XRP Surges: Breaking Resistance And Reaching $3.40?

Table of Contents

Technical Analysis: Chart Patterns and Indicators Suggesting a Bullish Trend for XRP

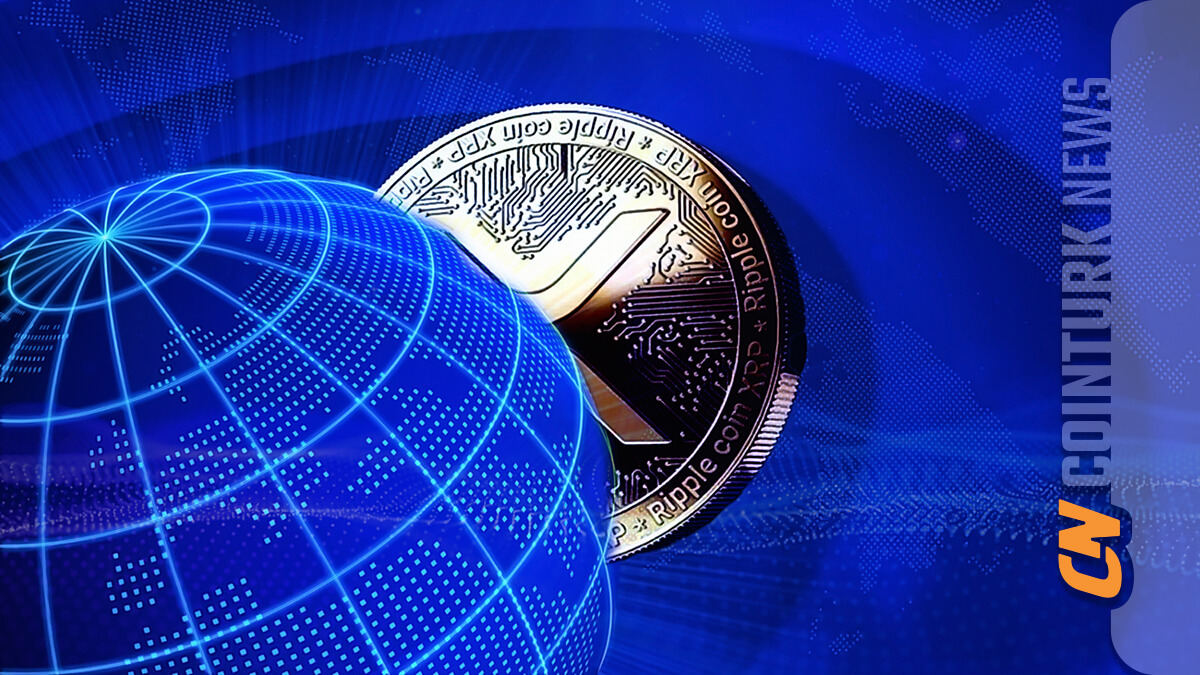

Technical analysis provides valuable insights into the short-term and medium-term price movements of XRP. Several indicators point towards a bullish trend, fueling the speculation of XRP reaching $3.40.

- Moving Averages: The 50-day and 200-day moving averages are converging, a bullish signal often preceding a significant price increase. The recent price action has pushed XRP decisively above these key moving averages, indicating strong buying pressure.

- RSI (Relative Strength Index): The RSI is currently above 70, suggesting the asset is in overbought territory. While this can sometimes signal an impending correction, the sustained volume and continued upward momentum suggest a strong bullish trend may continue.

- MACD (Moving Average Convergence Divergence): The MACD histogram shows a clear bullish crossover, confirming the upward momentum and suggesting further price appreciation.

- Chart Patterns: The XRP chart displays a potential bullish flag pattern, a continuation pattern indicating a continuation of the upward trend. The breakout from this pattern could propel XRP towards $3.40.

- Volume: The significant increase in trading volume accompanying the price surge reinforces the bullish momentum. High volume during price increases signifies strong conviction among buyers.

- Resistance and Support Levels: Previous resistance levels around $2.80 and $3.00 have been decisively broken, suggesting a weakening of selling pressure and paving the way for a potential move towards $3.40. The next significant resistance level lies around $3.20, which will be a key test of the bullish trend.

[Insert relevant chart/graph here showcasing the technical indicators and price action]

Fundamental Factors Driving the XRP Price Surge

Beyond technical analysis, several fundamental factors contribute to the recent XRP surge.

- Ripple's Legal Battle: The ongoing legal battle between Ripple and the SEC remains a significant factor influencing XRP's price. Positive developments in the case, such as favorable court rulings or settlements, can trigger significant price increases. Recent positive interpretations of court filings have instilled renewed confidence among investors.

- Increased Adoption: Growing adoption of XRP by financial institutions for cross-border payments is boosting investor confidence. Ripple's partnerships and collaborations with banks and payment providers are driving this adoption.

- New Use Cases: The expansion of XRP's use cases beyond cross-border payments, including its application in decentralized finance (DeFi) and other emerging technologies, is attracting new investors.

- Ripple's Expansion: Ripple's continued expansion into new markets and its focus on regulatory compliance are further strengthening investor confidence.

Market Sentiment and Investor Behavior Fueling the XRP Rally

The overall market sentiment towards XRP is overwhelmingly positive, further contributing to the rally.

- Social Media Sentiment: Social media platforms are buzzing with positive discussions and predictions about XRP's future price. This positive sentiment fuels further buying pressure.

- Trading Volume: The high trading volume indicates a significant increase in investor interest and participation.

- Whale Activity: The activities of large institutional investors (whales) are closely watched. Accumulation by whales can signal further upward price movement.

Potential Challenges and Risks to Reaching $3.40

While the prospects for XRP reaching $3.40 appear promising, several challenges and risks remain.

- Market Volatility: The cryptocurrency market is inherently volatile. A sudden market correction could negatively impact XRP's price.

- Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies remains a significant risk. Negative regulatory developments could trigger a price drop.

- Negative News: Any negative news related to Ripple or the broader cryptocurrency market could trigger a sell-off.

Conclusion: XRP's Future – Is $3.40 Achievable?

The XRP surge is driven by a combination of technical indicators suggesting a bullish trend, positive fundamental developments surrounding Ripple and XRP's adoption, and strong market sentiment. The potential for XRP to reach $3.40 is significant, fueled by the breaking of key resistance levels and sustained upward momentum. However, it is crucial to acknowledge the inherent volatility of the cryptocurrency market and the potential risks associated with investing in XRP. While the technical and fundamental factors are currently positive, negative news or regulatory changes could easily reverse the current trend.

Therefore, while the potential for XRP to surge and reach $3.40 is significant, it's crucial to conduct thorough research before investing. Stay informed about the latest developments in the XRP market and make well-informed decisions regarding your XRP investments. Remember to diversify your portfolio and only invest what you can afford to lose.

Featured Posts

-

Pittsburgh Steelers Combine Scouting For George Pickens Heir Apparent

May 07, 2025

Pittsburgh Steelers Combine Scouting For George Pickens Heir Apparent

May 07, 2025 -

Inside Zendayas Family The Breadwinner And Her Close Knit Siblings

May 07, 2025

Inside Zendayas Family The Breadwinner And Her Close Knit Siblings

May 07, 2025 -

The Ed Sheeran Rihanna Connection What We Know

May 07, 2025

The Ed Sheeran Rihanna Connection What We Know

May 07, 2025 -

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025 -

Sukces Jacka Harlukowicza Piec Najbardziej Popularnych Artykulow Onetu 2024

May 07, 2025

Sukces Jacka Harlukowicza Piec Najbardziej Popularnych Artykulow Onetu 2024

May 07, 2025

Latest Posts

-

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025 -

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025

Ethereum Price To Hit 4 000 Cross X Indicators And Institutional Buying Suggest So

May 08, 2025 -

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025

Bitcoin In Buguenkue Durumu Fiyat Hacim Ve Gelecek Tahminleri

May 08, 2025 -

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025

Increased Ethereum Network Activity Analysis Of Recent Address Interactions

May 08, 2025 -

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025

Ethereum Price 1 11 Million Eth Accumulated Bullish Market Outlook

May 08, 2025