Apple Stock (AAPL): Key Price Levels To Watch

Table of Contents

Understanding Support and Resistance Levels in AAPL

Support and resistance levels are crucial concepts in technical analysis. A support level represents a price floor where buying pressure is strong enough to prevent further price declines. Conversely, a resistance level acts as a price ceiling where selling pressure overwhelms buying pressure, halting upward momentum. Apple's stock price history is littered with examples of these levels, offering valuable insights for future price movements.

- Definition of support level (price floor): A price level where the stock price tends to find buyers and bounce back up.

- Definition of resistance level (price ceiling): A price level where the stock price tends to encounter selling pressure and reverse downwards.

- How these levels are identified using charts: Traders use various technical indicators, such as moving averages (like the 50-day and 200-day moving averages), to identify potential support and resistance areas. Chart patterns, such as trendlines and previous highs/lows, also play a significant role.

- Importance of volume confirmation in identifying strong support/resistance: High volume trading at a support or resistance level confirms its strength. High volume on a break of a support level, for instance, signals a stronger bearish signal than a break with low volume.

Key Apple Stock (AAPL) Price Levels to Watch Now

Identifying key price levels for AAPL requires analyzing both short-term and long-term charts. Here are a few crucial levels to watch:

-

$160: This level represents a significant psychological barrier and has historically acted as both support and resistance. A break above this level could signal further upside potential, while a sustained break below suggests further downside.

- Reason for significance: Acts as a psychological barrier and has seen past price reversals.

- Potential market reaction if the level is broken: A break above could lead to further gains towards $170 and beyond; a break below could signal a pullback towards $150.

- Suggested trading strategy: Consider buying on a retest of this level as support, or selling short if it acts as resistance. Always use appropriate stop-loss orders.

-

$175: This level represents a stronger resistance level based on previous highs. Breaking above this level could signal a significant bullish trend.

- Reason for significance: Previous high and strong psychological resistance.

- Potential market reaction if the level is broken: Could trigger a significant price surge.

- Suggested trading strategy: A break above could be a strong buy signal, but cautious entry with stop-loss orders is recommended.

-

$150: This level serves as a critical support level, a breach below could trigger significant selling pressure.

- Reason for significance: Historical support level and a significant psychological level.

- Potential market reaction if the level is broken: Could lead to further declines, possibly towards $140 or lower.

- Suggested trading strategy: A break below should be considered a strong sell signal or an opportunity to short the stock.

Technical Indicators for AAPL Analysis

Several technical indicators can enhance your AAPL stock analysis. While a comprehensive analysis involves many indicators, focusing on a few key indicators offers valuable insight.

-

Moving Averages (e.g., 50-day, 200-day): These averages smooth out price fluctuations, revealing underlying trends. A bullish crossover (50-day crossing above 200-day) is often considered a buy signal, while a bearish crossover (50-day crossing below 200-day) suggests a sell signal.

-

Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought (above 70) or oversold (below 30) conditions. An overbought RSI might suggest a potential pullback, while an oversold RSI could signal a bounce.

-

Moving Average Convergence Divergence (MACD): This indicator identifies momentum changes by comparing two moving averages. A bullish MACD crossover (MACD line crossing above the signal line) suggests increasing momentum, while a bearish crossover suggests declining momentum.

Factors Beyond Price: News and Fundamentals Affecting AAPL

News events and fundamental analysis significantly influence AAPL's stock price and its support and resistance levels.

-

Impact of positive news (e.g., new iPhone release): Positive news generally boosts the stock price, pushing it towards resistance levels or even breaking through them.

-

Impact of negative news (e.g., supply chain disruptions): Negative news can cause price drops, leading to tests of support levels.

-

Importance of considering earnings reports and financial health of Apple: Strong earnings reports and robust financial health reinforce bullish sentiment, while weak earnings can trigger price declines.

-

How to find reliable sources of news and financial data for AAPL: Reputable financial news sources, company press releases, and SEC filings provide reliable information.

Conclusion

Understanding key support and resistance levels, combined with technical indicators and awareness of market news, is crucial for successful Apple stock (AAPL) trading. We've identified several key price levels for AAPL that you should monitor closely: $150, $160, and $175. Remember to use technical indicators like moving averages, RSI, and MACD to further refine your analysis. Staying informed about these key price levels and related factors enables informed investment decisions. Stay informed about crucial price levels for Apple Stock (AAPL). Regularly review these key indicators to optimize your trading strategy and make confident investment choices in the dynamic world of AAPL. Continue to monitor the AAPL price and these levels to stay ahead of the market. Remember to always conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

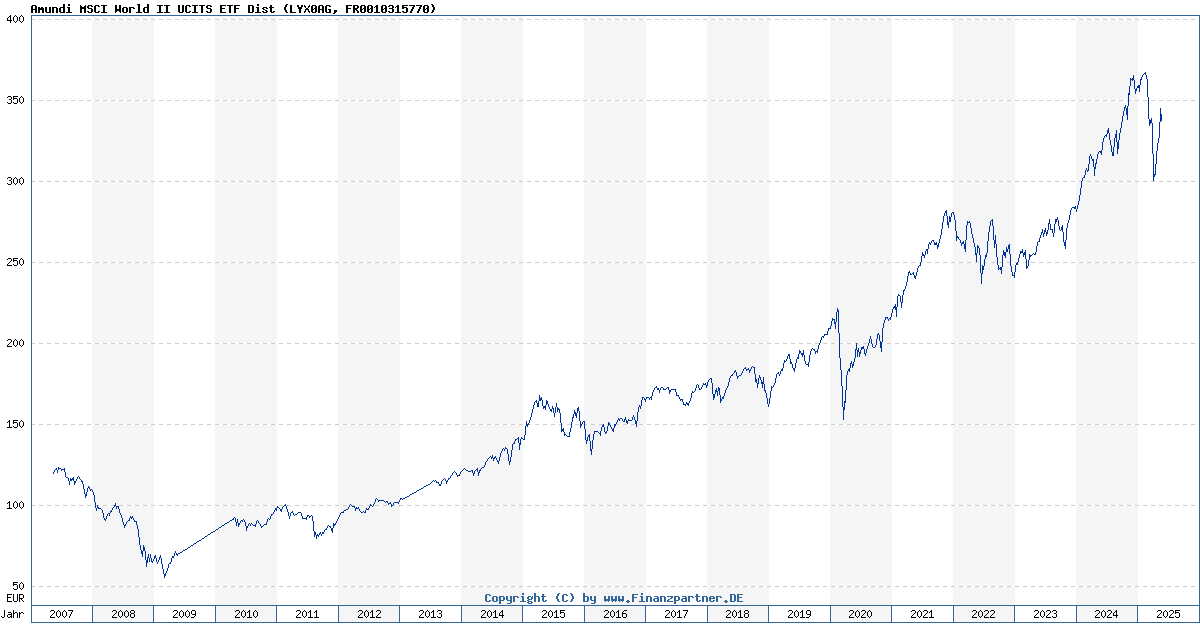

Tracking The Nav Of Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025

Tracking The Nav Of Amundi Msci World Ex United States Ucits Etf Acc

May 24, 2025 -

Porsche Investuoja I Tvaru Transporta Naujas Ikrovimo Centras Europoje

May 24, 2025

Porsche Investuoja I Tvaru Transporta Naujas Ikrovimo Centras Europoje

May 24, 2025 -

A Guide To Escaping To The Country Budget Friendly Options And Considerations

May 24, 2025

A Guide To Escaping To The Country Budget Friendly Options And Considerations

May 24, 2025 -

Net Asset Value Nav Explained Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Net Asset Value Nav Explained Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025 -

Dow Jones Steady Climb Strong Pmi Numbers Offer Support

May 24, 2025

Dow Jones Steady Climb Strong Pmi Numbers Offer Support

May 24, 2025

Latest Posts

-

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025

Museum Programs Under Threat Examining The Impact Of Federal Funding Cuts

May 24, 2025 -

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025

T Mobile Hit With 16 Million Fine For Repeated Data Breaches

May 24, 2025 -

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025

The Impact Of Trumps Cuts On Museum Programming And Funding

May 24, 2025 -

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 24, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Security Lapses

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Deep Dive

May 24, 2025