Léger Poll Highlights Canadian Business Inaction Due To Economic Uncertainty

Table of Contents

H2: Key Findings of the Léger Poll Regarding Canadian Business Investment

The Léger poll paints a concerning picture of Canadian business investment. Economic uncertainty is significantly impacting investment decisions across various sectors.

H3: Delayed Investment Plans

The poll shows a substantial percentage of Canadian businesses delaying crucial capital expenditures. A staggering 60% are postponing expansion plans, while 55% are delaying the adoption of new technologies. This reluctance to invest stems directly from the current economic climate.

- Examples of delayed investments:

- Equipment upgrades and replacements

- Facility expansions and renovations

- Research and development (R&D) initiatives

- Marketing and advertising campaigns

This delayed investment has significant long-term consequences. Without consistent modernization and expansion, Canadian businesses risk losing their competitive edge in both domestic and international markets. The Léger poll data strongly suggests a potential slowdown in productivity growth and innovation.

H3: Hiring Freezes and Reduced Workforce

The impact of economic uncertainty extends beyond capital investment. The Léger poll indicates that 38% of Canadian businesses have implemented hiring freezes, while 12% have even reduced their workforce.

- Sectors most affected: The manufacturing, hospitality, and retail sectors appear to be particularly vulnerable, experiencing significant hiring slowdowns.

This trend directly impacts job growth and increases the risk of rising unemployment. The reduced workforce can also hinder productivity and negatively affect overall economic output. The Léger poll's data underscores the severity of this issue for the Canadian job market.

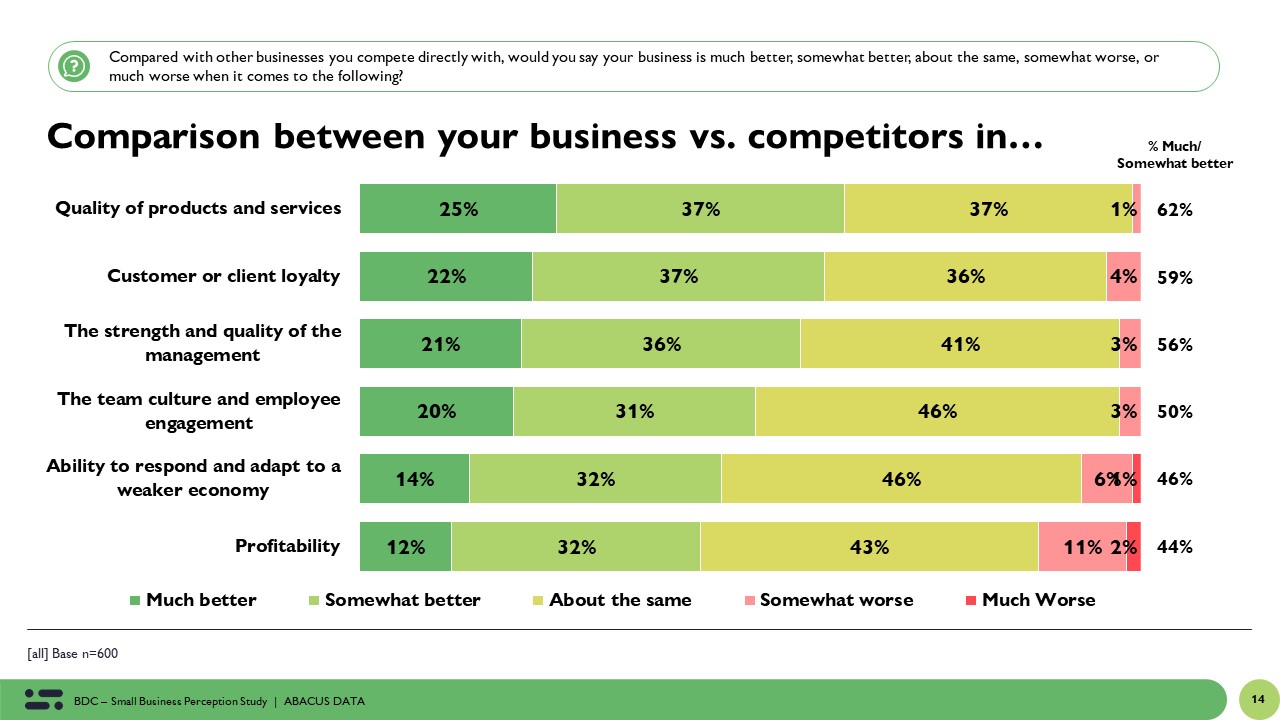

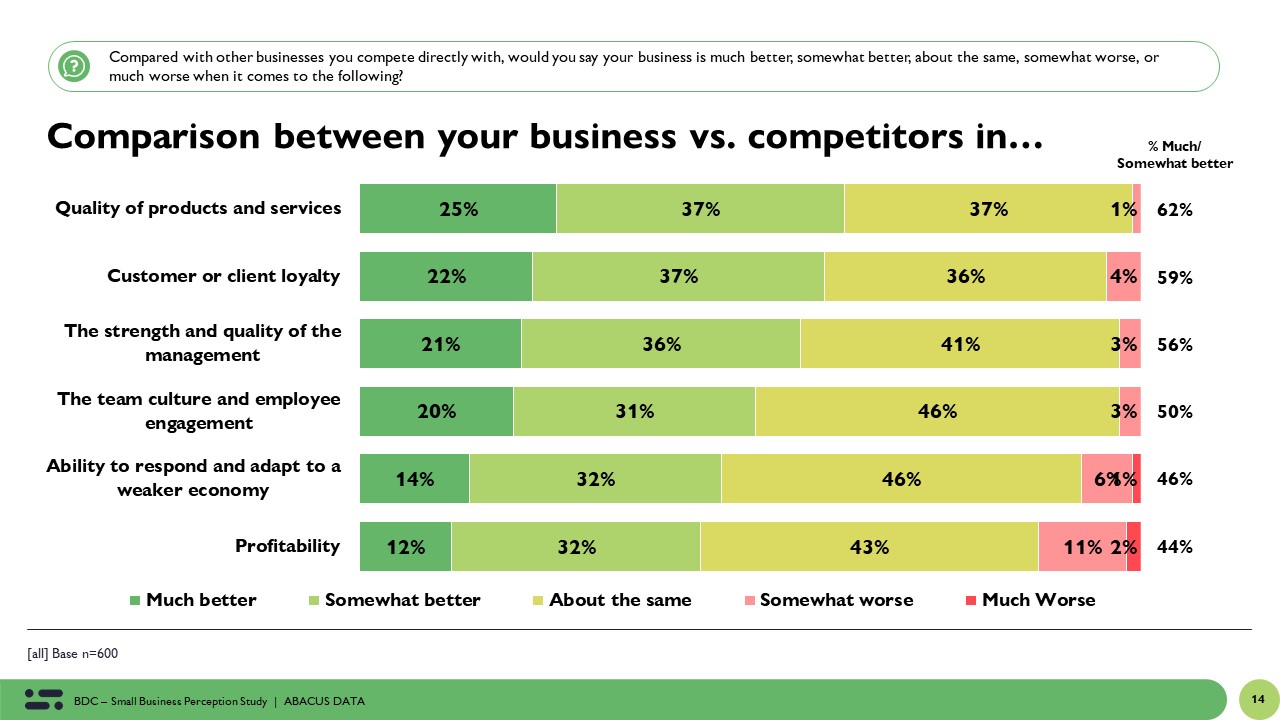

H3: Impact on Business Confidence

The Léger poll also measured business confidence, revealing a significant correlation with economic uncertainty. A mere 25% of businesses expressed high confidence in the current economic outlook.

- Factors contributing to low confidence:

- Persistent inflation

- Rising interest rates

- Geopolitical instability

- Supply chain disruptions

This lack of confidence directly translates into reduced investment and hiring activity, creating a vicious cycle that further dampens economic growth. The data from the Léger poll clearly indicates a strong link between confidence levels and investment decisions.

H2: Reasons Behind Canadian Business Inaction

Several factors contribute to the widespread business inaction highlighted by the Léger poll. The current economic climate presents significant challenges for businesses of all sizes.

H3: Inflation and Rising Interest Rates

Inflation and high interest rates are significant deterrents to investment. The increased cost of borrowing makes expansion and modernization projects considerably more expensive, impacting profitability.

- Impact on profitability: Higher interest rates increase the cost of debt financing, squeezing profit margins and making investment less attractive.

This is further compounded by the effect on consumer spending. As inflation reduces purchasing power, consumer demand decreases, leading to lower sales and further impacting businesses' willingness to invest.

H3: Geopolitical Instability and Supply Chain Disruptions

Global events and ongoing supply chain disruptions add to the uncertainty, making long-term planning extremely difficult.

- Examples of global events impacting Canadian businesses: The war in Ukraine, ongoing trade tensions, and energy price volatility all contribute to a climate of uncertainty.

The challenges of forecasting in such a volatile environment make businesses hesitant to commit to significant investments.

H3: Government Policies and Regulations

Government policies and regulations play a significant role in shaping business decisions. While some policies aim to support businesses, others may inadvertently create uncertainty or increase costs.

- Impact of government policies: The Léger poll doesn't directly address specific policies, but further research is needed to determine their impact on business confidence and investment.

Analyzing the effectiveness of current government support programs is crucial to understanding the full picture and finding ways to encourage investment.

H2: Potential Long-Term Consequences of Business Inaction

The prolonged hesitancy revealed by the Léger poll carries significant risks for the Canadian economy.

H3: Economic Growth Stagnation

Decreased investment and hiring directly translate to slower economic growth. This stagnation could lead to reduced overall productivity and a decline in the country's standard of living.

H3: Increased Unemployment

The hiring freezes and workforce reductions highlighted in the Léger poll point to a potential rise in unemployment. This can have profound social and economic consequences.

H3: Reduced Competitiveness

Delayed investments in modernization and innovation will negatively impact Canada's competitiveness in the global market. Without adapting to changing technologies and market demands, Canadian businesses risk falling behind their international competitors.

3. Conclusion

The Léger poll's findings paint a concerning picture of Canadian business sentiment and investment activity. Economic uncertainty, driven by inflation, rising interest rates, geopolitical instability, and supply chain disruptions, has led to widespread business inaction, impacting investment plans, hiring, and overall business confidence. The potential long-term consequences, including economic stagnation, increased unemployment, and reduced competitiveness, are significant. Understanding the impact of economic uncertainty on Canadian businesses, as revealed in the recent Léger poll, is crucial. Stay informed about further developments in Canadian business and economic trends by visiting the Léger website and following reputable financial news sources. Addressing this widespread business inaction and fostering a climate of confidence is essential for ensuring Canada's continued economic prosperity.

Featured Posts

-

Flopped Snow White Party A Small Birthday Celebration In Spain

May 14, 2025

Flopped Snow White Party A Small Birthday Celebration In Spain

May 14, 2025 -

Uncertainty Bites How Tariffs Impact Tech Company Ipo Plans

May 14, 2025

Uncertainty Bites How Tariffs Impact Tech Company Ipo Plans

May 14, 2025 -

Updated Offer Group Aims To Acquire Lion Electric

May 14, 2025

Updated Offer Group Aims To Acquire Lion Electric

May 14, 2025 -

Captain America Brave New World Digital And Physical Release Details

May 14, 2025

Captain America Brave New World Digital And Physical Release Details

May 14, 2025 -

The Tommy Fury Update That Has Everyone Talking About Molly Mae Hague

May 14, 2025

The Tommy Fury Update That Has Everyone Talking About Molly Mae Hague

May 14, 2025

Latest Posts

-

Navans Us Ipo Exclusive Details On Banking Partners

May 14, 2025

Navans Us Ipo Exclusive Details On Banking Partners

May 14, 2025 -

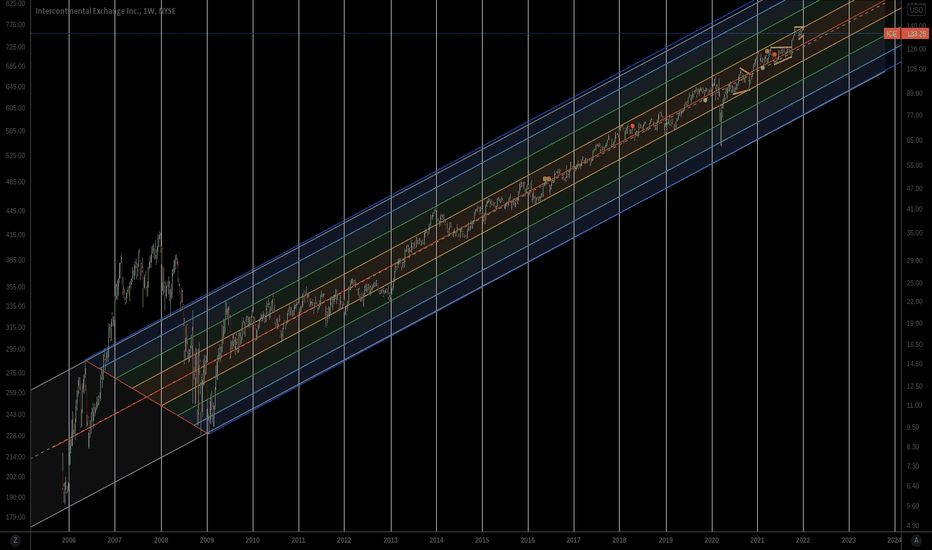

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025

Strong Nyse Trading Volume Boosts Ices First Quarter Earnings Beyond Forecasts

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025

The Impact Of Tariffs On Ipo Activity Current State And Future Outlook

May 14, 2025 -

Nyse Parent Company Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025

Nyse Parent Company Ice Reports Higher Than Expected First Quarter Profits

May 14, 2025 -

Market Chaos And The Freeze On Ipo Activity A Deep Dive

May 14, 2025

Market Chaos And The Freeze On Ipo Activity A Deep Dive

May 14, 2025