Uncovering Value: Is News Corp A Hidden Investment Opportunity?

Table of Contents

Analyzing News Corp's Diversified Portfolio

News Corp's strength lies in its diversified holdings, a key factor mitigating risk and offering potential for stable growth. This diversification across multiple sectors helps cushion the company against downturns in any single market segment.

The Power of Diversification

News Corp's portfolio includes several key business units:

- Newspapers: The Wall Street Journal, a leading financial newspaper, and The Times, a prominent UK-based publication, contribute significantly to revenue and brand recognition. These established titles hold considerable influence and subscriber bases.

- Book Publishing: HarperCollins Publishers, a major player in the book publishing industry, offers a diversified portfolio of authors and genres, contributing steady revenue streams and potential for growth through new acquisitions and digital expansion.

- Digital Real Estate: Realtor.com, a leading online real estate portal, provides significant exposure to the growing digital real estate market. Its strong brand recognition and expansive reach represent a key growth area for News Corp.

- Other Subsidiaries: News Corp also owns other subsidiaries contributing to its overall revenue stream, further enhancing its diversified structure.

This breadth of holdings reduces dependence on any single sector's performance, providing resilience against economic fluctuations and market shifts. The strength of individual segments, such as the Wall Street Journal's robust subscription base, offers a solid foundation for future growth.

Assessing the Financial Performance

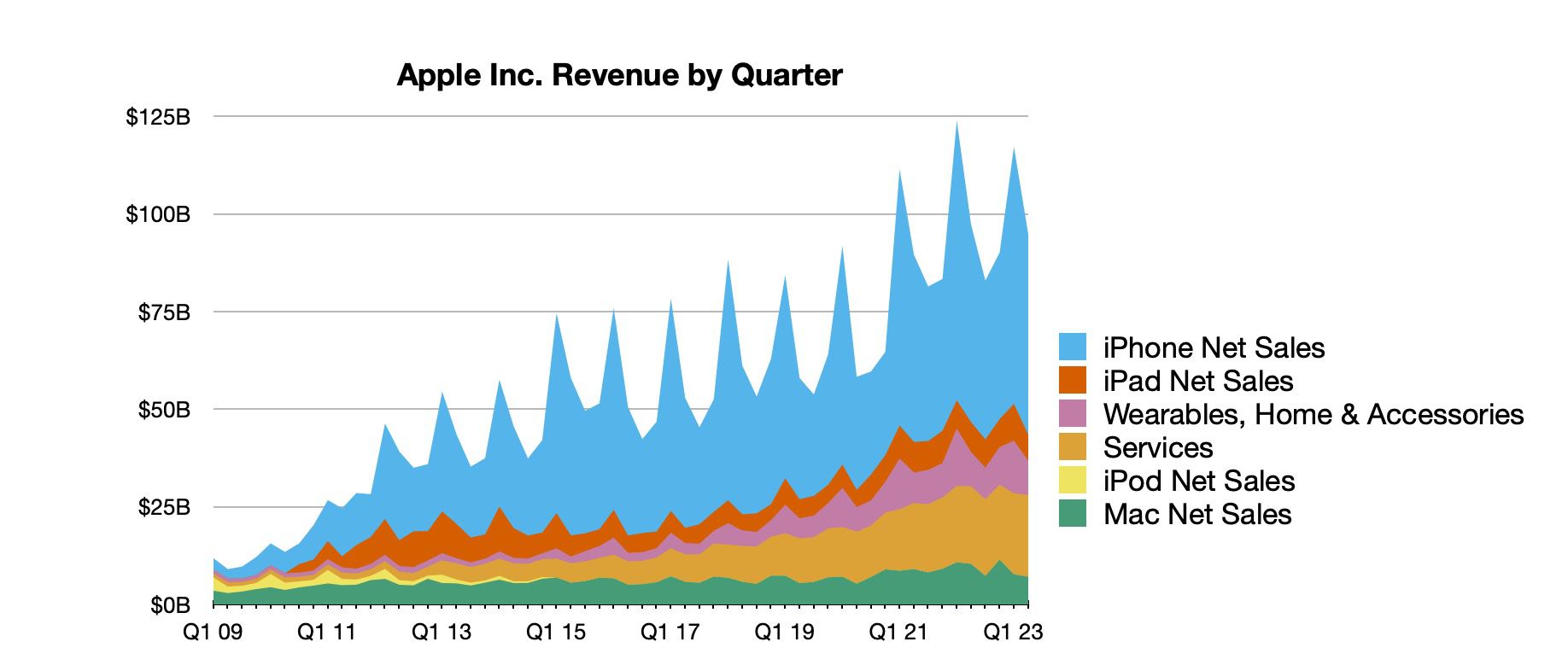

Analyzing News Corp's financial performance requires examining key indicators such as revenue, profit margins, debt levels, and cash flow. (Include charts and graphs here visualizing revenue growth, profit margins over time, and debt-to-equity ratio.) Comparing these figures to industry competitors like Disney, Comcast, or ViacomCBS reveals News Corp's relative position and potential for future growth. Recent financial news and announcements should also be considered when evaluating current performance and future projections. A detailed analysis of these figures allows investors to understand the company’s financial health and its capacity for future growth.

Evaluating News Corp's Growth Potential

While News Corp has a strong legacy in traditional media, its future hinges on its ability to adapt to and leverage digital trends.

Digital Transformation and Innovation

News Corp's strategic investments in digital platforms and technologies are crucial for its long-term success. The company’s focus on growing digital subscriptions and advertising revenue across its various platforms shows a commitment to navigating the changing media landscape. Successful digital initiatives and acquisitions will further contribute to this transition. Analysis of user engagement metrics on digital platforms and the efficacy of digital advertising strategies are essential for understanding the company's progress in this crucial area.

Strategic Acquisitions and Partnerships

Future growth may also be driven by strategic acquisitions and partnerships. Identifying potential target markets or technologies that align with News Corp’s existing business segments is key to understanding its potential for expansion. Analyzing existing partnerships and their contributions to revenue growth and market share reveals the efficacy of News Corp’s collaborative strategies.

Addressing Potential Risks and Challenges

While News Corp offers potential upside, investors must acknowledge several key risks.

Competition in the Media Industry

The media industry is fiercely competitive. News Corp faces intense competition from established players and new entrants alike. Specific competitors like other major media conglomerates must be analyzed for their market share and competitive strategies. News Corp’s ability to differentiate its offerings and maintain its market position will play a crucial role in its success.

Economic and Regulatory Headwinds

Macroeconomic factors and regulatory changes significantly impact News Corp's performance. Potential economic downturns could reduce advertising revenue and consumer spending, impacting all sectors of its business. Regulatory changes affecting media ownership or digital content could also pose significant challenges. Thorough analysis of these factors is crucial for assessing the inherent risk.

Reputational Risk

Reputational risks associated with News Corp's news operations must also be considered. Maintaining journalistic integrity and ethical standards are paramount in protecting the company's reputation and avoiding potentially damaging controversies.

Conclusion

News Corp's investment prospects present a mixed bag. While its diversified portfolio offers resilience, the company faces significant competition and economic headwinds. The successful navigation of its digital transformation and strategic acquisitions will be critical for achieving long-term growth. While challenges exist, News Corp's diversified portfolio and strategic initiatives suggest potential for long-term growth, especially considering potential undervaluation in the current market. Despite risks, the potential for undervaluation makes News Corp worthy of further investigation.

Consider News Corp as a potential addition to your investment strategy. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions. Is News Corp the hidden investment opportunity you've been searching for?

Featured Posts

-

Outrage As Ferrari Boss Criticizes Lewis Hamiltons Unfair Remarks

May 25, 2025

Outrage As Ferrari Boss Criticizes Lewis Hamiltons Unfair Remarks

May 25, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 25, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 25, 2025 -

Guccis Massimo Vian Departs Supply Chain Officer Exit Explained

May 25, 2025

Guccis Massimo Vian Departs Supply Chain Officer Exit Explained

May 25, 2025 -

Jymypaukku Tuukka Taponen F1 Sarjaan

May 25, 2025

Jymypaukku Tuukka Taponen F1 Sarjaan

May 25, 2025 -

Oleg Basilashvili Test Na Znanie Ego Roley

May 25, 2025

Oleg Basilashvili Test Na Znanie Ego Roley

May 25, 2025

Latest Posts

-

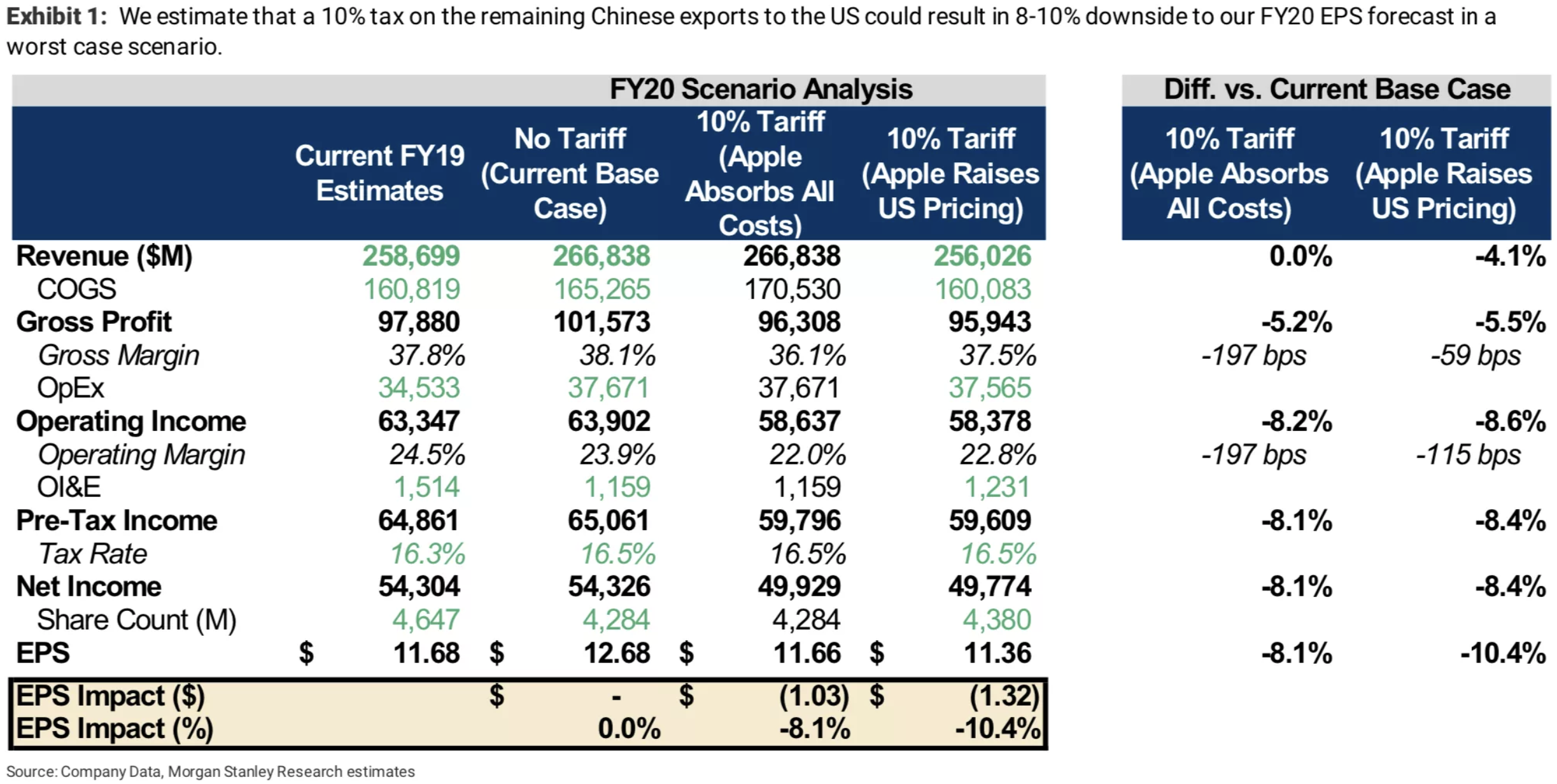

Apple Stock Takes A Hit From Projected 900 Million Tariff

May 25, 2025

Apple Stock Takes A Hit From Projected 900 Million Tariff

May 25, 2025 -

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025

Apple Stock Slumps 900 Million Tariff Impact

May 25, 2025 -

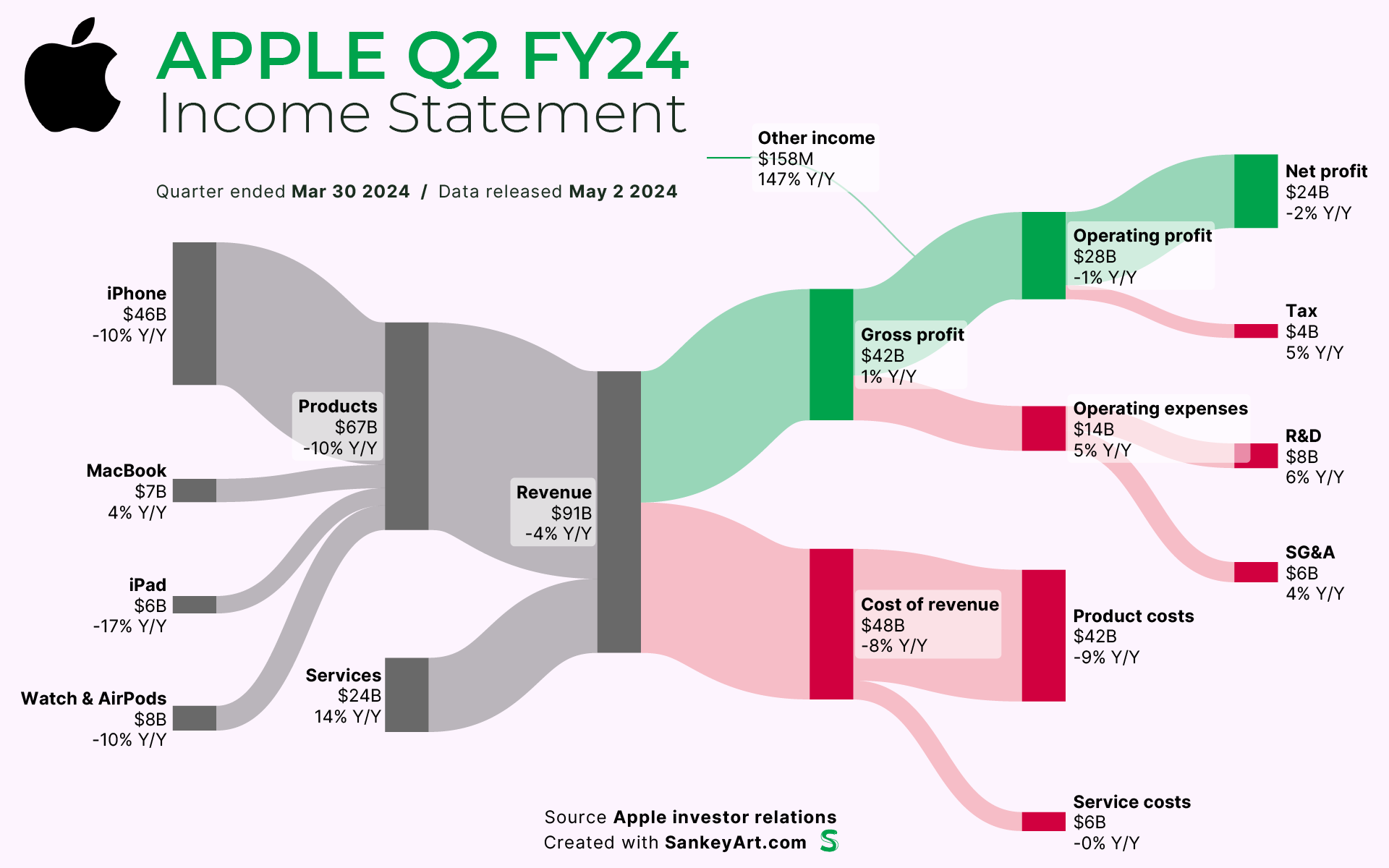

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025

Is Apple Stock A Buy After Strong Q2 Earnings

May 25, 2025 -

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025

Apple Stock Analysis Of Q2 Results And Future Predictions

May 25, 2025 -

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025