SEC Acknowledges Grayscale XRP ETF Filing: XRP Price Outperforms Bitcoin And Other Cryptos

Table of Contents

Grayscale's XRP ETF Filing: A Game Changer?

The Significance of SEC Acknowledgement

The SEC's acknowledgement of Grayscale's XRP ETF application is a monumental step. It signifies that the SEC is actively considering the application, moving it forward in the regulatory approval process. This is a stark contrast to previous instances where applications were either immediately rejected or met with prolonged silence. Historically, ETF approvals have been notoriously difficult to obtain, with many applications facing significant hurdles. This acknowledgement, however, suggests a potential shift in the SEC's stance towards XRP and the broader crypto market. The implications are huge: successful approval could significantly boost XRP's legitimacy, accelerating its adoption by institutional investors and potentially driving mainstream acceptance. Keywords: SEC approval, ETF application, regulatory approval, XRP adoption.

- Increased Regulatory Clarity: The process itself brings clarity to the regulatory landscape surrounding XRP.

- Boost in Institutional Investment: Approval could unlock significant institutional investment previously hesitant due to regulatory uncertainty.

- Enhanced Market Liquidity: An ETF listing would increase XRP's liquidity, making it easier to buy and sell.

Grayscale's Strategy and Market Positioning

Grayscale's move to file for an XRP ETF is a strategic maneuver reflecting their confidence in XRP's long-term prospects and their expertise in navigating the complex regulatory landscape. Grayscale, a prominent player in the digital asset management space, has a proven track record of successfully launching other crypto ETFs. Their influence and reputation within the crypto industry are significant factors contributing to the positive market sentiment surrounding this filing. A successful XRP ETF launch by Grayscale could reshape the entire ETF market, potentially attracting a significant influx of investment into XRP and the broader cryptocurrency space. Keywords: Grayscale Investments, market influence, investment strategy, ETF market.

- Diversification Strategy: The XRP ETF diversifies Grayscale's portfolio and offers investors exposure to a fast-growing segment of the crypto market.

- First-Mover Advantage: Securing approval first could give Grayscale a significant competitive advantage.

- Market Signaling: The filing acts as a signal of confidence in XRP's future, influencing investor sentiment.

XRP's Technical Analysis: Price Performance and Market Sentiment

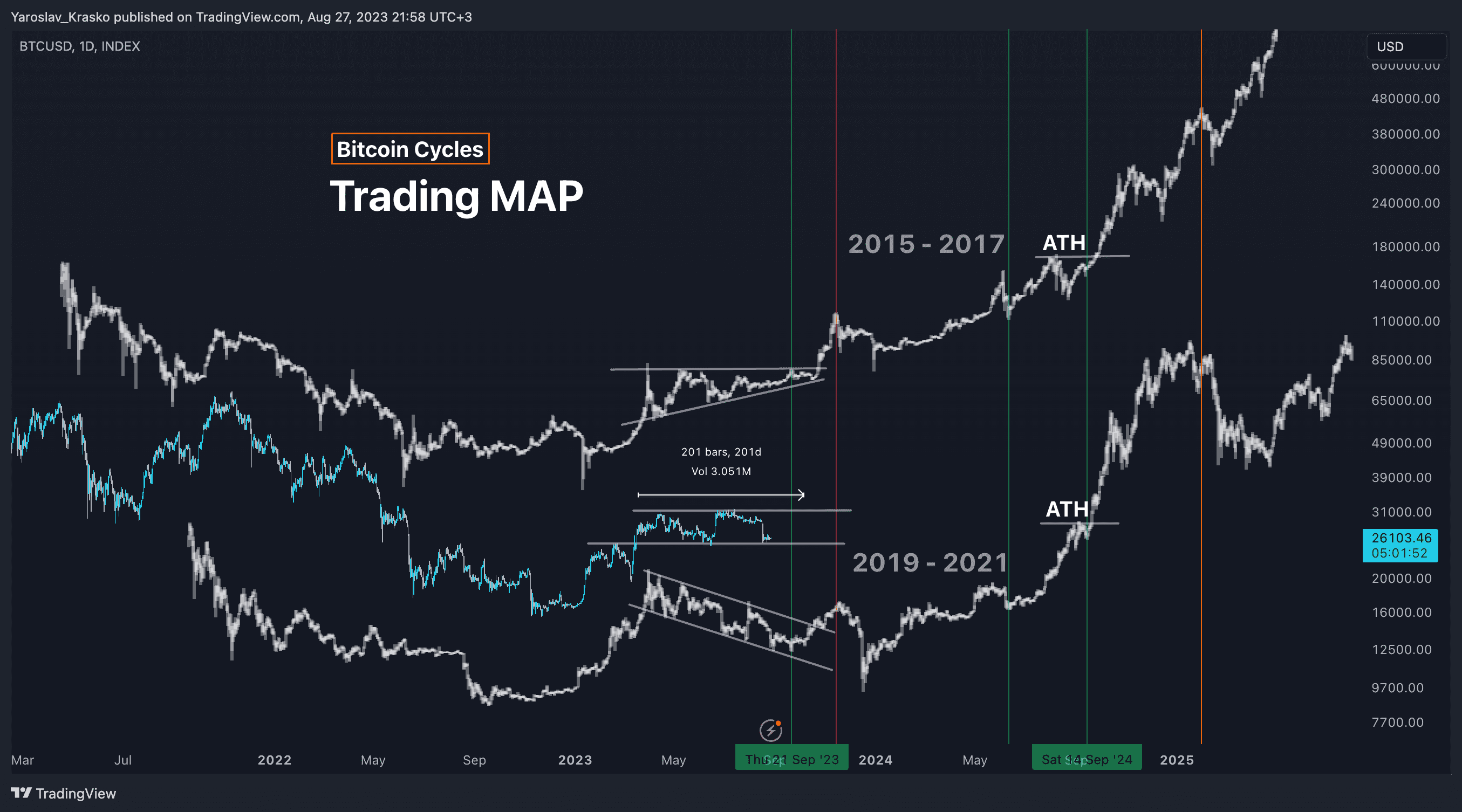

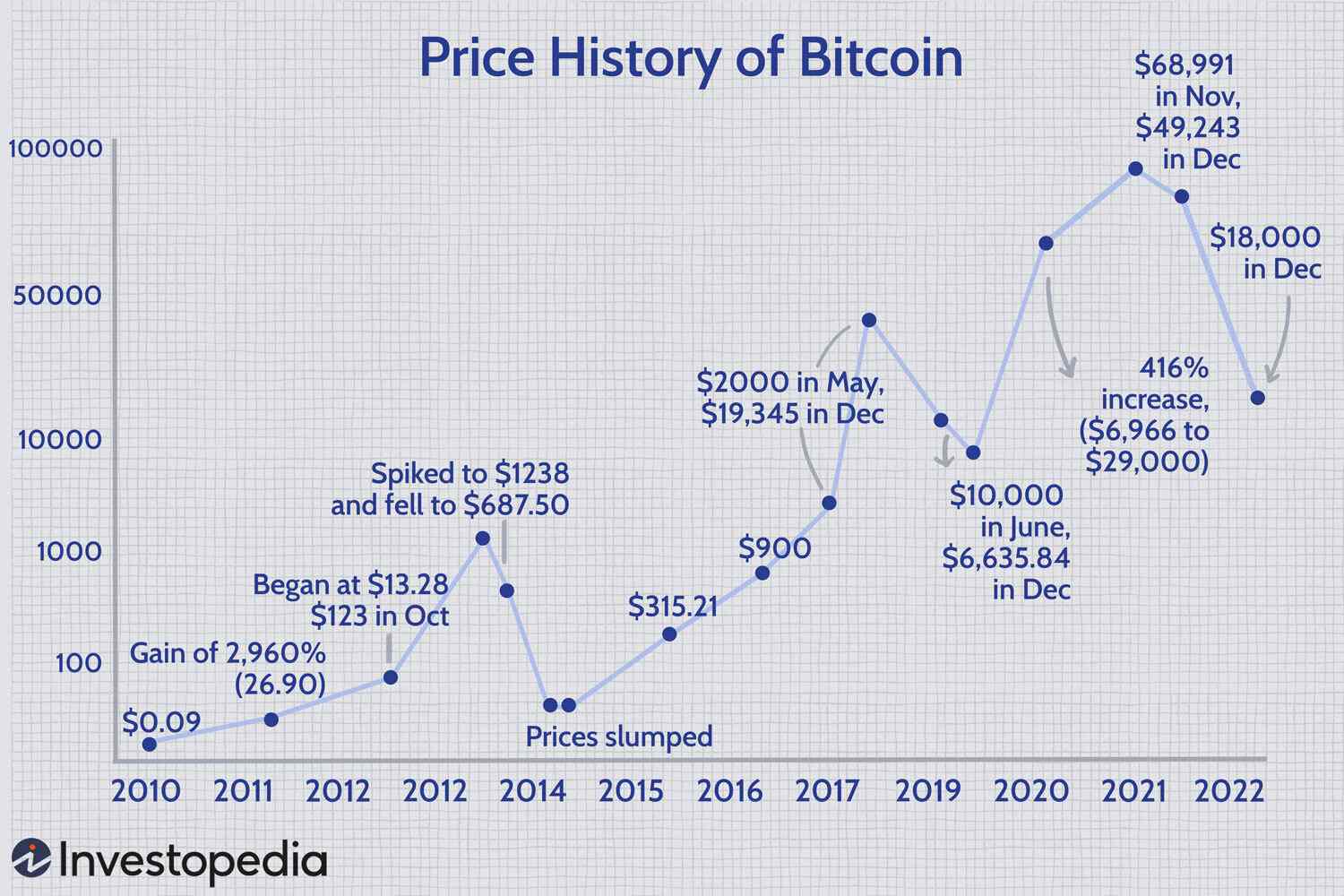

Following the SEC's acknowledgment, XRP's price experienced a significant surge. [Insert Chart/Graph showing XRP price performance compared to Bitcoin and other major cryptocurrencies]. This upward trajectory reflects a positive market sentiment fueled by the potential for regulatory approval and the increased institutional interest. Technical analysis suggests a strong bullish trend, with indicators pointing towards further potential price appreciation. However, it's crucial to remember that the crypto market is inherently volatile, and price movements can be influenced by various unpredictable factors. Keywords: XRP price chart, technical analysis, market sentiment, crypto trading.

- Volume Increase: Increased trading volume further reinforces the positive market sentiment.

- Support Levels: Key support levels indicate strong buying pressure.

- Resistance Levels: Overcoming resistance levels will be crucial for sustained upward momentum.

XRP Price Outperformance: Factors Contributing to the Rise

Beyond the ETF Filing: Other Contributing Factors

While the SEC acknowledgement is a primary driver, other factors contribute to XRP's remarkable price increase. Positive developments within the Ripple ecosystem, such as new partnerships and technological advancements, play a significant role. Furthermore, broader positive trends within the cryptocurrency market, including increased institutional adoption and growing interest from retail investors, also fuel XRP's price appreciation. The interplay between these factors and the ETF filing creates a synergistic effect, amplifying the overall positive impact. Keywords: Ripple ecosystem, XRP partnerships, crypto market trends, price drivers.

- Ripple's Ongoing Legal Battle: A positive resolution to the SEC lawsuit against Ripple could further boost XRP's price.

- Technological Advancements: Innovations within the XRP Ledger contribute to increased efficiency and adoption.

- Growing Institutional Interest: More institutional investors are exploring XRP as a potential investment asset.

Comparison to Bitcoin and Other Cryptocurrencies

XRP's price performance significantly outpaces Bitcoin, Ethereum, and other prominent cryptocurrencies following the SEC acknowledgement. [Insert Chart/Graph illustrating XRP's outperformance]. This disparity highlights the unique market dynamics surrounding XRP and the specific impact of the ETF filing. Factors such as XRP's relatively lower market capitalization and its potential for widespread adoption contribute to its exceptional growth. Keywords: Bitcoin price, Ethereum price, cryptocurrency comparison, market capitalization.

- Market Cap Comparison: Illustrate the difference in market capitalization between XRP and other leading cryptocurrencies.

- Volatility Comparison: Compare XRP's volatility with that of Bitcoin and Ethereum.

- Trading Volume Comparison: Show the increase in XRP's trading volume relative to other cryptocurrencies.

Conclusion: The Future of XRP and its ETF Prospects

The SEC's acknowledgement of Grayscale's XRP ETF filing marks a significant turning point for XRP. The subsequent price surge, outperforming even Bitcoin, underscores the market's anticipation of regulatory approval. While various factors contribute to this rise, the potential approval of the XRP ETF remains a dominant force. While the future holds uncertainties inherent in the volatile crypto market, the prospects for XRP look promising. The successful launch of an XRP ETF would undoubtedly revolutionize the cryptocurrency landscape, potentially attracting a massive influx of institutional investment and pushing XRP into the mainstream. Learn more about XRP, the ETF filing, and how to navigate this evolving investment landscape. Start exploring the potential of XRP and its ETF prospects today. Keywords: XRP investment, future of XRP, ETF investment, cryptocurrency investment.

Featured Posts

-

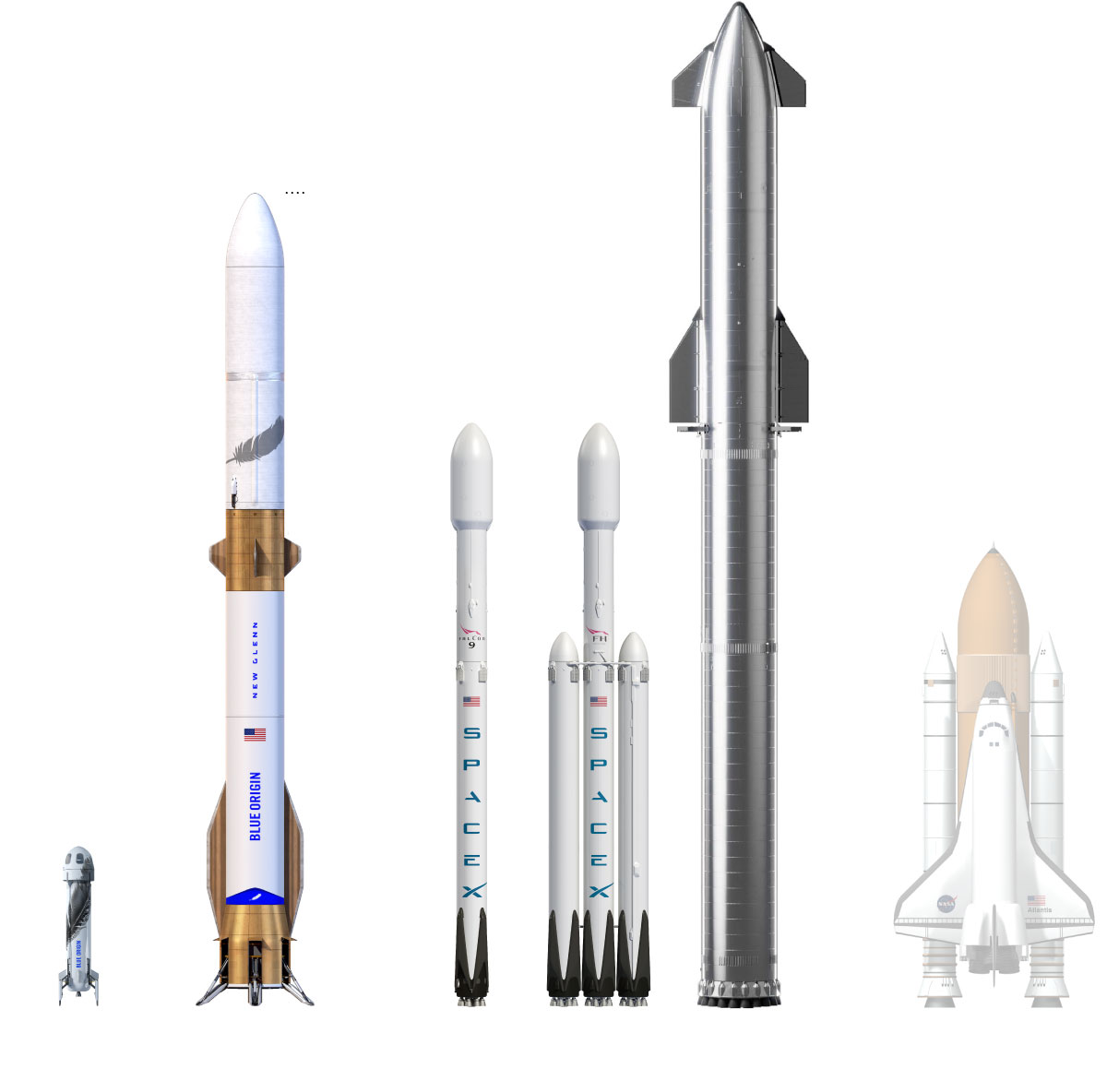

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Delays Flight

May 07, 2025

Blue Origin Rocket Launch Cancelled Subsystem Malfunction Delays Flight

May 07, 2025 -

Svetovy Pohar Hokeja Sa Vrati V Roku 2028 Oficialne Potvrdenie Nhl

May 07, 2025

Svetovy Pohar Hokeja Sa Vrati V Roku 2028 Oficialne Potvrdenie Nhl

May 07, 2025 -

Ki Inspiralta Jenna Ortegat Egy Meglepo Szineszno

May 07, 2025

Ki Inspiralta Jenna Ortegat Egy Meglepo Szineszno

May 07, 2025 -

Zendayas Surprise Spider Man Audition The Untold Story

May 07, 2025

Zendayas Surprise Spider Man Audition The Untold Story

May 07, 2025 -

Celebrity Special Behind The Scenes Of Who Wants To Be A Millionaire

May 07, 2025

Celebrity Special Behind The Scenes Of Who Wants To Be A Millionaire

May 07, 2025

Latest Posts

-

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025

Five Year Bitcoin Forecast Potential For 1 500 Growth

May 08, 2025 -

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025

Is This Bitcoin Rebound A Sign Of Things To Come

May 08, 2025 -

Bitcoin Rebound Investing Strategies For The Future

May 08, 2025

Bitcoin Rebound Investing Strategies For The Future

May 08, 2025 -

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025

1 500 Bitcoin Growth Analyzing The Prediction And Its Implications

May 08, 2025 -

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025