Warren Buffett On Leadership: The Importance Of Avoiding Unforced Errors

Table of Contents

Buffett's Emphasis on Risk Management and Discipline

Warren Buffett's aversion to unnecessary risk is legendary. He prioritizes long-term value creation over short-term gains, a principle that forms the bedrock of his investment strategies and leadership approach. He meticulously analyzes businesses before investing, focusing on their intrinsic value and long-term prospects rather than chasing fleeting market trends. This disciplined approach directly translates to leadership, emphasizing careful planning and calculated decision-making over impulsive actions.

- Examples of Buffett's disciplined investment strategies: His long-term holdings in companies like Coca-Cola and American Express demonstrate his patience and focus on fundamental analysis, avoiding the pitfalls of short-term speculation.

- Emphasis on thorough due diligence and understanding the business: Buffett famously spends countless hours researching companies, gaining a deep understanding of their operations, management, and competitive landscape before committing to an investment. This translates to leaders needing to thoroughly understand the challenges and opportunities facing their organizations before making critical decisions.

- Avoiding speculative investments and emotional decision-making: Buffett’s consistent avoidance of speculative bubbles and emotionally driven investments serves as a powerful lesson in disciplined leadership. Staying calm under pressure and resisting the urge to react impulsively are crucial components of effective leadership.

Identifying and Eliminating Potential Pitfalls (Unforced Errors)

Identifying and eliminating potential "unforced errors" is a crucial aspect of effective leadership. These are mistakes that could have been avoided with better planning, foresight, or self-awareness. Preventing these errors requires a proactive approach to risk management and a commitment to continuous improvement.

- Regular self-reflection and seeking feedback: Honest self-assessment is critical. Leaders should regularly reflect on their decisions and seek constructive feedback from trusted advisors and colleagues.

- Building strong teams with diverse perspectives: A team with varied backgrounds and expertise can help identify blind spots and potential pitfalls that a single individual might miss. Diverse perspectives are crucial in preventing unforced errors.

- Developing robust processes and checklists to avoid oversights: Implementing standardized procedures and checklists can help minimize errors caused by human oversight or forgetfulness. This systematic approach ensures thoroughness and consistency in decision-making.

- Utilizing scenario planning to prepare for potential challenges: Proactive scenario planning allows leaders to anticipate and mitigate potential risks before they escalate into significant problems. This foresight is invaluable in avoiding unforced errors.

The Power of Patience and Long-Term Vision

Buffett’s remarkable success stems in part from his unwavering long-term perspective. He consistently resists short-term pressures, understanding that lasting value is built over time. This patience and long-term vision are vital qualities for effective leadership.

- Resisting short-term pressures and market volatility: Just as Buffett avoids reacting to short-term market fluctuations, leaders should resist the temptation to make hasty decisions based on immediate pressures. Focusing on long-term goals is key.

- Focusing on core competencies and sustainable growth: Buffett prioritizes companies with sustainable competitive advantages and strong underlying businesses. Similarly, leaders should concentrate on developing core competencies and fostering long-term, sustainable growth within their organizations.

- Building a culture of patience and perseverance: A culture that values patience and perseverance is essential for navigating challenges and achieving long-term success. This requires clear communication and consistent reinforcement of long-term goals.

- Examples from Berkshire Hathaway's investment history: Berkshire Hathaway’s long-term investments in companies like Coca-Cola demonstrate the power of patience and the rewards of a long-term vision.

Delegation and Building a Strong Team

Effective delegation is a cornerstone of Buffett’s leadership style. He understands that relying solely on oneself leads to burnout and increases the likelihood of making mistakes. Surrounding himself with competent individuals allows him to focus on strategic decision-making, minimizing the potential for unforced errors.

- Hiring individuals with strong character and expertise: Buffett values individuals with integrity, competence, and a strong work ethic. Leaders should prioritize hiring talented individuals who complement their own skills and experience.

- Empowering team members and fostering collaboration: Delegation isn't just about assigning tasks; it's about empowering team members to take ownership and collaborate effectively.

- Establishing clear responsibilities and accountability: Clearly defined roles and responsibilities ensure that everyone understands their contribution and is accountable for their performance. This minimizes confusion and potential errors.

- Promoting open communication and feedback: Open communication fosters trust and facilitates the identification of potential problems early on, enabling proactive solutions and minimizing the likelihood of serious errors.

Conclusion: Mastering Leadership Through Error Prevention – The Warren Buffett Way

In conclusion, Warren Buffett's leadership philosophy provides invaluable insights into minimizing unforced errors. By emphasizing disciplined risk management, cultivating self-awareness, prioritizing patience and a long-term vision, and building strong, empowered teams, leaders can significantly improve their decision-making and achieve lasting success. The key takeaway is that preventing leadership errors isn't about eliminating risk entirely; it's about understanding and mitigating those risks that are within your control. Analyze your leadership style, focusing on incorporating Buffett's principles to minimize unforced errors in your business and achieve greater success. Consider further reading on Warren Buffett's investment philosophy and leadership strategies to deepen your understanding of this powerful approach to preventing leadership errors and maximizing long-term success.

Featured Posts

-

Jenna Ortega And Glen Powells Upcoming Film What We Know

May 07, 2025

Jenna Ortega And Glen Powells Upcoming Film What We Know

May 07, 2025 -

Oscar Winning Actors White Lotus Appearance Explained

May 07, 2025

Oscar Winning Actors White Lotus Appearance Explained

May 07, 2025 -

Dzheki Chan 71 Godini Schastliv Rozhden Den Na Legendata

May 07, 2025

Dzheki Chan 71 Godini Schastliv Rozhden Den Na Legendata

May 07, 2025 -

How The Pope Is Elected A Comprehensive Guide To The Conclave

May 07, 2025

How The Pope Is Elected A Comprehensive Guide To The Conclave

May 07, 2025 -

Steelers Key Decision Wide Receivers Future Revealed

May 07, 2025

Steelers Key Decision Wide Receivers Future Revealed

May 07, 2025

Latest Posts

-

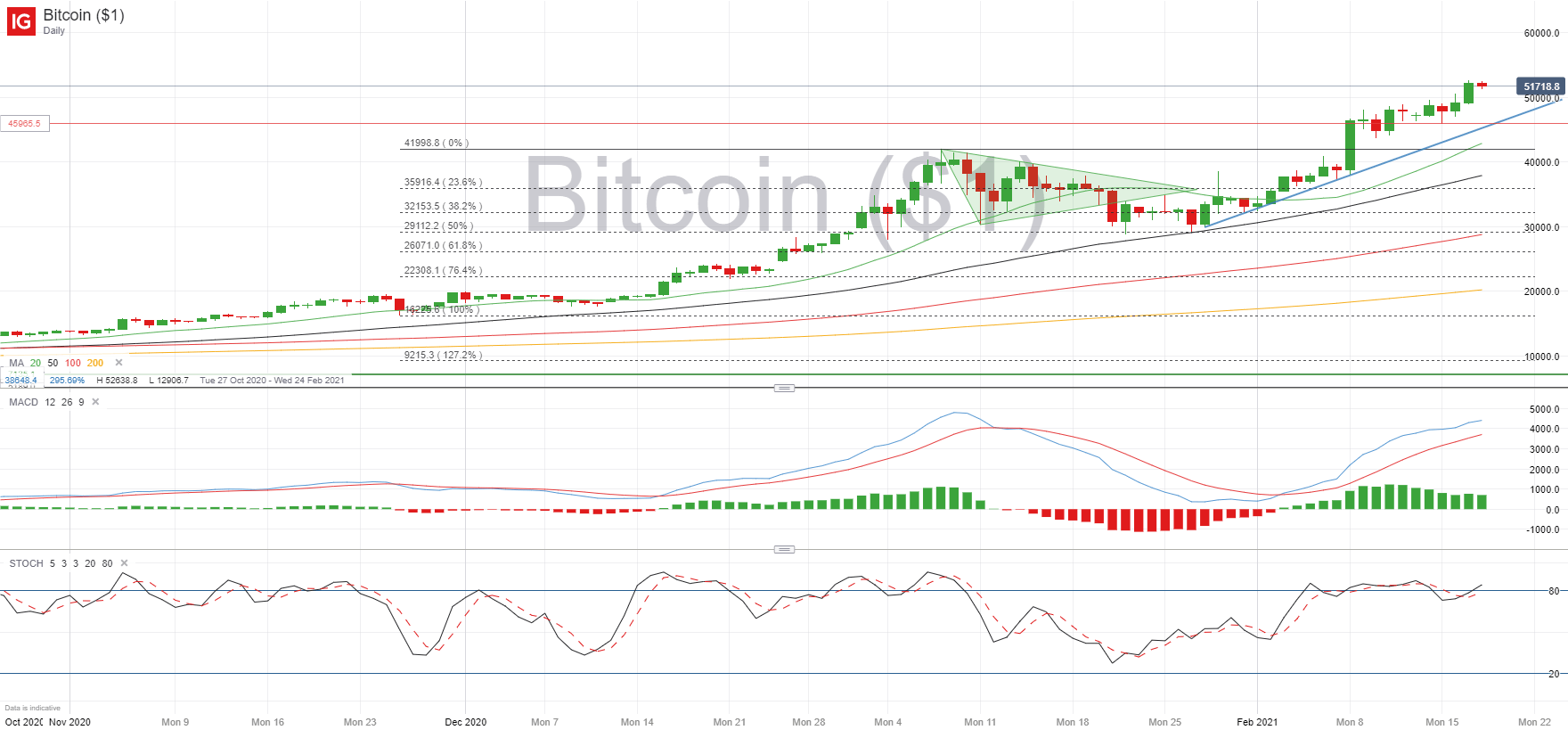

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025

Understanding Bitcoins Rebound Risks And Opportunities

May 08, 2025 -

2024

May 08, 2025

2024

May 08, 2025 -

The Bitcoin Rebound Signs Of A Lasting Recovery

May 08, 2025

The Bitcoin Rebound Signs Of A Lasting Recovery

May 08, 2025 -

Could Bitcoin Reach New Heights A 1 500 Growth Forecast

May 08, 2025

Could Bitcoin Reach New Heights A 1 500 Growth Forecast

May 08, 2025 -

Analyzing Bitcoins Rebound Potential For Future Growth

May 08, 2025

Analyzing Bitcoins Rebound Potential For Future Growth

May 08, 2025