High Stock Valuations: BofA's View And Why Investors Shouldn't Worry

Table of Contents

BofA's Concerns Regarding High Stock Valuations

BofA's market analysis highlights several concerns regarding current high stock valuations. Their key worry centers around elevated price-to-earnings (P/E) ratios, suggesting stocks may be overvalued compared to their earnings potential. This raises the specter of a potential stock market correction. Keywords: BofA market analysis, stock market correction, P/E ratio, valuation metrics.

-

Specific BofA Concerns:

- Reports indicate BofA analysts predict a potential 10-15% market correction based on current P/E ratios.

- Their analysis emphasizes the impact of rising interest rates on future corporate earnings, potentially squeezing valuations.

- They highlight specific sectors, like technology, as particularly vulnerable due to high valuations and potential growth slowdowns.

-

Economic Context: BofA's analysis is framed within the context of rising inflation and increasing interest rates. These factors can significantly impact corporate profitability and investor sentiment, contributing to their cautious outlook.

Why These High Valuations Might Not Be a Cause for Alarm

While BofA's concerns are valid, several factors suggest that high valuations aren't necessarily a reason for immediate alarm. A long-term investment perspective is crucial. Keywords: long-term investment, growth potential, economic growth, market fundamentals.

Strong Corporate Earnings and Future Growth Potential

Many sectors continue to demonstrate robust earnings growth, fueled by innovation and long-term growth drivers.

-

Examples of Strong Sectors:

- The technology sector, despite some recent pullbacks, continues to innovate and expand into new markets (e.g., AI, cloud computing).

- Certain healthcare companies are experiencing strong growth driven by an aging population and advancements in medical technology.

- Renewable energy companies are benefitting from increased government investment and growing consumer demand.

-

Justification for High Valuations: These sectors' strong earnings and growth prospects partially justify their higher valuations, supporting a long-term investment strategy.

Low Interest Rates and Ample Liquidity

Low interest rates and ample liquidity in the financial system continue to support higher stock valuations.

-

Impact of Low Interest Rates: Low borrowing costs encourage companies to invest and expand, boosting earnings and supporting higher stock prices. They also make stocks more attractive relative to bonds.

-

Ample Liquidity: Abundant liquidity in the market provides ample capital for investment, driving up demand for stocks.

-

Short to Medium-Term Support: These factors can sustain higher valuations in the short to medium term, though long-term sustainability depends on other economic variables.

Consideration of Specific Sectors and Individual Stocks

Even within a market characterized by high valuations, some sectors and individual stocks may be undervalued.

- Identifying Undervalued Assets: Careful analysis, focusing on strong fundamentals and growth prospects, can reveal opportunities.

- Example: Companies with strong balance sheets, consistent dividend payouts, and demonstrable growth potential may offer attractive entry points despite broader market valuations.

- Importance of Due Diligence: Thorough research and due diligence are crucial for identifying these hidden gems within the current market landscape.

Strategies for Navigating High Stock Valuations

Navigating high stock valuations requires a well-defined investment strategy. Keywords: diversification, risk management, long-term investment strategy, value investing, growth investing.

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) and sectors reduces overall portfolio risk.

- Risk Management: Understanding and managing your risk tolerance is crucial. Consider your investment horizon and adjust your portfolio accordingly.

- Long-Term Investment Horizon: A long-term perspective helps weather short-term market fluctuations. Focus on the long-term growth potential of your investments.

- Value Investing: Identify undervalued companies with strong fundamentals, aiming for long-term capital appreciation.

- Growth Investing: Invest in companies poised for rapid growth, even if their valuations are initially higher.

Conclusion: High Stock Valuations – A Balanced Perspective and Next Steps

BofA's concerns about high stock valuations are understandable, reflecting legitimate risks. However, strong corporate earnings, low interest rates, and the potential for identifying undervalued assets provide a more nuanced perspective. Long-term investment strategies, diversification, and thorough due diligence are crucial for navigating the current market.

Don't let concerns about high stock valuations paralyze your investment decisions. Instead, use this information to refine your investment strategy and capitalize on market opportunities. Develop a plan that aligns with your risk tolerance and long-term financial goals, considering both the potential risks and rewards associated with high stock valuations. Remember to conduct thorough research and consider seeking professional financial advice before making any investment decisions.

Featured Posts

-

Invest In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025

Invest In Elon Musks Private Ventures A Lucrative Side Hustle

Apr 26, 2025 -

Nepo Babies Dominate Television A Look At Their Success

Apr 26, 2025

Nepo Babies Dominate Television A Look At Their Success

Apr 26, 2025 -

New Tugboat For Turkey Damen And Icdas Joint Venture

Apr 26, 2025

New Tugboat For Turkey Damen And Icdas Joint Venture

Apr 26, 2025 -

King Day 2024 A Survey Reveals Divergent Views On The Holidays Future

Apr 26, 2025

King Day 2024 A Survey Reveals Divergent Views On The Holidays Future

Apr 26, 2025 -

Economic Uncertainty Ceos Cite Trump Tariffs As Major Threat

Apr 26, 2025

Economic Uncertainty Ceos Cite Trump Tariffs As Major Threat

Apr 26, 2025

Latest Posts

-

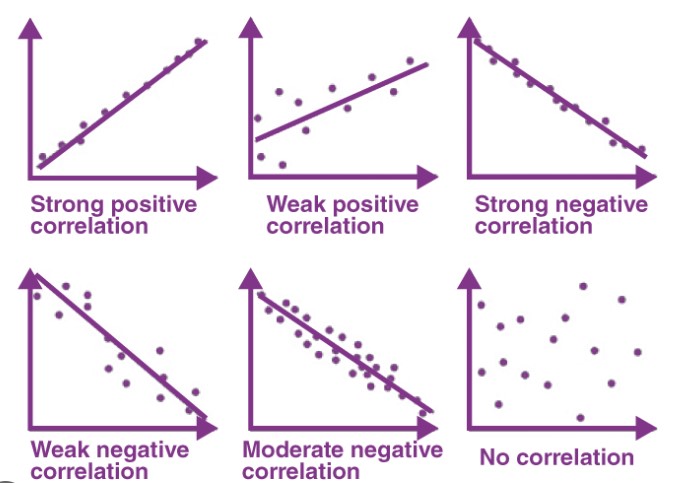

Bundestag Elections And The Dax Understanding The Correlation

Apr 27, 2025

Bundestag Elections And The Dax Understanding The Correlation

Apr 27, 2025 -

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025

The Interplay Between German Politics Bundestag Elections And Dax Fluctuations

Apr 27, 2025 -

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025

Dax Performance The Influence Of German Politics And Economic Data

Apr 27, 2025 -

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025

How Bundestag Elections And Key Business Figures Impact The Dax

Apr 27, 2025 -

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025

Dax Bundestag Elections And Economic Indicators A Comprehensive Analysis

Apr 27, 2025