Ripple (XRP) Price Movement: Assessing The Path To $3.40

Table of Contents

Current Market Conditions and XRP's Position

Analyzing the current Ripple (XRP) price requires examining its position within the broader cryptocurrency market. Its market capitalization and trading volume provide crucial context. Currently, XRP holds a significant position among altcoins, though its dominance fluctuates. Comparing XRP's performance against Bitcoin (BTC) and Ethereum (ETH) reveals its relative strength and vulnerability to overall market trends.

- Current XRP price and its recent volatility: As of [Insert Current Date], the XRP price is [Insert Current Price]. Recent volatility has been [Describe recent price swings - high, low, stable, etc.], influenced by factors discussed below.

- Key factors driving the current market sentiment towards XRP: Positive news, such as new partnerships or regulatory developments, tends to increase investor confidence and push the Ripple (XRP) price upwards. Conversely, negative news or market downturns can lead to price drops.

- Comparison of XRP's market share with competitors: XRP competes with other cryptocurrencies offering similar functionalities. Its market share relative to these competitors reflects investor preference and the perceived value proposition of XRP versus alternatives. This directly impacts the potential for price appreciation.

These factors collectively influence the potential for a significant Ripple (XRP) price increase. A strong market, positive sentiment, and a growing market share all contribute to a more optimistic outlook for XRP's future price.

The Impact of Ripple's Legal Battle with the SEC

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) significantly impacts the Ripple (XRP) price. The SEC's classification of XRP as a security has created uncertainty and affected investor confidence. The outcome of this lawsuit is a major factor influencing XRP's price trajectory.

- Positive developments in the Ripple vs. SEC case: Favorable court rulings or settlements could dramatically boost investor confidence, leading to a potential surge in the Ripple (XRP) price.

- Negative potential outcomes and their impact on XRP's price: An unfavorable ruling could further depress the XRP price, as it might solidify the perception of XRP as a security and limit its accessibility.

- The influence of legal uncertainty on investor sentiment: The ongoing uncertainty surrounding the case keeps many investors hesitant, limiting price growth until clarity is achieved.

A positive resolution is crucial for a significant price increase. A clear "win" for Ripple could remove a major barrier to broader adoption and unlock substantial price appreciation, potentially fueling a move towards $3.40.

Technological Advancements and Adoption Rate

Ripple's technology, primarily its use within RippleNet for cross-border payments, is a key driver of its value proposition. The wider adoption of RippleNet and its integration with financial institutions directly influences the demand and therefore the Ripple (XRP) price.

- New partnerships and integrations driving Ripple adoption: New partnerships with banks and financial institutions expand RippleNet's reach and demonstrate the practical application of XRP's technology.

- The role of XRP in facilitating faster and cheaper international payments: XRP's efficiency in facilitating quicker and cheaper cross-border transactions is a significant selling point for financial institutions.

- Potential for wider institutional adoption of XRP: Increased institutional adoption, particularly among large banks, is crucial for a significant rise in the Ripple (XRP) price. This legitimacy significantly influences market perception and price.

Increased adoption, driven by technological advancements and strategic partnerships, can significantly boost the Ripple (XRP) price, paving the way for a potential surge to $3.40.

Predictive Modeling and Technical Analysis

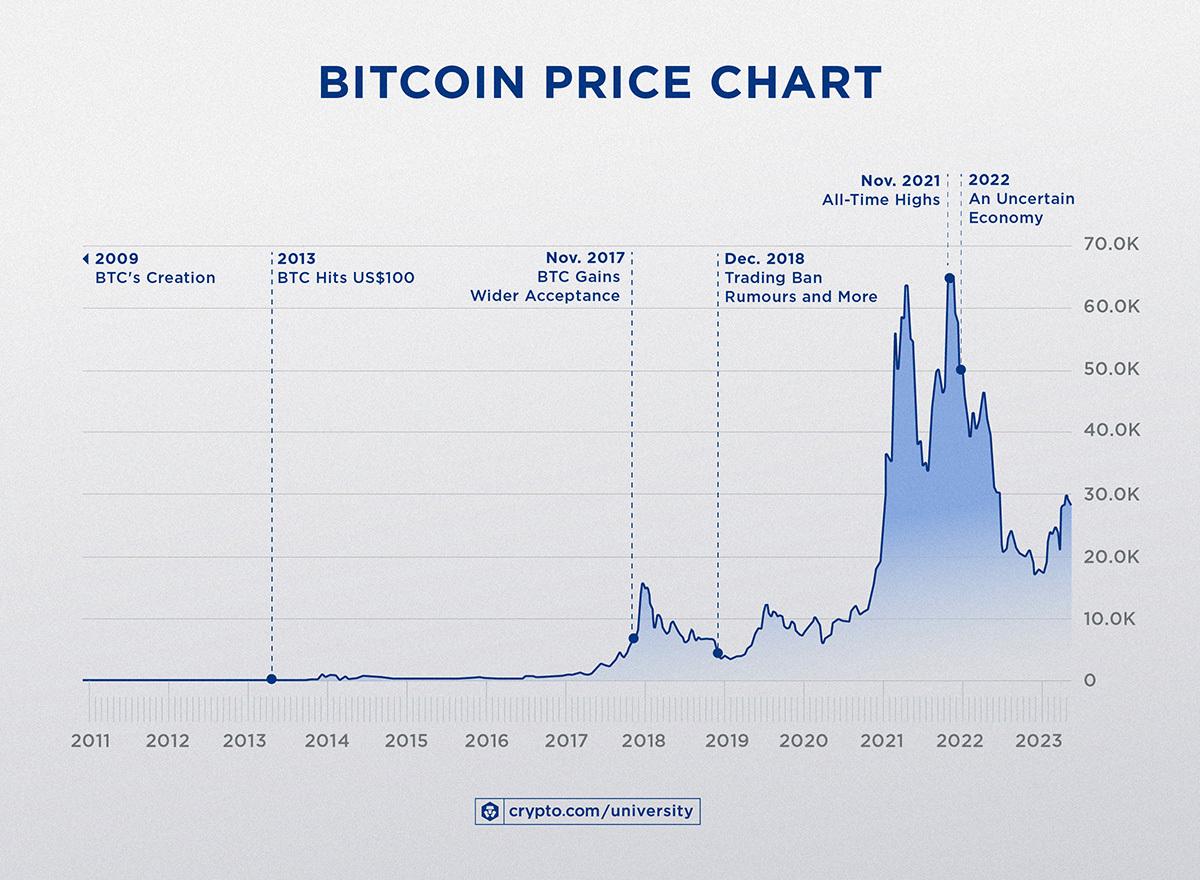

While predicting future prices is inherently speculative, technical analysis can offer valuable insights into potential price movements. Analyzing historical XRP price charts using indicators like moving averages, RSI, and MACD can provide clues about potential support and resistance levels.

- Key technical indicators suggesting potential price increase: Bullish signals from these indicators can suggest a positive outlook for the Ripple (XRP) price.

- Analysis of historical price charts to identify trends: Studying historical price trends can help identify potential patterns and forecast future price movements, though past performance is not indicative of future results.

- Limitations of technical analysis in predicting future prices: Technical analysis is not a foolproof prediction tool. External factors and market sentiment can significantly influence price movements beyond the scope of technical analysis.

Based on technical analysis and considering the aforementioned factors, the probability of reaching $3.40 remains [Optimistic, Pessimistic, or Neutral Assessment]. A confluence of positive factors is required for such a significant price increase.

Conclusion

Reaching a Ripple (XRP) price of $3.40 presents both significant challenges and opportunities. The outcome of the SEC lawsuit, the rate of technological adoption, and broader market conditions all play crucial roles. While technical analysis provides some predictive value, it's vital to acknowledge its limitations. Market volatility is a significant factor, and substantial price swings are possible.

While reaching $3.40 may present challenges, understanding the factors influencing the Ripple (XRP) price is crucial for informed investment decisions. Continue researching the Ripple (XRP) price and stay updated on the latest developments to make well-informed choices in this dynamic market. Remember to always conduct your own thorough due diligence before investing in any cryptocurrency, including Ripple (XRP).

Featured Posts

-

Wnba Preseason Showdown Aces And Wings Face Off At Notre Dame

May 07, 2025

Wnba Preseason Showdown Aces And Wings Face Off At Notre Dame

May 07, 2025 -

Bitcoins 10 Week High Broken Could 100 000 Be Next

May 07, 2025

Bitcoins 10 Week High Broken Could 100 000 Be Next

May 07, 2025 -

Svitske Zhittya Rianni Novi Foto V Shirokikh Dzhinsakh Ta Z Dorogimi Prikrasami

May 07, 2025

Svitske Zhittya Rianni Novi Foto V Shirokikh Dzhinsakh Ta Z Dorogimi Prikrasami

May 07, 2025 -

Hollywood Production At Standstill Joint Actors And Writers Strike

May 07, 2025

Hollywood Production At Standstill Joint Actors And Writers Strike

May 07, 2025 -

Exclusive New Terms For Federal Oversight Of Columbia University Unveiled By Trump Administration

May 07, 2025

Exclusive New Terms For Federal Oversight Of Columbia University Unveiled By Trump Administration

May 07, 2025

Latest Posts

-

The Xrp Market Recovery Hopes And Derivatives Market Challenges

May 08, 2025

The Xrp Market Recovery Hopes And Derivatives Market Challenges

May 08, 2025 -

Xrp Price Action Analyzing The Impact Of The Derivatives Market

May 08, 2025

Xrp Price Action Analyzing The Impact Of The Derivatives Market

May 08, 2025 -

Is Xrps Recovery Stalled By Derivatives Trading

May 08, 2025

Is Xrps Recovery Stalled By Derivatives Trading

May 08, 2025 -

The Future Of Xrp Analyzing The Impact Of Sec Decisions And Etf Listings

May 08, 2025

The Future Of Xrp Analyzing The Impact Of Sec Decisions And Etf Listings

May 08, 2025 -

Trumps Xrp Backing A Catalyst For Institutional Investment

May 08, 2025

Trumps Xrp Backing A Catalyst For Institutional Investment

May 08, 2025