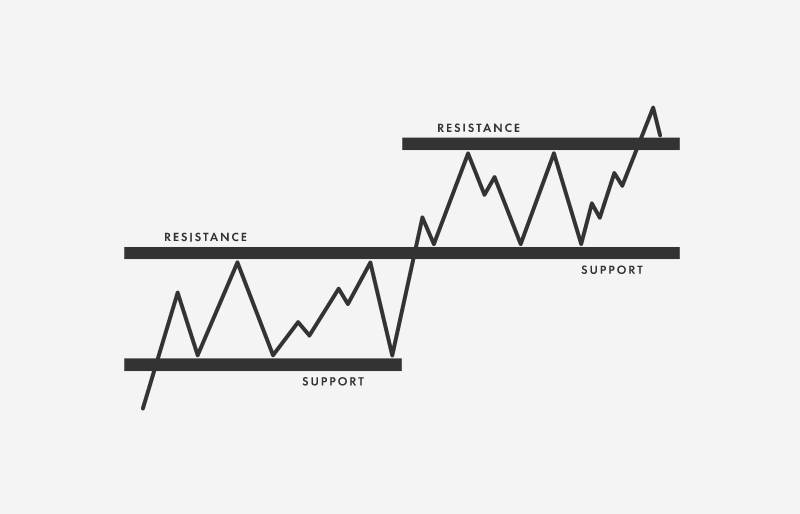

The Influence of Open Interest on XRP Price Action

Open interest provides valuable insights into market sentiment and potential price trends.

-

Increasing Open Interest: A steady rise in open interest suggests increasing market confidence and potential for sustained price movements in the direction of the dominant positions (long or short).

-

Decreasing Open Interest: A decline in open interest can signify waning investor confidence and potential price consolidation or reversal.

-

Interpreting Data: Analyzing changes in open interest alongside other indicators, like trading volume and price momentum, can offer valuable, but not foolproof, signals for potential trading opportunities. It's crucial to remember that open interest is just one piece of the puzzle, and using it alone for trading decisions can be very risky.

The SEC Lawsuit and its Ripple Effect on the Derivatives Market

Impact on Liquidity and Trading Volume

The ongoing SEC lawsuit against Ripple has significantly impacted the XRP derivatives market.

-

Changes in Trading Activity: The lawsuit introduced significant uncertainty, leading to periods of reduced trading volume and liquidity, particularly during key legal developments.

-

Legal Uncertainty: The ambiguous legal landscape around XRP creates uncertainty about the future, affecting both institutional and retail participation in the derivatives market.

Regulatory Uncertainty and its Influence on Price

Regulatory clarity (or lack thereof) heavily influences the XRP derivatives market and its impact on price.

-

Institutional Participation: Institutional investors are often risk-averse and hesitant to engage in markets with substantial regulatory uncertainty, which limits participation in the XRP derivatives market and potentially dampens liquidity.

-

Investor Confidence: Uncertainty surrounding the regulatory status of XRP impacts investor confidence, affecting trading activity and price volatility. Clear regulatory guidance could lead to increased participation and stability, while ongoing uncertainty likely will continue to fuel volatility.

Conclusion

The XRP derivatives market significantly shapes XRP price action. Understanding its mechanics, growth, and the impact of speculation, hedging, and regulatory uncertainty is vital for navigating XRP trading. While analyzing open interest and trading volume can provide valuable insights, predicting XRP's price with absolute certainty is impossible. Continuous learning about the XRP derivatives market dynamics is essential for informed decision-making. By staying abreast of the evolving landscape of XRP and its derivatives, you can better assess XRP price action and make more strategic trading choices. Deepen your understanding of XRP price action and its interplay with the derivatives market for more informed participation in this dynamic space.

Featured Posts

-

Sera Que Mick Jagger Trouxe O Pe Frio Para O Oscar Reacoes Brasileiras

May 08, 2025

Sera Que Mick Jagger Trouxe O Pe Frio Para O Oscar Reacoes Brasileiras

May 08, 2025 -

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025 -

Glen Powell Bulletproof Fitness And Method Acting For The Running Man

May 08, 2025

Glen Powell Bulletproof Fitness And Method Acting For The Running Man

May 08, 2025 -

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025 -

Xrp Price Analysis Assessing The Path To 3 40

May 08, 2025

Xrp Price Analysis Assessing The Path To 3 40

May 08, 2025

Latest Posts

-

School Timetable Changes Due To Psl In Lahore

May 08, 2025

School Timetable Changes Due To Psl In Lahore

May 08, 2025 -

Analyzing The Bitcoin Rebound Risks And Opportunities

May 08, 2025

Analyzing The Bitcoin Rebound Risks And Opportunities

May 08, 2025 -

One Cryptocurrency Standing Strong Despite The Trade War

May 08, 2025

One Cryptocurrency Standing Strong Despite The Trade War

May 08, 2025 -

Lahore Weather Eid Ul Fitr Forecast For The Next 48 Hours

May 08, 2025

Lahore Weather Eid Ul Fitr Forecast For The Next 48 Hours

May 08, 2025 -

Psl Matches Revised School Schedules In Lahore

May 08, 2025

Psl Matches Revised School Schedules In Lahore

May 08, 2025