Tariff Uncertainty Forces U.S. Businesses To Cut Costs

Table of Contents

Impact on Supply Chains and Sourcing

Tariff uncertainty significantly disrupts established supply chains, compelling businesses to re-evaluate their sourcing strategies. The increased costs and unpredictability associated with tariffs necessitate proactive adjustments to maintain operational efficiency and minimize financial risk.

Shifting Sourcing Strategies

Businesses are actively diversifying their supply chains to reduce reliance on single-source suppliers, especially those located in countries frequently subject to tariff changes. This diversification involves a multi-pronged approach:

- Exploring alternative suppliers in countries with more favorable trade agreements: This involves researching and vetting suppliers in countries with established free trade agreements or lower tariff rates, potentially shifting production to regions with greater stability.

- Investing in near-shoring or reshoring initiatives: Bringing manufacturing closer to home, either within the U.S. or to neighboring countries, reduces reliance on long and potentially unstable international supply chains. This mitigates risks associated with tariff fluctuations and transportation delays.

- Implementing robust risk management strategies to mitigate future tariff impacts: This includes developing contingency plans that address potential tariff changes, including scenario planning and diversification of suppliers and transportation routes. Regularly reviewing and updating these plans is critical in the face of ongoing tariff uncertainty.

Increased Transportation Costs

Tariffs don't just affect the cost of goods; they also significantly impact transportation costs. Increased customs processing times, added fees, and potential delays lead to higher shipping expenses and logistical challenges. Businesses are actively seeking ways to mitigate these added burdens:

- Optimizing logistics and freight forwarding strategies: This includes streamlining processes, negotiating better rates with carriers, and exploring alternative routing options to minimize transit times and associated costs.

- Negotiating better rates with shipping carriers: Building strong relationships with shipping companies and negotiating volume discounts can significantly reduce transportation costs.

- Exploring alternative transportation modes to minimize expenses: Businesses may consider shifting from air freight to sea freight for less time-sensitive goods, or exploring rail transport as a cost-effective alternative.

Impact on Pricing and Profitability

The impact of tariff uncertainty extends beyond supply chain disruptions; it directly affects pricing strategies and overall profitability. Businesses are forced to make difficult choices to balance maintaining competitiveness and sustaining profit margins.

Price Increases and Reduced Margins

The increased costs associated with tariffs create a dilemma: pass the increased costs onto consumers, potentially impacting sales volume, or absorb the costs, resulting in reduced profit margins. Businesses are employing several strategies to navigate this complex issue:

- Implementing dynamic pricing strategies to adjust to fluctuating tariff costs: This involves regularly monitoring tariff changes and adjusting prices accordingly to reflect the actual cost of goods.

- Exploring cost-cutting measures across various departments: This may involve streamlining operations, improving efficiency, and identifying areas for cost reduction without compromising quality or customer service.

- Carefully evaluating the impact of price increases on consumer demand: Conducting market research and analyzing consumer behavior is crucial to determine the price elasticity of demand and make informed decisions about price adjustments.

Reduced Investment and Hiring

The uncertainty created by fluctuating tariffs discourages investment in expansion and hiring, leading to slower economic growth. Businesses hesitate to commit to long-term investments in the face of unpredictable costs.

- Delaying capital expenditures and expansion plans: Businesses are putting major investments on hold until there's more clarity regarding future tariffs and trade policies.

- Implementing hiring freezes or reducing workforce size: To control costs, companies may freeze hiring or even reduce their workforce to maintain profitability.

- Focusing on operational efficiency to maximize existing resources: Improving efficiency and optimizing existing resources becomes a priority to minimize the impact of tariff uncertainty.

Government Policies and Business Response

Businesses aren't passively accepting the impact of tariff uncertainty; they are actively engaging with the government and exploring available support programs.

Lobbying Efforts and Policy Advocacy

Businesses are actively lobbying for policy changes that create a more stable and predictable trade environment. This involves various efforts:

- Engaging with government representatives to advocate for trade policy reforms: Businesses are actively participating in political processes to influence trade legislation and create a more favorable trade environment.

- Supporting industry associations' efforts to influence trade legislation: Many businesses are working through their respective industry associations to collectively advocate for changes in trade policy.

- Participating in public forums and debates on trade policy: Companies are using various platforms to express their concerns and advocate for policies that promote economic stability.

Utilizing Trade Adjustment Assistance Programs

The U.S. government offers various trade adjustment assistance programs designed to help companies adjust to the impacts of trade liberalization and tariff changes. Businesses are actively exploring these resources:

- Researching eligibility for trade adjustment assistance programs: Businesses are carefully examining the requirements and eligibility criteria for government support programs.

- Seeking expert advice on navigating the application process: Navigating the application process for these programs often requires specialized knowledge and expertise.

- Utilizing program funds for retraining, relocation, and other support: These programs can provide financial assistance for various initiatives to help businesses adapt to trade changes.

Conclusion

Tariff uncertainty presents a significant challenge for U.S. businesses, forcing them to adopt a wide range of cost-cutting measures to ensure survival and maintain competitiveness. From strategically shifting sourcing and optimizing logistics to carefully managing pricing and investment decisions, the impact is widespread. Understanding the implications of tariff uncertainty and proactively implementing mitigation strategies is crucial for business survival and long-term success. Don't let tariff uncertainty cripple your business; take proactive steps today to adapt and thrive in this dynamic environment. Learn more about mitigating the effects of tariff uncertainty and develop a robust strategy to protect your business.

Featured Posts

-

Shedeur Sanders Receives Apology For Prank Call From Son Of Falcons Dc

Apr 29, 2025

Shedeur Sanders Receives Apology For Prank Call From Son Of Falcons Dc

Apr 29, 2025 -

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025 -

Understanding The Value Of Middle Managers Benefits For Companies And Their Workforces

Apr 29, 2025

Understanding The Value Of Middle Managers Benefits For Companies And Their Workforces

Apr 29, 2025 -

Reliance Industries Earnings Surprise Implications For Indian Equities

Apr 29, 2025

Reliance Industries Earnings Surprise Implications For Indian Equities

Apr 29, 2025 -

Tariff Uncertainty Forces U S Businesses To Cut Costs

Apr 29, 2025

Tariff Uncertainty Forces U S Businesses To Cut Costs

Apr 29, 2025

Latest Posts

-

Nyt Spelling Bee March 14 2025 Complete Solution Guide

Apr 29, 2025

Nyt Spelling Bee March 14 2025 Complete Solution Guide

Apr 29, 2025 -

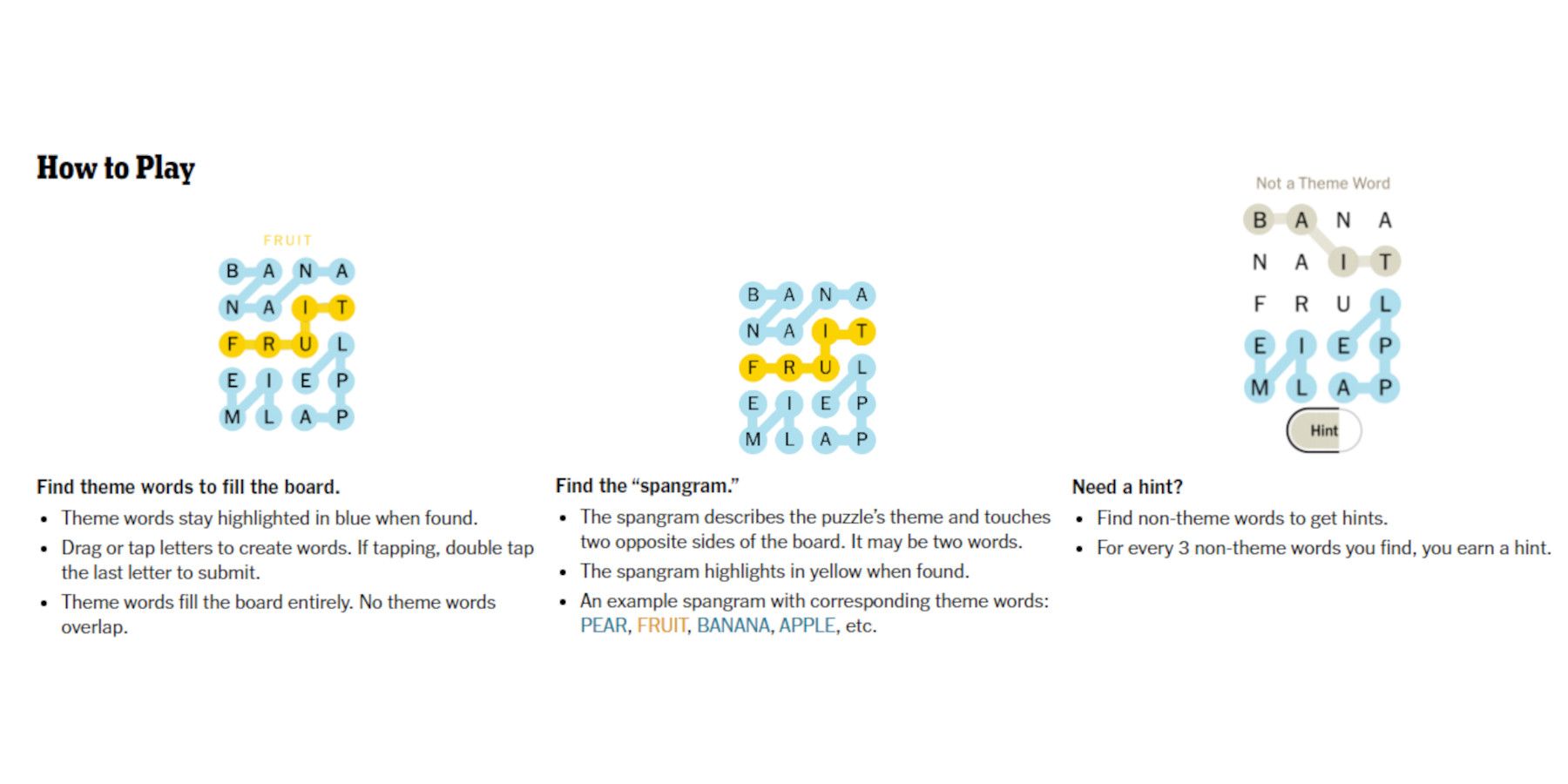

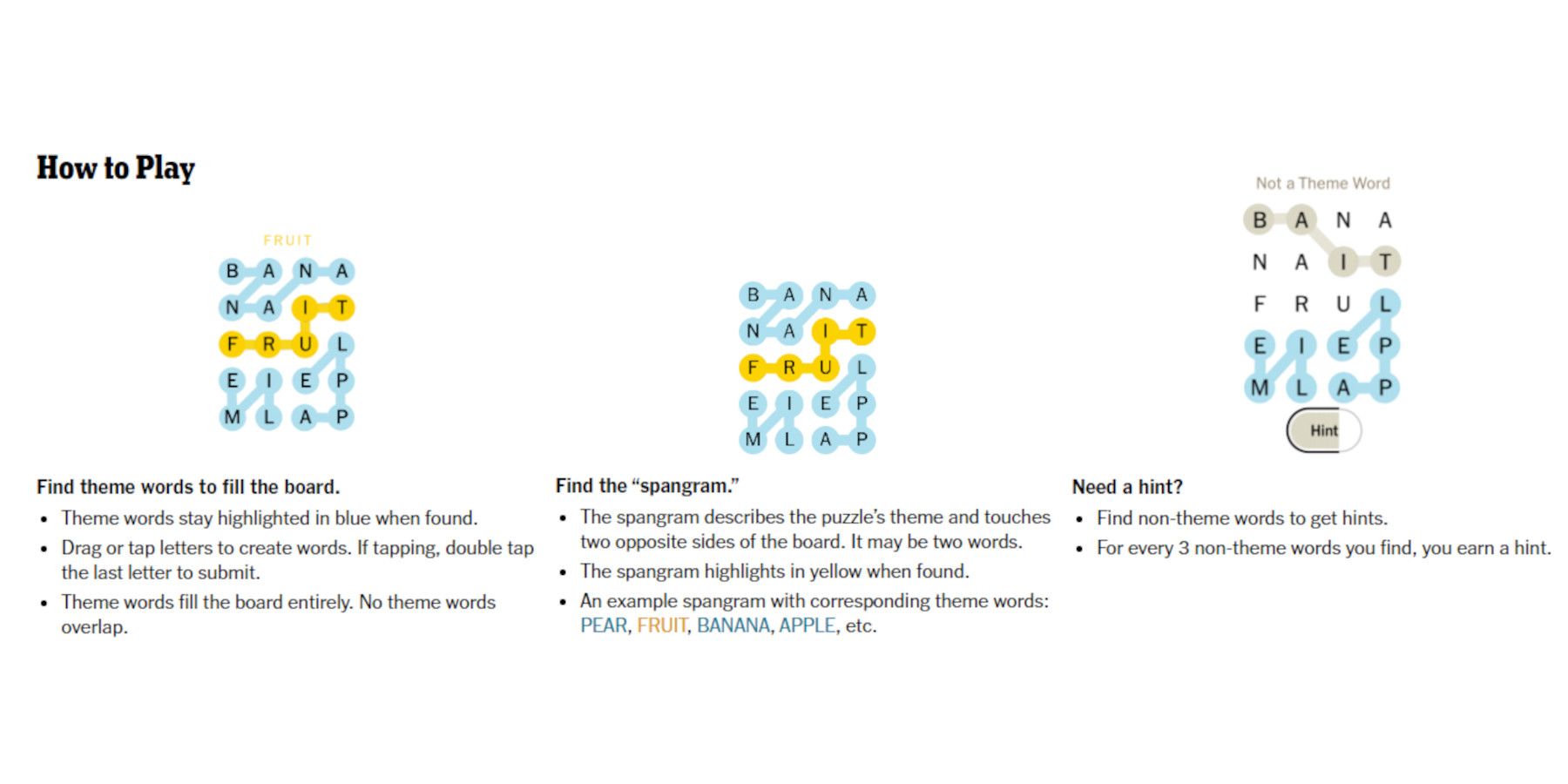

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025

Nyt Strands Puzzle February 27 2025 Answers And Clues

Apr 29, 2025 -

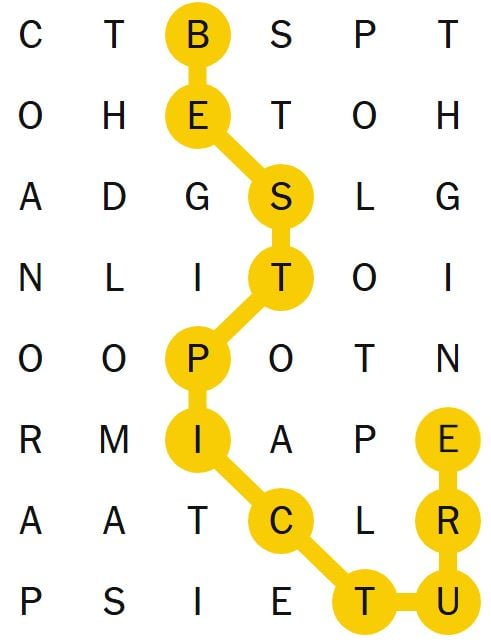

Nyt Strands Hints And Answers Tuesday April 29 Game 422

Apr 29, 2025

Nyt Strands Hints And Answers Tuesday April 29 Game 422

Apr 29, 2025 -

Nyt Spelling Bee March 14 2025 Solutions And Pangram

Apr 29, 2025

Nyt Spelling Bee March 14 2025 Solutions And Pangram

Apr 29, 2025 -

Nyt Strands February 27 2025 Complete Answers And Hints

Apr 29, 2025

Nyt Strands February 27 2025 Complete Answers And Hints

Apr 29, 2025