Understanding And Interpreting The NAV Of The Amundi DJIA UCITS ETF

Table of Contents

What is the Net Asset Value (NAV)?

The Net Asset Value (NAV) represents the market value of all the assets held within an ETF, divided by the number of outstanding shares. For the Amundi DJIA UCITS ETF, this means the NAV reflects the total value of the ETF's holdings in the 30 companies that make up the Dow Jones Industrial Average (DJIA). Each company's weighting within the DJIA directly influences its contribution to the ETF's NAV.

The Amundi DJIA UCITS ETF NAV is calculated daily, usually at the close of the trading day. This calculation considers the closing prices of all 30 DJIA components, adjusted for any dividends paid or corporate actions that occurred during the day. The resulting figure represents the theoretical price per share of the ETF.

- NAV reflects the market value of the ETF's holdings. This means it’s a direct reflection of the underlying asset performance.

- Calculated daily, usually at the end of the trading day. This ensures the NAV is up-to-date and reflects the most recent market activity.

- Represents the theoretical price per share. It's the value you would theoretically receive if you were to liquidate your shares at that precise moment.

- Influenced by the performance of the Dow Jones Industrial Average (DJIA). As the DJIA rises or falls, so too does the NAV of the Amundi DJIA UCITS ETF.

Factors Affecting the Amundi DJIA UCITS ETF NAV

Several factors significantly impact the Amundi DJIA UCITS ETF NAV. Understanding these influences is critical for interpreting NAV changes and making informed investment decisions.

The most significant factor is the performance of the underlying Dow Jones Industrial Average. Positive market movements generally lead to a higher NAV, while negative movements result in a lower NAV.

- DJIA performance is the primary driver. The NAV closely mirrors the daily ups and downs of the DJIA.

- Economic news and global events impact the DJIA and thus the NAV. Geopolitical events, economic data releases, and industry-specific news all affect the DJIA and subsequently the ETF's NAV.

- Currency exchange rates (if the ETF holds international assets). Although the Amundi DJIA UCITS ETF primarily tracks a US index, currency fluctuations can indirectly affect the NAV if the ETF holds any international assets or uses currency hedging strategies.

- Dividend payments reduce the NAV. When the companies within the DJIA pay dividends, the NAV of the ETF will decrease by the equivalent amount distributed to shareholders.

How to Interpret Amundi DJIA UCITS ETF NAV Changes

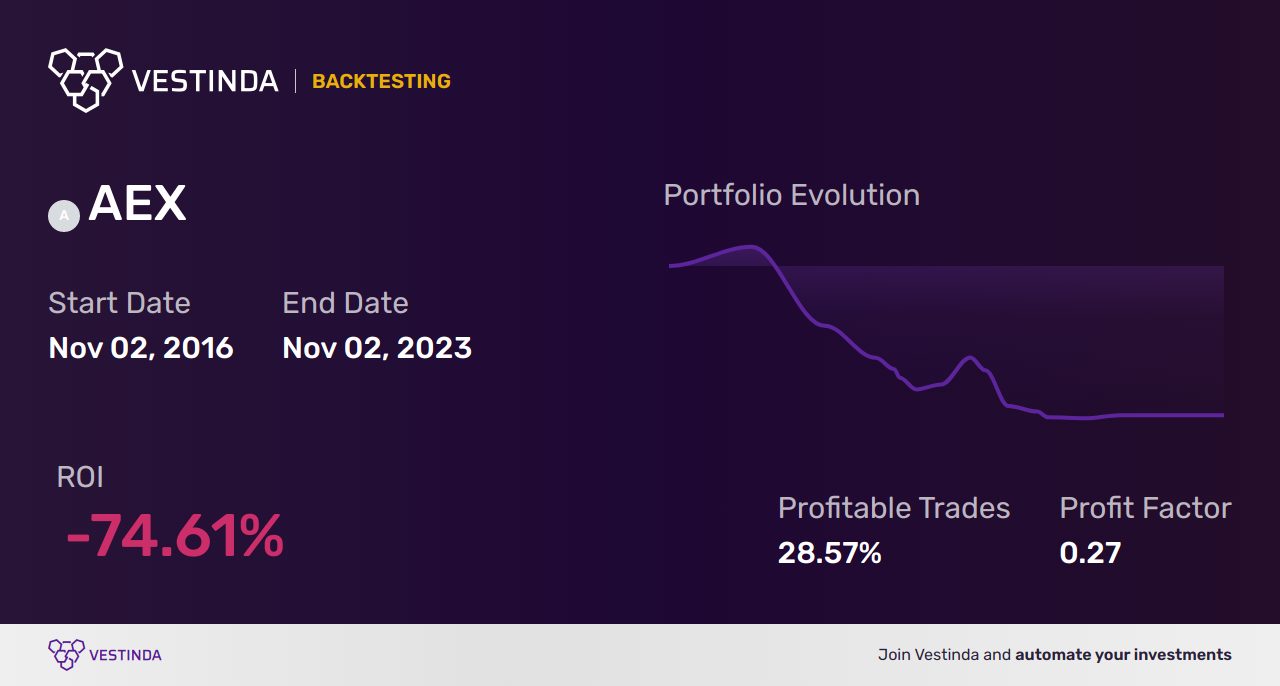

Tracking the Amundi DJIA UCITS ETF NAV over time provides valuable insights into the ETF's performance and the broader market trends. You can usually visualize these changes using charts and graphs available on various financial platforms.

Comparing the NAV to the ETF's market price is essential. The market price is the price at which you can buy or sell the ETF shares, which may differ slightly from the NAV due to supply and demand (the bid/ask spread). A significant difference between the market price and NAV can indicate a premium or discount.

- Use charts and graphs to visualize NAV trends. This helps identify long-term trends and potential turning points.

- Understand the difference between NAV and market price (bid/ask spread). The spread represents the difference between the buying and selling price, reflecting market liquidity.

- Identify potential arbitrage opportunities (if a significant premium/discount exists). A large discrepancy between the NAV and market price might present arbitrage opportunities for sophisticated investors.

- Relate NAV changes to broader market trends. Analyzing the NAV alongside other market indicators helps understand the context of price movements.

Where to Find the Amundi DJIA UCITS ETF NAV

Obtaining the daily NAV for the Amundi DJIA UCITS ETF is straightforward. Reliable sources include:

- Amundi's official website: The asset manager usually publishes daily NAV data on its website.

- Major financial news websites (Bloomberg, Yahoo Finance, etc.): Many reputable financial websites provide real-time or delayed NAV information for ETFs.

- Your brokerage account's platform: Your brokerage account will display the NAV and market price of your ETF holdings.

Conclusion

Understanding the Amundi DJIA UCITS ETF NAV is crucial for making informed investment decisions. By understanding how the NAV is calculated, the factors influencing it, and how to interpret its fluctuations, you can effectively monitor your investment's performance and make strategic adjustments. Regularly check the Amundi DJIA UCITS ETF NAV and utilize the resources mentioned above to stay informed and optimize your investment strategy. Remember to always consult with a financial advisor before making any investment decisions. Learn more about interpreting the Amundi DJIA UCITS ETF NAV today!

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Comprehensive Guide

May 24, 2025 -

Proposed French Law Banning The Hijab For Girls Under 15 In Public Areas

May 24, 2025

Proposed French Law Banning The Hijab For Girls Under 15 In Public Areas

May 24, 2025 -

Demnas Gucci Designs Kering Reports Lower Sales Figures For Year

May 24, 2025

Demnas Gucci Designs Kering Reports Lower Sales Figures For Year

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value Nav

May 24, 2025 -

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025

Menya Vela Kakaya To Sila Dokumentalniy Film Posvyaschenniy 100 Letiyu Innokentiya Smoktunovskogo

May 24, 2025

Latest Posts

-

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025

Euronext Amsterdam Stocks Jump 8 Following Trumps Tariff Decision

May 24, 2025 -

Relx Ai Gedreven Groei Ondanks Economische Tegenwind

May 24, 2025

Relx Ai Gedreven Groei Ondanks Economische Tegenwind

May 24, 2025 -

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025