Ethereum's Price Action: Conquering Resistance, Aiming For $2,000

Table of Contents

Recent Price Surge and Breakout

Ethereum experienced a notable price increase in the last [Number] weeks, breaking past several key resistance levels. For example, on [Date], the Ethereum price jumped from $[Price] to $[Price], a significant surge of [Percentage] in a single day. This bullish momentum was fueled by several factors.

- Successful breach of a key resistance level: The recent price surge saw Ethereum decisively break through the $[Price] resistance level, a significant psychological barrier for many investors. This breakthrough signifies increased confidence in the market.

- Increased trading volume accompanying the price surge: The price increase was not only significant but also accompanied by a notable rise in trading volume, suggesting strong buying pressure and reduced selling pressure. This high volume break further validates the breakout.

- Positive sentiment fueled by Shanghai upgrade and DeFi growth: The successful completion of the Shanghai upgrade, enabling ETH withdrawals from staking, along with continued growth in the Decentralized Finance (DeFi) ecosystem built on Ethereum, contributed to the positive market sentiment.

[Insert Chart or Graph visualizing the price movement here. Clearly label axes and highlight key price points and dates.]

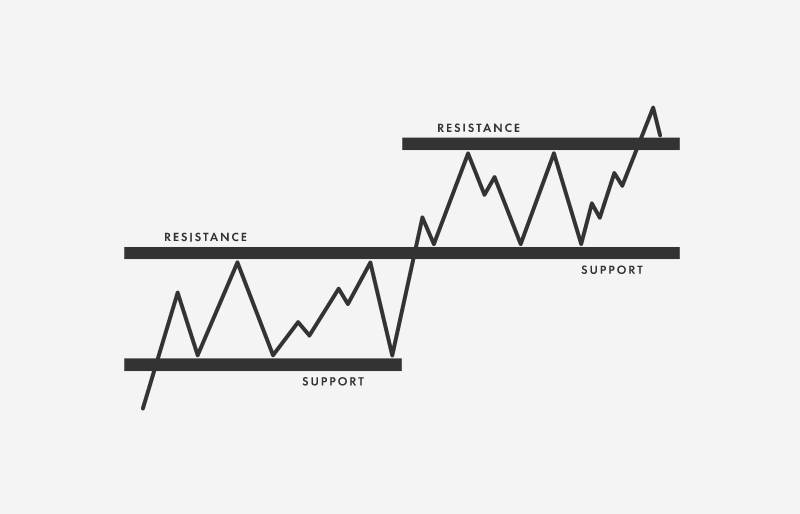

Analyzing Key Resistance Levels

For Ethereum to reach $2,000, it needs to overcome several key resistance levels. These levels represent psychological barriers, historical highs, or points where previous price movements have stalled.

- $1,800: A major psychological barrier. This round number represents a significant hurdle for many traders, and breaking through it would signal a strong bullish trend. Market sentiment around this level is crucial to observe.

- $1,900: Historical high or significant previous resistance. Depending on the timeframe considered, $1,900 might represent a previous all-time high or a point of significant past resistance. Overcoming this level would be another major signal of strength.

- Technical indicators suggesting potential breakouts or reversals: Technical indicators like the Relative Strength Index (RSI) and moving averages can help predict potential breakouts or reversals at these resistance levels. Monitoring these indicators is crucial for accurate Ethereum price prediction.

It is also essential to consider potential support levels, such as $[Price] and $[Price]. These are price points where buying pressure might outweigh selling pressure, potentially halting a price decline. Tracking these support and resistance levels is vital for understanding the Ethereum price trajectory.

Factors Influencing Ethereum's Price

Several factors influence Ethereum's price, ranging from macroeconomic conditions to the activity on the Ethereum network itself.

- Correlation with Bitcoin's price movements: As the largest cryptocurrency, Bitcoin's price often influences the entire cryptocurrency market, including Ethereum. A strong Bitcoin price usually correlates with a strong Ethereum price.

- Impact of regulatory announcements: Regulatory decisions and announcements concerning cryptocurrencies can significantly impact market sentiment and consequently, the Ethereum price. Regulatory clarity is generally seen as bullish.

- Growth of decentralized applications (dApps) built on Ethereum: The increasing adoption and growth of decentralized applications (dApps) on the Ethereum blockchain contribute to its value and long-term price appreciation. More dApp usage generally increases demand for ETH.

- The role of staking and ETH2.0: The Ethereum 2.0 upgrade and the associated staking mechanism are long-term factors that influence the Ethereum price. Increased staking activity generally reduces the circulating supply of ETH, potentially leading to price appreciation.

Predicting Future Price Movement

Predicting the future price movement of Ethereum involves analyzing various factors and scenarios.

- Bullish scenario: Reaching $2,000 within [Timeframe]. If the current bullish momentum continues, and key resistance levels are broken, Ethereum could reach $2,000 within [Timeframe]. This scenario depends on sustained positive market sentiment and continued network growth.

- Bearish scenario: Retracement to [Price level] before further upward movement. A bearish scenario might involve a retracement to a support level like $[Price] before resuming an upward trajectory. This could be due to profit-taking or external market factors.

- Neutral scenario: Consolidation around the current price range. A neutral scenario involves consolidation around the current price range, with sideways trading before a decisive breakout in either direction. This might occur if the market awaits further catalysts.

Technical analysis using indicators such as moving averages and RSI, combined with fundamental analysis focusing on network activity and development progress, is essential for a more accurate Ethereum price prediction.

Conclusion

Ethereum's price action is currently characterized by a surge in price, breaking through several key resistance levels. Reaching $2,000 requires overcoming further resistance levels, notably $1,800 and $1,900. Factors influencing the Ethereum price include its correlation with Bitcoin, regulatory developments, DeFi growth, and the ongoing transition to ETH2.0. While several scenarios are possible, a sustained bullish trend, combined with positive market sentiment and further adoption, could drive Ethereum towards its $2,000 target. Stay informed about the latest developments affecting Ethereum's price to make informed investment decisions. Keep monitoring the Ethereum price and its trajectory towards the $2,000 target. Regularly check for updates on Ethereum price analysis and predictions to optimize your investment strategy.

Featured Posts

-

K

May 08, 2025

K

May 08, 2025 -

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Psg Expands Globally New Research Facility Opens In Doha

May 08, 2025

Psg Expands Globally New Research Facility Opens In Doha

May 08, 2025 -

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025

Ripple Xrp And The 3 40 Resistance A Technical Analysis

May 08, 2025 -

Inter Milans Path To The Champions League Final A Victory Over Barcelona

May 08, 2025

Inter Milans Path To The Champions League Final A Victory Over Barcelona

May 08, 2025

Latest Posts

-

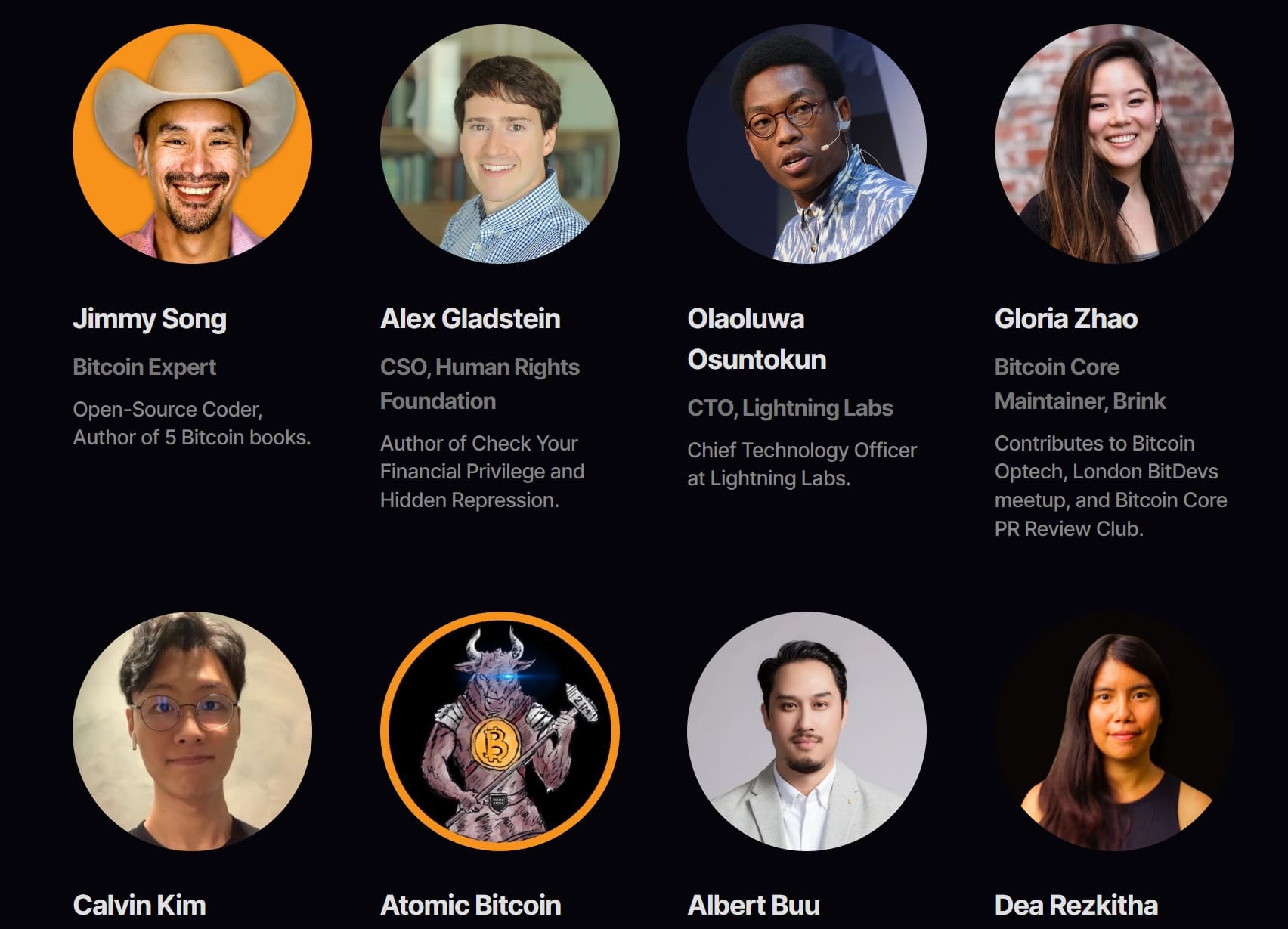

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025

2025 Bitcoin Conference In Seoul Industry Leaders Announced

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Gathering

May 08, 2025 -

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025

The Trade War And Crypto A Single Cryptocurrencys Potential For Growth

May 08, 2025 -

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025

Bitcoin Seoul 2025 Shaping The Future Of Bitcoin In Asia

May 08, 2025 -

Recent Bitcoin Rebound A Deeper Dive Into Market Trends

May 08, 2025

Recent Bitcoin Rebound A Deeper Dive Into Market Trends

May 08, 2025