Dragon Den: Against The Odds - A Businessman's Unconventional Deal

Table of Contents

The Business Idea: A Gamble Worth Taking?

Unconventional Approach to Sustainable Packaging:

Mark Olsen's company, "EcoPack Solutions," presented a radical departure from traditional packaging materials. Instead of relying on unsustainable plastics or cardboard, EcoPack utilized a bio-engineered mushroom-based material. This unconventional approach to sustainable packaging was initially met with skepticism. Many potential investors saw the high initial production costs and the unproven market for such a product as insurmountable barriers.

- Unique Selling Proposition (USP): EcoPack offered a completely biodegradable and compostable packaging solution, addressing growing concerns about plastic waste and environmental sustainability.

- Market Gap: The business aimed to fill a significant gap in the market for eco-friendly alternatives to traditional packaging, targeting environmentally conscious consumers and businesses.

- Initial Challenges: Securing funding, establishing reliable supply chains for the unique mushroom material, and convincing potential clients of the material's durability were major initial hurdles.

Market Analysis and Potential:

Despite the risks, thorough market research underpinned Olsen's belief in EcoPack's potential. Growing consumer demand for sustainable products and increasing legislative pressure on businesses to reduce their environmental impact provided a strong foundation for the business model.

- Market Demand: Studies indicated a significant and rapidly growing market for eco-friendly packaging, with projected annual growth exceeding 15%.

- Target Audience: EcoPack aimed at both environmentally conscious consumers and businesses seeking to improve their sustainability credentials. This included food companies, cosmetic brands, and e-commerce businesses.

- Competitive Advantages: The unique biodegradable nature of the packaging and its competitive price point (once production scaled) gave EcoPack a distinct advantage over existing solutions.

The Dragon's Den Pitch: Navigating the Sharks

Preparing for the High-Stakes Pitch:

Preparing for the Dragon's Den was a grueling process. Condensing years of research, development, and market analysis into a concise and compelling investor presentation was a monumental task. Creating a compelling pitch deck that showcased the intricacies of the mushroom-based packaging while addressing potential investor concerns required meticulous planning.

- Business Plan Adjustments: Olsen refined his business plan to focus on short-term milestones and demonstrable achievements that could convince the Dragons of EcoPack's viability.

- Key Pitch Elements: He emphasized the growing market demand, the environmental benefits, and the long-term cost savings that EcoPack offered compared to traditional packaging.

- Initial Dragon Reactions: The Dragons were initially skeptical, questioning the scalability of the business and the potential for mass production of the mushroom material.

Handling Investor Scrutiny:

Facing intense scrutiny from experienced investors, Olsen needed to navigate complex questions about production costs, scalability, and market penetration. His responses were crucial in overcoming the Dragons' reservations.

- Q&A Examples: Dragons questioned the durability and cost-effectiveness of the mushroom packaging, prompting Olsen to detail the rigorous testing the material had undergone and outline cost-reduction strategies based on economies of scale.

- Counter-Arguments: He addressed concerns about competition by highlighting EcoPack's unique biodegradable properties and the increasing regulatory pressure on businesses to adopt sustainable practices.

- Convincing Elements: Olsen's passion for sustainability, combined with his detailed market analysis and clear vision for the future, finally won over the Dragons.

The Unconventional Deal: Securing Investment Against the Odds

Negotiating the Terms:

The investment deal secured by Olsen was far from conventional. It involved a complex structure incorporating both equity and revenue sharing, acknowledging the inherent risks associated with such a novel business.

- Specific Terms: The Dragons invested £250,000 in exchange for a 20% equity stake and a percentage of the revenue for the first five years.

- Unconventional Aspects: The revenue-sharing component was unconventional, reflecting the Dragons' acknowledgement of the inherent risks associated with the new technology.

- Benefits & Risks: While the investment provided crucial capital, the revenue-sharing agreement meant a smaller share of profits for Olsen in the early years. However, the Dragons' expertise and network significantly accelerated EcoPack's growth.

The Post-Dragon's Den Journey:

The Dragon's Den appearance catapulted EcoPack into the spotlight, significantly boosting brand awareness and attracting new clients. The investment allowed Olsen to scale up production and expand into new markets.

- Positive Outcomes: Sales increased dramatically, brand recognition soared, and the company secured partnerships with major retailers.

- Challenges: Scaling production presented new logistical and operational challenges, requiring further investment and adaptation.

- Long-Term Impact: EcoPack’s success story continues, highlighting the power of unconventional thinking and the potential for high-impact investments in the Dragon's Den.

Conclusion:

Mark Olsen's journey on Dragon's Den exemplifies the power of perseverance and the potential for unconventional deals to yield extraordinary results. His success wasn't just about a clever business idea; it was about navigating the complexities of securing funding for a truly innovative product. Overcoming the skepticism of the Dragons, securing funding through a unique deal structure, and adapting to new challenges after the initial investment, all contributed to his remarkable success. This story underscores the importance of thorough market research, a compelling pitch, and the ability to convincingly articulate the value proposition of a risky yet impactful business idea. Share your experiences with unconventional business deals in the comments below! Learn more about EcoPack Solutions and their journey from a Dragon's Den gamble to success!

Featured Posts

-

Coronation Street A Popular Characters Sudden And Unexpected Exit

May 01, 2025

Coronation Street A Popular Characters Sudden And Unexpected Exit

May 01, 2025 -

Chocolat Pour Le Premier Bebe Ne En Normandie L Offre D Une Boulangerie Locale

May 01, 2025

Chocolat Pour Le Premier Bebe Ne En Normandie L Offre D Une Boulangerie Locale

May 01, 2025 -

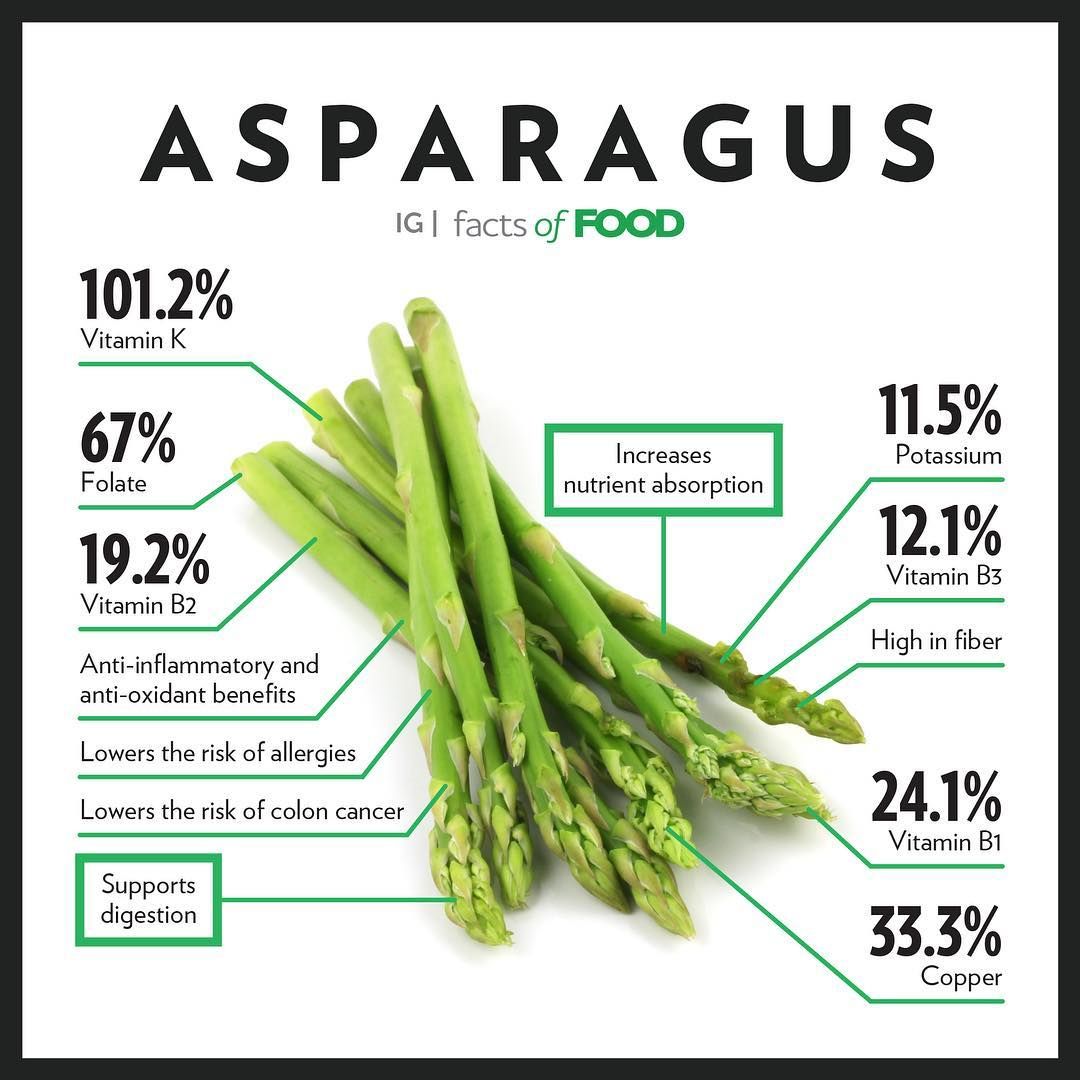

How Healthy Is Asparagus Unveiling The Benefits Of This Nutrient Rich Vegetable

May 01, 2025

How Healthy Is Asparagus Unveiling The Benefits Of This Nutrient Rich Vegetable

May 01, 2025 -

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025

Finding Alternatives Chinas Response To Us Pharmaceutical Imports

May 01, 2025 -

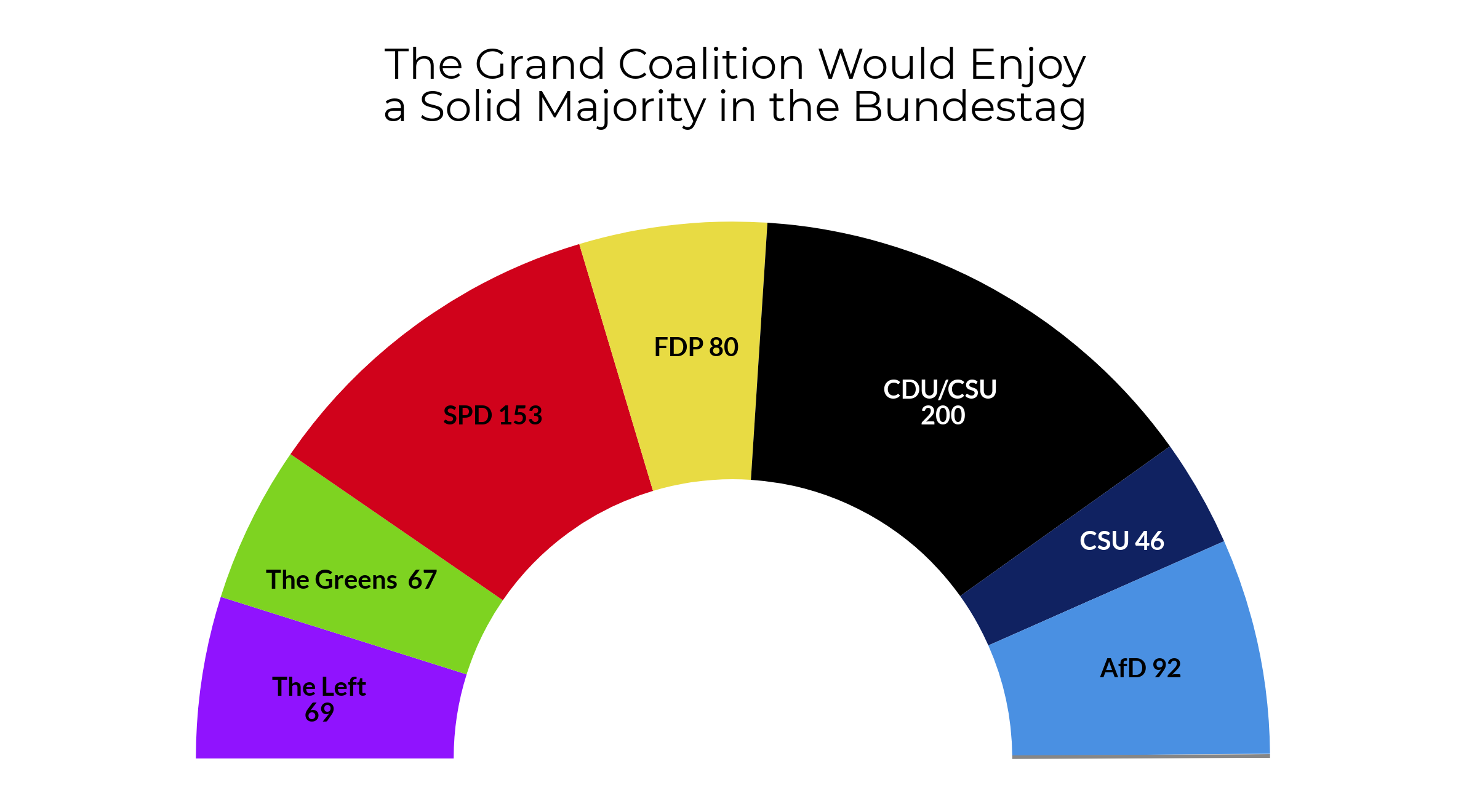

German Coalition Deal Midday Announcement Expected

May 01, 2025

German Coalition Deal Midday Announcement Expected

May 01, 2025

Latest Posts

-

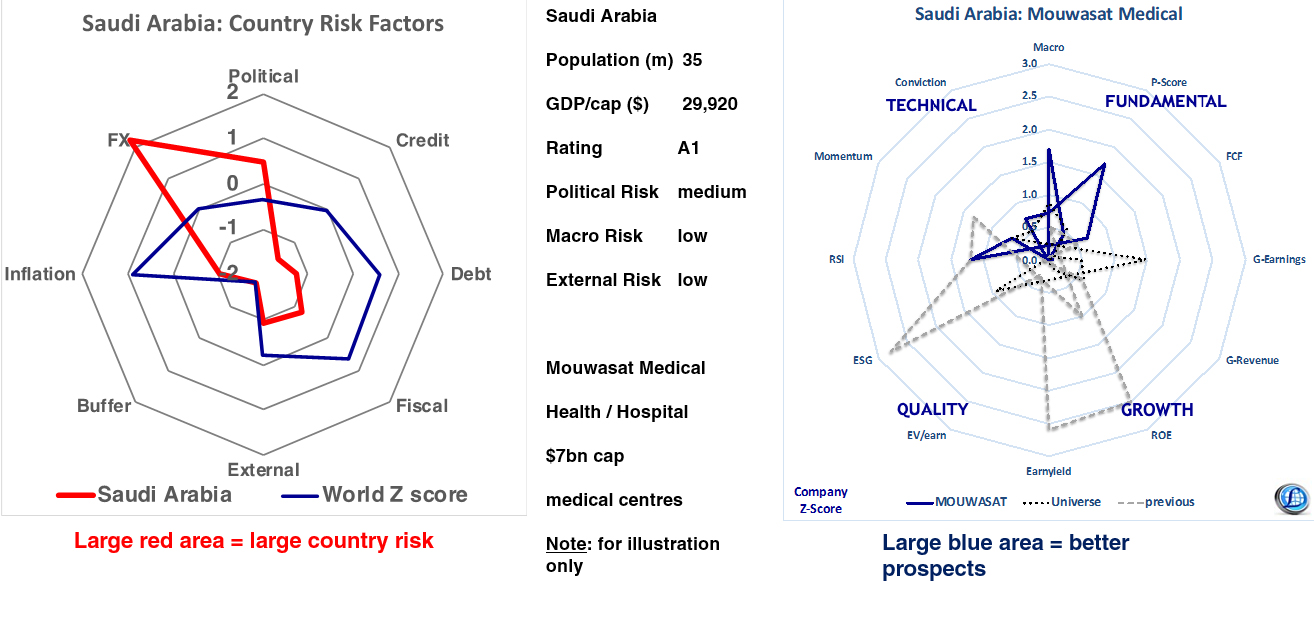

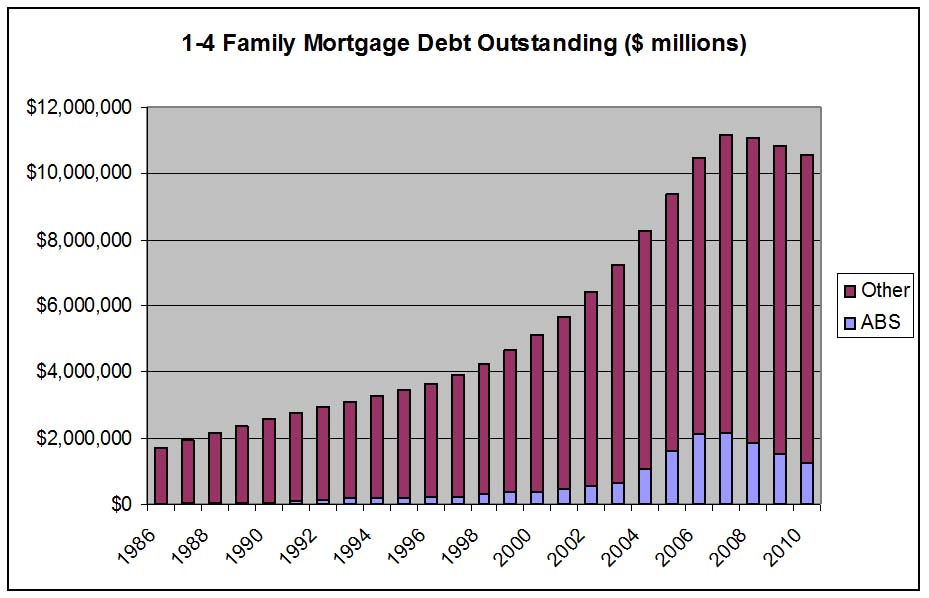

Impact Of Saudi Rule Change On Abs Market Growth

May 02, 2025

Impact Of Saudi Rule Change On Abs Market Growth

May 02, 2025 -

New Saudi Regulations Reshaping The Abs Market Landscape

May 02, 2025

New Saudi Regulations Reshaping The Abs Market Landscape

May 02, 2025 -

The Saudi Abs Market Post Reform Growth And Opportunities

May 02, 2025

The Saudi Abs Market Post Reform Growth And Opportunities

May 02, 2025 -

Saudi Abs Market Unprecedented Growth Following Regulatory Overhaul

May 02, 2025

Saudi Abs Market Unprecedented Growth Following Regulatory Overhaul

May 02, 2025 -

Saudi Arabias Abs Market Transformation A Market Bigger Than Spain

May 02, 2025

Saudi Arabias Abs Market Transformation A Market Bigger Than Spain

May 02, 2025