XRP Stagnation: Derivatives Trading Impacts Price Recovery

Table of Contents

The Role of XRP Derivatives in Price Suppression

Understanding the influence of derivatives trading on XRP's price is key to understanding its current stagnation. XRP derivatives, like futures, options, and swaps, allow traders to speculate on XRP's price movements without directly owning the asset. This creates a separate market that significantly impacts the spot price.

Short Selling and Price Manipulation

Short selling in the XRP derivatives market allows traders to profit from a price decline. By borrowing and selling XRP, they hope to buy it back at a lower price, pocketing the difference. This practice can exert considerable downward pressure on the spot price, exacerbating XRP stagnation. The sheer volume of short positions can create a self-fulfilling prophecy, pushing the price even lower and discouraging buyers.

Amplified Volatility

Leveraged trading, common in derivatives markets, amplifies both gains and losses. This heightened volatility creates a risky environment, deterring long-term investors who prefer stable price action. The dramatic price swings fueled by leveraged trading contribute significantly to XRP’s price instability and hinder its potential for sustainable growth.

Example: A Case Study

A recent example of derivatives' impact on XRP’s price is seen during periods of intense regulatory news. Negative headlines often trigger a surge in short selling, leading to immediate price drops before stabilizing (or further declining) as the news is digested. This illustrates how derivatives markets can swiftly react to news and amplify its effect on the spot price.

- Increased liquidity in the derivatives market doesn't always translate to higher spot prices.

- Short-selling can create a self-fulfilling prophecy, leading to further price drops.

- Excessive volatility can scare away potential investors.

Lack of Positive Sentiment and Regulatory Uncertainty

Beyond the mechanics of derivatives trading, the overall sentiment surrounding XRP and regulatory uncertainty play a critical role in its price stagnation.

Regulatory Scrutiny

The ongoing legal battle between Ripple Labs and the SEC has cast a long shadow over XRP. The lack of regulatory clarity creates a risk-averse environment, discouraging both retail and institutional investors. This uncertainty is a major factor contributing to the XRP price stagnation.

Negative News Cycle

Negative news related to Ripple's legal battles and any regulatory actions fuels speculation and often leads to increased short selling in the derivatives market. This negativity creates a feedback loop, depressing XRP's price further.

Impact on Institutional Investment

Institutional investors are generally risk-averse. The regulatory uncertainty surrounding XRP, combined with the negative news cycle, has deterred significant institutional investment. This lack of institutional participation significantly limits XRP's price appreciation potential and reinforces the stagnation.

- Negative news often leads to increased short selling in derivatives.

- Regulatory uncertainty creates a risk-averse environment.

- Lack of institutional involvement limits price appreciation potential.

Potential Strategies for XRP Price Recovery

While the challenges are significant, several strategies could contribute to XRP's price recovery and alleviate the current stagnation.

Increased Adoption and Utility

Increased adoption of XRP in decentralized finance (DeFi) applications and other use cases is crucial. Demonstrating real-world utility and widespread adoption will increase demand, eventually pushing the price higher.

Positive Regulatory Developments

A positive resolution to Ripple's legal battle or clear regulatory guidelines would significantly boost investor confidence, potentially leading to a surge in XRP's price. This clarity is essential for overcoming the current XRP stagnation.

Focus on Long-Term Value

Instead of focusing solely on short-term price fluctuations, emphasizing the long-term value proposition of XRP – its speed, low transaction fees, and scalability – is vital for attracting investors.

Community Building and Education

A strong and engaged community can act as a powerful catalyst for growth. Educational initiatives that explain XRP's technology and potential to a wider audience will help alleviate the uncertainty surrounding the cryptocurrency.

- Development of new use cases for XRP.

- Improved communication and transparency from Ripple.

- Educational initiatives to inform investors about XRP’s potential.

Conclusion: Overcoming XRP Stagnation: A Path Forward

XRP's current price stagnation is a complex issue stemming from the interplay of derivatives trading, regulatory uncertainty, and negative market sentiment. Addressing these factors is crucial for unlocking XRP's potential. Increased adoption, positive regulatory developments, a focus on long-term value, and robust community building are vital steps towards a price recovery.

Investing in XRP requires careful consideration of the factors influencing its price. Understanding the interplay between XRP and the derivatives market is crucial for navigating the current challenges and participating in its potential future recovery. Stay informed about regulatory developments and XRP’s growing adoption to make informed investment decisions.

Featured Posts

-

Anthony Edwards Shoving Incident A Detailed Look At The Altercation

May 07, 2025

Anthony Edwards Shoving Incident A Detailed Look At The Altercation

May 07, 2025 -

Why Zendayas Sister Skipped Tom Hollands Wedding

May 07, 2025

Why Zendayas Sister Skipped Tom Hollands Wedding

May 07, 2025 -

Zendayas Sisters Account Cancer Family And A Lack Of Support

May 07, 2025

Zendayas Sisters Account Cancer Family And A Lack Of Support

May 07, 2025 -

Cavaliers Vs Knicks Prediction Will The Knicks Triumph At Msg

May 07, 2025

Cavaliers Vs Knicks Prediction Will The Knicks Triumph At Msg

May 07, 2025 -

Alex Ovechkins Road Trip Ritual Lucky Sub And Cheetos

May 07, 2025

Alex Ovechkins Road Trip Ritual Lucky Sub And Cheetos

May 07, 2025

Latest Posts

-

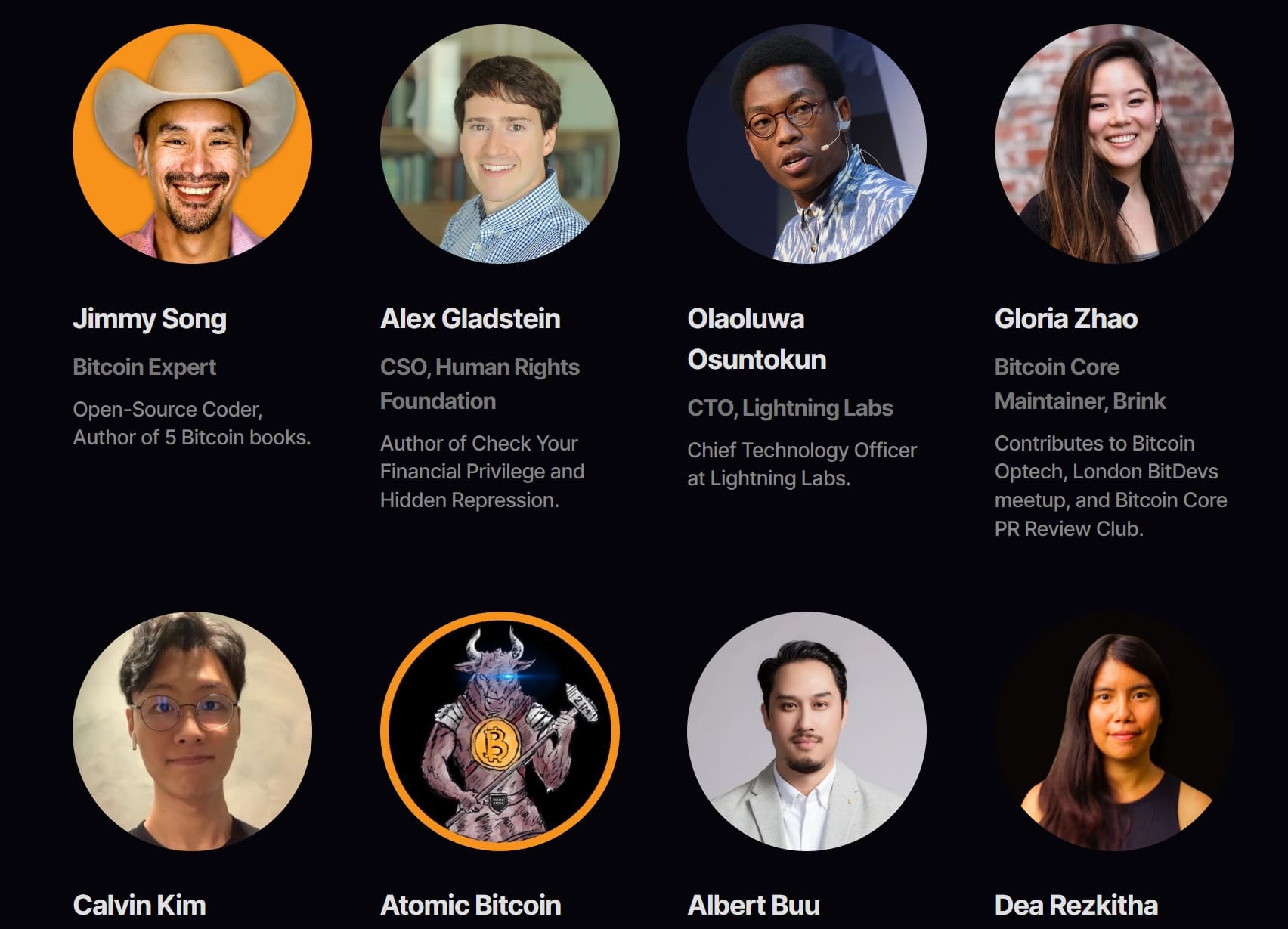

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025 -

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025 -

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025 -

Recent Bitcoin Rebound A Deeper Dive Into Market Trends

May 08, 2025

Recent Bitcoin Rebound A Deeper Dive Into Market Trends

May 08, 2025