How Chainalysis' Acquisition Of Alterya Will Shape The Future Of Blockchain

Table of Contents

Enhanced Blockchain Investigation Capabilities

Chainalysis' acquisition of Alterya brings together two industry leaders, dramatically enhancing blockchain investigation capabilities. This merger signifies a significant leap forward in the fight against cryptocurrency-related crime and improves the overall security of the blockchain ecosystem.

Improved Data Analysis and Visualization

Chainalysis already boasts leading blockchain analytics tools, renowned for their ability to track cryptocurrency transactions and identify illicit activities. Alterya's expertise in data integration and visualization will significantly enhance these capabilities. This means:

- Faster and more comprehensive investigations of illicit blockchain activity: Investigators can now analyze vast datasets with unprecedented speed and efficiency, uncovering hidden connections and patterns faster than ever before.

- Improved identification of patterns and trends in cryptocurrency transactions: The enhanced data visualization tools allow for a more intuitive understanding of complex transaction flows, helping to identify emerging trends and predict future criminal activities.

- Enhanced ability to trace funds and uncover complex money laundering schemes: The combination of Chainalysis's existing capabilities and Alterya's technology makes it easier to follow the intricate trails of cryptocurrency transactions involved in money laundering, even across multiple blockchains and jurisdictions.

- More user-friendly interfaces for investigators and compliance professionals: The improved user experience will make complex blockchain data analysis more accessible to a wider range of professionals, regardless of their technical expertise.

Expanded Data Sources and Coverage

Alterya's technology brings access to a wider range of data sources, significantly expanding Chainalysis' investigative reach. This includes:

- Integration with more decentralized exchanges (DEXs) and privacy coins: This expansion will allow for more comprehensive tracking of cryptocurrency transactions, even those conducted through platforms designed to obscure user identities.

- Access to darknet market data and other underground sources: This access will provide crucial insights into the activities of cybercriminals and other illicit actors operating within the dark web.

- Improved ability to track cryptocurrency flows across multiple blockchains: The combined platform will offer a more holistic view of cryptocurrency movements, making it easier to identify and disrupt cross-blockchain criminal activities.

Strengthened Regulatory Compliance

The Chainalysis-Alterya merger has profound implications for regulatory compliance within the cryptocurrency industry. The enhanced capabilities will assist businesses in navigating the complex and ever-evolving regulatory landscape.

Meeting Increasing Regulatory Demands

Governments worldwide are increasingly scrutinizing the use of cryptocurrencies in illicit activities. This acquisition positions Chainalysis to better assist businesses in complying with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations. This includes:

- Improved AML/KYC compliance solutions for cryptocurrency exchanges and businesses: The merged entity will offer more robust and comprehensive solutions to help businesses meet their regulatory obligations.

- Enhanced tools for identifying and reporting suspicious activities: Improved algorithms and data analysis capabilities will help businesses proactively identify and report suspicious transactions.

- Proactive risk management solutions for crypto businesses: The combined platform will provide tools to help businesses assess and mitigate risks associated with cryptocurrency transactions.

Collaboration with Law Enforcement

The enhanced analytical capabilities resulting from the merger will significantly improve collaboration between Chainalysis and law enforcement agencies. This will lead to:

- Streamlined data sharing and investigation processes: Faster and more efficient sharing of critical information will enable law enforcement to act more swiftly and effectively.

- More effective targeting of cybercriminals and illicit actors: Improved data analysis will help law enforcement agencies identify and target criminal networks more accurately.

- Increased success in recovering stolen funds: The enhanced tracing capabilities will greatly assist in recovering assets stolen through cryptocurrency-related crimes.

Impact on Cryptocurrency Adoption

The Chainalysis-Alterya merger is not just about combating crime; it also has the potential to positively influence the adoption of cryptocurrencies.

Increased Transparency and Trust

Improved blockchain analysis tools will lead to increased transparency within the cryptocurrency ecosystem, fostering greater trust among users and investors. This will lead to:

- Reduced risk of fraud and scams: Enhanced analysis capabilities will make it more difficult for fraudsters and scammers to operate within the cryptocurrency space.

- Greater confidence for institutional investors: The increased transparency and regulatory compliance will encourage institutional investors to enter the market.

- Enhanced security for cryptocurrency users: Improved analysis tools will help users identify and mitigate security risks associated with their cryptocurrency holdings.

Facilitating Institutional Investment

The merger will significantly improve the ability of businesses to meet regulatory requirements, paving the way for increased institutional investment in cryptocurrencies. This will result in:

- Improved risk assessment capabilities for institutional investors: The enhanced analytical tools will enable investors to better assess and manage the risks associated with cryptocurrency investments.

- Increased confidence in the security and regulatory compliance of cryptocurrency investments: Improved compliance capabilities will ease concerns regarding regulatory scrutiny and security breaches.

- Greater integration of cryptocurrencies into traditional financial markets: The improved compliance and transparency will accelerate the integration of cryptocurrencies into the mainstream financial system.

Conclusion

Chainalysis' acquisition of Alterya represents a significant step forward for blockchain analytics and compliance. The combined capabilities of these two companies promise to enhance investigations, strengthen regulatory compliance, and ultimately shape a more secure and transparent cryptocurrency ecosystem. This merger will undoubtedly impact the future trajectory of blockchain technology and its widespread adoption. Learn more about the implications of Chainalysis' Acquisition of Alterya and its effects on the blockchain industry by exploring further resources and staying updated on industry developments.

Featured Posts

-

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025 -

Exclusive University Group Defies Trump Administration Policies

Apr 29, 2025

Exclusive University Group Defies Trump Administration Policies

Apr 29, 2025 -

Lynas Rare Earths Seeks Us Funding For Texas Refinery Amid Rising Costs

Apr 29, 2025

Lynas Rare Earths Seeks Us Funding For Texas Refinery Amid Rising Costs

Apr 29, 2025 -

Mlb Game Recap Twins 6 Mets 3

Apr 29, 2025

Mlb Game Recap Twins 6 Mets 3

Apr 29, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires A Growing Concern

Apr 29, 2025

The Ethics Of Betting On The Los Angeles Wildfires A Growing Concern

Apr 29, 2025

Latest Posts

-

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025

Exploring The Countrys Fastest Growing Business Regions

Apr 29, 2025 -

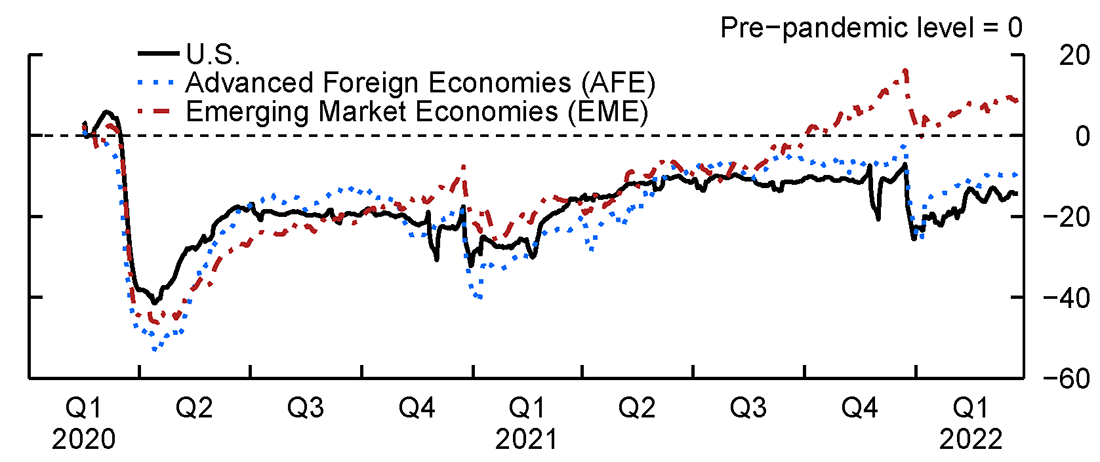

Ecb Report Post Pandemic Fiscal Policies Contribute To Inflation

Apr 29, 2025

Ecb Report Post Pandemic Fiscal Policies Contribute To Inflation

Apr 29, 2025 -

Inflation Persists Ecb Attributes High Prices To Pandemic Relief Spending

Apr 29, 2025

Inflation Persists Ecb Attributes High Prices To Pandemic Relief Spending

Apr 29, 2025 -

A Data Driven Look At The Countrys Newest Business Hotspots

Apr 29, 2025

A Data Driven Look At The Countrys Newest Business Hotspots

Apr 29, 2025 -

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025

Post April 8th Treasury Market Analysis Findings And Forecasts

Apr 29, 2025