BofA's View: Why Overvalued Stocks Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Beyond Simple Valuation Metrics

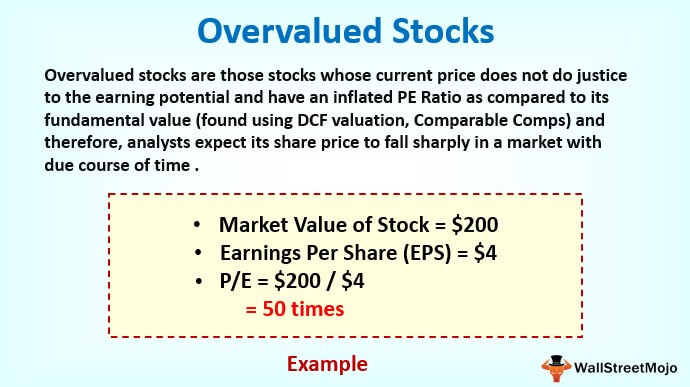

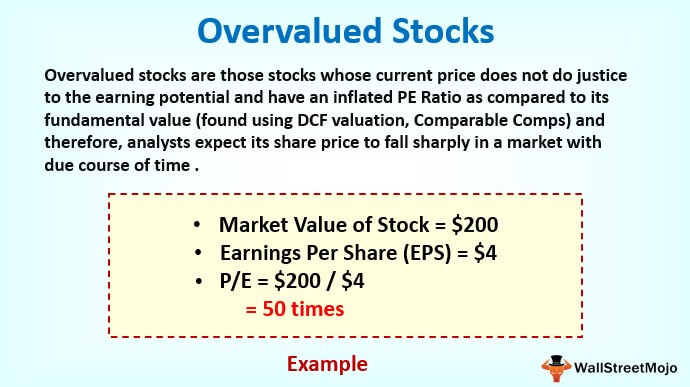

BofA argues that relying solely on Price-to-Earnings ratios (P/E) or other traditional valuation metrics to determine whether stocks are "overvalued" can be a misleading and short-sighted approach. While these metrics offer a snapshot of current market sentiment, they often fail to capture the full picture of a company's long-term potential.

-

Future Earnings Growth Potential: A high P/E ratio might seem alarming, but if a company is poised for significant future earnings growth, that high valuation may be justified. Investors should look beyond current earnings and consider the company's growth trajectory. Rapid expansion into new markets or the launch of innovative products can significantly impact future profitability.

-

The Impact of Low Interest Rates: Low interest rate environments often lead to higher valuations across the stock market. When interest rates are low, investors are willing to accept lower returns on bonds and other fixed-income securities, driving capital towards stocks, potentially inflating their valuations.

-

Technological Advancements and Disruptive Innovation: Rapid technological changes can render traditional valuation models obsolete. Companies leveraging disruptive technologies often command premium valuations, even if their current earnings don't fully reflect their future potential. Think about the early valuations of tech giants like Amazon or Google – initially high, but ultimately justified by exponential growth.

-

Qualitative Factors: Traditional valuation metrics often overlook crucial qualitative factors. Strong management teams, a durable competitive advantage (like a strong brand or unique technology), and a clear long-term strategy are all critical elements that can justify a higher valuation.

The Importance of Long-Term Investing in a Volatile Market

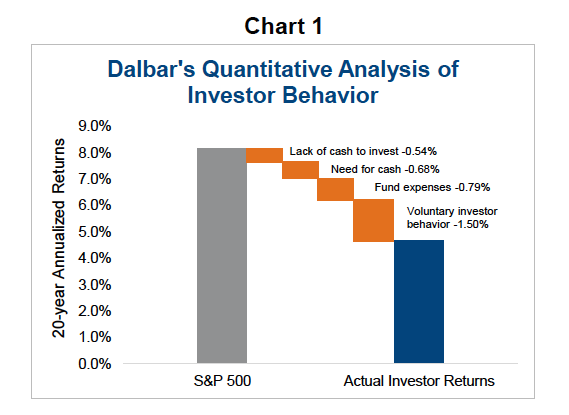

Market fluctuations are inherent to the stock market. Short-term price movements, even dramatic ones, shouldn't dictate your investment decisions, especially if you're focused on long-term growth. Short-term volatility is often noise; long-term trends reveal the true story.

-

Dollar-Cost Averaging: Regularly investing a fixed amount of money at set intervals, regardless of market price, is a powerful technique for mitigating risk. Dollar-cost averaging reduces the impact of volatility by buying more shares when prices are low and fewer when prices are high.

-

The Power of Compounding: Over the long term, the power of compounding returns is transformative. Even modest annual returns can accumulate significantly over decades, far outweighing the impact of short-term market corrections.

-

Historically Overvalued Stocks: Many historically "overvalued" stocks have gone on to deliver strong long-term returns. Focusing solely on short-term valuation can cause you to miss out on significant growth opportunities.

-

Weathering Market Corrections: Long-term investors are better positioned to weather short-term market corrections. A long-term perspective allows you to ride out temporary downturns, avoiding panic selling that can lock in losses.

Risk Mitigation Through Portfolio Diversification

Diversifying your investments across different asset classes and sectors is crucial for reducing overall portfolio risk. Don't put all your eggs in one basket!

-

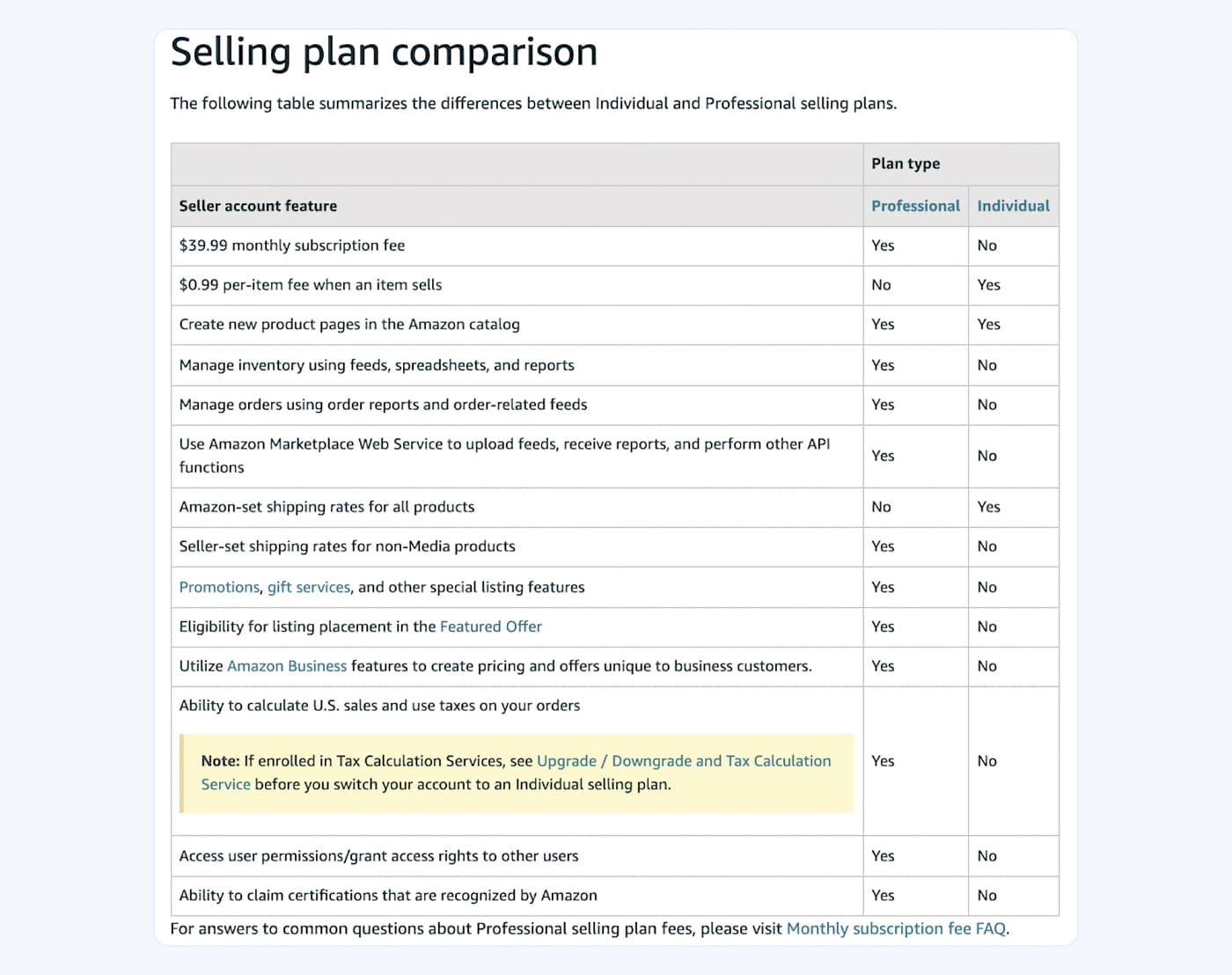

Growth and Value Stocks: A balanced portfolio should include both growth stocks (with high potential but potentially higher risk) and value stocks (with lower valuations but potentially slower growth).

-

International Diversification: Investing in international markets reduces your reliance on any single economy, helping to mitigate risks associated with regional downturns.

-

Bonds and Fixed-Income Securities: Including bonds and other fixed-income securities in your portfolio can provide stability and reduce overall volatility.

-

Offsetting Losses from Overvalued Stocks: Diversification helps to offset potential losses from any single investment, including those that might be considered overvalued. If one sector underperforms, other sectors may compensate.

Understanding Your Risk Tolerance

Your investment strategy must align with your individual risk profile.

-

Risk Tolerance Levels: Investors typically fall into aggressive, moderate, or conservative categories depending on their risk tolerance and time horizon.

-

Professional Financial Advice: Seeking professional financial advice is highly recommended to determine the appropriate asset allocation for your specific circumstances and risk tolerance.

Conclusion

BofA's perspective highlights that focusing solely on whether stocks are "overvalued" can be a shortsighted approach. Long-term investing, coupled with a well-diversified portfolio and an understanding of your own risk tolerance, provides a more robust strategy to navigate market volatility. The key takeaway is to avoid making hasty decisions based on short-term market fluctuations and focus on the long-term growth potential of your investments. Don't let concerns about overvalued stocks deter you from a sound, long-term investment strategy. Learn more about building a diversified portfolio that aligns with your risk tolerance and explore the long-term growth opportunities available in the market. Contact a financial advisor to discuss your options and develop a plan for managing your investments in the face of potentially overvalued stocks.

Featured Posts

-

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025

Musks X Debt Sale New Financials Reveal A Transforming Company

Apr 28, 2025 -

Market Volatility And Investor Behavior A Case Study Of Recent Trends

Apr 28, 2025

Market Volatility And Investor Behavior A Case Study Of Recent Trends

Apr 28, 2025 -

Us China Trade War Partial Tariff Relief For Select American Products

Apr 28, 2025

Us China Trade War Partial Tariff Relief For Select American Products

Apr 28, 2025 -

Silent Divorce Understanding The Subtle Signs Of Marital Breakdown

Apr 28, 2025

Silent Divorce Understanding The Subtle Signs Of Marital Breakdown

Apr 28, 2025 -

Market Swings Professional Selling And The Individual Investor Response

Apr 28, 2025

Market Swings Professional Selling And The Individual Investor Response

Apr 28, 2025

Latest Posts

-

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025