Apple Stock Price: Key Levels And Q2 Earnings Outlook

Table of Contents

Key Apple Stock Price Levels to Watch

Understanding key support and resistance levels is crucial for assessing the potential trajectory of the Apple stock price. These levels represent areas where buying or selling pressure is expected to be particularly strong.

Support Levels

Support levels represent prices where buying pressure is anticipated to outweigh selling pressure, potentially preventing further price declines. Technical analysts often use indicators like moving averages (e.g., 50-day, 200-day) and Fibonacci retracements to identify these levels.

- $150: A significant psychological level and a potential strong support area. A break below this level could trigger further selling.

- $145: A key support level based on recent lows and chart patterns. A breach here could signal increased bearish sentiment.

- $140: A more critical support level. Breaking this could indicate a more significant downward trend.

If these support levels are broken, it could signal a more bearish trend, potentially leading to further price declines. However, a bounce off these levels could indicate buying interest and a potential price recovery.

Resistance Levels

Resistance levels represent price points where selling pressure is anticipated to be stronger than buying pressure, hindering further price increases. Breaking through resistance levels often signals a bullish shift in momentum.

- $175: A major resistance level based on previous highs and chart patterns. Overcoming this could signal a significant bullish move.

- $180: A psychological level that could act as a strong resistance point. Breaking through this would be a powerful indicator of upward momentum.

- $190: A very significant resistance level representing a previous all-time high. A break above this could signal a new bullish phase.

If these resistance levels hold, it suggests a potential pause or reversal in the upward trend. However, a successful break above these levels could signal a strong bullish trend with further potential price increases.

Psychological Levels

Round numbers like $150, $175, and $200 often act as significant psychological levels. These levels can influence investor sentiment and trigger trading activity, even in the absence of strong fundamental reasons. Historically, Apple's stock price has shown sensitivity to these psychological markers. For example, the break below $170 in a previous quarter caused significant investor concern, even if fundamental factors were less negative.

Q2 2024 Earnings Outlook: Factors to Consider

The Q2 2024 earnings report will be crucial in determining the future trajectory of the Apple stock price. Several key factors will influence the results:

Product Sales

Sales projections for key products are vital. While the iPhone remains the core revenue driver, performance across all product lines is important.

- iPhone: Analysts predict a slight year-over-year sales growth, but concerns exist regarding potential market saturation and economic headwinds.

- iPad: Growth is anticipated to remain moderate, driven by continued demand in the education and professional sectors.

- Mac: Sales growth is expected to be more subdued, potentially impacted by macroeconomic conditions.

- Wearables, Home, and Accessories: This segment is expected to continue its strong growth, driven by popular products like the Apple Watch and AirPods.

- Services: The Services segment is anticipated to continue its robust growth, driven by increasing subscription revenue and a growing installed base of devices.

Supply Chain and Manufacturing

Global supply chain disruptions and rising manufacturing costs remain potential headwinds for Apple. Geopolitical events and inflation significantly influence production costs and distribution timelines.

Market Competition

Intense competition from companies like Samsung and Google in various product categories presents ongoing challenges for Apple. Maintaining its innovative edge and competitive advantage is crucial.

Economic Conditions

Macroeconomic factors, including inflation, interest rates, and recessionary fears, significantly impact consumer spending. Weaker economic conditions could negatively affect Apple's sales and profitability.

Analyzing the Apple Stock Price: Putting it All Together

The Apple stock price outlook depends on a delicate balance of factors. Strong Q2 earnings, exceeding analyst expectations, coupled with a break above key resistance levels, could signal a bullish trend. Conversely, disappointing earnings or a break below key support levels could trigger a bearish trend.

Conclusion: Investing in Apple Stock: Your Next Steps

Understanding key support and resistance levels ($140, $150, $175, $180, $190) for the Apple stock price, combined with a careful analysis of the Q2 earnings outlook and its influencing factors (product sales, supply chain, competition, and economic conditions), is vital for making informed investment decisions. Remember to conduct thorough research, consult with a financial advisor, and carefully consider your risk tolerance and financial goals before investing in Apple stock or any other security. Stay informed about the Apple stock price and Q2 earnings by following reputable financial news sources and conducting your own thorough analysis before making any investment decisions.

Featured Posts

-

Ferrari Owners Kit Top Gear Recommendations

May 24, 2025

Ferrari Owners Kit Top Gear Recommendations

May 24, 2025 -

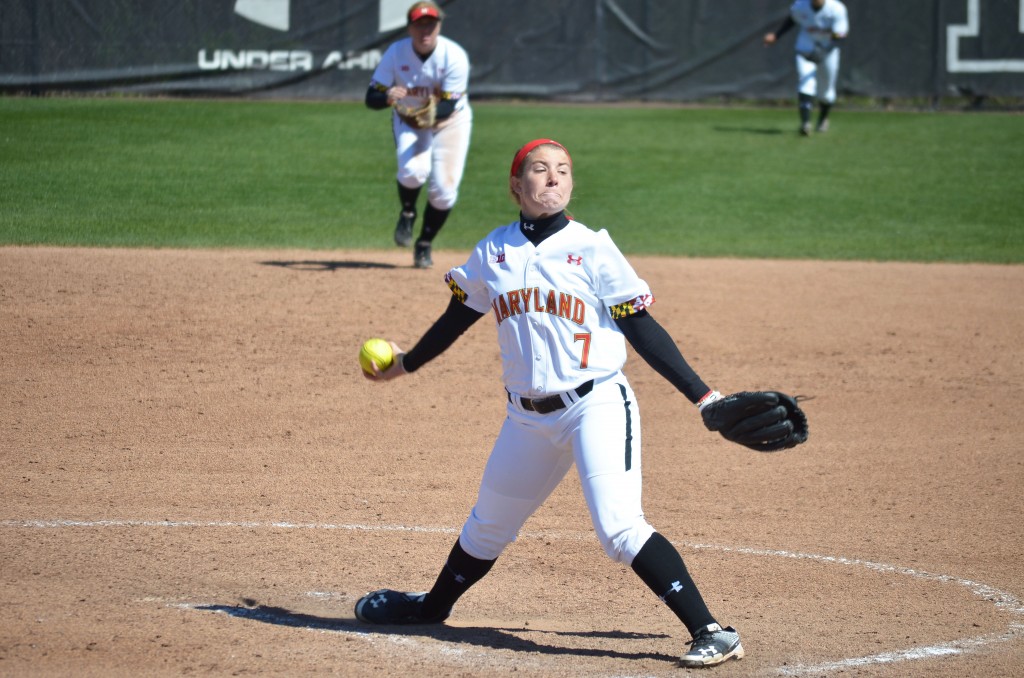

Maryland Softball Defeats Delaware 5 4 In Hard Fought Battle

May 24, 2025

Maryland Softball Defeats Delaware 5 4 In Hard Fought Battle

May 24, 2025 -

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025

Dazi Stati Uniti Prezzi Moda E Tendenze 2024

May 24, 2025 -

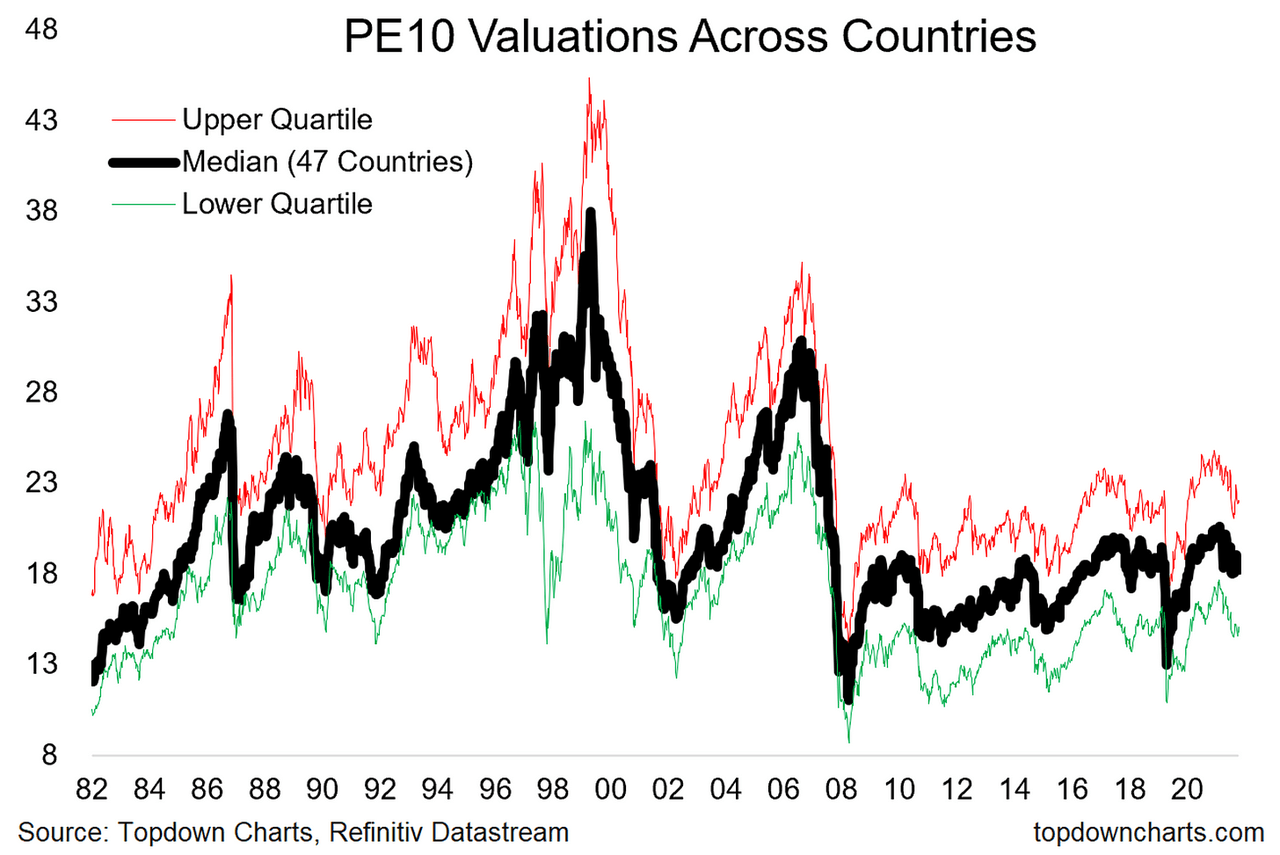

Bof As View Why Current Stock Market Valuations Are Not A Reason For Concern

May 24, 2025

Bof As View Why Current Stock Market Valuations Are Not A Reason For Concern

May 24, 2025 -

Footballer Kyle Walker Seen With Models In Milan Following Wifes Uk Return

May 24, 2025

Footballer Kyle Walker Seen With Models In Milan Following Wifes Uk Return

May 24, 2025

Latest Posts

-

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025 -

Tva Group Layoffs 30 Jobs Cut Amid Streaming Competition And Regulatory Pressure

May 24, 2025

Tva Group Layoffs 30 Jobs Cut Amid Streaming Competition And Regulatory Pressure

May 24, 2025 -

Millions In Losses Office365 Executive Account Hack Exposes Security Gaps

May 24, 2025

Millions In Losses Office365 Executive Account Hack Exposes Security Gaps

May 24, 2025 -

Cybercriminals Millions Fbi Probes Office365 Executive Inbox Breaches

May 24, 2025

Cybercriminals Millions Fbi Probes Office365 Executive Inbox Breaches

May 24, 2025 -

Bank Of Canada Desjardins Sees Potential For Three Further Rate Reductions

May 24, 2025

Bank Of Canada Desjardins Sees Potential For Three Further Rate Reductions

May 24, 2025