XRP's Path To Record High: Grayscale ETF Filing And Market Analysis

Table of Contents

The Ripple Effect of Grayscale's Bitcoin ETF Filing on XRP

A successful Bitcoin ETF could have significant implications for the entire cryptocurrency market, including XRP. This ripple effect stems from several key factors.

Increased Regulatory Clarity

A successful Bitcoin ETF application would likely lead to increased regulatory clarity within the crypto space. This is because the SEC's approval would set a precedent, potentially influencing their future decisions on other cryptocurrencies like XRP.

- Increased institutional investment: Regulatory clarity reduces risk for institutional investors, encouraging larger investments in the crypto market.

- Reduced regulatory uncertainty: Clearer regulatory guidelines lessen the uncertainty surrounding cryptocurrency investments, making them more attractive.

- Positive sentiment shift in the market: Positive regulatory developments generally boost investor confidence and lead to a more bullish market sentiment.

The SEC's approval of a Bitcoin ETF could be a significant domino effect, signaling a more accepting regulatory environment for other digital assets and potentially paving the way for greater XRP adoption by institutional investors.

Boosting Investor Confidence

A successful Bitcoin ETF filing would significantly boost investor confidence, impacting not only Bitcoin but also the broader crypto market, including XRP.

- More institutional investors entering the market: The success of a Bitcoin ETF would demonstrate the viability and legitimacy of crypto investments to institutional players.

- Attracting retail investors: Increased institutional involvement attracts retail investors, leading to greater market participation and increased demand.

- Increasing liquidity: More investors mean higher trading volumes, resulting in improved market liquidity and reduced price volatility for assets like XRP.

The psychological impact of a successful ETF launch cannot be overstated. It would signify a major step towards mainstream acceptance of cryptocurrencies and could trigger a significant positive shift in market sentiment, benefiting XRP along with other altcoins.

Increased Market Liquidity

The influx of institutional capital through ETFs significantly increases market liquidity. This directly impacts the price stability and growth potential of assets like XRP.

- Reduced price volatility: Higher trading volume absorbs shocks, making price movements smoother and less susceptible to manipulation.

- Increased trading volume: More buyers and sellers mean more frequent transactions, leading to faster price discovery and more efficient price adjustments.

- Better price discovery: Greater liquidity ensures that prices more accurately reflect the true market value of the asset.

Increased liquidity is crucial for XRP's price appreciation. It allows for smoother price movements, making it less vulnerable to wild swings and creating a more predictable and reliable market for investors.

Fundamental Analysis of XRP's Potential

Beyond the broader market influences, XRP possesses inherent strengths that contribute to its potential for growth.

Technological Advancements

XRP's technology is designed for fast, low-cost cross-border payments, a significant advantage over traditional financial systems.

- Fast transaction speeds: XRP transactions are significantly faster than traditional bank transfers, making it ideal for real-time payments.

- Low transaction fees: The cost of sending XRP is considerably lower compared to many other cryptocurrencies and traditional payment systems.

- Scalability solutions: XRP's underlying technology is designed to handle a large volume of transactions, making it suitable for widespread adoption.

These technological advantages position XRP as a competitive player in the rapidly growing cross-border payment market, attracting both individuals and institutions seeking efficient and cost-effective solutions.

Growing Institutional Adoption

XRP is increasingly gaining traction within the financial industry, driven by its utility in remittance and payment solutions.

- Partnerships with banks and payment processors: Ripple, the company behind XRP, has established partnerships with numerous financial institutions, expanding XRP's reach and usage.

- Increasing use cases: XRP's adoption is growing across diverse industries, demonstrating its real-world utility beyond speculation.

- Growing network effect: The larger the XRP network becomes, the more valuable it becomes, reinforcing its position in the market.

The growing adoption by financial institutions signifies a shift towards mainstream acceptance, supporting the long-term growth potential of XRP.

Ripple's Ongoing Legal Battle

The ongoing legal battle between Ripple and the SEC is a crucial factor influencing XRP's price.

- Potential outcomes of the lawsuit: The case's outcome could significantly impact XRP's regulatory status and investor sentiment.

- Impact on investor sentiment: Uncertainty surrounding the lawsuit can lead to price volatility and potentially dampen investor enthusiasm.

- Market reaction scenarios: Different outcomes could lead to dramatically different market reactions, ranging from significant price increases to substantial decreases.

It's vital to acknowledge the uncertainty surrounding the lawsuit. A positive outcome could lead to a surge in XRP's price, while a negative outcome could negatively impact its value. Maintaining a balanced perspective is crucial when considering XRP's future.

Market Analysis and Price Prediction

To formulate a price prediction for XRP, we need to consider technical indicators and overall market sentiment.

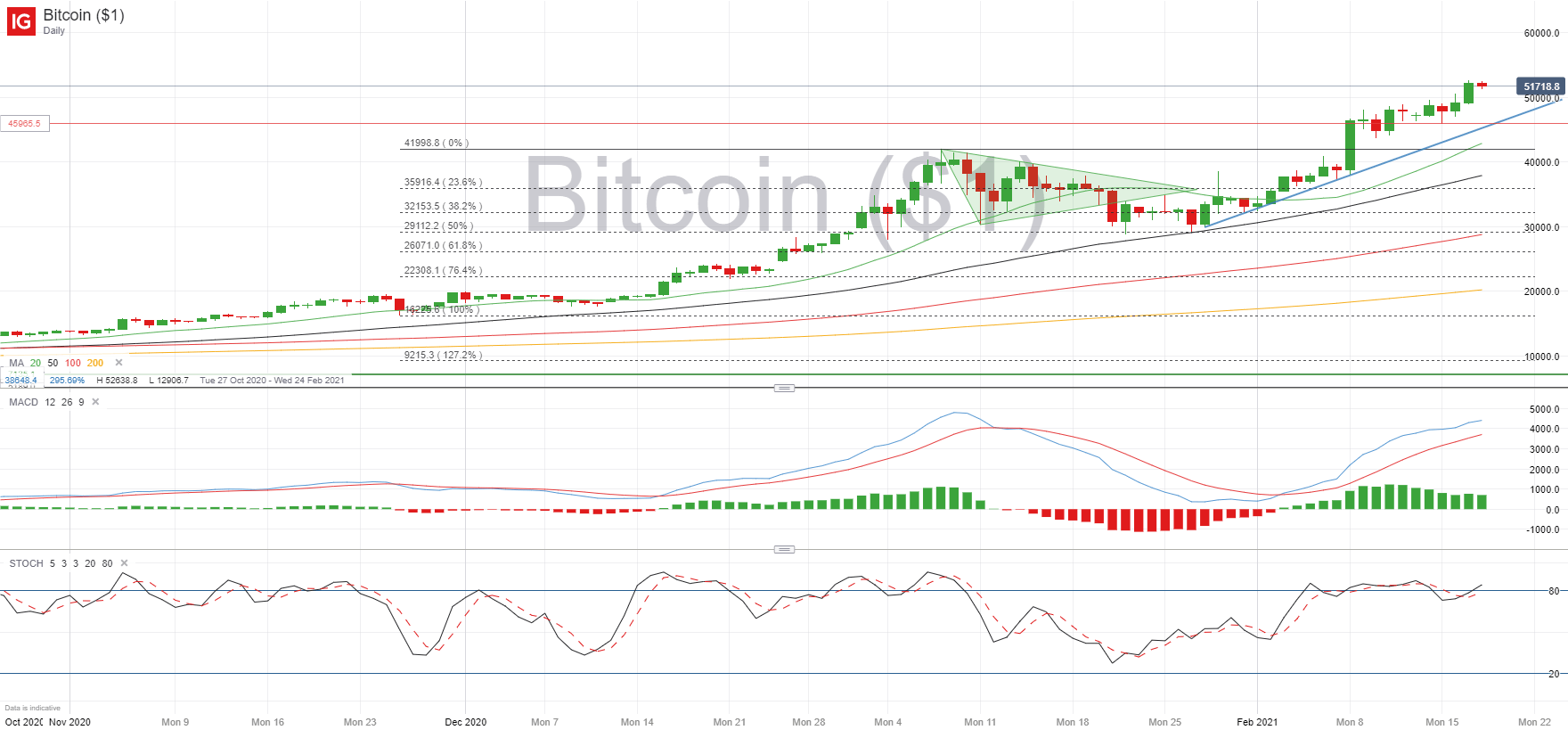

Technical Indicators

Analyzing technical indicators provides insights into potential price movements.

- Key support and resistance levels: Identifying these levels helps determine potential price reversal points.

- Trend analysis: Analyzing the overall trend (uptrend, downtrend, or sideways) helps predict future price direction.

- Potential breakout points: Identifying points where the price might break through support or resistance levels can signal significant price changes.

(Include charts and graphs here to visually represent technical analysis)

Market Sentiment

Gauging market sentiment is critical in predicting price movements.

- Social media sentiment: Analyzing social media discussions about XRP can reflect public opinion and expectations.

- News coverage: Positive or negative news coverage can significantly impact investor sentiment and price.

- Expert opinions: Following expert opinions and analyses can provide further insights into the potential future price movements.

A balanced assessment of bullish and bearish perspectives is necessary for a realistic prediction.

Price Target and Timeline

Based on the analysis above, a conservative price target for XRP within the next 12-18 months could be [Insert Conservative Price Target Here], while an optimistic scenario could reach [Insert Optimistic Price Target Here]. However, it is important to note that these are just estimations based on current trends, and the actual price could differ significantly.

- Conservative estimate: [Insert details and justification]

- Optimistic scenario: [Insert details and justification]

- Factors affecting the timeline: The Ripple lawsuit outcome, broader market trends, and adoption rate are key factors influencing the timeline.

Conclusion

The Grayscale ETF filing has injected renewed optimism into the cryptocurrency market, and XRP, with its unique combination of technological strength and growing institutional adoption, is well-positioned to benefit. While the Ripple lawsuit remains a significant factor, positive developments in the regulatory landscape and increased market liquidity could drive XRP towards a new record high. Further analysis of technical indicators and market sentiment strengthens this projection. Stay informed on XRP developments and continue to monitor the market closely to potentially capitalize on this exciting opportunity. Keep researching XRP and its potential for future growth.

Featured Posts

-

7 Sezon Chernogo Zerkala Chto Izvestno O Date Vykhoda 13 Marta 2025

May 07, 2025

7 Sezon Chernogo Zerkala Chto Izvestno O Date Vykhoda 13 Marta 2025

May 07, 2025 -

Detroit Tigers Secure First Win 9 6 Victory Against Seattle Mariners

May 07, 2025

Detroit Tigers Secure First Win 9 6 Victory Against Seattle Mariners

May 07, 2025 -

2025 Nhl Draft Lottery What Utah Hockey Fans Need To Know

May 07, 2025

2025 Nhl Draft Lottery What Utah Hockey Fans Need To Know

May 07, 2025 -

Tom Holland And Zendaya A Paws And Love Encounter On The Euphoria Set

May 07, 2025

Tom Holland And Zendaya A Paws And Love Encounter On The Euphoria Set

May 07, 2025 -

Ripples Xrp Whale Acquires 20 Million Tokens Whats Next

May 07, 2025

Ripples Xrp Whale Acquires 20 Million Tokens Whats Next

May 07, 2025

Latest Posts

-

Could Bitcoin Reach New Heights A 1 500 Growth Forecast

May 08, 2025

Could Bitcoin Reach New Heights A 1 500 Growth Forecast

May 08, 2025 -

Analyzing Bitcoins Rebound Potential For Future Growth

May 08, 2025

Analyzing Bitcoins Rebound Potential For Future Growth

May 08, 2025 -

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In Five Years

May 08, 2025 -

Bitcoins Recovery A Deeper Look At The Market Trend

May 08, 2025

Bitcoins Recovery A Deeper Look At The Market Trend

May 08, 2025 -

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025

Bitcoins Potential 1 500 Surge A Growth Investors Prediction

May 08, 2025