Frankfurt Stock Market Update: DAX At 23,9XX Following Losses

Table of Contents

Analysis of the DAX's Decline to 23,9XX

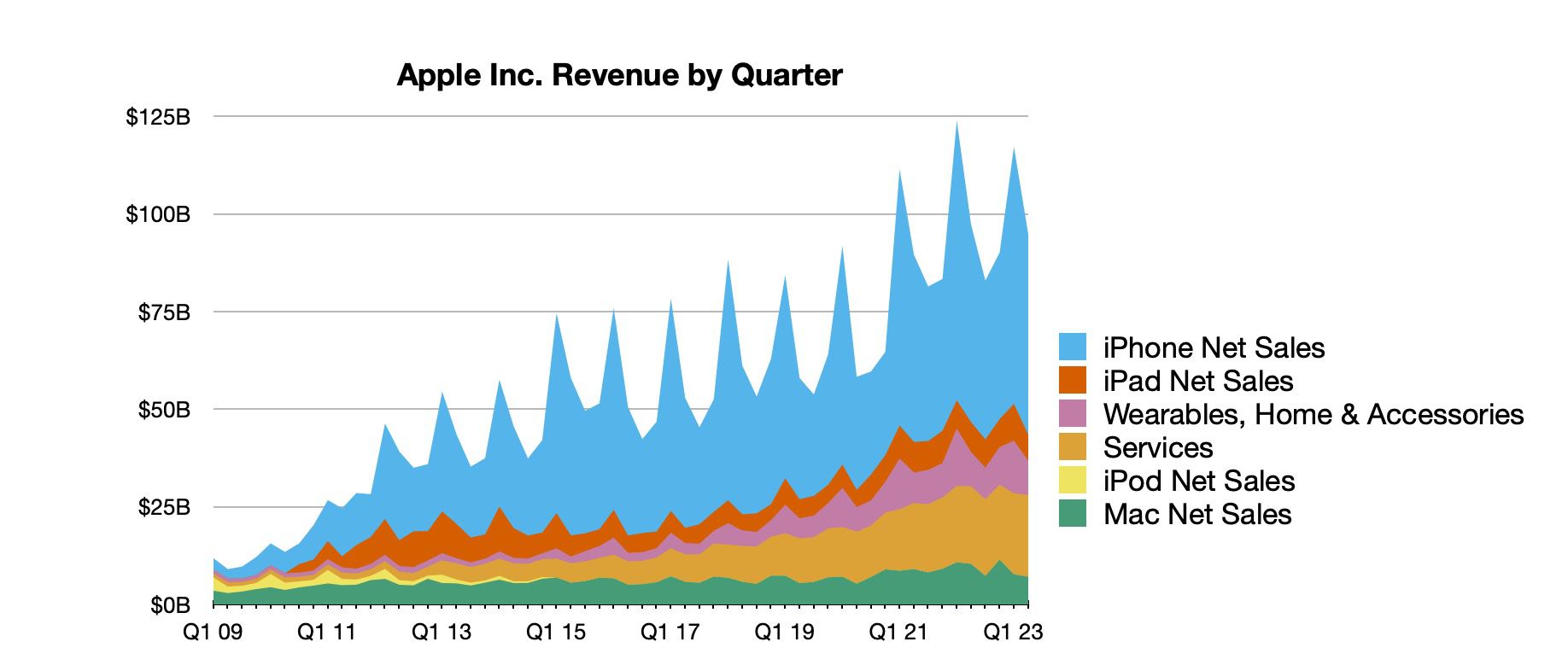

The DAX experienced a significant drop, representing a [Insert Percentage]% decrease from its previous closing high of [Insert Previous High Value] on [Insert Date(s) of Losses]. This decline wasn't a single-day event but rather a culmination of several factors impacting investor confidence. The following chart illustrates the DAX's movement over the past [Number] days:

[Insert Chart/Graph of DAX performance here]

-

Key Factors Contributing to the Drop:

- Inflation Concerns: Persistent high inflation rates in Germany and the Eurozone are eroding consumer purchasing power and impacting corporate profitability. The European Central Bank's (ECB) interest rate hikes, while aimed at curbing inflation, also contribute to increased borrowing costs for businesses.

- Geopolitical Instability: The ongoing war in Ukraine continues to create uncertainty in energy markets and supply chains, impacting German businesses heavily reliant on exports. Geopolitical risks are a significant factor influencing investor sentiment.

- Interest Rate Hikes: As mentioned, the ECB's aggressive interest rate hikes, while intended to combat inflation, increase borrowing costs, impacting business investment and potentially slowing economic growth. This directly affects the profitability of many DAX-listed companies.

-

Impact on Specific Sectors:

- The energy sector has been particularly hard hit due to the war in Ukraine and volatile energy prices.

- The automotive sector faces challenges related to supply chain disruptions and the transition to electric vehicles.

- Financial institutions are grappling with increased interest rate risk and potential loan defaults.

-

Comparison to Other Major European Indices: The DAX's performance mirrors, to some extent, the trends seen in other major European indices like the CAC 40 (Paris) and FTSE 100 (London), though the magnitude of the decline varies. A comparative analysis of these indices provides further context to the broader European market sentiment.

Impact on German Economy and Investor Confidence

The DAX's performance is strongly correlated with the overall health of the German economy. A declining DAX reflects weakening investor confidence and potential economic slowdown.

- Effect on Consumer Spending and Business Investment: Decreased investor confidence can lead to reduced consumer spending and a hesitation in business investment, creating a negative feedback loop that further impacts economic growth. The current market situation warrants a careful observation of these key economic indicators.

- Analysis of Investor Sentiment: Trading volume and market volatility serve as key indicators of investor sentiment. High volatility combined with decreased trading volume suggests a market lacking in conviction and potential for further decline.

- Potential Government Responses: The German government may implement fiscal stimulus measures or other policies to counter the economic downturn and bolster investor confidence. This could include tax breaks, investment incentives, or targeted support for affected sectors.

Potential Future Outlook for the Frankfurt Stock Market

Predicting the future of the Frankfurt Stock Market is inherently challenging, but a cautiously optimistic outlook can be formulated based on several factors.

- Predictions for Short-Term and Long-Term DAX Performance: The short-term outlook remains uncertain, with potential for further volatility. However, in the long term, the German economy's resilience and the DAX's historical performance suggest a potential recovery. This recovery will, however, depend heavily on global economic conditions and effective policy responses.

- Key Indicators to Watch: Closely monitoring inflation rates, unemployment figures, and manufacturing data will be crucial in predicting future market movements. These indicators provide invaluable insights into the health of the German economy and investor sentiment.

- Investment Strategies for Navigating Market Uncertainty: Investors might consider diversification strategies, hedging against risks, and focusing on companies with strong fundamentals and long-term growth potential. A well-informed and diversified investment strategy is crucial during times of market uncertainty.

Conclusion: Frankfurt Stock Market Update: Navigating the DAX's Current State

The DAX's decline to around 23,9XX reflects a confluence of factors, including inflation concerns, geopolitical instability, and interest rate hikes. This has impacted investor confidence and the overall German economy. While the short-term outlook remains uncertain, long-term prospects depend heavily on monitoring key economic indicators and the effectiveness of policy responses. To stay informed about the Frankfurt Stock Market and the DAX's performance, subscribe to our newsletter, follow us on social media, and check back regularly for further updates on the Frankfurt Stock Market. For further research, explore keywords like "DAX forecast," "German economic outlook," or "Frankfurt Stock Exchange analysis".

Featured Posts

-

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025

Apple Stock Q2 Earnings I Phone Sales And Investor Outlook

May 25, 2025 -

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 25, 2025

Pts Riviera Blue Porsche 911 S T For Sale A Collectors Dream

May 25, 2025 -

Ex French Prime Minister Disagrees With Macrons Policies

May 25, 2025

Ex French Prime Minister Disagrees With Macrons Policies

May 25, 2025 -

40 Svadeb Na Kharkovschine Pochemu Pary Vybrali Data Fotoreportazh

May 25, 2025

40 Svadeb Na Kharkovschine Pochemu Pary Vybrali Data Fotoreportazh

May 25, 2025 -

Casualty Treated After Car Overturns On M56

May 25, 2025

Casualty Treated After Car Overturns On M56

May 25, 2025

Latest Posts

-

Analyzing Wedbushs Apple Prediction Bullish Despite Price Target Decrease

May 25, 2025

Analyzing Wedbushs Apple Prediction Bullish Despite Price Target Decrease

May 25, 2025 -

Apple Stock Aapl Price Targets Identifying Crucial Support And Resistance

May 25, 2025

Apple Stock Aapl Price Targets Identifying Crucial Support And Resistance

May 25, 2025 -

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025

Apple Stock Forecast Wedbushs Bullish Stance Despite Lower Target

May 25, 2025 -

Where Will Apple Stock Aapl Go Next Key Price Level Projections

May 25, 2025

Where Will Apple Stock Aapl Go Next Key Price Level Projections

May 25, 2025 -

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025

Investing In Apple Weighing Wedbushs Opinion After Price Target Adjustment

May 25, 2025