Why Current Stock Market Valuations Aren't As Risky As You Think (BofA)

Table of Contents

The Influence of Corporate Earnings and Profitability

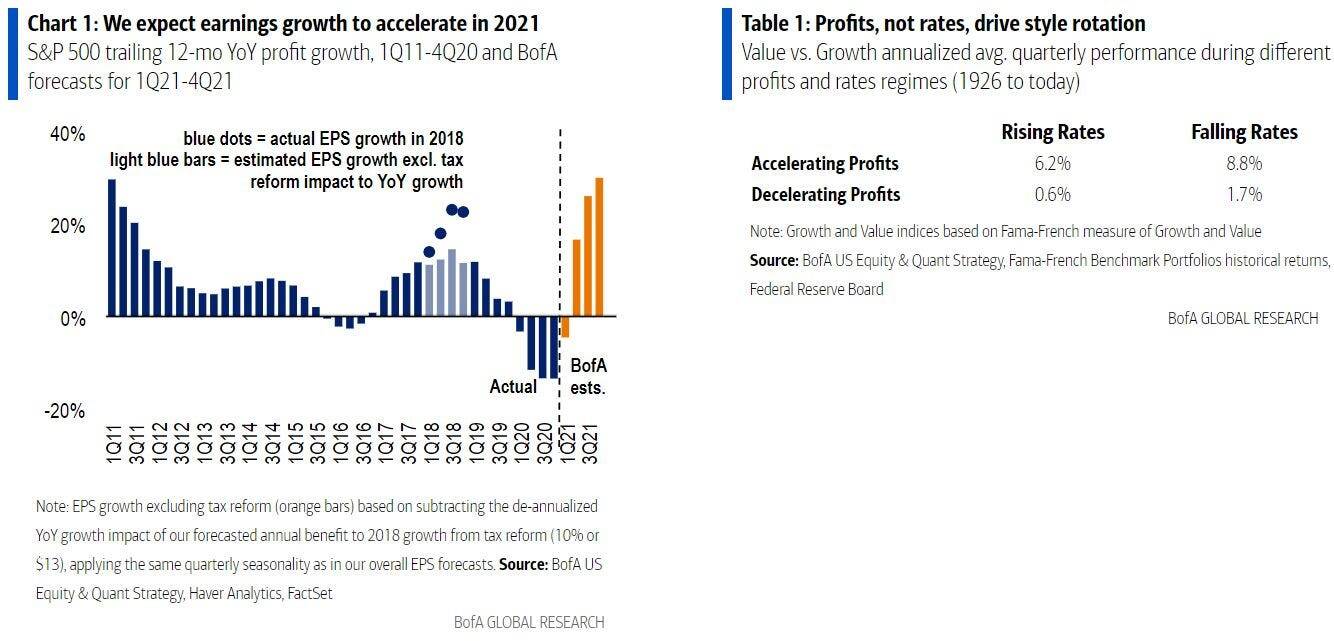

Strong corporate earnings and healthy profit margins can significantly justify seemingly high stock market valuations. Ignoring this fundamental aspect of valuation leads to a skewed perception of risk. Let's examine the key relationships:

-

Earnings growth and P/E ratios: A high price-to-earnings (P/E) ratio often signals a high valuation. However, a company with robust earnings growth can justify a higher P/E ratio. Rapid earnings growth suggests future profitability, making the current price more palatable. Investors are essentially paying a premium for anticipated future earnings.

-

High-valuation, high-growth companies: Many tech companies and innovative businesses exhibit high valuations alongside impressive earnings growth. While their P/E ratios might appear elevated compared to more mature industries, their trajectory of expanding revenue and profits often warrants the higher valuation multiple. Analyzing individual company performance is crucial here.

-

Beyond P/E ratios: While the P/E ratio is a commonly used valuation metric, it’s essential to consider other factors. The Price-to-Earnings-to-Growth (PEG) ratio adjusts the P/E ratio for earnings growth rate, providing a more nuanced picture. Similarly, the price-to-sales ratio can be valuable for companies with negative earnings but strong revenue growth.

The Role of Interest Rates and Inflation in Shaping Valuations

Interest rate hikes and inflation undeniably impact stock market valuations. However, the situation may not be as dire as initially perceived. Understanding the nuances of these relationships is key:

-

Interest rates and the discount rate: Rising interest rates directly influence the discount rate used in Discounted Cash Flow (DCF) models. A higher discount rate reduces the present value of future cash flows, potentially leading to lower valuations. However, if earnings growth outpaces the increase in interest rates, the impact on valuations might be less dramatic.

-

Inflation and earnings growth: Inflation can impact both earnings and valuations. While higher inflation can erode purchasing power, it can also push companies to increase prices, leading to higher earnings – provided demand remains strong. The net effect depends on the interplay between inflation and the ability of companies to pass on increased costs to consumers.

-

BofA's interest rate predictions: BofA's analysts frequently publish reports outlining their predictions for future interest rate movements and their anticipated impact on the market. These forecasts, while not guarantees, offer valuable insights into the potential trajectory of valuations. Analyzing their reasoning and assumptions is vital for making informed investment decisions.

Long-Term Growth Potential and Technological Advancements

Technological advancements and long-term growth potential play a crucial role in supporting current valuations, even amidst near-term uncertainties. Focusing solely on short-term volatility can obscure significant long-term opportunities:

-

High-growth sectors: Sectors like technology, renewable energy, and biotechnology are experiencing rapid growth, driven by innovation and increasing demand. Companies in these sectors often command premium valuations reflecting their potential for future earnings expansion.

-

Technological innovation and future earnings: Disruptive technologies are constantly reshaping industries, creating new markets and opportunities for substantial earnings growth. Investing in companies at the forefront of these advancements might justify higher valuations, even if current profits are modest.

-

Premium valuations and long-term prospects: Investors are willing to pay premium valuations for companies with strong long-term growth prospects. The potential for exponential growth in the future can easily outweigh concerns about current valuations, particularly in rapidly evolving industries.

BofA's Specific Arguments and Market Outlook

BofA Global Research frequently publishes detailed reports analyzing market conditions and offering investment recommendations. Understanding their perspective is crucial for a comprehensive risk assessment:

-

Key arguments: BofA's arguments often emphasize the strength of corporate earnings and the resilience of the economy despite inflationary pressures and rising interest rates. They frequently highlight the potential for sustained growth in specific sectors.

-

Market forecasts and recommendations: BofA regularly provides market forecasts and investment recommendations, outlining their preferred asset allocation strategies based on their analysis of current stock market valuations and the broader economic outlook.

-

Caveats and risks: It's crucial to note that even BofA acknowledges potential risks and uncertainties. Their analyses typically include caveats and highlight potential downside scenarios, allowing for a more balanced and informed perspective.

Conclusion

This analysis shows that while high stock market valuations can be concerning, a deeper look reveals factors such as strong corporate earnings, the potential impact of future interest rate movements, and exciting technological growth trends that might mitigate the perceived risk. BofA's perspective underscores the importance of considering various factors beyond simple valuation metrics when assessing market risk. While this article provides insights into why current stock market valuations might not be as alarming as they seem, thorough due diligence and a diversified investment strategy remain crucial. Understanding the nuances of current stock market valuations is key to informed decision-making. Conduct your own research and consult with a financial advisor before making any investment decisions based on this information regarding current stock market valuations.

Featured Posts

-

160km Mlb

Apr 29, 2025

160km Mlb

Apr 29, 2025 -

A Deep Dive Into Ai Cognition Understanding Its Capabilities And Limitations

Apr 29, 2025

A Deep Dive Into Ai Cognition Understanding Its Capabilities And Limitations

Apr 29, 2025 -

Us Pressure Fails To Sway Hungary On China Economic Relations

Apr 29, 2025

Us Pressure Fails To Sway Hungary On China Economic Relations

Apr 29, 2025 -

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025

Tragedy Strikes Georgia Deputy Killed Colleague Injured In Traffic Stop

Apr 29, 2025 -

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Israel Facing Pressure To Lift Gaza Aid Ban Amidst Shortages

Apr 29, 2025

Latest Posts

-

Willie Nelson Documentary Austins Biggest Story This Week

Apr 29, 2025

Willie Nelson Documentary Austins Biggest Story This Week

Apr 29, 2025 -

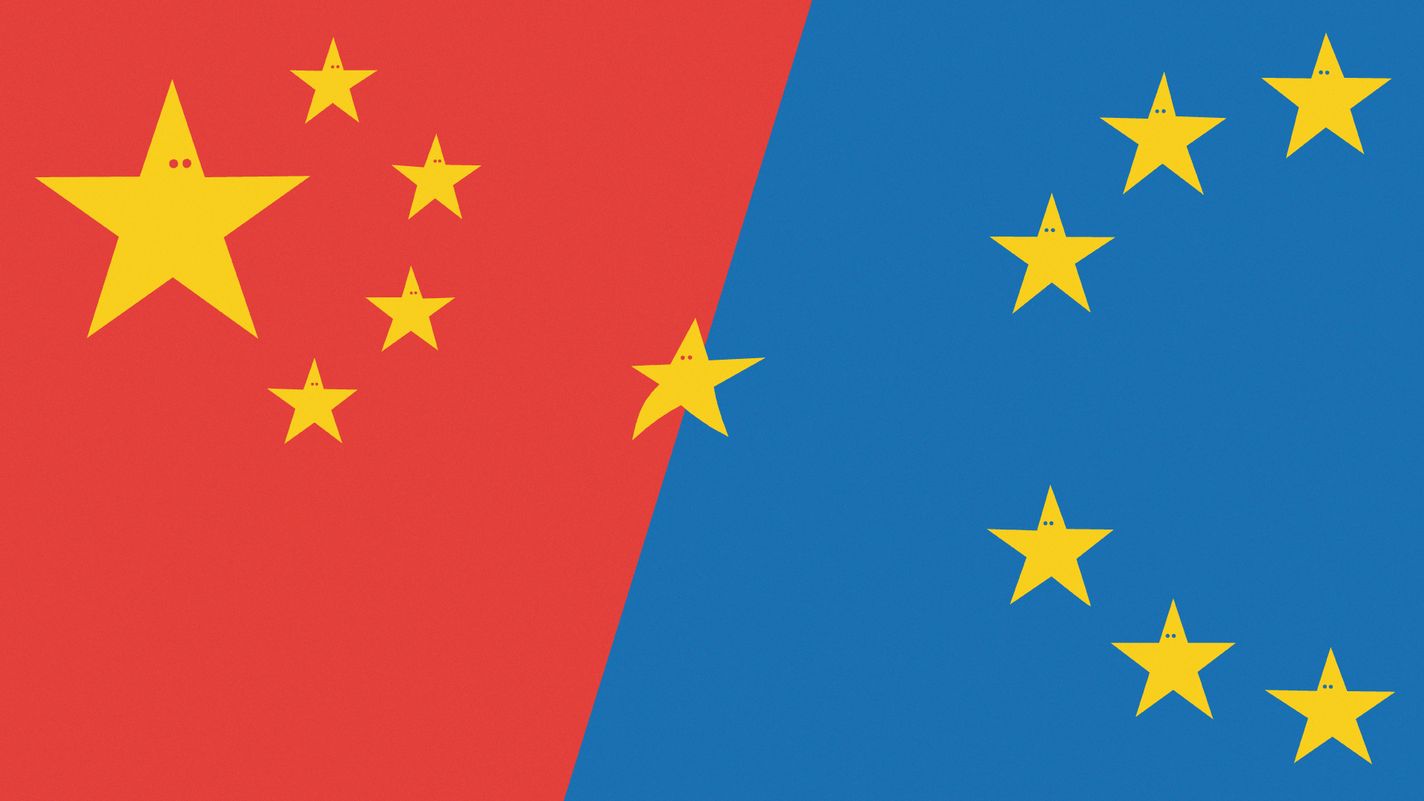

Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025

Weak Retail Sales Signal Potential Bank Of Canada Rate Cuts

Apr 29, 2025 -

Economists Predict Rate Cuts Amid Weak Retail Sales

Apr 29, 2025

Economists Predict Rate Cuts Amid Weak Retail Sales

Apr 29, 2025 -

Wife Of Country Music Legend Addresses Sons Caretaker Rumors

Apr 29, 2025

Wife Of Country Music Legend Addresses Sons Caretaker Rumors

Apr 29, 2025 -

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcom Acquisition

Apr 29, 2025

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcom Acquisition

Apr 29, 2025