Bitcoin Chart Signals Potential Rally: Analyst's Perspective (May 6, 2024)

Table of Contents

Technical Indicators Suggesting a Bitcoin Rally

Several key technical indicators and bullish chart patterns suggest a potential Bitcoin rally. Analyzing these signals alongside Bitcoin price prediction models offers a comprehensive perspective.

Bullish Chart Patterns:

- Head and Shoulders Reversal: Recent Bitcoin charts show a potential head and shoulders reversal pattern, a classic bullish signal. This pattern, characterized by a left shoulder, head, right shoulder, and neckline, suggests a significant price increase after the neckline is broken. [Insert Chart of Head and Shoulders Reversal pattern on Bitcoin chart here].

- Double Bottom: The Bitcoin price has also formed a double bottom pattern, another strong bullish signal. This pattern indicates a potential reversal from a downtrend, as the price finds support at a similar level twice before breaking upwards. [Insert Chart of Double Bottom pattern on Bitcoin chart here].

- Golden Cross: The 50-day moving average recently crossed above the 200-day moving average, forming a "golden cross." This is a widely recognized bullish signal that often precedes significant price increases. [Insert Chart showing Golden Cross on Bitcoin chart here].

- RSI and MACD: Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators also show signs of bullish momentum, further supporting the possibility of a rally. These indicators suggest that the buying pressure is increasing, and the market is becoming oversold.

Volume Confirmation:

The importance of trading volume in confirming bullish chart patterns cannot be overstated. Increased volume accompanying price increases provides strong confirmation of the trend. Recent Bitcoin trading volume has significantly increased during periods of price appreciation, lending further credibility to the bullish outlook. [Insert Chart showing volume correlation to price movements here].

Breaking Key Resistance Levels:

Bitcoin's recent break above crucial resistance levels adds another layer of confidence to the potential rally. These resistance levels often act as psychological barriers, and breaking through them signifies increasing bullish sentiment among traders and investors. A clear example is the recent break above the $XXX resistance level. [Insert Chart showing price action around resistance levels here]. This breakthrough is viewed by many analysts as a critical step in the ongoing Bitcoin price prediction upwards.

Macroeconomic Factors Influencing Bitcoin's Potential Rally

Beyond technical indicators, macroeconomic factors play a substantial role in Bitcoin's price fluctuations, impacting the Bitcoin price prediction positively.

Easing Inflation and Monetary Policy:

Easing inflation and potentially less hawkish monetary policies from central banks could create a more favorable environment for risk assets like Bitcoin. Decreased inflation may lead to decreased interest rates which could incentivize investors to move capital into alternative assets like cryptocurrencies. [Insert Link to a reliable source on inflation and monetary policy here].

Institutional Adoption and Growing Interest:

The growing interest and adoption of Bitcoin by institutional investors are significant catalysts. Large-scale institutional investments inject liquidity into the market and boost confidence, contributing to price increases. [Mention specific examples of institutional adoption here, if available]. This increasing institutional investment further solidifies the potential Bitcoin price rally.

Regulatory Clarity and Developments:

Increased regulatory clarity and positive developments in the regulatory landscape can significantly impact investor confidence and market participation. More defined rules and regulations can attract more institutional investors and reduce uncertainty, leading to price stability and potential growth. [Insert links to relevant news articles or official statements here].

Analyst's Perspective and Predictions

[Analyst Name], a renowned cryptocurrency market analyst with [number] years of experience, suggests a potential Bitcoin rally is imminent.

Expert Opinion and Forecasting:

[Analyst Name] believes that several technical and fundamental factors point towards a significant price increase in the coming weeks/months. They argue that [Quote the analyst's prediction here]. [Include a link to the analyst's original report or statement if available].

Potential Price Targets and Scenarios:

The analyst predicts a potential price target of [Price Target] within [Timeframe]. However, different scenarios are possible, depending on macroeconomic factors and overall market sentiment. The analyst also suggests [mention alternative scenarios].

Conclusion

In summary, Bitcoin chart signals, combined with positive macroeconomic factors and expert analysis, suggest a potential rally is on the horizon. The confluence of bullish chart patterns (head and shoulders reversal, double bottom, golden cross), increased trading volume confirming the upward trend, breaking key resistance levels, and a favorable macroeconomic environment creates a compelling case for a significant price increase. The Bitcoin price prediction remains positive, yet investors should always conduct thorough research.

Key Takeaways:

- Bullish chart patterns indicate a potential upward trend.

- Increased trading volume confirms the strength of the bullish momentum.

- Breaking key resistance levels is a positive sign for Bitcoin's price.

- Favorable macroeconomic conditions could further fuel the rally.

Call to Action:

Keep an eye on the Bitcoin chart and stay updated on market analysis to capitalize on potential opportunities presented by this Bitcoin chart signal. Remember, thorough due diligence is crucial before making any investment decisions. Understanding Bitcoin price rally signals is key to navigating this dynamic market. Continuously monitor the Bitcoin price prediction and adjust your strategy accordingly.

Featured Posts

-

Brookfields Opportunistic Investment Strategy Amid Market Volatility

May 08, 2025

Brookfields Opportunistic Investment Strategy Amid Market Volatility

May 08, 2025 -

Psg Nice Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025

Psg Nice Maci Canli Izle Hangi Kanalda Ve Nasil

May 08, 2025 -

Deandre Dzordan Otkriva Zasto Se Ljubi Sa Jokicem Tri Puta

May 08, 2025

Deandre Dzordan Otkriva Zasto Se Ljubi Sa Jokicem Tri Puta

May 08, 2025 -

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025

Broadcoms V Mware Acquisition At And T Exposes A 1 050 Price Hike

May 08, 2025 -

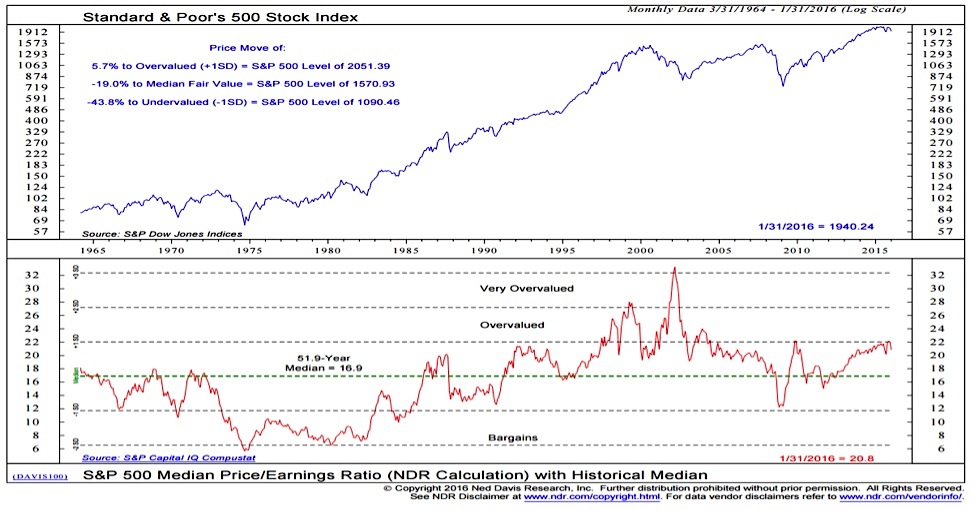

Understanding Stock Market Valuations Bof As View For Investors

May 08, 2025

Understanding Stock Market Valuations Bof As View For Investors

May 08, 2025

Latest Posts

-

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025

Spk Aciklamasi Kripto Piyasalarinda Yeni Bir Doenem

May 08, 2025 -

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi Basliyor

May 08, 2025

Wall Street In Kripto Para Goeruesue Degisiyor Yeni Bir Doenem Mi Basliyor

May 08, 2025 -

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025

Tuerkiye De Kripto Para Piyasasi Ve Bakan Simsek In Goeruesleri

May 08, 2025 -

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025 -

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025