Escape To The Country: Financial Planning For A Rural Lifestyle

Table of Contents

Assessing Your Current Financial Situation

Before you even start browsing idyllic countryside properties, a thorough assessment of your current finances is paramount. This involves understanding your income and expenses and realistically calculating the cost of living in your chosen rural area.

Understanding Your Income and Expenses

Analyze your current income streams – salary, investments, pensions – and meticulously track your expenses. This detailed budget will reveal areas where you can cut back before your move. Consider using budgeting apps or spreadsheets to gain a clear picture of your financial health.

- Create a detailed budget: Categorize your expenses (housing, transportation, food, entertainment, etc.) to identify areas for potential savings.

- Differentiate between needs and wants: Prioritize essential expenses and minimize non-essential spending.

- Explore potential side hustles for extra income: Remote work opportunities, freelance gigs, or part-time jobs can supplement your income, especially if you anticipate a reduction in salary after relocating.

- Consider selling assets to build a financial buffer: Selling non-essential assets can provide a crucial financial cushion during the transition phase.

Calculating the Cost of Living in Rural Areas

Researching the cost of living in your target rural location is crucial. Costs can vary dramatically depending on location, amenities, and property type. Don't underestimate the potential for higher expenses in some areas.

- Housing prices (property taxes, maintenance): Property taxes in rural areas can sometimes be surprisingly high. Factor in maintenance costs, which can be significantly higher than in urban areas due to potential issues with older properties and lack of readily-available tradespeople.

- Transportation costs (car ownership, fuel): Public transportation is often limited in rural areas, meaning reliance on a car is common, leading to higher fuel and maintenance costs.

- Healthcare access and costs: Access to healthcare may be more limited in rural areas, potentially increasing travel time and costs for appointments and treatments.

- Grocery shopping (potential lack of nearby supermarkets & higher prices): Food costs can be higher due to limited supermarket options and potentially increased transportation costs to reach larger stores.

- Utilities (electricity, water, heating): Utilities can be more expensive in rural areas, particularly heating costs due to larger properties and potentially less efficient heating systems.

- Internet access: Reliable high-speed internet access can be an issue in some rural areas. Ensure you investigate internet availability before committing to a move.

Securing Your Housing

Finding the right property is a significant step in your escape to the country. This involves careful consideration of various factors and navigating the often unique aspects of rural real estate markets.

Choosing the Right Property

Consider the type of property (house, cottage, barn conversion, farm), its size, location (proximity to amenities, schools, work), and condition (repair costs). Don't just focus on the initial purchase price; factor in all associated ongoing costs.

- Factor in property taxes, insurance, and potential renovation or maintenance costs: These can add significantly to your overall housing costs. Get several quotes for insurance and factor in a contingency fund for repairs.

- Explore financing options: mortgages, loans: Research different mortgage options and secure pre-approval to strengthen your position when making an offer on a property.

Navigating Rural Real Estate Markets

Rural real estate markets can operate differently than urban ones. Be prepared for a longer search process and seek advice from local real estate agents specializing in rural properties.

- Be prepared for a longer search process: The availability of suitable properties in rural areas can be more limited.

- Understand local zoning regulations and building codes: These can significantly impact your plans for renovations or extensions.

Planning for Unexpected Expenses

Life throws curveballs, and rural living can present unique challenges. Having a financial safety net is crucial for weathering unexpected expenses.

Emergency Fund

Building a substantial emergency fund is vital. Aim for at least 3-6 months of living expenses to cover unforeseen repairs, medical emergencies, or loss of income.

- Aim for at least 3-6 months of living expenses: This will provide a financial buffer during unexpected events.

- Regularly contribute to your emergency fund: Make consistent contributions to maintain an adequate level of savings.

Insurance Coverage

Ensure you have adequate insurance coverage, tailoring it to the specific needs of your rural location.

- Research different insurance providers for competitive rates: Compare quotes from multiple providers to find the best value.

- Consider specialized coverage for farms or livestock: If you're planning on keeping animals, ensure you have appropriate liability and property insurance.

Long-Term Financial Planning

Your financial planning shouldn't stop at the move. Consider long-term implications for retirement and estate planning.

Retirement Planning

If you're closer to retirement, ensure your retirement plan is compatible with a rural lifestyle. Potential changes to income need careful consideration.

- Review your retirement savings, pensions, and social security benefits: Ensure your retirement income will cover your expenses in your new location.

- Consider part-time work or alternative income streams in retirement: Supplementing your retirement income with part-time work or other income sources can enhance your financial security.

Estate Planning

Create or update your will and estate plan to reflect your new location and circumstances.

- Consider the implications for inheritance taxes and property distribution: Consult with a financial advisor or estate planning lawyer to ensure your wishes are legally protected.

Conclusion

Escaping to the country can be an incredibly rewarding experience. However, thorough financial planning is the cornerstone of a successful and sustainable transition. By carefully assessing your current financial standing, securing appropriate housing, planning for unexpected expenses, and developing a long-term financial strategy, you can confidently embrace your rural lifestyle dream. Don't let financial uncertainties derail your escape. Start planning your financial future for a fulfilling escape to the country today!

Featured Posts

-

Dax Surge Will Wall Streets Comeback Dampen German Market Gains

May 24, 2025

Dax Surge Will Wall Streets Comeback Dampen German Market Gains

May 24, 2025 -

Former French Pm Discrepancies With Macrons Decisions

May 24, 2025

Former French Pm Discrepancies With Macrons Decisions

May 24, 2025 -

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025

Paris Economic Slowdown Luxury Goods Sector Impact March 7 2025

May 24, 2025 -

Porsche 956 Muezede Tavana Neden Asili

May 24, 2025

Porsche 956 Muezede Tavana Neden Asili

May 24, 2025 -

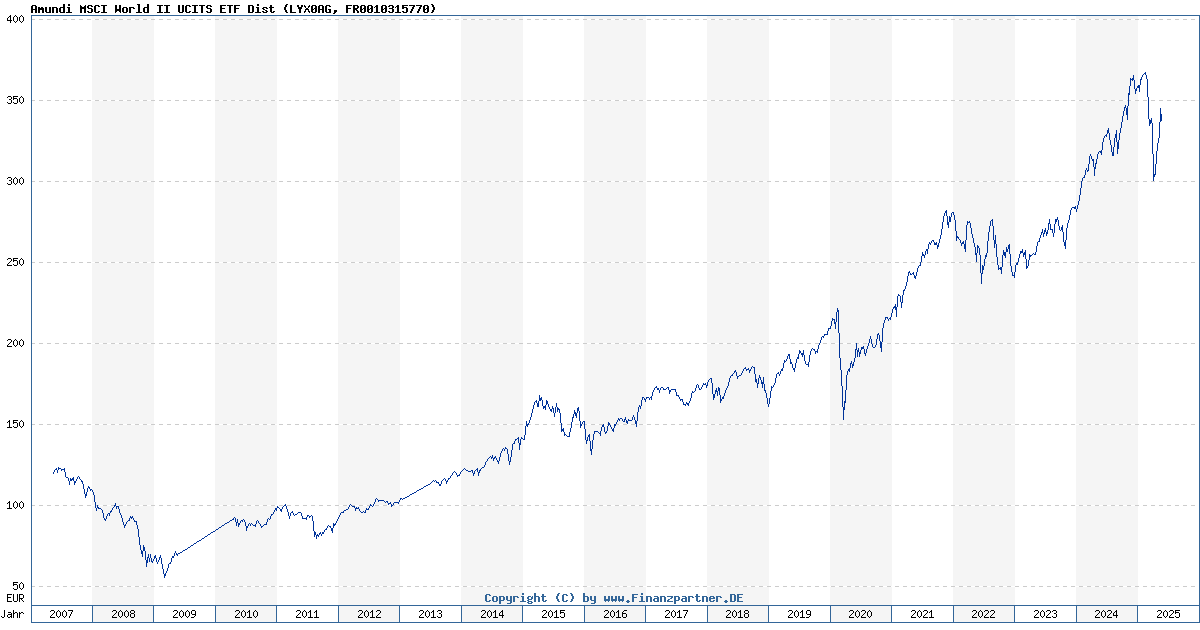

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Understanding Net Asset Value Nav

May 24, 2025

Latest Posts

-

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025

Analisi Borsa Fed Banche Italiane E Il Futuro Di Piazza Affari

May 24, 2025 -

Borsa Debito Pubblico Inflazione E Decisioni Della Fed

May 24, 2025

Borsa Debito Pubblico Inflazione E Decisioni Della Fed

May 24, 2025 -

Borsa Piazza Affari In Attenzione Fed E Banche In Primo Piano

May 24, 2025

Borsa Piazza Affari In Attenzione Fed E Banche In Primo Piano

May 24, 2025 -

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 24, 2025

Analiz Stati Gryozy Lyubvi Ili Ilicha V Gazete Trud

May 24, 2025 -

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Worries

May 24, 2025

Heineken Tops Revenue Expectations Reaffirms Outlook Despite Tariff Worries

May 24, 2025