Shopify Stock Jumps Over 14% After Nasdaq 100 Listing

Table of Contents

Nasdaq 100 Inclusion: A Major Milestone for Shopify

Being listed on the Nasdaq 100 is a momentous achievement for any company. The Nasdaq 100 comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market, representing a benchmark for technological innovation and market leadership. Inclusion signifies not just size and financial success, but also a stamp of approval from the investment community. For Shopify, this listing brings several key advantages:

- Increased investor confidence: The Nasdaq 100 listing bolsters investor confidence, attracting a larger pool of institutional and individual investors seeking exposure to high-growth technology companies. This translates to increased liquidity and potentially higher valuations for Shopify stock.

- Enhanced brand reputation and credibility: Inclusion in the Nasdaq 100 further enhances Shopify's already strong brand reputation and credibility. It signifies a level of success and stability that resonates with customers, partners, and investors alike.

- Access to a wider pool of investors: The Nasdaq 100 attracts significant international investment, giving Shopify exposure to a far broader and more diverse investor base than previously accessible.

- Potential for higher trading volume: Increased investor interest typically leads to higher trading volume, contributing to greater liquidity and price stability for Shopify stock.

- Improved liquidity for Shopify stock: Higher trading volume directly translates into improved liquidity, making it easier for investors to buy and sell Shopify stock without significantly impacting its price.

Analyzing the Factors Contributing to the Stock Surge

While the Nasdaq 100 listing is a major driver of the recent Shopify stock jump, other factors likely contributed to this significant price increase. Several potential influences include:

- Strong Q2 2023 earnings report: Shopify's recent quarterly earnings report (assuming positive results) likely played a crucial role, showcasing robust revenue growth, strong profitability, and positive future guidance. Investors respond positively to strong financial performance, fueling further upward momentum in the stock price.

- Positive analyst ratings and upgrades: Favorable analyst ratings and upgrades often precede significant price increases. Positive sentiment from market analysts builds confidence and encourages buying pressure.

- Growing e-commerce market trends favoring Shopify's platform: The continued growth of the e-commerce sector globally is a significant tailwind for Shopify. As online shopping continues to expand, Shopify's platform benefits from this robust market growth.

- Successful new product launches or partnerships: Any recent successful new product releases or strategic partnerships could have further boosted investor optimism and contributed to the stock's performance.

- Overall positive investor sentiment in the tech sector: A generally positive market sentiment toward the technology sector also played a role in the overall positive movement of Shopify's stock price.

Long-Term Implications for Shopify Investors

The Nasdaq 100 listing has significant long-term implications for Shopify investors. However, it's crucial to consider both the potential upsides and downsides:

- Potential for continued stock price appreciation: The increased visibility and investor interest resulting from the Nasdaq 100 listing could lead to continued stock price appreciation in the long term, providing attractive returns for investors.

- Increased competition in the e-commerce space: Shopify faces intense competition from other e-commerce platforms, requiring continuous innovation and adaptation to maintain its market share.

- Economic factors influencing consumer spending: Macroeconomic factors, such as inflation and recessionary fears, can significantly impact consumer spending, potentially affecting Shopify's revenue growth and stock price.

- Shopify's future innovation and strategic initiatives: Shopify's ability to innovate and execute its strategic initiatives will be crucial in sustaining long-term growth and investor confidence.

- Advice for investors (buy, hold, or sell): Individual investment decisions should always be based on thorough research, risk tolerance, and financial goals. Consulting a financial advisor is recommended before making any significant investment choices.

Shopify's Competitive Landscape and Future Outlook

Shopify competes with other major e-commerce platforms like Wix, Squarespace, and BigCommerce. Its competitive advantages include a user-friendly platform, a robust app ecosystem, and a strong merchant network. However, maintaining its market share will require continuous innovation, adapting to new technologies like AI and Web3, and proactively addressing emerging challenges.

Conclusion

The inclusion of Shopify in the Nasdaq 100 resulted in a remarkable 14%+ jump in its stock price, reflecting a significant vote of confidence from the investment community. This surge is attributed to the prestige of the Nasdaq 100 listing, coupled with strong financial performance, positive market trends, and overall positive investor sentiment. While future performance is never guaranteed, the long-term outlook for Shopify remains positive, contingent on continued innovation and successful navigation of the competitive landscape. Keep a close eye on the Shopify stock price and its journey within the Nasdaq 100, and remember to conduct your own thorough research before making any investment decisions. For more information, visit the Shopify Investor Relations website.

Featured Posts

-

Budapest Tommy Fury Hazater Es Uezenetet Kueld Jake Paulnak

May 14, 2025

Budapest Tommy Fury Hazater Es Uezenetet Kueld Jake Paulnak

May 14, 2025 -

Nolte On Snow Whites Poor Box Office Performance A Critical Analysis

May 14, 2025

Nolte On Snow Whites Poor Box Office Performance A Critical Analysis

May 14, 2025 -

Stream Captain America Brave New World On Pvod Your Guide

May 14, 2025

Stream Captain America Brave New World On Pvod Your Guide

May 14, 2025 -

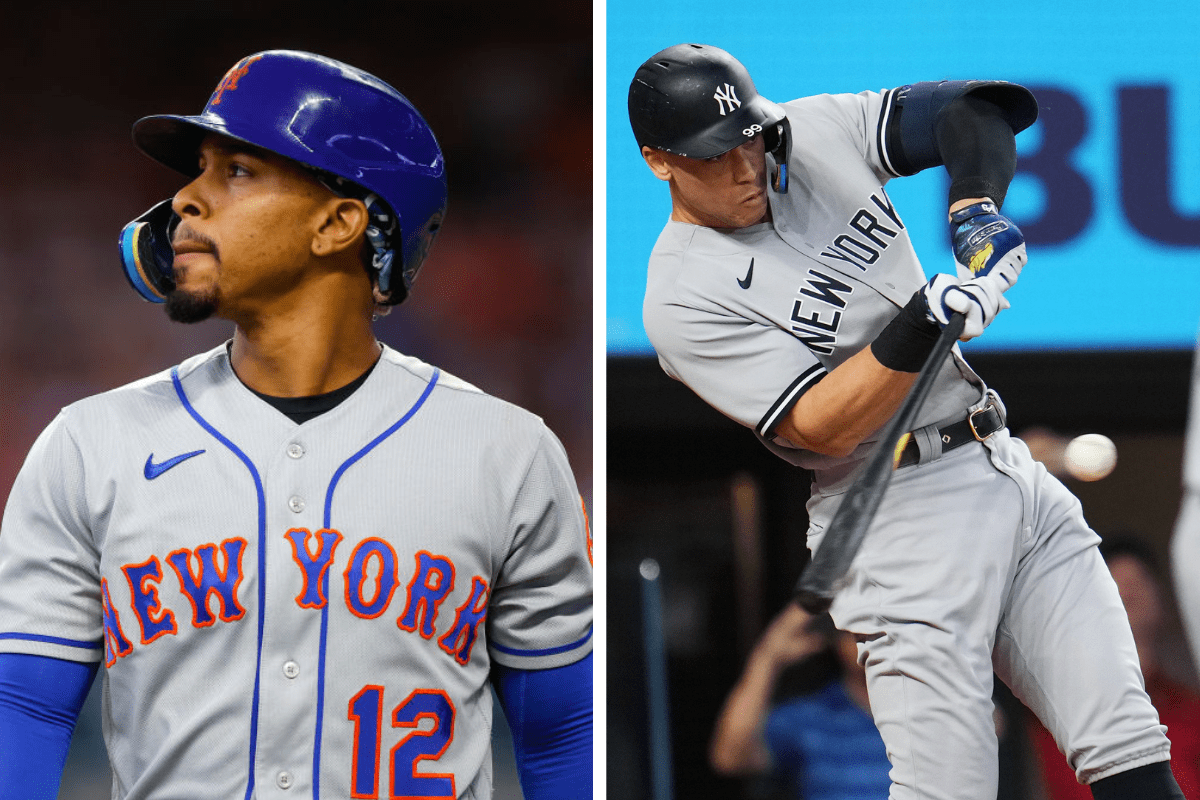

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025 -

Snow White Live Action Remake A Key Problem Solved By Disney

May 14, 2025

Snow White Live Action Remake A Key Problem Solved By Disney

May 14, 2025

Latest Posts

-

Exclusive Navan Taps Investment Banks For Us Initial Public Offering

May 14, 2025

Exclusive Navan Taps Investment Banks For Us Initial Public Offering

May 14, 2025 -

Navans Us Ipo Exclusive Details On Banking Partners

May 14, 2025

Navans Us Ipo Exclusive Details On Banking Partners

May 14, 2025 -

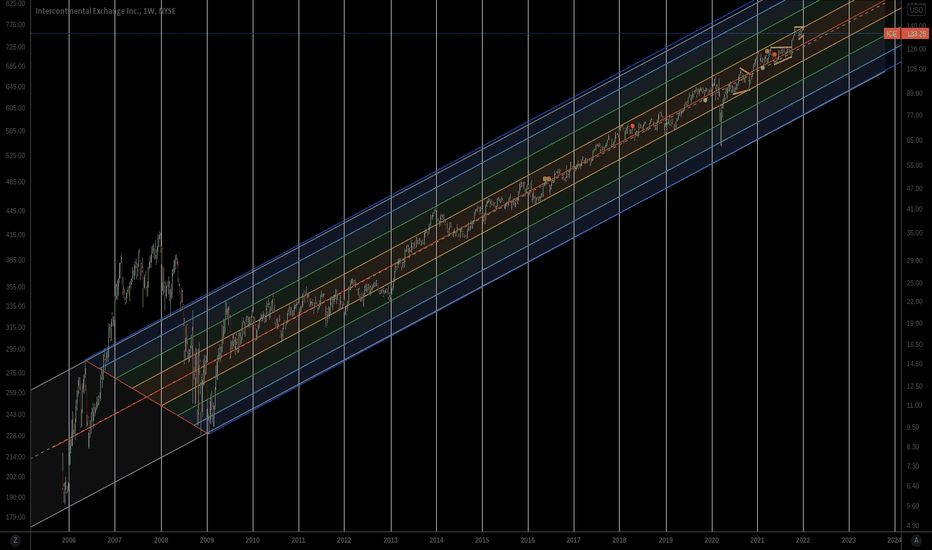

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025 -

Nyse Parent Company Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025

Nyse Parent Company Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025