XRP Outperforms Bitcoin And Top Cryptos Following SEC Grayscale ETF Filing Acknowledgment

Table of Contents

XRP's Price Surge and Market Capitalization

XRP's price has skyrocketed, leaving Bitcoin and Ethereum in its wake. Over the past [specify timeframe, e.g., week/month], XRP’s price increased by [specific percentage], a dramatic contrast to Bitcoin's [Bitcoin percentage change] and Ethereum's [Ethereum percentage change] increase during the same period. This substantial gain has propelled XRP's market capitalization, solidifying its position among the top [XRP ranking] cryptocurrencies.

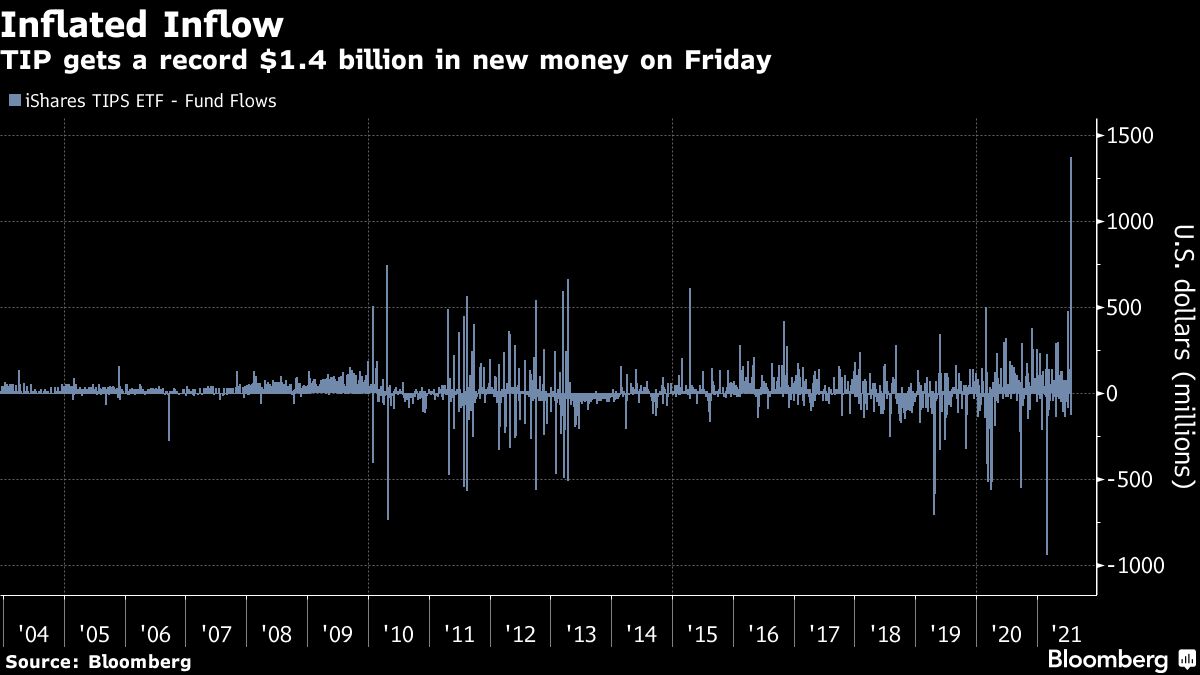

[Insert chart or graph visually representing XRP, Bitcoin, and Ethereum price movements over the specified timeframe].

- Specific Percentage Price Increase: XRP saw a [specific percentage]% increase in price from [date] to [date].

- Performance Comparison: XRP significantly outperformed Bitcoin and Ethereum, showcasing its independent market momentum.

- Trading Volume Spikes: Notable increases in trading volume accompanied the price surge, indicating significant market activity and investor interest.

The Impact of the SEC's Acknowledgment of the Grayscale ETF Filing

The SEC's acknowledgment of Grayscale's Bitcoin spot ETF application is a pivotal moment for the cryptocurrency industry. This positive development signals a potential shift towards greater regulatory clarity and acceptance of cryptocurrencies in the United States. The ripple effect could be substantial, potentially boosting investor confidence and driving increased investment across the entire crypto market, benefiting altcoins like XRP. Many market analysts believe this decision could unlock significant institutional investment into crypto.

- Bitcoin Spot ETF Implications: A Bitcoin spot ETF would provide a regulated and accessible investment vehicle for institutional investors, potentially bringing billions of dollars into the cryptocurrency market.

- Investor Sentiment: The SEC's action could significantly improve investor sentiment, reducing uncertainty and encouraging further investment.

- Regulatory Clarity: Increased regulatory clarity could attract more institutional investors and legitimize the cryptocurrency market further.

XRP's Unique Position and Potential Advantages

XRP distinguishes itself through its speed and low transaction costs. Designed as a fast and efficient payment system, it offers potential advantages over other cryptocurrencies, particularly in cross-border transactions. Several partnerships and developments have also contributed to the recent price surge, highlighting its growing adoption and potential.

- Technological Advantages: XRP's technology allows for rapid and inexpensive transactions, making it attractive for various financial applications.

- Financial Institution Adoption: Increased interest from financial institutions and potential partnerships could significantly boost XRP's value and adoption.

- Recent News and Partnerships: [Mention specific news or partnerships that have positively impacted XRP's value, linking to relevant sources if possible].

Analyzing the Correlation (or Lack Thereof) Between XRP and Bitcoin

While many altcoins tend to follow Bitcoin's price movements, XRP's recent performance suggests a degree of decoupling. The correlation coefficient between XRP and Bitcoin's price movements during [specify timeframe] is [insert correlation coefficient]. This suggests that XRP is demonstrating independent momentum, potentially influenced more by its unique characteristics and market factors than by Bitcoin's price action alone.

- Correlation Coefficient: A low correlation coefficient indicates a weaker relationship between XRP and Bitcoin price movements.

- Influencing Factors: Factors such as the SEC's actions, XRP's specific use cases, and independent market sentiment likely contribute to this decoupling.

- Comparison with Other Altcoins: [Compare XRP's correlation with Bitcoin to other prominent altcoins to highlight its unique behavior].

Conclusion

XRP's recent outperformance against Bitcoin and other top cryptocurrencies is noteworthy, driven by a confluence of factors, including the SEC's acknowledgment of the Grayscale ETF filing and XRP's own unique characteristics and developments. The potential for increased regulatory clarity and institutional investment in crypto is a significant catalyst, boosting investor confidence and driving demand for altcoins like XRP. Keep a close eye on XRP's performance and consider its potential as the cryptocurrency market reacts to the SEC's actions. Learn more about XRP investment opportunities today! Research XRP price prediction models and track XRP performance for informed investment decisions.

Featured Posts

-

The Rise And Fall Of Skype A Technological Analysis

May 07, 2025

The Rise And Fall Of Skype A Technological Analysis

May 07, 2025 -

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025

Alkhtwt Almlkyt Almghrbyt Tezz Rhlatha Byn Saw Bawlw Waldar Albydae

May 07, 2025 -

The Young And The Restless Is Claires Pregnancy The Key To Saving Summer

May 07, 2025

The Young And The Restless Is Claires Pregnancy The Key To Saving Summer

May 07, 2025 -

Wnba Las Vegas Aces Megan Gustafson Out Indefinitely Due To Leg Injury

May 07, 2025

Wnba Las Vegas Aces Megan Gustafson Out Indefinitely Due To Leg Injury

May 07, 2025 -

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025

Playoff Stars Emerge Mitchell And Brunson Shine Bright

May 07, 2025

Latest Posts

-

110 Growth Potential Analyzing The Billionaire Backed Black Rock Etf For 2025

May 08, 2025

110 Growth Potential Analyzing The Billionaire Backed Black Rock Etf For 2025

May 08, 2025 -

Wall Street Predicts 110 Jump Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025

Wall Street Predicts 110 Jump Why Billionaires Are Investing In This Black Rock Etf

May 08, 2025 -

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025

Is Bitcoins Rebound Just The Beginning A Comprehensive Analysis

May 08, 2025 -

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025

Black Rock Etf Billionaire Investment Signals Potential 110 Surge In 2025

May 08, 2025 -

Billionaires 110 Etf Bet Black Rock Fund Poised For Massive Growth In 2025

May 08, 2025

Billionaires 110 Etf Bet Black Rock Fund Poised For Massive Growth In 2025

May 08, 2025