5 Do's And Don'ts For Landing A Private Credit Job

Table of Contents

Landing a private credit job can be challenging, but with the right approach, you can significantly increase your chances of success. This guide outlines five crucial do's and don'ts to help you navigate the competitive private credit market and secure your dream private credit job. We'll cover everything from crafting the perfect resume to mastering the interview process. Let's get started!

<h2>Do's for Securing a Private Credit Job</h2>

<h3>1. Network Strategically</h3>

Building a strong network is crucial in the private credit industry. Don't underestimate the power of personal connections. Networking for a private credit job isn't just about handing out resumes; it's about building genuine relationships.

- Attend industry conferences and events: These are prime opportunities to meet potential employers and learn about the latest market trends. Look for events focused on private credit networking and private credit industry events.

- Leverage LinkedIn: Optimize your LinkedIn profile with relevant keywords like "Private Credit Analyst," "Portfolio Manager," and "Credit Underwriting." Actively connect with professionals in the field.

- Informational interviews are invaluable: Reach out to people working in private credit and request informational interviews to learn about their career paths and gain insights into the industry.

- Join relevant professional organizations: Organizations like the CFA Institute and the CAIA Association offer networking opportunities and valuable resources.

<h3>2. Tailor Your Resume and Cover Letter</h3>

Your resume and cover letter are your first impression. A generic application will likely be overlooked. For your private credit resume and private credit cover letter, remember to:

- Quantify your achievements: Instead of simply stating your responsibilities, quantify your achievements. For example, "Increased portfolio returns by 15%" is far more impactful than "Managed a portfolio of assets."

- Use keywords: Incorporate relevant keywords such as "credit analysis," "portfolio management," "due diligence," and "private equity" throughout your resume and cover letter. Tailoring your resume and cover letter to the specific job description is vital for attracting attention.

- Customize for each application: Don't send the same resume and cover letter to every firm. Research each firm's investment strategy and tailor your application to reflect your understanding of their specific focus. Showcase your understanding of private credit strategies and market trends.

<h3>3. Master the Interview Process</h3>

The interview process for a private credit job is rigorous. Preparation is key. Expect a mix of behavioral, technical, and case study questions.

- Practice your answers: Prepare for common private credit interview questions focusing on your experience in credit analysis, financial modeling, and risk assessment.

- Research the firm and interviewer: Demonstrate your genuine interest by researching the firm's investment strategy, recent deals, and the interviewer's background.

- Demonstrate your understanding: Clearly articulate your understanding of private credit principles, including different financing structures, valuation methodologies, and risk management techniques.

- Ask insightful questions: Asking insightful questions shows your engagement and initiative. Prepare a few thoughtful questions to demonstrate your interest in the role and the firm.

<h3>4. Showcase Financial Modeling Expertise</h3>

Proficiency in financial modeling is essential for any private credit role.

- Be prepared to discuss your experience: Be ready to discuss your experience with various financial models, such as discounted cash flow (DCF), leveraged buyout (LBO), and other valuation techniques relevant to financial modeling for private credit.

- Showcase your ability to interpret financial statements: Demonstrate your ability to analyze financial statements, identify key risks and opportunities, and make informed investment decisions.

- Highlight your experience with credit underwriting and risk assessment: Emphasize your experience in assessing credit risk, structuring deals, and managing portfolios.

- Practice building financial models under pressure: Practice building financial models under timed conditions to simulate the pressures of a real-world work environment.

<h3>5. Highlight Relevant Certifications and Education</h3>

Demonstrate your commitment to the field by highlighting relevant certifications and education.

- Obtain relevant certifications: The CFA charter, CAIA charter, or other relevant certifications (like CFA Private Credit or CAIA Private Credit) significantly enhance your credentials.

- Emphasize your education: Highlight any relevant coursework in finance, accounting, or economics. Show a clear path demonstrating your career progression toward your ideal private credit role.

- Show a commitment to continuous learning: Stay updated on industry trends and regulations by participating in continuing education programs.

<h2>Don'ts for Securing a Private Credit Job</h2>

<h3>1. Don't Neglect Networking</h3>

Don't rely solely on online applications. Networking is crucial for landing a private credit job.

- Actively cultivate relationships: Attend industry events and engage with attendees. Don't underestimate the value of private credit networking strategies.

<h3>2. Don't Submit Generic Applications</h3>

Avoid sending the same resume and cover letter to every firm. Each application should be tailored to the specific requirements of the job and the firm's investment strategy. Avoid generic targeted private credit applications.

<h3>3. Don't Underestimate the Importance of Technical Skills</h3>

Proficiency in financial modeling and analysis is essential. Don't underestimate the need for strong private credit technical skills, particularly in Excel and other financial modeling software, and data analysis skills like those used for Excel for Private Credit.

<h3>4. Don't Be Unprepared for Interview Questions</h3>

Thorough preparation is essential for a successful interview. Avoid going into interviews without adequate preparation for private credit interview preparation and private credit interview questions and answers.

<h3>5. Don't Neglect Your Online Presence</h3>

Maintain a professional online presence, especially on LinkedIn. A weak or unprofessional online presence can hinder your job search. Pay attention to your online presence for private credit professionals.

<h2>Conclusion</h2>

Securing a private credit job requires dedication, preparation, and a strategic approach. By following these five do's and don'ts, you can significantly improve your chances of landing your dream private credit job. Remember to network effectively, tailor your applications, master the interview process, showcase your technical skills, and maintain a strong online presence. Don't delay, start your journey to your ideal private credit career now!

Featured Posts

-

Sanes Brilliance Guides Bayern Munich Past St Pauli In Five Goal Encounter

Apr 25, 2025

Sanes Brilliance Guides Bayern Munich Past St Pauli In Five Goal Encounter

Apr 25, 2025 -

Best Makeup Organisers For A Clutter Free And Well Organised Dressing Table

Apr 25, 2025

Best Makeup Organisers For A Clutter Free And Well Organised Dressing Table

Apr 25, 2025 -

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

Apr 25, 2025

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

Apr 25, 2025 -

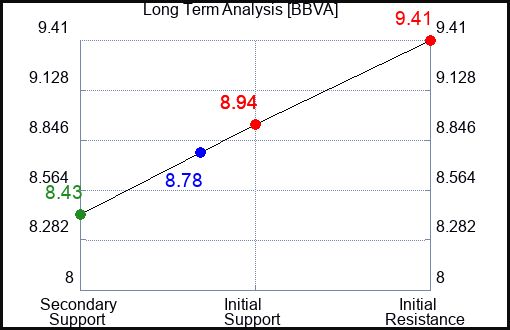

The Future Of Bbva Investment Banking A Long Term Strategy

Apr 25, 2025

The Future Of Bbva Investment Banking A Long Term Strategy

Apr 25, 2025 -

Gold Investment Price Increase After Trumps Recent Statements

Apr 25, 2025

Gold Investment Price Increase After Trumps Recent Statements

Apr 25, 2025

Latest Posts

-

Michael Sheens 1 Million Neighbourly Act In Port Talbot

May 01, 2025

Michael Sheens 1 Million Neighbourly Act In Port Talbot

May 01, 2025 -

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025

Michael Sheens Million Pound Giveaway Details Revealed

May 01, 2025 -

Doctor Reveals One Food Worse Than Smoking Leading Cause Of Early Death

May 01, 2025

Doctor Reveals One Food Worse Than Smoking Leading Cause Of Early Death

May 01, 2025 -

Where To Stream Michael Sheen And Sharon Horgans Compelling British Drama

May 01, 2025

Where To Stream Michael Sheen And Sharon Horgans Compelling British Drama

May 01, 2025 -

The Financial Impact Of A Consumer Boycott The Target Example

May 01, 2025

The Financial Impact Of A Consumer Boycott The Target Example

May 01, 2025