8% Stock Market Rise On Euronext Amsterdam Following Trump's Tariff Action

Table of Contents

Trump's Tariff Actions and Their Unexpected Impact on Euronext Amsterdam

The Specific Tariff Announcement

On [Insert Date], the Trump administration announced [Clearly state the specific tariff action, e.g., new import duties on steel and aluminum from specific countries, including details about percentages and affected goods]. This action targeted [List target countries], with exemptions granted to [List exempted countries, if any]. Prior to the announcement, market analysts largely predicted [Mention the anticipated negative market reaction, citing sources if possible]. The expectation was a general downturn, particularly affecting sectors directly involved in the import/export of the affected goods.

- Nature of Tariffs: [Detail the type of tariffs imposed, e.g., import duties, anti-dumping duties].

- Target Countries: [List the specific countries targeted by the tariffs].

- Exemptions: [List any exemptions granted and explain the rationale].

- Prior Expectations: [Explain the consensus view among analysts before the announcement and cite reputable sources].

Unanticipated Positive Market Reaction

Despite the generally negative perception of tariffs, the Euronext Amsterdam market reacted positively. This unexpected surge can be attributed to several intertwining factors:

- Limited Impact on Dutch Businesses: The tariffs may have had a surprisingly limited direct impact on key Dutch businesses. [Provide specific examples and data if available. For instance, mention specific sectors less affected by the tariffs or explain why Dutch companies were less exposed].

- Sector-Specific Boost: [Explain if a specific sector in the Netherlands benefited from the tariffs. For example, a domestic industry might have become more competitive due to tariffs on foreign competitors]. This sector-specific growth might have disproportionately affected the overall index.

- Market Speculation: The market reaction could also stem from speculation about future policy changes or potential countermeasures by the European Union.

- Global Economic Factors: Positive global economic indicators, separate from the tariff announcement, could have contributed to the overall market sentiment, amplifying the positive impact of the unexpected tariff outcome.

Analyzing the Volatility and its Implications for Investors

Short-Term vs. Long-Term Implications

The 8% surge on Euronext Amsterdam presents both short-term and long-term implications for investors:

- Short-Term: Day traders likely benefited significantly from the rapid increase, while long-term investors may have seen a temporary boost to their portfolio values. However, the risk of a swift correction remains.

- Long-Term: The long-term effects depend heavily on the continued impact of the tariffs on specific sectors within the Dutch economy. Some sectors might experience sustained growth, while others might face challenges.

- Market Correction Risk: A sharp increase like this often precedes a correction. Investors should be prepared for potential volatility and potential downward adjustments.

Investment Strategies Following the Surge

Navigating the market volatility requires a cautious and strategic approach:

- Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risk.

- Fundamental & Technical Analysis: Combining fundamental analysis (examining company financials) with technical analysis (chart patterns and indicators) can help make informed investment decisions.

- Risk Management: Implementing stop-loss orders and other risk management techniques is essential to protect against potential losses.

Comparative Analysis: Euronext Amsterdam vs. Other European Markets

Performance of Similar Indices

Compared to other major European indices like the FTSE 100 and DAX, Euronext Amsterdam's 8% rise was [Describe if it was significantly higher, similar, or lower than other indices]. [Insert comparative data and charts, if available, showing the performance of these indices during the same period].

- Comparative Data: [Present specific data points illustrating the differences in performance across the indices].

- Reasons for Discrepancies: [Analyze why Euronext Amsterdam reacted differently. This could be due to differences in sector composition, exposure to the affected goods, or investor sentiment].

Geopolitical Factors and their Influence

The unique performance of Euronext Amsterdam could also be linked to geopolitical factors:

- Netherlands-Target Country Relations: [Analyze the relationships between the Netherlands and the countries targeted by the tariffs. Stronger trade ties with unaffected countries could explain a more muted response].

- Unique Economic Conditions: [Explore specific economic conditions within the Netherlands that could contribute to the positive market response].

Conclusion

The 8% stock market rise on Euronext Amsterdam following Trump's tariff actions highlights the complex interplay of factors influencing market behavior. This unexpected surge underscores the importance of understanding both short-term volatility and long-term implications for investors. While the initial reaction was positive, the long-term effects remain uncertain, and investors must proceed cautiously.

Call to Action: Stay informed about developments in the Euronext Amsterdam market and utilize sound investment strategies to navigate the inherent risks and opportunities presented by this volatility. Conduct further research on the impact of Trump's tariff actions on European stock markets and develop informed investment strategies around the Euronext Amsterdam market. Understanding the dynamics of the Euronext Amsterdam stock market and the influence of global events like these tariff actions is key to successful investment in this dynamic environment.

Featured Posts

-

Sean Penn Weighs In On The Woody Allen Sexual Abuse Allegations

May 25, 2025

Sean Penn Weighs In On The Woody Allen Sexual Abuse Allegations

May 25, 2025 -

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 25, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Issue

May 25, 2025 -

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025

Europese En Amerikaanse Aandelen Een Vergelijking Van Recente Marktbewegingen

May 25, 2025 -

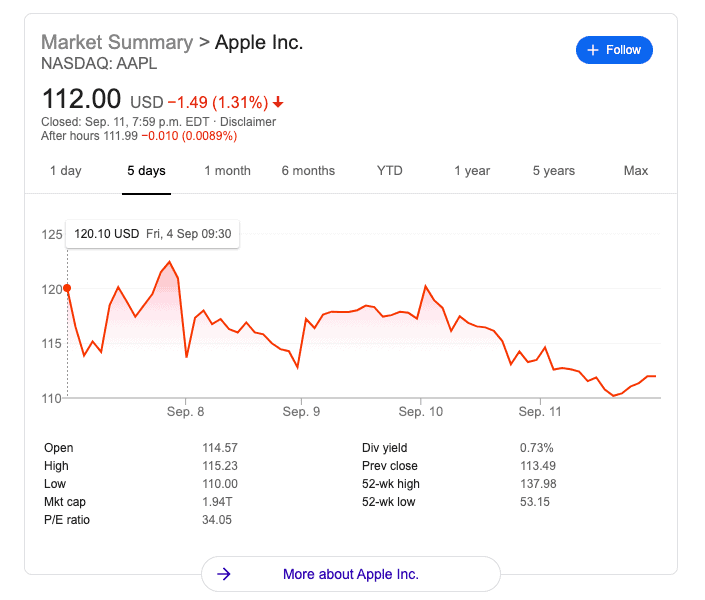

Should You Buy Apple Stock After Wedbushs Price Target Cut

May 25, 2025

Should You Buy Apple Stock After Wedbushs Price Target Cut

May 25, 2025 -

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Models Night Out Turns Sour Annie Kilners Poisoning Allegations Against Kyle Walker

May 25, 2025

Latest Posts

-

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025 -

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025

Rio Tinto Rebuttal Addressing Forrests Pilbara Wasteland Concerns

May 25, 2025 -

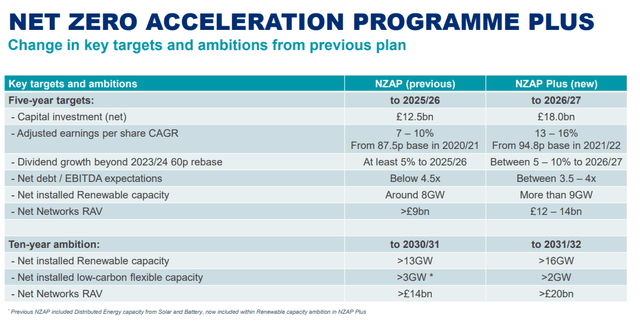

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025

Sse Announces 3 Billion Reduction In Spending Plan Due To Growth Slowdown

May 25, 2025 -

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025

China Us Trade Explodes As Exporters Scramble For Trade Truce

May 25, 2025 -

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025

Boe Rate Cut Odds Fall Following Uk Inflation Figures Pound Gains

May 25, 2025