XRP's Uncertain Future: A Look At The Derivatives Market

Table of Contents

The Ripple Case and its Impact on XRP Derivatives Trading

The Ripple lawsuit against the SEC is arguably the single most significant factor influencing the XRP derivatives market. This legal uncertainty creates a volatile environment, directly impacting trading volume and investor confidence in XRP futures and options.

Legal Uncertainty and Market Sentiment

The outcome of the Ripple case remains unpredictable, creating a climate of uncertainty that affects the pricing of XRP derivatives. A positive ruling could trigger a surge in price and trading volume, while a negative outcome could lead to a significant downturn. Even the ongoing legal battles themselves introduce considerable volatility.

- Pricing Impacts: Regulatory uncertainty makes it difficult to accurately price XRP derivatives, leading to wider bid-ask spreads and increased risk for traders.

- Correlation with Legal Updates: Any news related to the case, whether positive or negative, immediately impacts XRP's price, creating ripple effects across its derivatives market. Significant price swings are often observed following court hearings or legal filings.

- Potential Scenarios:

- Positive Ruling: A favorable ruling could lead to increased investor confidence and a surge in XRP derivatives trading volume, potentially pushing prices higher.

- Negative Ruling: A negative ruling could severely damage investor confidence, causing a significant drop in price and trading volume.

- Ongoing Legal Battles: Continued uncertainty will likely maintain the high volatility of the XRP derivatives market, making it a high-risk, high-reward environment.

Analyzing XRP Derivatives Market Liquidity and Volume

Understanding the liquidity and volume of the XRP derivatives market is crucial for any potential trader. Analyzing historical data reveals significant trends and patterns impacting this market segment.

Trading Volume Trends

Historical data shows that XRP derivatives trading volume has fluctuated significantly, often mirroring the overall volatility of the XRP cryptocurrency. Periods of legal uncertainty and market turmoil have typically led to increased trading activity, while periods of relative calm have seen lower volumes.

- Comparison with Other Cryptocurrencies: Compared to more established cryptocurrencies like Bitcoin and Ethereum, the XRP derivatives market generally exhibits lower trading volume, reflecting its smaller market capitalization and the lingering legal uncertainty.

- Role of Major Exchanges: Major cryptocurrency exchanges play a critical role in facilitating XRP derivatives trading. The liquidity offered by these exchanges directly influences the overall market liquidity and trading volume.

- Impact of Market Volatility: Higher XRP volatility generally translates to increased trading volume in the derivatives market as traders seek to hedge their risk or speculate on price movements.

Liquidity Concerns and Market Depth

While some major exchanges offer XRP derivatives, concerns regarding market liquidity and depth remain. This can pose challenges for traders seeking to enter or exit positions quickly.

- Finding Buyers and Sellers: Finding counterparties for larger trades can be difficult due to the relatively lower volume compared to other established crypto derivatives markets.

- Bid-Ask Spread: The bid-ask spread for XRP derivatives often reflects the market's uncertainty and lack of liquidity, resulting in potentially higher trading costs.

- Comparison to Other Markets: The liquidity of the XRP derivatives market lags significantly behind more mature markets for Bitcoin and Ethereum derivatives.

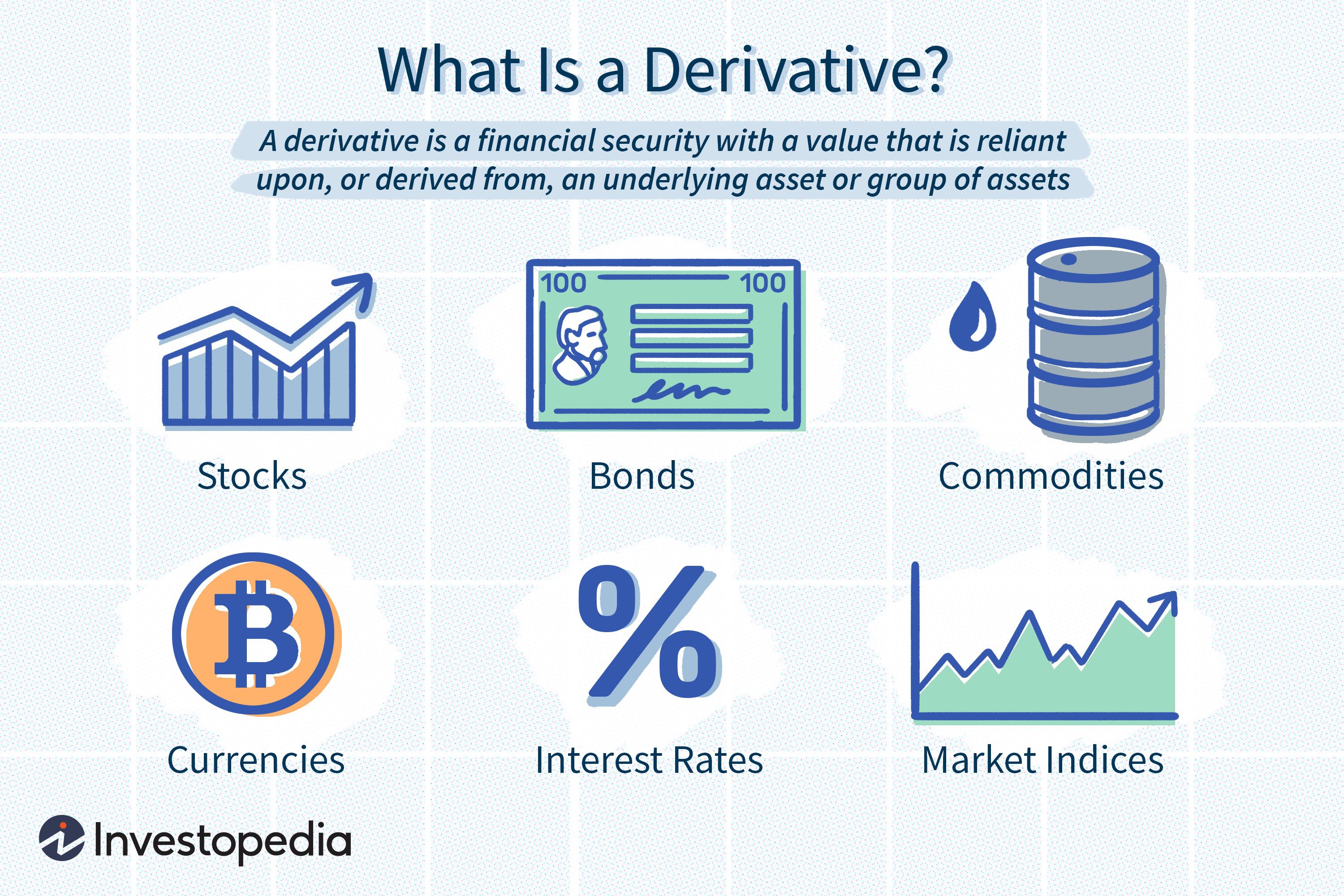

XRP Derivatives Products: Futures, Options, and other Instruments

The XRP derivatives market offers a variety of instruments, each with its own characteristics, risks, and rewards.

Types of XRP Derivatives

Traders can access several types of XRP derivatives contracts, allowing them to manage risk and speculate on price movements in different ways.

- Futures: Futures contracts obligate the buyer to purchase XRP at a predetermined price on a future date. They offer a way to hedge against price declines or speculate on price increases.

- Options: Options contracts grant the buyer the right, but not the obligation, to buy or sell XRP at a specified price on or before a specific date. They offer flexibility in managing risk and speculative opportunities.

- Swaps: Swaps are privately negotiated agreements between two parties to exchange cash flows based on the price of XRP. They are often used for hedging purposes.

The Future of XRP in the Derivatives Market: Predictions and Analysis

Predicting the future of XRP in the derivatives market is challenging, but several potential scenarios can be outlined.

Potential Scenarios

The future of XRP derivatives hinges heavily on the outcome of the Ripple lawsuit and broader market conditions.

- Bullish Scenario: A positive legal outcome and increased adoption of XRP could significantly boost demand for XRP derivatives, leading to higher trading volumes and potentially higher prices.

- Bearish Scenario: A negative legal ruling or a lack of widespread adoption could severely dampen demand for XRP derivatives, potentially causing a significant decline in prices and trading volume.

- Neutral Scenario: The market may stabilize, with trading volume remaining relatively consistent, assuming a neutral legal outcome and moderate market conditions.

Factors Influencing Future Growth

Beyond the Ripple lawsuit, several factors could influence the future of XRP in the derivatives market:

- Technological Advancements: Any innovations or improvements to the XRP Ledger could enhance its attractiveness and boost demand for its derivatives.

- Regulatory Clarity: Increased regulatory clarity regarding XRP's status could lead to greater investor confidence and increased trading activity.

- Overall Crypto Market Trends: The performance of the broader cryptocurrency market will inevitably impact the XRP derivatives market.

Conclusion: The Uncertain Path Ahead for XRP Derivatives

The future of XRP in the derivatives market remains uncertain, largely due to the ongoing Ripple lawsuit and the inherent volatility of the cryptocurrency itself. The lack of significant liquidity and the considerable impact of the legal proceedings highlight the risks involved in trading XRP derivatives. The analysis presented highlights the importance of carefully considering the potential scenarios, both positive and negative, before engaging in this market.

Key Takeaways: The XRP derivatives market presents both opportunities and significant risks. The Ripple case remains the dominant factor, impacting pricing, volume, and overall market sentiment. Liquidity concerns and the inherent volatility of XRP must be carefully assessed.

Call to Action: Before investing in XRP derivatives, thoroughly research the asset, understand the risks associated with its volatility, and stay informed about the ongoing legal proceedings and the evolving XRP derivatives market. Analyze XRP's future prospects carefully and consider your risk tolerance before engaging in any trading activities.

Featured Posts

-

New York Yankees 2000 Diary Comeback Attempt Ends 500

May 07, 2025

New York Yankees 2000 Diary Comeback Attempt Ends 500

May 07, 2025 -

Konklawe Watykanskie Ekspert Odslania Kulisy Wyboru Papieza

May 07, 2025

Konklawe Watykanskie Ekspert Odslania Kulisy Wyboru Papieza

May 07, 2025 -

The Randle Factor How His Presence Affects Lakers And Timberwolves

May 07, 2025

The Randle Factor How His Presence Affects Lakers And Timberwolves

May 07, 2025 -

Duobeles Itaka Nba Lyderiu Pralaimejimo Apzvalga

May 07, 2025

Duobeles Itaka Nba Lyderiu Pralaimejimo Apzvalga

May 07, 2025 -

Xrp Navigating The Etf Landscape Sec Challenges And The Path Ahead

May 07, 2025

Xrp Navigating The Etf Landscape Sec Challenges And The Path Ahead

May 07, 2025

Latest Posts

-

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025

Analyzing The Challenges Facing Xrp Etfs Supply And Investor Interest

May 08, 2025 -

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025

Xrp Etf Risks High Supply And Limited Institutional Adoption

May 08, 2025 -

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply And Institutional Interest

May 08, 2025 -

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025

Xrp Etf Disappointing Prospects Due To Supply And Low Institutional Demand

May 08, 2025 -

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025

Understanding The 400 Xrp Price Increase Is It A Short Term Or Long Term Trend

May 08, 2025