European Market Update: Tariff Hopes And LVMH's Decline

Table of Contents

Diminished Tariff Hopes and their Impact on European Trade

Recent negotiations surrounding EU tariffs have yielded limited progress, leaving many European businesses facing ongoing uncertainty. The persistent trade disputes, particularly with key global partners, continue to negatively impact European trade and economic growth. These ongoing trade wars create significant challenges for European industries.

-

Stagnant Progress on Trade Agreements: The lack of substantial breakthroughs in reducing import and export tariffs creates an unpredictable environment for businesses. This unpredictability hinders long-term planning and investment decisions.

-

Negative Impact on Key Sectors: European businesses, particularly those in agriculture and manufacturing, are feeling the brunt of these tariffs. Increased costs associated with import tariffs reduce competitiveness in the global market, while export tariffs limit access to key export markets. The automotive and textile industries, for example, are experiencing significant challenges due to these ongoing trade tensions.

-

Uncertainty Hampering Investment and Growth: The continued uncertainty surrounding future tariff policies discourages both domestic and foreign investment in the European Union. This lack of investment directly impacts economic growth and job creation. Businesses hesitate to commit to long-term projects when faced with the potential for sudden shifts in trade policies and associated costs.

-

Mitigating Tariff-Related Risks: European businesses need to proactively implement strategies to minimize the negative impact of tariffs. This includes diversifying supply chains, exploring new export markets, and engaging in lobbying efforts to advocate for favorable trade policies. A thorough understanding of the impact of specific tariffs on their business is crucial for effective risk management.

LVMH's Decline: A Sign of Broader Luxury Market Weakness?

The unexpected decline in LVMH's stock price and financial performance has raised concerns about the health of the broader European luxury goods market. This decline is a significant indicator that warrants careful analysis.

-

LVMH's Financial Performance: A detailed examination of LVMH's recent financial reports reveals a concerning trend of slowing revenue growth and reduced profitability. This underperformance has understandably sparked concerns among investors.

-

Contributing Factors: Several factors likely contribute to LVMH's struggles. These include shifting consumer preferences towards experiences over material goods, increasing geopolitical instability affecting consumer confidence, and the overall economic slowdown impacting luxury spending. The rising cost of raw materials and manufacturing also play a significant role.

-

Impact on the Luxury Goods Market: LVMH's decline serves as a potential harbinger of broader weakness in the luxury sector. The performance of other major luxury brands needs to be monitored closely to gauge the extent of this potential market slowdown.

-

Long-Term Implications: The long-term implications for the European luxury sector depend on several factors, including the resolution of geopolitical uncertainties and the resilience of consumer demand for luxury goods in a changing economic environment. A deeper understanding of evolving consumer behavior is crucial.

Overall European Market Outlook and Investment Strategies

The European market currently faces a complex interplay of factors impacting its overall economic outlook. Navigating this requires a nuanced understanding and a strategic approach to investment.

-

Current State of the European Economy: The European economy exhibits a mixed picture. While some sectors show resilience, others are struggling with the ongoing trade disputes and economic slowdown. Inflation and interest rates also significantly affect the market's performance.

-

Economic Growth Forecasts: Predictions for future economic growth in Europe vary, with many analysts projecting moderate growth but acknowledging significant downside risks associated with ongoing geopolitical uncertainties and potential economic shocks.

-

Investment Opportunities: Despite the challenges, opportunities remain within the European market. Identifying sectors less vulnerable to trade disputes and those with strong growth potential is crucial for successful investments. Focus on sectors demonstrating resilience and adaptation to the current market conditions is recommended.

-

Risk Management and Portfolio Diversification: Given the current uncertainties, robust risk management strategies are paramount. Diversifying investment portfolios across different asset classes and geographical regions is essential to mitigate potential losses. Reducing exposure to specific sectors heavily impacted by tariffs or economic slowdowns is vital.

Conclusion:

This European market update highlights the significant headwinds facing the European economy, from stalled tariff negotiations to the concerning performance of major players like LVMH. These factors underscore the need for careful analysis, strategic planning, and proactive risk management for investors and businesses operating in the European market. The interplay between trade policies, consumer spending, and the overall economic climate necessitates a continuous monitoring of key economic indicators and market trends. Stay informed about the evolving European market landscape to effectively navigate its complexities and capitalize on emerging opportunities. Continue to monitor the European market for crucial updates and adapt your strategies accordingly.

Featured Posts

-

Aex Stijgt Na Trump Uitstel Analyse Van De Marktbewegingen

May 25, 2025

Aex Stijgt Na Trump Uitstel Analyse Van De Marktbewegingen

May 25, 2025 -

Understanding And Interpreting The Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Interpreting The Nav Of Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Trump E I Dazi L Effetto Domino Sulla Moda Europea

May 25, 2025

Trump E I Dazi L Effetto Domino Sulla Moda Europea

May 25, 2025 -

I Dazi Di Trump Come La Moda Italiana E Non Solo Ha Subito Le Conseguenze

May 25, 2025

I Dazi Di Trump Come La Moda Italiana E Non Solo Ha Subito Le Conseguenze

May 25, 2025 -

Casualty Treated After Car Overturns On M56

May 25, 2025

Casualty Treated After Car Overturns On M56

May 25, 2025

Latest Posts

-

Analyzing Wedbushs Apple Prediction Bullish Despite Price Target Decrease

May 25, 2025

Analyzing Wedbushs Apple Prediction Bullish Despite Price Target Decrease

May 25, 2025 -

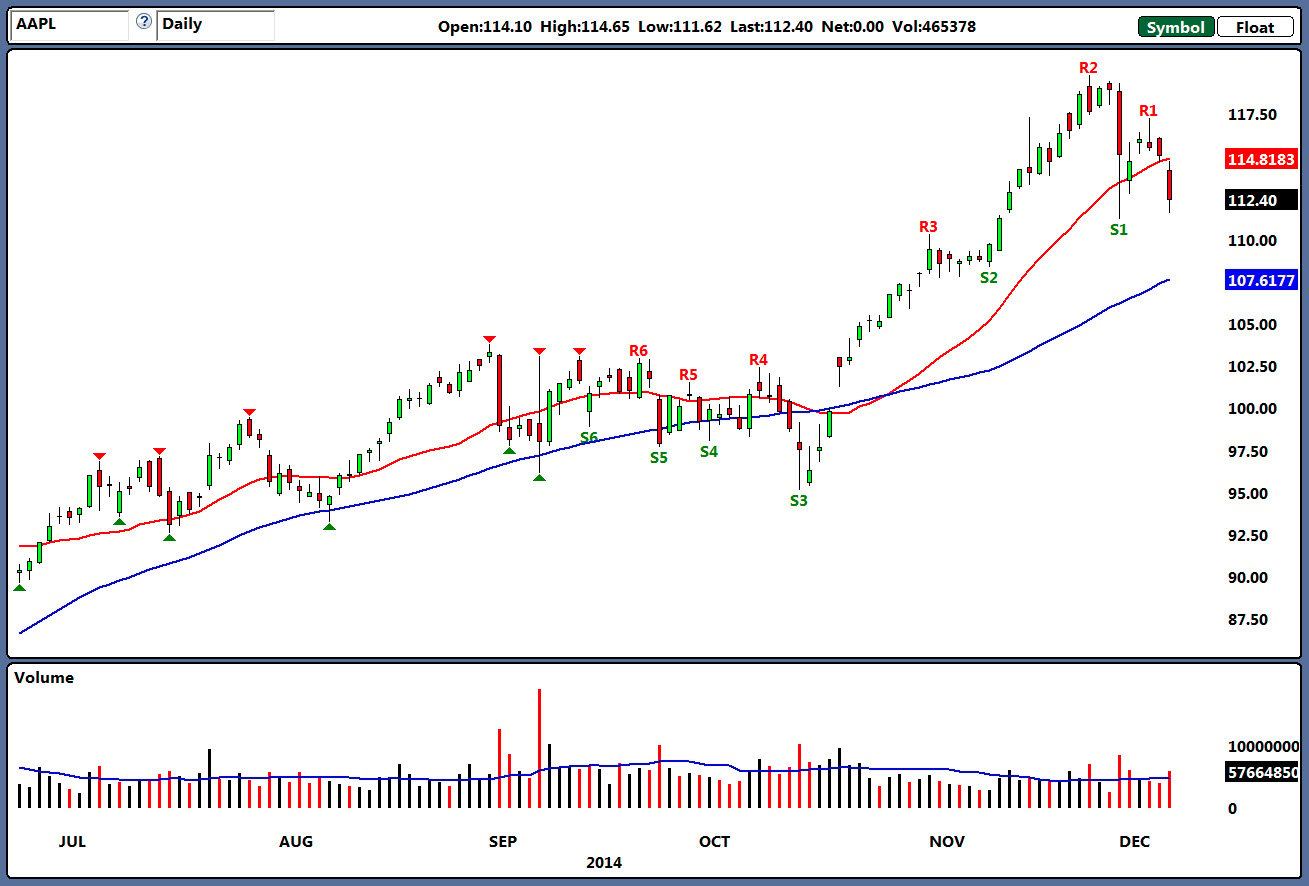

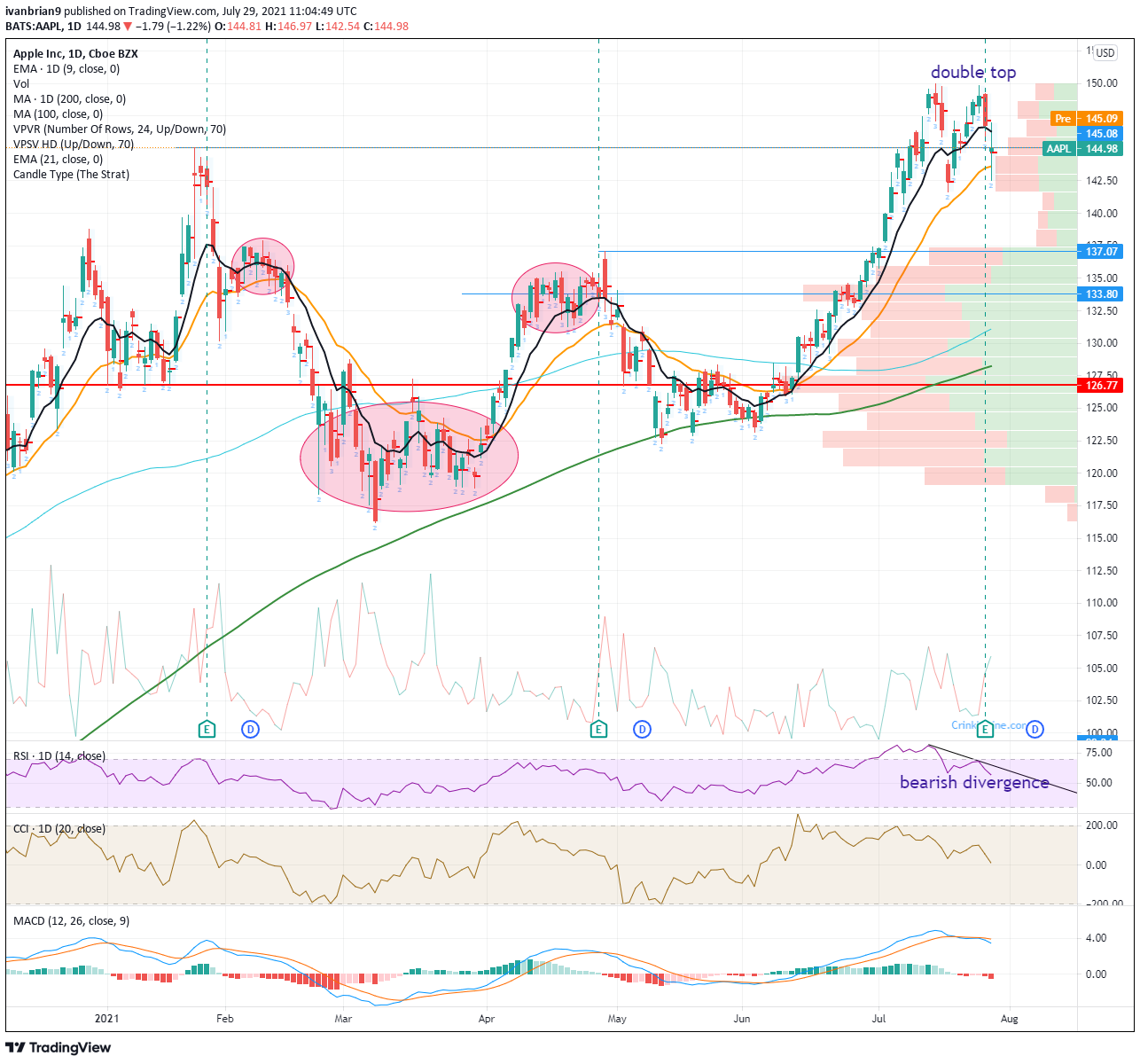

Apple Stock Aapl Price Targets Identifying Crucial Support And Resistance

May 25, 2025

Apple Stock Aapl Price Targets Identifying Crucial Support And Resistance

May 25, 2025 -

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025 -

Where Will Apple Stock Aapl Go Next Key Price Level Projections

May 25, 2025

Where Will Apple Stock Aapl Go Next Key Price Level Projections

May 25, 2025 -

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025