The Role Of Tax Credits In Growing Minnesota's Film Industry

Table of Contents

Attracting Film Productions to Minnesota

Minnesota's film tax credit program plays a crucial role in attracting film productions to the state. By offering significant financial incentives, it makes Minnesota a more competitive location compared to other states vying for the same projects. These incentives directly impact a production's bottom line, making it more attractive to choose Minnesota as a filming location.

- Reduced production costs: The tax credits significantly reduce the overall cost of production, making Minnesota a more financially appealing choice for filmmakers. This is especially important for independent films and smaller productions with tighter budgets.

- Offsetting expenses: Tax credits help offset various production expenses, including crew salaries, location fees, and equipment rentals. This allows producers to allocate more resources to other crucial aspects of filmmaking, such as talent acquisition and post-production.

- Increased profitability: The improved profitability resulting from the tax credits encourages investment in larger, more ambitious projects. Productions that might have been deemed too risky financially in other states become viable options in Minnesota.

- Successful productions: The success of films like [Insert Example 1: Film Title and brief description, highlighting its Minnesota connection] and [Insert Example 2: Film Title and brief description, highlighting its Minnesota connection] demonstrates the effectiveness of the Minnesota film tax credits in attracting high-quality productions. These films not only showcased Minnesota's diverse landscapes but also brought significant economic benefits to the state. These successes further solidify Minnesota's position as a desirable filming location. Using keywords like film incentives Minnesota and movie tax credits Minnesota helps potential filmmakers find this information easily.

Job Creation and Economic Growth through Minnesota Film Tax Credits

The economic impact of the Minnesota film tax credits extends far beyond the film sets themselves. The program acts as a powerful catalyst for job creation across various sectors, contributing significantly to the state's economic growth.

- Quantifiable data on job creation: [Insert Statistics here, if available. Examples: "Studies show that for every $1 million invested in film production, X number of jobs are created." or "Since the inception of the tax credit program, Y number of jobs have been created within the Minnesota film industry."] This demonstrates the program's effectiveness in stimulating employment.

- Ripple effect: The increased activity from film productions has a significant ripple effect on local businesses. Hotels, restaurants, transportation services, and other support industries experience a boost in revenue as crews and cast members utilize their services.

- Skilled labor development: The influx of film productions creates opportunities for professional development and training, cultivating a skilled workforce within the Minnesota film industry. This leads to long-term economic benefits.

- Individual success stories: [Include examples of individuals who have found employment through film productions made possible by the tax credit program. Highlight their career growth and positive experiences.] These personal stories showcase the human impact of the Minnesota film tax credits and film industry employment Minnesota. This provides a human connection and builds trust with your readers.

Boosting Minnesota's Creative Economy and Tourism

The Minnesota film tax credits contribute significantly to the state's creative economy and act as a powerful engine for tourism. By showcasing Minnesota's landscapes and culture on the big screen, the program attracts both filmmakers and tourists.

- Increased visibility: Films shot in Minnesota gain international exposure, bringing attention to the state's unique locations and creating a compelling narrative that encourages tourism.

- Film tourism: This exposure translates directly into film tourism. Tourists visit locations featured in their favorite movies and TV shows, injecting revenue into local businesses and attractions.

- Enriched cultural landscape: The growth of film festivals, screenings, and related events enhances Minnesota's cultural landscape, adding to its overall appeal.

- Showcasing Minnesota's unique character: [Include examples of successful films that effectively showcased Minnesota’s unique landscapes and culture. This section should use keywords such as film tourism Minnesota and creative economy Minnesota to further optimize the article for search engines.]

Addressing Potential Concerns and Future of Minnesota Film Tax Credits

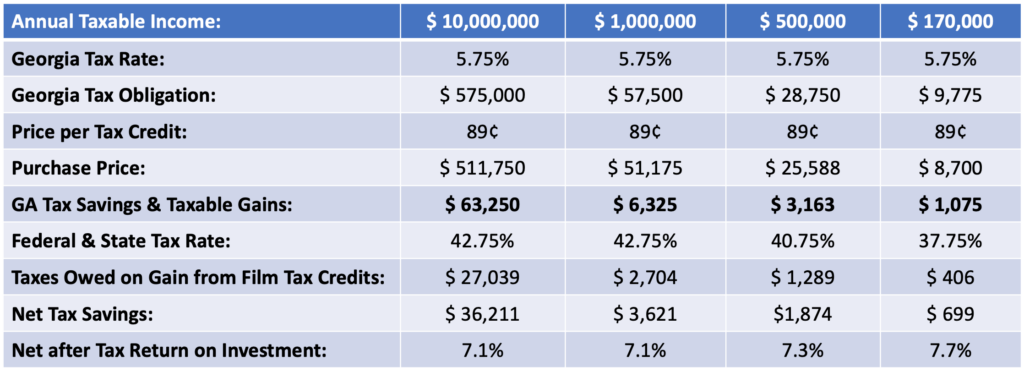

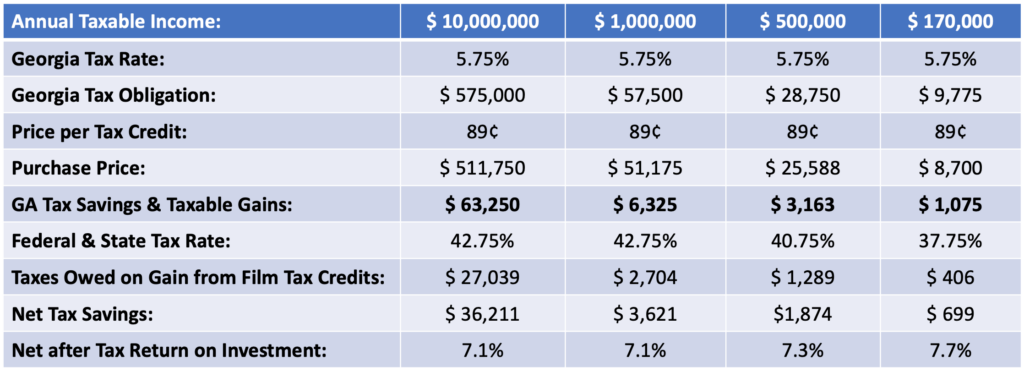

While the benefits of Minnesota film tax credits are significant, it's crucial to address potential concerns. Some critics might argue about the cost to taxpayers.

- Economic benefits outweigh costs: A thorough cost-benefit analysis is needed to demonstrate that the economic benefits—in terms of job creation, tourism revenue, and overall economic growth—significantly outweigh the costs to taxpayers.

- Program improvements: Continuous evaluation and adjustments to the program are essential to maximize its effectiveness and ensure its long-term sustainability. This might include targeted incentives for specific types of productions or collaborations with local communities. Keywords like Minnesota state budget and film tax credit reform are important here.

- Long-term sustainability: Ensuring the long-term sustainability of the program requires careful planning, transparent budgeting, and a commitment from both the state government and the film industry. This requires a discussion of sustainable film industry Minnesota.

Conclusion

Minnesota's film tax credits are instrumental in attracting productions, creating jobs, stimulating economic growth, and enhancing the state's image as a vibrant film destination. The program has a demonstrable positive impact on the state's economy and its cultural landscape. To further strengthen Minnesota's position as a leading film production hub, continued support for and strategic refinement of the Minnesota film tax credits are essential. Let's work together to ensure the continued success of the Minnesota film industry through smart investment in Minnesota film tax credits and related initiatives.

Featured Posts

-

Huaweis New Ai Chip A Challenge To Nvidias Dominance

Apr 29, 2025

Huaweis New Ai Chip A Challenge To Nvidias Dominance

Apr 29, 2025 -

Astedwa Lfn Abwzby 19 Nwfmbr

Apr 29, 2025

Astedwa Lfn Abwzby 19 Nwfmbr

Apr 29, 2025 -

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Urgent Need For Israel To Lift Aid Restrictions

Apr 29, 2025 -

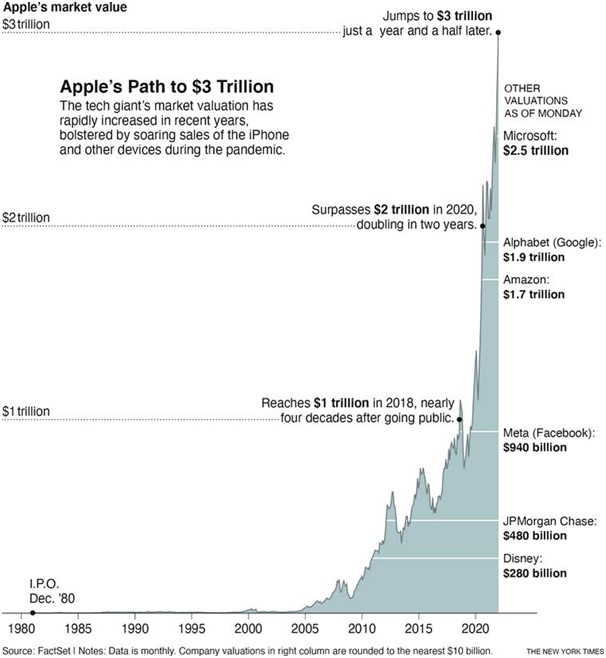

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025

The Magnificent Sevens Fall Analyzing A 2 5 Trillion Market Value Decline

Apr 29, 2025 -

Minnesota Governor Under Pressure To Enforce Transgender Sports Ban

Apr 29, 2025

Minnesota Governor Under Pressure To Enforce Transgender Sports Ban

Apr 29, 2025

Latest Posts

-

Republican Divisions Could Halt Trumps Tax Plan

Apr 29, 2025

Republican Divisions Could Halt Trumps Tax Plan

Apr 29, 2025 -

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025

Trumps Tax Bill Republican Opposition And Potential Blockades

Apr 29, 2025 -

Assessing The Risk Russias Military Actions And European Stability

Apr 29, 2025

Assessing The Risk Russias Military Actions And European Stability

Apr 29, 2025 -

Recent Russian Military Activities A Cause For European Concern

Apr 29, 2025

Recent Russian Military Activities A Cause For European Concern

Apr 29, 2025 -

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025

Understanding Russias Military Strategy And Its Impact On Europe

Apr 29, 2025