Sharp Decline In Amsterdam Stock Market: 7% Drop At Opening

Table of Contents

Causes of the Amsterdam Stock Market's Sharp Decline

The sudden 7% drop in the Amsterdam Stock Market isn't an isolated event; it reflects a confluence of global and regional factors impacting investor confidence and market stability.

Global Economic Uncertainty

Rising inflation globally is a primary culprit. High inflation erodes purchasing power and increases uncertainty about future economic growth, prompting investors to reassess their portfolios. Fears of a potential recession are further fueling this uncertainty. Central banks around the world are raising interest rates to combat inflation, but this can also slow economic growth and impact corporate profitability, leading to lower stock prices.

- Rising Interest Rates: Higher interest rates increase borrowing costs for businesses, impacting investment and potentially leading to reduced profits.

- Energy Crisis: The ongoing energy crisis, particularly in Europe, is adding to inflationary pressures and creating economic instability.

- Geopolitical Tensions: The war in Ukraine and other geopolitical uncertainties contribute to global economic instability and negatively affect investor sentiment.

Sector-Specific Impacts

The decline wasn't uniform across all sectors. The technology sector, often sensitive to interest rate hikes and economic slowdowns, experienced particularly heavy losses. The energy sector, while initially benefiting from high prices, has seen some correction due to market volatility and concerns about future demand.

- Technology Sector: Companies reliant on venture capital and future growth saw significant drops due to increased borrowing costs and reduced investor appetite for risk.

- Energy Sector: While energy prices remain elevated, volatility in the market and concerns about future demand impacted stock prices for some energy companies.

- Financial Sector: Banks and financial institutions also experienced a degree of decline, reflecting broader market anxieties.

Geopolitical Factors

Geopolitical instability plays a significant role in influencing investor sentiment. The ongoing war in Ukraine, for instance, continues to create uncertainty about energy supplies and global trade, impacting market confidence. Political instability in other regions also contributes to this heightened risk aversion.

- Ukraine Conflict: The war's impact on energy supplies, inflation, and global trade significantly influences investor confidence in the Amsterdam Stock Market and beyond.

- Global Political Instability: Political uncertainties in various regions add to the overall sense of risk aversion, prompting investors to seek safer havens.

Impact on Investors and the Dutch Economy

The sharp decline in the Amsterdam Stock Market has significant implications for both investors and the Dutch economy.

Investor Reactions and Strategies

Many investors are reacting to the downturn by selling off assets, shifting towards safer investments like government bonds, or adopting a more cautious approach. This market volatility underscores the importance of a robust investment strategy.

- Selling Off Assets: A knee-jerk reaction for some investors, potentially leading to losses if they sell at the bottom of the market.

- Seeking Safer Investments: Investors are moving towards less volatile assets, seeking to preserve capital.

- Recommended Strategies: Diversification, risk management, and a long-term investment horizon are crucial strategies during market downturns.

Economic Consequences for the Netherlands

The stock market decline could have far-reaching consequences for the Dutch economy. Reduced investor confidence can impact consumer spending, potentially slowing economic growth. Companies listed on the AEX might face challenges in raising capital, affecting investment and job creation.

- Consumer Confidence: A declining stock market can negatively impact consumer confidence, leading to reduced spending.

- Employment: Economic slowdown could lead to reduced hiring or even job losses in certain sectors.

- Economic Growth: The overall impact could be a decrease in GDP growth for the Netherlands.

Market Outlook and Predictions

Predicting the future of the Amsterdam Stock Market is challenging, but analyzing analyst predictions and developing sound strategies is vital.

Analyst Predictions and Forecasts

Market analysts offer varied opinions. Some anticipate a gradual recovery, while others foresee further declines depending on global economic developments and the resolution of geopolitical tensions.

- Gradual Recovery: Some analysts expect the market to stabilize and gradually recover as economic uncertainties ease.

- Further Declines: Others predict further market declines if global economic conditions worsen or geopolitical tensions escalate.

Strategies for Navigating Market Volatility

Despite the uncertainty, investors can employ strategies to mitigate risk and potentially benefit from the downturn. Value investing, focusing on undervalued companies, can be a viable approach. Maintaining a long-term perspective and diversifying your portfolio are essential.

- Value Investing: Identifying undervalued companies that offer long-term growth potential.

- Long-Term Perspective: Avoiding impulsive decisions based on short-term market fluctuations.

- Diversification: Spreading investments across different asset classes to reduce overall risk.

Conclusion

The 7% drop in the Amsterdam Stock Market at opening represents a significant event, driven by a combination of global economic uncertainty, sector-specific challenges, and geopolitical factors. This decline has substantial implications for investors and the Dutch economy. Understanding market volatility and employing sound investment strategies are paramount during such times. Stay informed about the Amsterdam Stock Market, and consult with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. Consider further reading on managing investment risk during a stock market decline or understanding the factors impacting the AEX Index to gain a deeper understanding of this dynamic market.

Featured Posts

-

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025

Rayakan Seni Dan Otomotif Di Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

High Speed Chase Culminates In Unbelievable Texting And Refueling Stop

May 24, 2025

High Speed Chase Culminates In Unbelievable Texting And Refueling Stop

May 24, 2025 -

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025

Serious M56 Crash Car Overturns Paramedic Response Underway

May 24, 2025 -

A Deep Dive Into Demna Gvasalias Gucci Debut Collection

May 24, 2025

A Deep Dive Into Demna Gvasalias Gucci Debut Collection

May 24, 2025 -

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025

Konchita Vurst Pro Yevrobachennya 2025 Prognoz Na Chotirokh Peremozhtsiv

May 24, 2025

Latest Posts

-

Millions In Losses Office365 Executive Account Hack Exposes Security Gaps

May 24, 2025

Millions In Losses Office365 Executive Account Hack Exposes Security Gaps

May 24, 2025 -

Cybercriminals Millions Fbi Probes Office365 Executive Inbox Breaches

May 24, 2025

Cybercriminals Millions Fbi Probes Office365 Executive Inbox Breaches

May 24, 2025 -

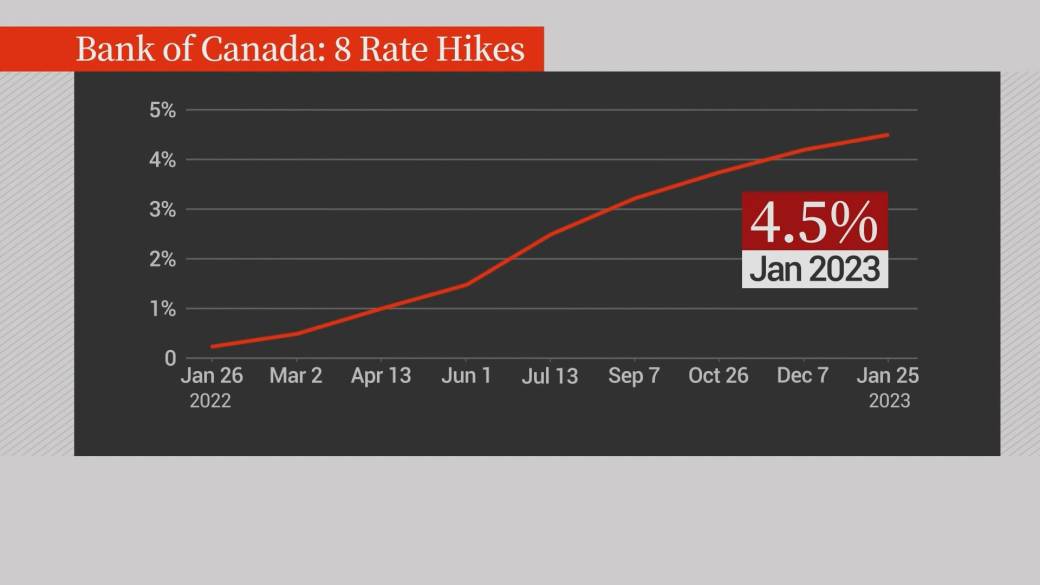

Bank Of Canada Desjardins Sees Potential For Three Further Rate Reductions

May 24, 2025

Bank Of Canada Desjardins Sees Potential For Three Further Rate Reductions

May 24, 2025 -

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025

Federal Investigation Millions Lost In Office365 Executive Account Compromise

May 24, 2025 -

Desjardins Forecasts Three Additional Bank Of Canada Interest Rate Cuts

May 24, 2025

Desjardins Forecasts Three Additional Bank Of Canada Interest Rate Cuts

May 24, 2025