Tracking The Net Asset Value Of The Amundi MSCI World Catholic Principles UCITS ETF Acc

Table of Contents

Accessing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV Data

Finding the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is straightforward. Several reliable sources provide this crucial data, each with its own advantages and disadvantages.

Where to find real-time NAV:

- Amundi's official website: The most authoritative source is Amundi's official website. They usually provide end-of-day NAVs, which are updated daily. Look for sections dedicated to fund factsheets or ETF information.

- Major financial data providers: Bloomberg Terminal, Refinitiv Eikon, and other professional financial data platforms offer real-time NAVs, often with a subscription. These are excellent options for serious investors who need up-to-the-minute data.

- Brokerage platforms: Most online brokerage accounts display the current NAV of your holdings, including the Amundi MSCI World Catholic Principles UCITS ETF Acc. The accuracy and timeliness depend on your brokerage.

- Financial news websites: Many financial news websites provide ETF data, including the NAV. However, always double-check the source and the last updated time to ensure accuracy.

Delayed vs. Real-time data: Real-time data reflects the NAV at the exact moment you access it. However, this is typically only available through professional-grade services. Delayed data, often offered by brokerage platforms and some websites, might show the NAV from the end of the previous trading day.

Data frequency: You'll typically find the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc updated daily, usually at the end of the trading day.

Understanding Factors Affecting the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is not static; it fluctuates based on several key factors:

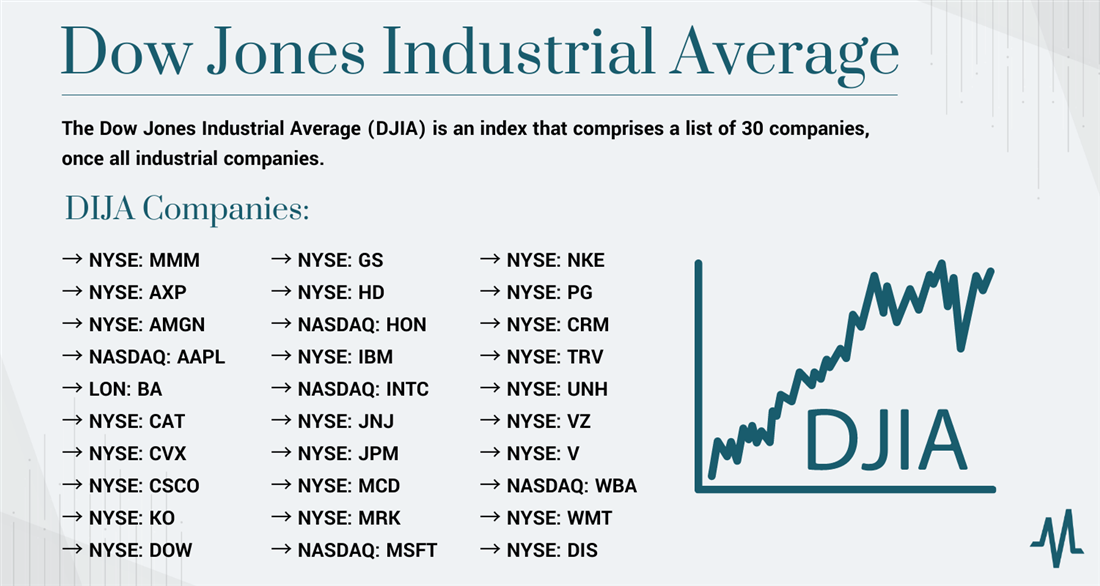

Market fluctuations: The overall performance of global markets significantly impacts the ETF's NAV. A positive market trend generally leads to a higher NAV, while a negative trend decreases it. Global market indices such as the S&P 500 and MSCI World Index serve as relevant benchmarks.

Underlying asset performance: The ETF invests in a portfolio of companies. The performance of these individual companies directly influences the overall NAV. Strong performance from the underlying assets leads to a higher NAV, and vice versa.

Currency fluctuations: Because the ETF likely holds assets in multiple currencies, changes in exchange rates can affect the NAV. For instance, a strengthening Euro against the US dollar could positively impact the NAV if a significant portion of the holdings are in Euros.

Dividend distributions: When companies within the ETF's portfolio pay dividends, the ETF receives these dividends, which can temporarily impact the NAV. The impact will depend on the dividend reinvestment policy.

Expense ratio: The ETF's expense ratio, which covers management fees and other operating costs, gradually impacts the NAV over time. A higher expense ratio will slightly reduce the NAV compared to an ETF with a lower expense ratio.

Using NAV Data to Make Informed Investment Decisions

Tracking the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc provides valuable insights for making informed investment decisions.

Monitoring performance: Regularly reviewing NAV changes helps you monitor the ETF's performance over time. This allows you to assess whether it's meeting your investment goals.

Comparing to benchmarks: Comparing the ETF's NAV performance against relevant benchmarks, such as the MSCI World Index, provides context. It shows how the ETF performs relative to a broader market index.

Buy and sell signals (caveat): While NAV changes can be indicative of performance, they should not be the sole basis for buy or sell decisions. Consider broader market conditions, your risk tolerance, and your overall investment strategy.

Portfolio diversification: Remember that the Amundi MSCI World Catholic Principles UCITS ETF Acc is just one component of a well-diversified portfolio. Consider the ETF's role within your overall investment strategy.

Conclusion: Stay Informed on Your Amundi MSCI World Catholic Principles UCITS ETF Acc Investment

Regularly monitoring the NAV of your Amundi MSCI World Catholic Principles UCITS ETF Acc investment is crucial for informed decision-making. Utilizing multiple sources, such as Amundi's website, your brokerage platform, and reputable financial news sources, helps ensure accurate and up-to-date data. Understanding the factors that influence the NAV allows you to better assess your investment's performance within the context of the broader market and your personal investment goals. Regularly monitor the NAV of your Amundi MSCI World Catholic Principles UCITS ETF Acc investment to make informed decisions and optimize your portfolio's performance. For more information, visit the [Amundi Website Link Here].

Featured Posts

-

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Importance

May 24, 2025

Amundi Msci World Ii Ucits Etf Dist Daily Nav And Its Importance

May 24, 2025 -

Your Step By Step Guide To An Escape To The Country

May 24, 2025

Your Step By Step Guide To An Escape To The Country

May 24, 2025 -

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025

Prepustanie V Nemecku H Nonline Sk Prinasa Prehlad O Situacii

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci All Country World Ucits Etf Usd Acc

May 24, 2025 -

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 24, 2025

Maryland Softballs Comeback Win 5 4 Victory Over Delaware

May 24, 2025

Latest Posts

-

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Factors Affecting Net Asset Value

May 24, 2025 -

Analysis Brbs Acquisition Of Banco Master And Its Implications For The Brazilian Market

May 24, 2025

Analysis Brbs Acquisition Of Banco Master And Its Implications For The Brazilian Market

May 24, 2025 -

Understanding And Interpreting The Nav Of The Amundi Djia Ucits Etf

May 24, 2025

Understanding And Interpreting The Nav Of The Amundi Djia Ucits Etf

May 24, 2025 -

Brazils Banking Industry Brb And Banco Masters Strategic Merger

May 24, 2025

Brazils Banking Industry Brb And Banco Masters Strategic Merger

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Nav Explained

May 24, 2025