Ripple Lawsuit: SEC Considers XRP As Commodity In Settlement Talks

Table of Contents

The SEC's Shifting Stance on XRP Classification

The SEC's initial claim in the Ripple Lawsuit was that XRP, Ripple's native cryptocurrency, is an unregistered security. This classification carries significant weight, as securities are subject to strict regulations under U.S. law, requiring registration with the SEC before being offered or sold to the public. Conversely, classifying XRP as a commodity would place it under a different regulatory framework, with potentially less stringent requirements.

The implications of classifying XRP as a security versus a commodity are vast. A security classification could expose Ripple to substantial financial penalties and legal repercussions. Conversely, commodity classification would likely result in a less severe outcome for Ripple and provide more regulatory clarity for XRP investors.

- Legal Ramifications: A security classification could lead to Ripple facing charges of securities fraud and significant financial penalties. XRP investors could also face losses if the classification impacts the value and tradability of the cryptocurrency.

- Regulatory Oversight: Securities are heavily regulated, requiring disclosures and compliance with various rules. Commodities, on the other hand, are typically subject to less stringent regulations.

- Potential Penalties: If XRP is deemed a security, Ripple could face substantial fines and potentially even criminal charges, significantly impacting its future operations.

Key Details of the Potential Settlement

While the specifics of any potential Ripple Lawsuit settlement remain largely confidential, rumors suggest the SEC might be willing to compromise on its initial position. This potential shift implies that Ripple might be making concessions, potentially involving changes to its business practices or financial commitments. The impact on XRP's price is expected to be significant, with a settlement potentially leading to increased investor confidence and price appreciation, or conversely, further uncertainty depending on the terms.

- Financial Penalties: A settlement might involve Ripple paying a substantial fine to the SEC to resolve the case without a full court trial.

- Changes to Ripple's Business Practices: Ripple might be required to alter its operations and compliance measures to align with future regulatory expectations.

- Likelihood of Settlement: The likelihood of a settlement remains uncertain, as both parties have shown a willingness to litigate. However, a settlement would offer a quicker resolution than a lengthy court battle.

Expert Opinions on the Ripple Lawsuit Settlement

Legal experts and cryptocurrency analysts offer diverse perspectives on the potential outcome of the Ripple Lawsuit settlement. Some believe a settlement is likely, given the potential costs and uncertainties of a trial. Others suggest that Ripple will fight the SEC's claims vigorously, highlighting the potential for a landmark court decision.

- Expert Quotes: “[Insert quotes from relevant experts here, citing their sources appropriately.]” Diverse viewpoints reflect the complexities of the case and the uncertainty surrounding the potential outcome.

- Strengths and Weaknesses: Arguments for a settlement often highlight the significant costs of litigation, while arguments against a settlement emphasize the long-term implications of accepting the SEC's initial classification of XRP as a security.

- Predictions for XRP: Experts’ predictions for XRP’s future vary widely, ranging from substantial price increases following a favorable settlement to prolonged uncertainty if the case proceeds to trial.

The Impact on the Cryptocurrency Market

The outcome of the Ripple Lawsuit will undoubtedly have a significant impact on the broader cryptocurrency market. A settlement, especially one that clarifies the regulatory status of XRP, could provide much-needed regulatory clarity and potentially boost investor confidence. Conversely, a drawn-out legal battle or an unfavorable ruling could create further uncertainty and potentially dampen market sentiment. The ripple effect could extend to other cryptocurrency projects facing similar legal challenges, influencing how they navigate regulatory hurdles.

- Investor Confidence: A clear resolution, regardless of the outcome, could stabilize the market and potentially lead to renewed investor interest.

- Influence on Other Cryptocurrencies: The precedent set by the Ripple Lawsuit could significantly impact how other cryptocurrencies are classified and regulated.

- Impact on Cryptocurrency Adoption: Regulatory clarity could accelerate the adoption of cryptocurrencies, while uncertainty could hinder broader market acceptance.

Conclusion

The Ripple Lawsuit, with the SEC's consideration of XRP as a commodity in settlement talks, represents a pivotal moment for the cryptocurrency industry. The potential settlement could provide much-needed regulatory clarity, although significant uncertainty remains. The outcome will have far-reaching consequences for Ripple, XRP investors, and the broader cryptocurrency market. It's crucial to continue monitoring the situation closely.

Call to Action: Stay informed about the evolving Ripple Lawsuit and the potential implications for XRP and the cryptocurrency market. Follow reputable news sources for the latest updates on the Ripple Lawsuit and the XRP classification debate. Continue to research the evolving legal landscape surrounding digital assets to make informed investment decisions. Understanding the SEC's stance on commodities versus securities is crucial for navigating the future of the cryptocurrency market.

Featured Posts

-

Italys Hidden Gem Little Tahitis Pristine Beaches

May 02, 2025

Italys Hidden Gem Little Tahitis Pristine Beaches

May 02, 2025 -

Millions Stolen Office365 Breach Exposes Executive Inboxes Fbi Investigation Reveals

May 02, 2025

Millions Stolen Office365 Breach Exposes Executive Inboxes Fbi Investigation Reveals

May 02, 2025 -

Easy Crab Stuffed Shrimp In Rich Lobster Sauce

May 02, 2025

Easy Crab Stuffed Shrimp In Rich Lobster Sauce

May 02, 2025 -

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025

Christina Aguileras Photoshoot Fans Accuse Her Of Excessive Photoshopping

May 02, 2025 -

Fortnites Shutdowns What Does It Mean For The Future

May 02, 2025

Fortnites Shutdowns What Does It Mean For The Future

May 02, 2025

Latest Posts

-

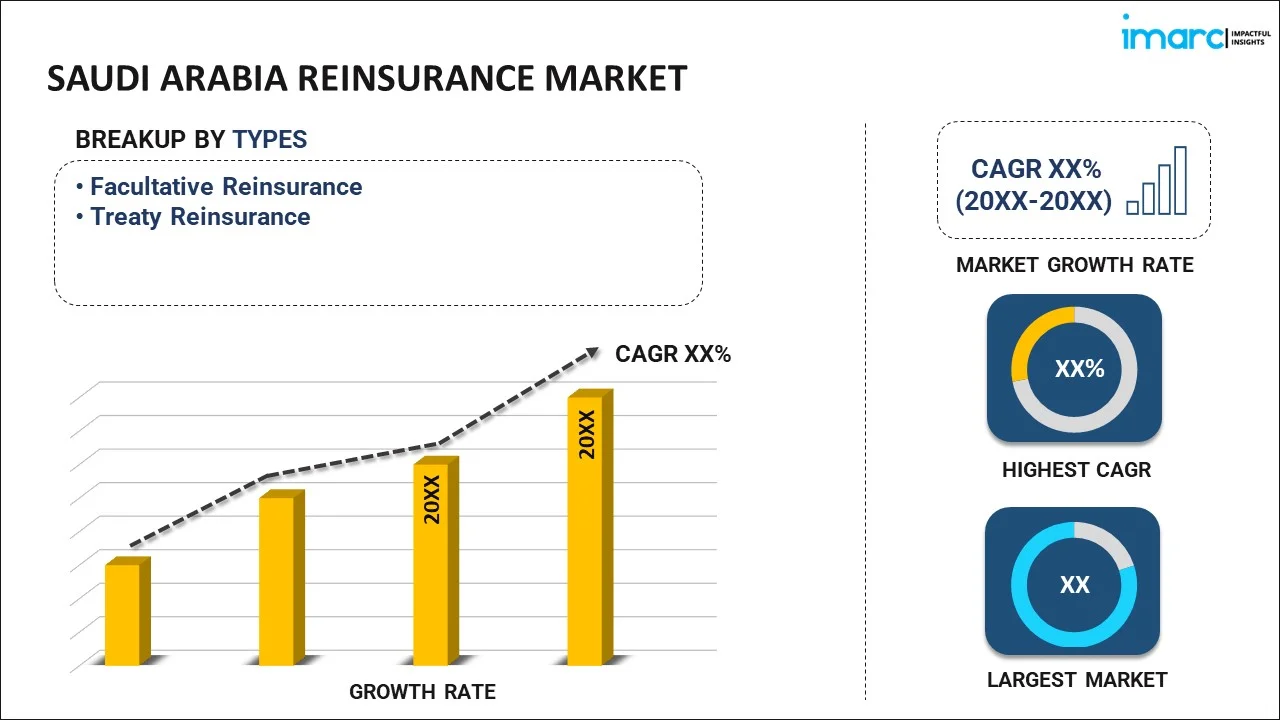

Impact Of Recent Saudi Regulatory Changes On The Abs Market

May 03, 2025

Impact Of Recent Saudi Regulatory Changes On The Abs Market

May 03, 2025 -

The Saudi Abs Markets Expansion A Game Changing Regulatory Update

May 03, 2025

The Saudi Abs Markets Expansion A Game Changing Regulatory Update

May 03, 2025 -

Landmark Saudi Rule Change Unlocking A Giant Abs Market

May 03, 2025

Landmark Saudi Rule Change Unlocking A Giant Abs Market

May 03, 2025 -

New Saudi Regulation To Revolutionize The Abs Market Size And Scope

May 03, 2025

New Saudi Regulation To Revolutionize The Abs Market Size And Scope

May 03, 2025 -

Saudi Abs Market Transformation Impact Of A Key Regulatory Shift

May 03, 2025

Saudi Abs Market Transformation Impact Of A Key Regulatory Shift

May 03, 2025