Apple Stock Update: Fiscal Q2 Earnings Analysis And Future Outlook

Table of Contents

Q2 2024 Earnings Highlights

Revenue and Earnings per Share (EPS):

Apple reported [Insert Actual Revenue Figure] in revenue for Q2 2024, representing a [Insert Percentage]% year-over-year (YoY) change. Earnings per share (EPS) came in at [Insert Actual EPS Figure], compared to analyst expectations of [Insert Analyst Expectation Figure]. This represents a [Insert Percentage]% YoY change.

- YoY Growth Comparison: While revenue growth was positive, it fell short of some analyst projections, primarily due to [mention specific reasons, e.g., weaker-than-expected iPhone sales in certain regions].

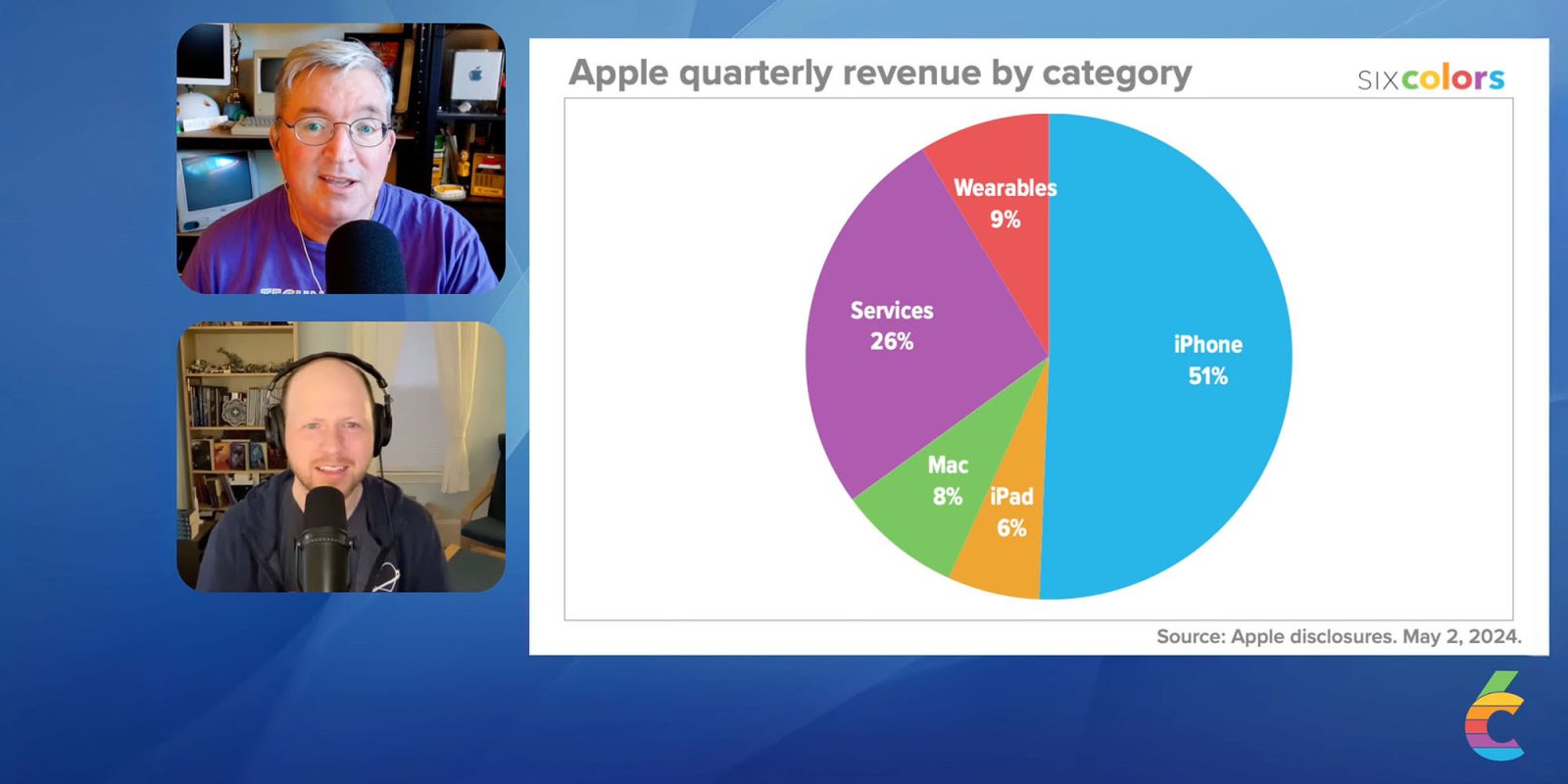

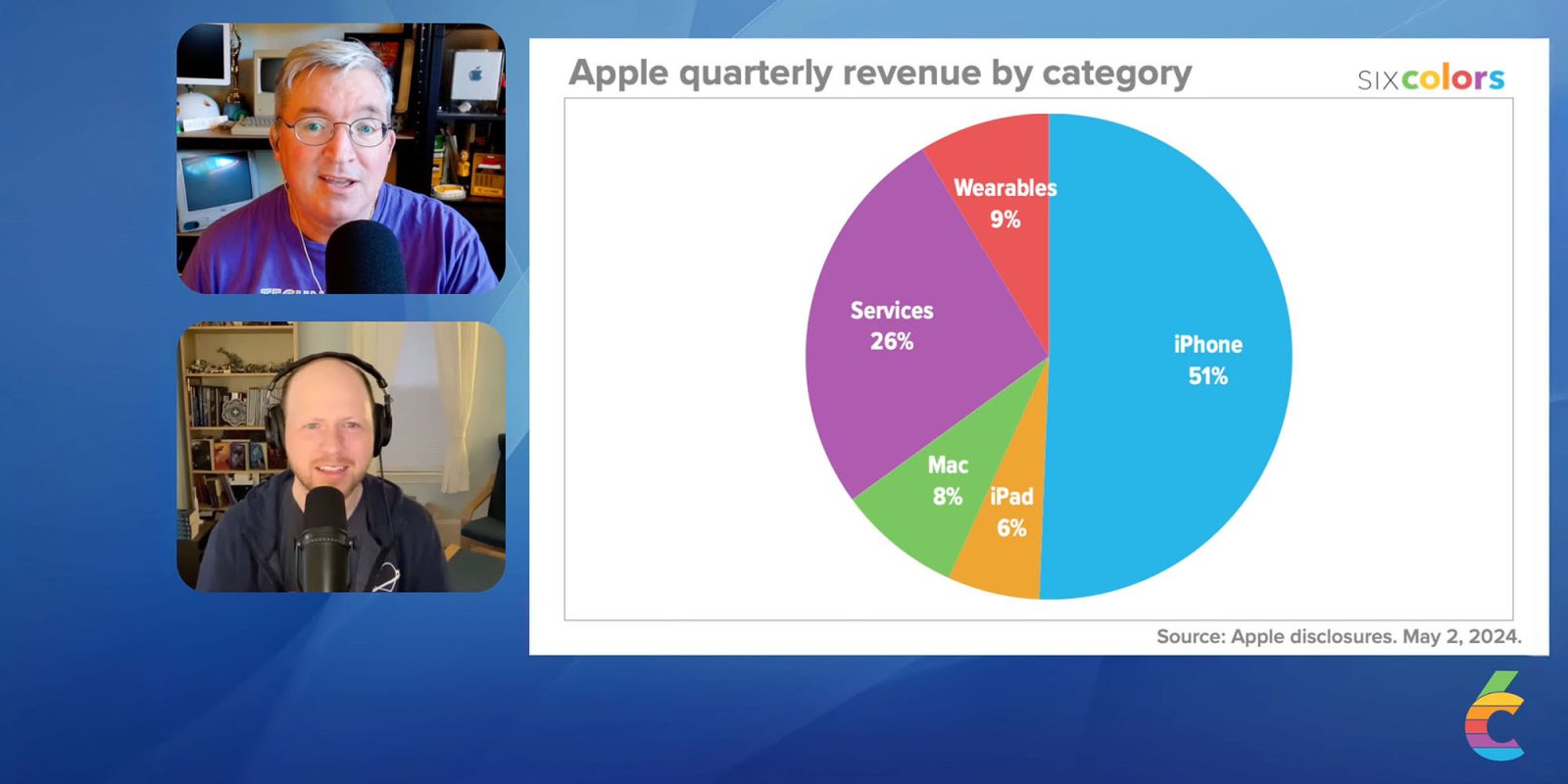

- Key Revenue Drivers: The Services segment continues to be a strong performer, contributing significantly to overall revenue. Growth in this area was driven by increased subscriptions to Apple Music, iCloud, and the App Store. However, iPhone sales, while still substantial, experienced a slight slowdown compared to the previous year.

Product-Specific Performance:

The performance varied across Apple's product lines:

- iPhone: iPhone sales showed a [Insert Percentage]% YoY change, indicating [growth/decline]. This was primarily influenced by [mention factors like new model releases, consumer spending, etc.].

- iPad: The iPad segment saw [Insert Percentage]% YoY growth/decline, attributed to [mention factors influencing performance].

- Mac: Mac sales experienced a [Insert Percentage]% YoY change due to [mention factors like supply chain issues, competition, etc.].

- Wearables, Home, and Accessories: This category showed [Insert Percentage]% YoY growth, driven by strong demand for [mention specific products].

- Services: The Services segment continued its impressive growth trajectory, posting a [Insert Percentage]% YoY increase. This underscores the increasing importance of recurring revenue streams for Apple's long-term profitability.

Geographical Performance:

Apple's geographical performance was mixed:

- Americas: The Americas region showed [Insert Percentage]% YoY growth, maintaining its position as a key market for Apple.

- Europe: Europe experienced [Insert Percentage]% YoY growth/decline, reflecting [mention economic conditions or other relevant factors].

- Greater China: The Greater China region saw [Insert Percentage]% YoY growth/decline, largely influenced by [mention relevant factors like economic slowdown or government policies].

- Japan: Japan showed [Insert Percentage]% YoY growth/decline. [Explain the reasons behind this trend].

Key Factors Influencing Apple Stock

iPhone Sales and Innovation:

iPhone sales remain the cornerstone of Apple's revenue. The success of future iPhone releases will be crucial to maintaining the company's growth trajectory.

- Future iPhone Releases: Anticipation is high for the upcoming [mention rumored iPhone models], which are expected to feature [mention key features and innovations]. These features could significantly impact consumer demand and, consequently, Apple's stock price.

- Market Competition: Intense competition from Android manufacturers continues to put pressure on Apple's market share. Apple needs to continue innovating to maintain its premium pricing strategy.

Services Revenue Growth:

Apple's Services segment is a crucial driver of future growth and profitability. Its recurring revenue streams provide stability and predictability.

- Subscription Growth: Apple continues to see strong growth in its subscription services, with [mention specific growth numbers for key services].

- New Service Offerings: The expansion into new service areas, such as [mention potential new services], presents significant opportunities for revenue diversification and growth.

Supply Chain and Global Economic Conditions:

Global economic uncertainty and potential supply chain disruptions pose ongoing risks to Apple's performance.

- Geopolitical Risks: The ongoing geopolitical tensions and trade disputes could impact Apple's manufacturing and distribution network.

- Inflationary Pressures: Rising inflation and increased component costs could squeeze Apple's profit margins.

Future Outlook and Investment Implications

Analyst Ratings and Price Targets:

Analyst ratings on Apple stock are currently [mention overall sentiment – e.g., mostly positive, mixed]. Price targets range from [Insert Low Price Target] to [Insert High Price Target], reflecting the varied perspectives on Apple's future prospects.

- Rationale for Differing Opinions: The divergence in price targets stems from differing assessments of factors such as the success of future product launches, the impact of economic conditions, and the intensity of competition.

Potential Risks and Opportunities:

Apple faces several risks and opportunities:

- Risks: Increased competition, regulatory scrutiny (e.g., antitrust concerns), and economic downturns are potential headwinds.

- Opportunities: Expansion into new markets (e.g., augmented reality/virtual reality), development of new product categories, and further growth in the Services segment represent significant growth opportunities.

Investment Strategies:

The analysis suggests that Apple stock presents a [mention overall investment outlook - e.g., relatively strong, cautiously optimistic] investment opportunity. However, individual investment strategies should be tailored to personal risk tolerance and financial goals. This is not financial advice.

- Long-Term vs. Short-Term: Investors with a long-term horizon may find Apple stock attractive due to its strong brand, diversified revenue streams, and potential for future growth. Short-term investors should closely monitor market trends and news impacting Apple's performance.

Conclusion

Apple's Q2 earnings provide a mixed bag of results. While strong services revenue growth demonstrates resilience, challenges in certain product segments and global economic uncertainty present some concerns. Understanding these factors is crucial for navigating the complexities of the Apple stock market. Stay informed on future announcements and continue to monitor key performance indicators to make informed decisions about your Apple stock portfolio. Regularly review updated analyses of Apple stock performance to optimize your investment strategy. Consider consulting a financial advisor before making any investment decisions.

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6 Case

May 24, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Details Of The Jan 6 Case

May 24, 2025 -

National Rallys Le Pen Sundays Demonstration And Its Implications

May 24, 2025

National Rallys Le Pen Sundays Demonstration And Its Implications

May 24, 2025 -

Best Us Beaches 2025 Dr Beachs Expert Recommendations

May 24, 2025

Best Us Beaches 2025 Dr Beachs Expert Recommendations

May 24, 2025 -

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025

Frankfurt Stock Market Closes Lower Dax Below 24 000 Points

May 24, 2025 -

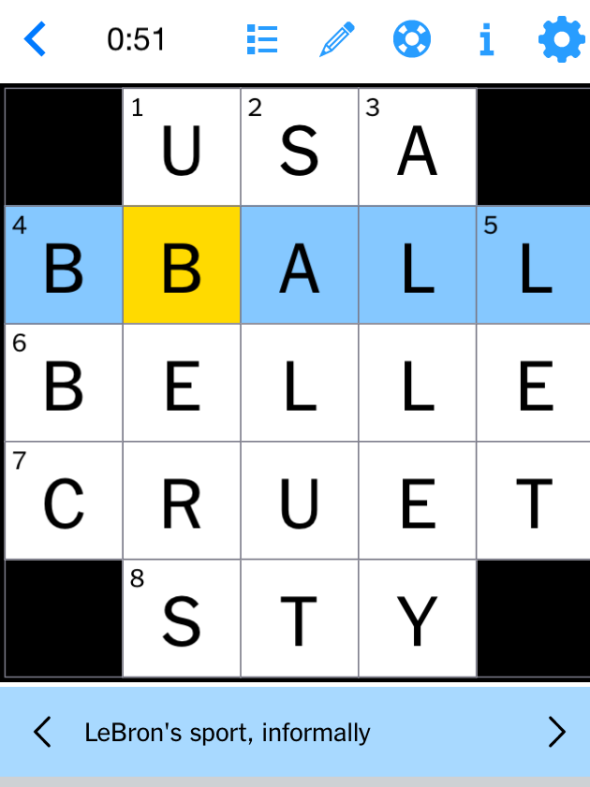

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025

March 13 2025 Nyt Mini Crossword Clues Answers And Solutions

May 24, 2025

Latest Posts

-

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025

Posthaste Risks And Implications Of The Global Bond Markets Instability

May 24, 2025 -

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025

V Mware Costs To Skyrocket At And T Highlights 1 050 Price Increase From Broadcom

May 24, 2025 -

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025

Is The Worlds Largest Bond Market About To Collapse A Posthaste Analysis

May 24, 2025 -

Global Bond Market Instability A Posthaste Warning

May 24, 2025

Global Bond Market Instability A Posthaste Warning

May 24, 2025 -

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025

Tva Group Restructuring 30 Positions Eliminated Due To Industry Challenges

May 24, 2025