Is The Derivatives Market Hindering XRP's Price Rise?

Table of Contents

We will delve into the intricacies of XRP's price fluctuations, the mechanics of cryptocurrency derivatives, and analyze evidence suggesting a potential correlation between derivative trading activity and XRP's price performance. Ultimately, we aim to present a balanced perspective on this complex issue.

Understanding XRP and its Price Volatility

XRP, the native cryptocurrency of Ripple, is designed to facilitate fast and low-cost international money transfers. Its underlying technology, the Ripple protocol, uses a distributed ledger to enable seamless transactions between financial institutions. However, XRP's price remains notoriously volatile.

Several factors contribute to XRP's price volatility:

- Supply and Demand: Like any asset, XRP's price is influenced by the interplay of supply and demand. Increased buying pressure leads to price increases, while selling pressure pushes prices down.

- Regulatory Announcements: News and announcements concerning Ripple and its legal battles, particularly those related to securities regulations, significantly impact investor sentiment and XRP's price.

- Market Sentiment: General market sentiment towards cryptocurrencies and XRP specifically plays a crucial role. Positive news and adoption lead to price increases, while negative news or market downturns can trigger price drops.

- Adoption Rate: Widespread adoption by financial institutions and businesses is crucial for XRP's long-term price appreciation. Increased usage translates to higher demand and potentially higher prices.

- Speculation: Speculative trading significantly contributes to XRP's volatility. Traders often buy or sell based on short-term price predictions, amplifying price swings.

XRP's price history is marked by significant fluctuations. For example:

- [Insert date and event]: [Describe a significant event and its impact on XRP price]

- [Insert date and event]: [Describe a significant event and its impact on XRP price]

- [Insert date and event]: [Describe a significant event and its impact on XRP price]

These fluctuations highlight the speculative nature of the XRP market and the influence of external factors on its price. Understanding these factors is vital to assessing the potential impact of the derivatives market. Keywords: XRP price, XRP volatility, XRP price prediction, XRP market cap, Ripple, XRP adoption

The Role of Derivatives Markets in Crypto

Derivatives are financial contracts whose value is derived from an underlying asset. In the crypto world, these derivatives include futures, options, and swaps, all based on cryptocurrencies like XRP. These instruments allow traders to speculate on future price movements without directly owning the underlying asset.

Derivatives trading allows for leveraged positions, meaning traders can control a larger amount of XRP than their actual investment allows. This magnifies potential profits but also significantly increases the risk of substantial losses.

Short selling is a key aspect of derivatives trading. Traders can profit from a decline in XRP's price by borrowing XRP, selling it at the current price, and hoping to buy it back later at a lower price to return it, pocketing the difference. This mechanism can exert downward pressure on the price of XRP.

Here's a simplified look at shorting XRP using derivatives:

- Borrow XRP from a lender.

- Sell the borrowed XRP at the current market price.

- If the price falls, buy XRP back at the lower price.

- Return the borrowed XRP and keep the difference as profit.

Keywords: Crypto derivatives, XRP derivatives, Bitcoin derivatives, cryptocurrency futures, options trading, leverage trading, short selling XRP

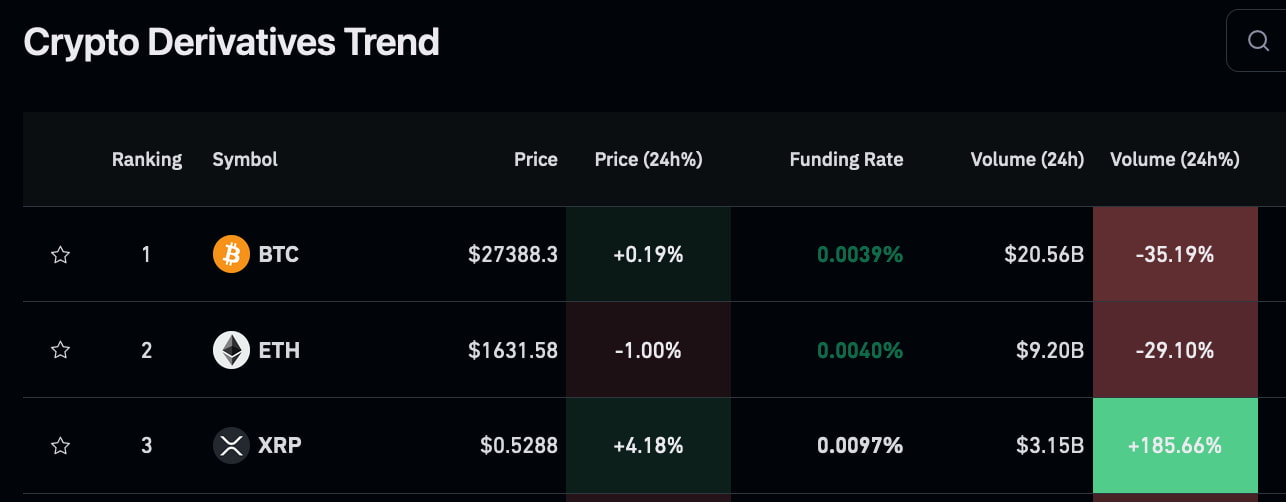

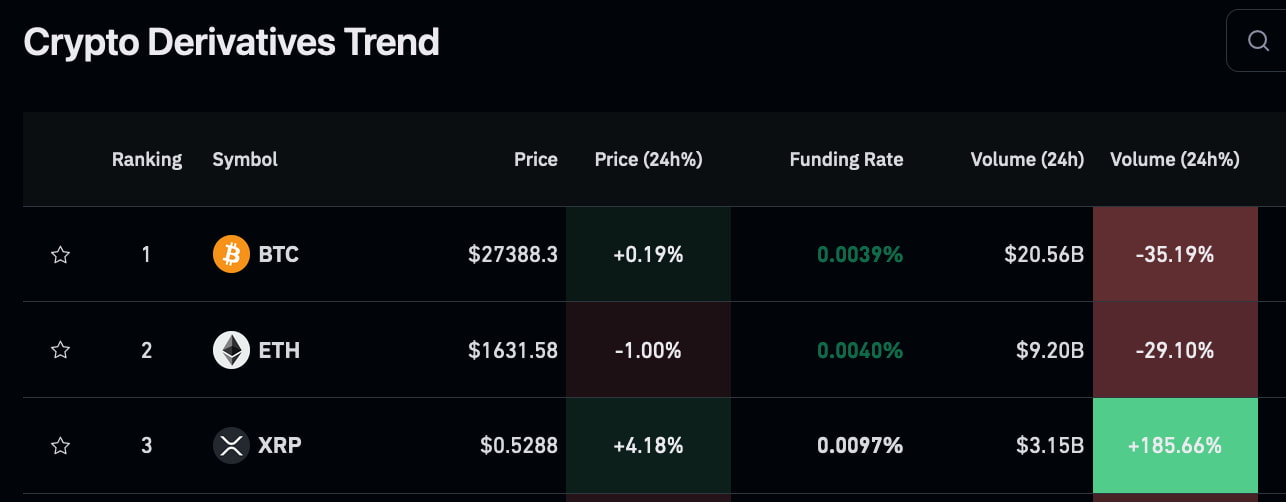

Evidence of Derivatives Impact on XRP Price

Analyzing the correlation between XRP derivatives trading volume and price movements requires careful examination of historical data. While definitive proof of causation is difficult to establish, patterns suggest a potential link.

[Include charts and graphs showing correlations, if available. Alternatively, describe observed correlations in detail. For instance:]

- Periods of high XRP derivatives trading volume have sometimes coincided with subsequent price drops.

- Large institutional investors using derivatives might be able to exert significant influence on XRP's short-term price movements. Their actions could amplify downward pressure.

Further research is needed to ascertain the degree of impact. However, existing anecdotal evidence and market observations suggest a potential correlation between increased derivatives trading and price suppression in some instances. Keywords: XRP price correlation, derivatives market analysis, XRP trading volume, institutional investors XRP, XRP market manipulation

Alternative Factors Affecting XRP Price

While the derivatives market might play a role in XRP's price fluctuations, it's crucial to acknowledge other significant factors influencing its value:

- Regulatory Uncertainty: The ongoing legal battles between Ripple and the SEC regarding XRP's classification as a security create significant uncertainty for investors, affecting XRP's price.

- Ripple Lawsuit: The outcome of the SEC vs. Ripple case will heavily influence investor sentiment and XRP's future price. A positive outcome for Ripple could lead to substantial price increases.

- Broader Market Trends: The overall cryptocurrency market sentiment and Bitcoin's price movements significantly impact XRP's price. Positive trends in the broader market often boost XRP's value, while negative trends can cause declines.

These factors, independent of the derivatives market, significantly impact XRP's price performance. Keywords: Ripple lawsuit, SEC vs Ripple, regulatory uncertainty XRP, Bitcoin price correlation, crypto market sentiment

Conclusion: The Derivatives Market and XRP's Future

This article explored the potential influence of the derivatives market on XRP's price. While establishing a direct causal relationship requires further in-depth analysis, the evidence suggests a potential correlation between high derivatives trading volume and instances of XRP price decline. However, it's crucial to acknowledge the role of other influential factors, such as regulatory uncertainty and broader market trends.

The interplay between these factors creates a complex picture, highlighting the need for ongoing research and careful analysis. The derivatives market presents both opportunities and risks for XRP. While it can provide liquidity and facilitate price discovery, it also carries the potential for price manipulation and amplified volatility.

To form your own informed opinion, continue researching the XRP price and the derivatives market. Further investigation into the correlation between XRP derivatives trading and price movements is crucial for a comprehensive understanding of this dynamic cryptocurrency.

Featured Posts

-

Hollywood Production At Standstill Joint Actors And Writers Strike

May 07, 2025

Hollywood Production At Standstill Joint Actors And Writers Strike

May 07, 2025 -

Nhl Potvrdzuje Svetovy Pohar Hokeja Pre Rok 2028

May 07, 2025

Nhl Potvrdzuje Svetovy Pohar Hokeja Pre Rok 2028

May 07, 2025 -

Restaurant Shooting In Arizona Updates And Details

May 07, 2025

Restaurant Shooting In Arizona Updates And Details

May 07, 2025 -

The Karate Kid A Legacy Of Martial Arts And Life Lessons

May 07, 2025

The Karate Kid A Legacy Of Martial Arts And Life Lessons

May 07, 2025 -

Bitcoin Nears 100 000 Breaking 10 Week High

May 07, 2025

Bitcoin Nears 100 000 Breaking 10 Week High

May 07, 2025

Latest Posts

-

Xrp Price Soars Outperforming Bitcoin Post Sec Grayscale Etf Filing Recognition

May 08, 2025

Xrp Price Soars Outperforming Bitcoin Post Sec Grayscale Etf Filing Recognition

May 08, 2025 -

Xrp News Sec Commodity Classification And Regulatory Uncertainty

May 08, 2025

Xrp News Sec Commodity Classification And Regulatory Uncertainty

May 08, 2025 -

Grayscales Xrp Etf Filing Xrp Price Surge And Implications For The Crypto Market

May 08, 2025

Grayscales Xrp Etf Filing Xrp Price Surge And Implications For The Crypto Market

May 08, 2025 -

Wednesday April 9th Lotto Results Jackpot Numbers Revealed

May 08, 2025

Wednesday April 9th Lotto Results Jackpot Numbers Revealed

May 08, 2025 -

Sec Acknowledges Grayscale Xrp Etf Filing Impact On Xrp And Bitcoin Prices

May 08, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Impact On Xrp And Bitcoin Prices

May 08, 2025