BBVA's Commitment To Investment Banking: Long-Term Growth Strategy

Table of Contents

BBVA's Investment Banking Services: A Comprehensive Portfolio

BBVA offers a comprehensive suite of investment banking services designed to meet the diverse needs of its clients. Their expertise spans across key areas, ensuring a robust and adaptable approach to corporate finance.

Mergers and Acquisitions (M&A) Advisory

BBVA boasts significant expertise in M&A advisory services, guiding clients through complex transactions and maximizing value creation. Their deep understanding of corporate finance allows them to provide tailored solutions for a wide range of industries. BBVA's success is demonstrated through a history of successful deal-making and strong client relationships.

- Successful M&A Deals: BBVA has successfully advised on numerous high-profile mergers and acquisitions across various sectors, including energy, technology, and consumer goods. (Specific examples would be included here if publicly available and permissible).

- Industry Expertise: BBVA possesses deep sector expertise, enabling them to understand the specific challenges and opportunities within each industry they serve, leading to more effective transaction advisory.

- Innovative Approaches: BBVA utilizes innovative approaches to M&A advisory, including advanced data analytics and strategic partnerships to provide clients with a competitive edge in deal making.

Equity Capital Markets (ECM)

BBVA plays a crucial role in equity capital markets, assisting companies with initial public offerings (IPOs), follow-on offerings, and other equity financing strategies. Their expertise in equity underwriting ensures efficient capital raising for their clients.

- Successful IPOs: BBVA has a strong track record of successfully managing IPOs for both large and mid-sized companies, demonstrating their ability to navigate the complexities of the equity markets. (Specific examples would be included here if publicly available and permissible).

- Market Share: BBVA holds a significant market share in several key ECM markets, reflecting their reputation for delivering high-quality services and achieving positive results for their clients.

- Strategic Partnerships: BBVA's strategic partnerships with leading financial institutions enhance their ECM capabilities, providing clients with access to a broader network and increased deal flow.

Debt Capital Markets (DCM)

BBVA's expertise extends to debt capital markets, providing comprehensive solutions for corporate debt financing, including bond issuance and syndicated loans. They offer innovative financing solutions tailored to specific client needs.

- Significant Debt Financing Deals: BBVA has been instrumental in arranging significant debt financing deals, including corporate bonds and syndicated loans for major corporations. (Specific examples would be included here if publicly available and permissible).

- Sustainable Finance Expertise: BBVA demonstrates a strong commitment to sustainable finance, offering expertise in green bonds and other responsible lending solutions.

- Innovative Financing Solutions: BBVA continuously explores innovative financing solutions to meet the evolving needs of its clients, offering a variety of options to optimize their capital structure.

Technological Innovation in BBVA's Investment Banking Approach

BBVA's investment banking operations are significantly enhanced by technological innovation and a proactive approach to digital transformation.

Digital Transformation and Fintech Integration

BBVA actively integrates fintech partnerships and leverages digital investment banking technologies such as AI in finance and big data analytics to improve efficiency, reduce costs, and enhance client service.

- Technology Implementation: BBVA has implemented cutting-edge technologies throughout its investment banking operations, including advanced analytics platforms and automated workflows.

- Fintech Partnerships: BBVA actively seeks strategic partnerships with innovative fintech companies to enhance its service offerings and access new technologies.

- Benefits of Integration: Technological integration has resulted in reduced operational costs, improved client service, and faster transaction processing.

Sustainable and Responsible Investment Banking at BBVA

BBVA is deeply committed to sustainable and responsible investment banking practices, incorporating ESG (Environmental, Social, and Governance) factors into its decision-making processes.

ESG Integration and Impact Investing

BBVA integrates ESG criteria into its investment banking activities, actively promoting sustainable finance and impact investing.

- Sustainable Finance Initiatives: BBVA is actively involved in various sustainable finance initiatives, including the financing of renewable energy projects and green bonds.

- ESG Targets and Commitments: BBVA has set ambitious ESG targets and publicly reports on its progress in meeting these commitments.

- Sustainable Development Deals: BBVA has successfully facilitated several deals that directly contribute to sustainable development goals.

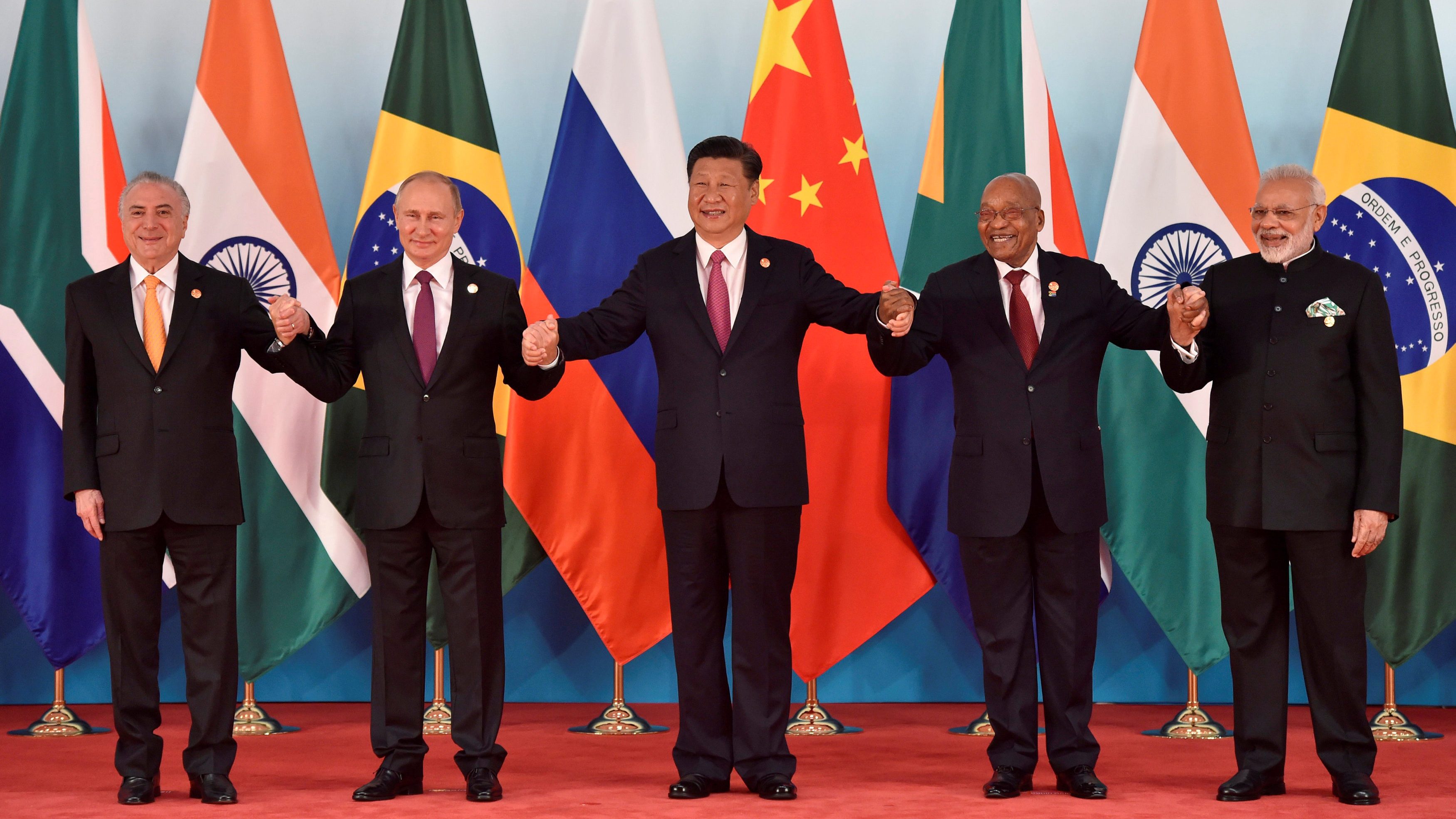

Global Reach and Strategic Partnerships in Investment Banking

BBVA's extensive global network and strategic partnerships are key differentiators in its investment banking strategy.

International Expansion and Market Presence

BBVA's presence in key global markets provides a significant advantage in facilitating cross-border transactions and serving multinational clients.

- Global Market Presence: BBVA operates in numerous key markets across the globe, enabling it to provide seamless service to clients with international operations.

- Cross-Border Transactions: BBVA has successfully completed numerous cross-border transactions, demonstrating its expertise in navigating complex international regulatory environments.

- Strategic Alliances: BBVA has formed strategic alliances and partnerships with leading financial institutions around the world to expand its global reach and service capabilities.

Conclusion

BBVA's long-term investment banking strategy is built on a foundation of comprehensive services, technological innovation, a commitment to sustainability, and a strong global presence. Their dedication to providing high-quality services, combined with their forward-thinking approach, positions them for continued growth and success in the investment banking sector. Discover how BBVA's commitment to investment banking can support your financial goals. Explore BBVA's investment banking solutions today!

Featured Posts

-

Understanding The Gold Price Spike Following Trumps Comments

Apr 25, 2025

Understanding The Gold Price Spike Following Trumps Comments

Apr 25, 2025 -

A Comprehensive Guide To The Countrys Promising Business Locations

Apr 25, 2025

A Comprehensive Guide To The Countrys Promising Business Locations

Apr 25, 2025 -

Revoluts 72 Revenue Increase A Deep Dive Into Fintechs Global Ambitions

Apr 25, 2025

Revoluts 72 Revenue Increase A Deep Dive Into Fintechs Global Ambitions

Apr 25, 2025 -

Analyzing Bbvas Long Term Investment Banking Strategy

Apr 25, 2025

Analyzing Bbvas Long Term Investment Banking Strategy

Apr 25, 2025 -

St Peters Basilica Hosts Pope Francis Body For Public Farewell

Apr 25, 2025

St Peters Basilica Hosts Pope Francis Body For Public Farewell

Apr 25, 2025

Latest Posts

-

Gillian Anderson As A Doctor Who Villain Ncuti Gatwas Choice

Apr 30, 2025

Gillian Anderson As A Doctor Who Villain Ncuti Gatwas Choice

Apr 30, 2025 -

X Files Ryan Coogler Reinventera T Il La Serie Mythique

Apr 30, 2025

X Files Ryan Coogler Reinventera T Il La Serie Mythique

Apr 30, 2025 -

Doctor Who Ncuti Gatwa Eyes Gillian Anderson For Villain Role

Apr 30, 2025

Doctor Who Ncuti Gatwa Eyes Gillian Anderson For Villain Role

Apr 30, 2025 -

Le Realisateur De Black Panther Aux Commandes D Un Reboot De X Files

Apr 30, 2025

Le Realisateur De Black Panther Aux Commandes D Un Reboot De X Files

Apr 30, 2025 -

Ncuti Gatwa Wants Gillian Anderson As Doctor Who Villain

Apr 30, 2025

Ncuti Gatwa Wants Gillian Anderson As Doctor Who Villain

Apr 30, 2025