Understanding The Net Asset Value (NAV) Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and how is it calculated?

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this means the total value of the 30 constituent stocks of the Dow Jones Industrial Average, less any expenses, such as management fees and other operational costs. Market fluctuations directly impact the daily NAV. When the value of the underlying stocks rises, the NAV increases, and vice versa. Keywords: NAV calculation, asset value, liabilities, market fluctuations, daily NAV.

- Formula (simplified): NAV = (Total Asset Value - Total Liabilities) / Number of Outstanding Shares

- Examples of Assets: Shares of companies like Apple, Microsoft, and Nike (constituents of the Dow Jones Industrial Average).

- Examples of Liabilities: Management fees charged by Amundi, administrative expenses.

Accessing the Daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF

Finding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is straightforward. Amundi, the ETF provider, typically publishes this information on their official website. You can also find the NAV on major financial news websites and through many brokerage platforms. The NAV is usually calculated and published at the end of each trading day, reflecting the closing prices of the underlying assets. Checking the NAV before buying or selling shares helps you understand the current market value of your investment. Keywords: daily NAV, Amundi website, financial news, NAV publication, buying, selling.

- Specific Website Links: [Insert link to Amundi website's ETF information page]. [Insert links to other relevant financial data providers].

- Alternative Sources: Major financial news websites (e.g., Bloomberg, Yahoo Finance), your brokerage account.

- Potential Delays: There might be a slight delay (usually a few hours) between the market close and the official publication of the NAV.

The Importance of NAV in Investment Decisions

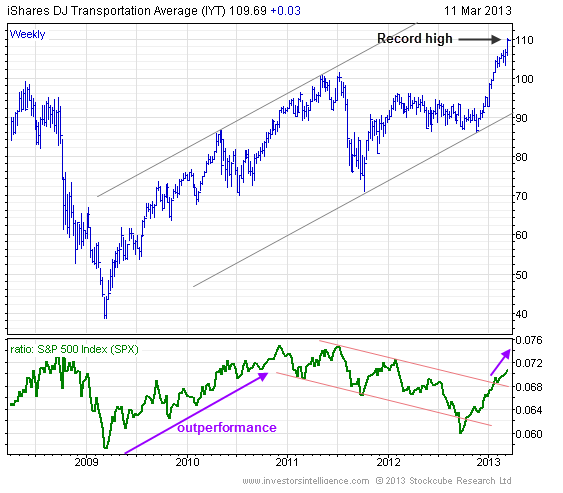

The NAV plays a critical role in evaluating the performance of the Amundi Dow Jones Industrial Average UCITS ETF. By tracking changes in the NAV over time, you can assess your investment returns. Comparing the NAV of this ETF to others tracking similar indices allows you to benchmark performance. Understanding NAV facilitates informed investment decisions, enabling you to make strategic adjustments to your portfolio based on market conditions and your investment goals. Keywords: ETF performance, investment returns, comparing ETFs, investment decisions.

- Example Scenarios: A rising NAV indicates positive performance, while a falling NAV suggests underperformance. Comparing the NAV's growth against other similar ETFs helps determine if the Amundi DJIA ETF is meeting your expectations.

- Reflecting Market Movements: Changes in the NAV directly mirror the movements of the Dow Jones Industrial Average.

- Long-Term Investment Planning: Analyzing long-term NAV trends helps in understanding the growth potential of the ETF and making informed long-term investment decisions.

Conclusion: Mastering the Net Asset Value (NAV) of Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Understanding the Net Asset Value (NAV) of the Amundi Dow Jones Industrial Average UCITS ETF is fundamental to successful investing. Regularly checking the NAV, readily available through various sources, helps you monitor performance, compare it to other investment options, and make well-informed decisions. By utilizing NAV data effectively, you enhance your ability to manage your investment portfolio strategically. Keywords: Amundi Dow Jones Industrial Average UCITS ETF, NAV, Net Asset Value, investment decisions, informed investing.

Call to Action: Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its NAV by visiting [link to Amundi website]. Understanding your Net Asset Value is key to successful ETF investing!

Featured Posts

-

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 24, 2025 -

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 24, 2025

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 24, 2025 -

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Net Asset Value Nav Explained Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025

89 Svadeb V Krasivuyu Datu Na Kharkovschine Rekord Dnya

May 24, 2025 -

France Considers Tougher Sentences For Young Criminals

May 24, 2025

France Considers Tougher Sentences For Young Criminals

May 24, 2025

Latest Posts

-

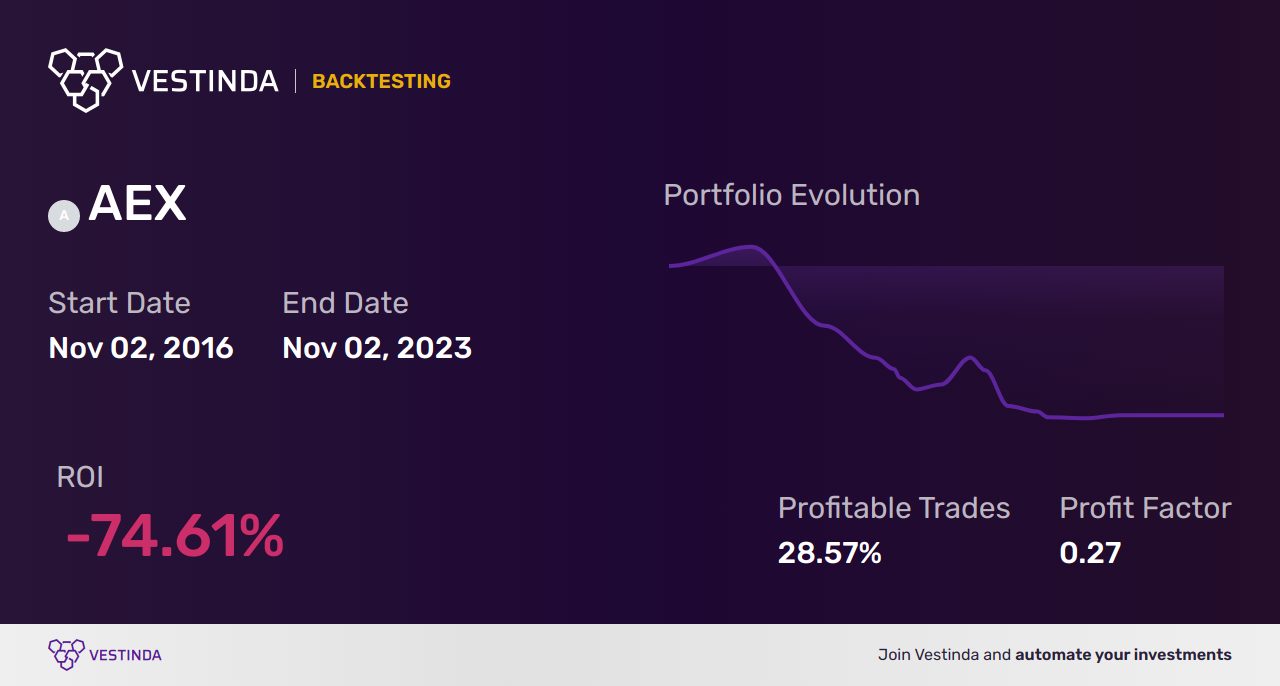

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025

Na Uitstel Trump Sterke Winsten Voor Alle Aex Aandelen

May 24, 2025 -

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025

Aex Index Crumbles More Than 4 Loss Lowest Point In 12 Months

May 24, 2025 -

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025

Aex Stijgt Na Trump Uitstel Positief Sentiment Voor Alle Fondsen

May 24, 2025 -

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025

Amsterdam Aex Index Suffers Sharpest Fall In Over A Year

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025