Reliance Industries Earnings Surprise: Implications For Indian Equities

Table of Contents

Reliance Industries' Q[Quarter] Earnings Performance

Key Financial Highlights

Reliance Industries' Q[Quarter] earnings showcased a [positive/negative] surprise, significantly deviating from analyst expectations. Let's look at the key figures:

- Revenue: [Insert Revenue Figure] – representing a [percentage]% [increase/decrease] compared to the previous quarter and a [percentage]% [increase/decrease] compared to analyst estimates.

- Profit: [Insert Profit Figure] – showing a [percentage]% [increase/decrease] year-on-year and a [percentage]% [beat/miss] of analyst forecasts.

- Key Performance Indicators (KPIs): [Mention specific KPIs like EBITDA margins, Debt-to-Equity ratio, etc. and their percentage changes].

The refining and petrochemicals segments demonstrated [growth/decline], while the telecom sector (Jio) experienced [growth/decline] in [mention specific metrics like subscriber base or ARPU]. These Reliance Industries results clearly highlight the company's performance across various sectors. The Q[Quarter] earnings provide valuable insights into the company's financial performance and KPI trends. Strong revenue growth and improved profitability were key factors impacting the overall results.

Drivers of Earnings Surprise

The earnings drivers behind this Reliance Industries results surprise are multifaceted.

- Market Conditions: Favorable global commodity prices significantly boosted profits in the refining and petrochemicals sectors.

- Operational Efficiency: Internal cost-cutting measures and improved operational efficiency contributed to higher profitability.

- Strategic Initiatives: Successful implementation of new strategic initiatives in [mention specific initiatives] led to revenue growth and market share gains.

- Unexpected Events: [Mention any unforeseen events, like changes in government policies or unexpected partnerships, that positively or negatively impacted the results].

Analyzing these factors provides a holistic understanding of the Reliance Industries results and their impact. Understanding the interplay between market conditions, operational efficiency, strategic initiatives, and unexpected events is key to predicting future performance.

Impact on Reliance Industries Stock Price

Immediate Market Reaction

The immediate market reaction to the Reliance Industries results was [positive/negative]. The stock price experienced a [percentage]% [increase/decrease] immediately following the announcement, with unusually high trading volume indicating strong investor interest. This stock price movement reflects the market’s assessment of the Q[Quarter] earnings. The level of market volatility also indicates the significance of the event.

Long-Term Outlook

The long-term outlook for Reliance Industries' stock price is [positive/negative], depending on several factors. While the current Q[Quarter] earnings are positive, the company faces potential challenges such as [mention challenges like competition, regulatory changes, or global economic slowdown]. However, the strong financial performance reported could lead to a higher stock valuation and attract long-term investment. The future growth prospects remain promising, subject to these market dynamics influencing the overall investment outlook.

Broader Implications for Indian Equities

Sectoral Impact

The ripple effects of the Reliance Industries results are felt across various sectors in the Indian market. The energy sector, in particular, experienced [positive/negative] changes due to its close correlation with Reliance's performance. Similarly, the telecom and retail sectors also saw a [positive/negative] impact due to [explain the reason]. This sectoral performance demonstrates the close market correlation between Reliance Industries and related sectors, resulting in an impact on the overall index impact.

Overall Market Sentiment

Investor sentiment following the Reliance Industries earnings release is generally [positive/negative]. This impacts overall market confidence and potentially influences foreign investment flows into India. The positive or negative nature of the market outlook will likely depend on how the market interprets the Reliance Industries results and their long-term consequences.

Conclusion: Reliance Industries Earnings Surprise: Implications for Indian Equities

In conclusion, the Reliance Industries earnings surprise has significant implications for the Indian equity market. The strong Q[Quarter] earnings demonstrate the company's resilience and strategic success across various sectors, but challenges remain. The impact on the stock price, along with its ripple effect across related sectors and overall investor sentiment, necessitates a careful evaluation of investment strategies. To stay informed about Reliance Industries' future earnings reports and their implications for your investments, continue following our updates. Analyze Reliance Industries' future performance and understand the implications of Reliance Industries’ performance on your investment strategy.

Featured Posts

-

Do Film Tax Credits Work A Minnesota Case Study

Apr 29, 2025

Do Film Tax Credits Work A Minnesota Case Study

Apr 29, 2025 -

Minnesota Faces Federal Pressure Over Trumps Transgender Athlete Ban

Apr 29, 2025

Minnesota Faces Federal Pressure Over Trumps Transgender Athlete Ban

Apr 29, 2025 -

Trumps Transgender Athlete Ban Minnesotas Response Demanded

Apr 29, 2025

Trumps Transgender Athlete Ban Minnesotas Response Demanded

Apr 29, 2025 -

Mlb 160km

Apr 29, 2025

Mlb 160km

Apr 29, 2025 -

The Russian Militarys Actions A Growing Threat To Europe

Apr 29, 2025

The Russian Militarys Actions A Growing Threat To Europe

Apr 29, 2025

Latest Posts

-

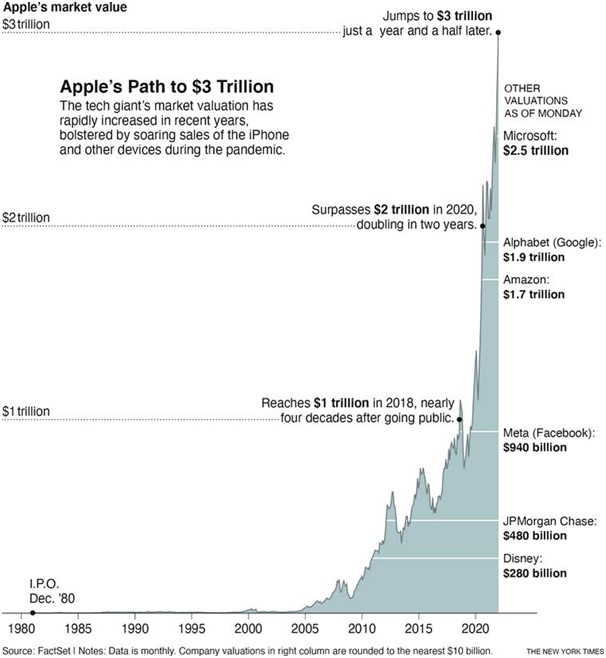

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025 -

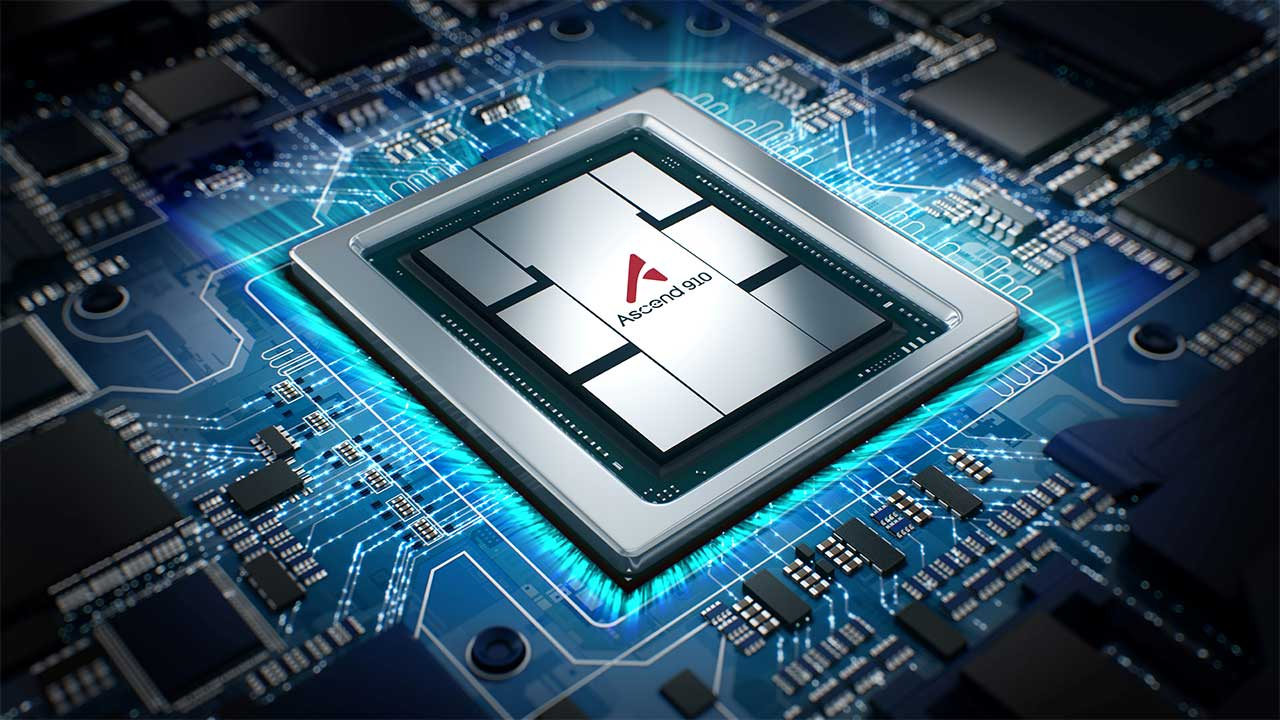

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025

Exclusive Ai Chip Development Huawei Takes On Nvidia

Apr 29, 2025 -

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025

Russias Military Buildup Keeping Europe On High Alert

Apr 29, 2025 -

Market Crash Seven Leading Stocks Shed 2 5 Trillion In Value

Apr 29, 2025

Market Crash Seven Leading Stocks Shed 2 5 Trillion In Value

Apr 29, 2025 -

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Aiming For Nvidia Parity

Apr 29, 2025